In which legal acts can you find a sample of filling out waybills?

The main source of law, which sets out the procedure for filling out waybills, is Order No. 368 of the Ministry of Transport of Russia dated September 11, 2020. It is valid from January 1, 2021.

And from 09/01/2021, when filling out waybills, you must also take into account the new rules for technical control of vehicles, approved. by order of the Ministry of Transport dated January 15, 2021 No. 9. For more details, see here. Let's highlight the key points:

- waybills must be filled out for each individual type of vehicle (clause 8 of Order No. 368 of the Ministry of Transport); when using the car in shifts by different drivers, you need to create a separate sheet for each of them (clause 10);

Important to consider! Hint from ConsultantPlus: According to the explanations of the Ministry of Transport of Russia, one waybill can be issued for several drivers, if... (for more details, see K+). Trial access to the system can be obtained for free.

- the waybill is issued strictly for a shift or for a flight, whichever is longer. It is impossible to prepare waybills for a month (clause 9);

- the type of vehicle must be stated in the title of the document, and the number of the waybill in the title (in accordance with the numbering established by the company);

- in the document, in addition to the basic details of the sender: name, address and telephone number, the OGRN must be indicated;

A sample form can be downloaded here.

- the waybill must indicate the odometer readings in correlation with the date and time of the car leaving for the task, as well as its return to the garage, signed by the responsible persons of the company or individual entrepreneur, and if the individual entrepreneur himself performs the work of the driver, then he personally (clause 12, p. . 13);

- if the waybill is issued when different drivers use the car in shifts, the odometer readings are noted on the sheet of the driver who first leaves the garage for the task, as well as the driver who drives back to the garage (clause 14);

- the waybill must record the date and time of medical examinations, which are carried out before departure on a flight and after returning from it - they are affixed by a medical employee directly involved in the examination, and are also certified by his signature with the obligatory indication of his full name ( paragraph 15);

- a mandatory requisite of the waybill is a note on the inspection of the technical condition of the vehicle before leaving for a flight (before a shift) - the controlling person conducting the inspection indicates the date and time of its conduct, certified by a signature with a transcript down to the initials (clause 16);

- completed waybills must be registered in a special journal, which is kept by the owner of the transport (clause 17);

- from 01/01/2021, all waybills must contain information about transportation, which includes information about types of communication and types of transportation (clause 6).

We talked in more detail about the changes in travel sheets from January 2021 here.

Read about the procedure for filling out the travel logbook here.

Completed sheets must be stored in the organization using the vehicles for at least 5 years.

These are the provisions of the main legal acts governing the filling out of travel forms. The legislator has not determined how to fill out the relevant document - the necessary data can be entered into it either by hand or on a computer.

It is extremely important to fill out travel forms correctly. Let us consider what will happen if we neglect this using the example of several arbitration proceedings.

For more information about the features of waybills used by individual entrepreneurs, read the article “What are the features of a waybill for individual entrepreneurs (form)?” .

Related documents

- Certificate of cost of work performed and expenses. Form No. ks-

- Standard additional agreement to a capital construction contract (approved by Resolution of the USSR State Construction Committee dated January 23, 1987 No. 13)

- Standard contract for the construction of residential or non-residential premises (household order) (approved by Resolution of the Council of Ministers of the RSFSR dated April 1, 1981 No. 187)

- Construction contract (tripartite)

- Tripartite contract agreement for the construction of real estate (with the participation of two customers and one contractor)

- Contract agreement for a range of construction and installation works

- Contract agreement for construction of facilities

- Household contract for repair and construction work

- Contract agreement for finishing work to renovate an apartment

- Contract agreement for interior finishing work of a building

- Contract agreement for repair work in the apartment

- Contract agreement for roofing work (using customer’s materials)

- Contract for roofing work (using contractor's material)

- Contract agreement for repair work

- Contract agreement for repair and construction work for an organization

- Contract for construction and installation work

- Contract for the construction of a residential building (cottage)

- Contract agreement for the manufacture of building structures and structures

- Tripartite contract agreement for the construction of real estate (with the participation of two customers and one contractor)

- Contract agreement for repair work of industrial and domestic premises

Errors in the waybill and refusal to refund VAT

The legal consequences of errors made in a document such as a waybill can be very unpleasant for the taxpayer. Noteworthy is the case in which the Federal Tax Service refused to recognize the right of an individual entrepreneur to deduct VAT due to the fact that the waybills were filled out incorrectly.

We are talking about arbitration case No. A65-20582/2013. The plaintiff, an individual entrepreneur, bought a car from an LLC and prepared a number of supporting documents - an invoice and an acceptance certificate. The seller issued an invoice to the buyer, which included VAT. It is also known that the individual entrepreneur paid for the car using credit funds.

The individual entrepreneur, having carried out the state registration of the car, submitted a VAT return to the Federal Tax Service, which indicated the amount to be deducted. However, the tax authorities denied the deduction to the individual entrepreneur, considering that the car was purchased not for business, but for personal purposes.

The buyer of the car filed a claim in arbitration, intending to have the Federal Tax Service's decision annulled in court. But his attempts were not crowned with success - the court in 3 instances confirmed the rightness of the tax authorities.

During the hearing, the individual entrepreneur presented to the court copies of travel documents as evidence of using the car for business purposes. However, the judges considered that these sources did not comply with the requirements of the order of the Ministry of Transport, since they did not indicate some important, in the opinion of the court, details. In addition, during the hearings, it was established that in the vehicle acceptance certificate there was an error in indicating the name of the LLC that sold the vehicle to the individual entrepreneur.

The destination is not specified - expenses for fuel and lubricants cannot be written off

Another very noteworthy situation occurred within the framework of arbitration case No. A55-23291/2012. The Supreme Arbitration Court refused to transfer it to the level of the presidium of this instance, thus leaving the cassation decision in force.

The taxpayer filed a lawsuit against the Federal Tax Service, intending to challenge the tax authorities’ decision to refuse to include fuel and lubricants costs in the company’s cost structure. Federal Tax Service inspectors considered these costs unconfirmed, since the travel sheets generated by the taxpayer to confirm the costs of fuel and lubricants did not indicate the destinations to which the drivers traveled.

The amount included in the lawsuit is quite significant - 700,000 rubles. But the taxpayer was unable to sue her. During the hearings at first instance, the judges confirmed that the tax authorities were right. The appeal gave the plaintiff a chance, establishing that the route of the car, as well as the destination of the cargo, should not be recorded in a document such as a waybill by organizations that are not transport companies in their main profile. In addition, as the appellate court considered, the waybill should not be considered as the only source capable of confirming the involvement of the car in the taxpayer’s business activities.

However, the cassation overturned the decision made by the appellate court. The judges considered that the waybill is a document that is created specifically for the purpose of confirming the validity of the company’s costs in the form of fuel and lubricant costs. Therefore, if the waybill does not contain information about the destination, then, according to the judges, it is impossible to reliably establish the fact that the company’s drivers used the car for official purposes. Therefore, this detail of the waybill, if we follow the position of cassation, should be considered as mandatory, reflecting the essence of the business transaction.

Information about the destination recorded in a document such as a waybill, if we follow the logic of the provisions of the ruling of the Supreme Court in this case, must be sufficiently detailed. As VAS believed, the waybill should include the name of the organization where the car is going, as well as the address of the corresponding facility.

Rules for issuing waybills for accounting in 2021

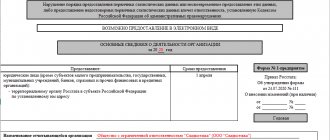

In practice, a fairly wide range of waybills can be used - it all depends on the type of vehicle, the method of its use, as well as the specifics of the organization’s activities. The main source of law that approves waybill forms for various types of automotive equipment, as well as types of enterprises, is State Statistics Committee Resolution No. 78 dated November 28, 1997. However, the use of this document is not mandatory, and the owner of the transport has the right to develop his own waybill form or, Taking a suitable unified form as a basis, supplement it with the necessary details.

But whatever the form used by the owner of the transport, it must contain the required details for him, it must be approved as used and filled out, following the recommendations of Order No. 368 of the Ministry of Transport.

ConsultantPlus experts have prepared a sample of filling out a waybill according to Form No. 3 for a passenger car. Get trial demo access to the K+ system and download the document for free with comments on its design:

Our specialists, based on standardized forms, have also prepared for you samples of filling out travel forms in Word and Excel format. the most commonly used travel forms and samples of how to fill them out in articles such as:

- “Waybill for a truck of an individual entrepreneur”;

- “Truck waybill in accounting (form).”

Sample of drawing up a certificate of completion of work

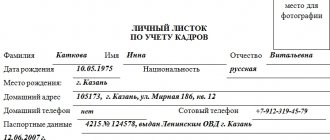

A sample certificate of work and services performed must include mandatory items, despite the lack of a unified form. The standard document is drawn up in two copies that have the same legal force, since the standard provides for two parties - the customer and the contractor.

It is advisable to indicate the following information in the AVR:

- Serial number for reflection in accounting registers.

- Date of preparation of the document. If additional time is required for acceptance by the customer, then it is advisable to print a space on the form indicating the customer’s acceptance date, which serves as the moment of transfer of ownership and the date of sale.

- Details of the concluded agreement, according to the terms of which contractual obligations are fulfilled.

- Execution period indicating the start and end times.

- Volumes and specific list of work performed, reflecting the material components spent during the execution process. In particular, it is advisable to include the used components and materials in quantitative and cost terms in the certificate of completed maintenance work, which will allow the contractor to easily reflect the cost as part of tax expenses.

- Total cost including VAT. A certificate of completion of work without VAT is drawn up if:

- the executor is not a tax payer;

- the operation is preferential and is not subject to VAT;

- The territory of Russia is not recognized as the place of sale when providing intermediary services.

- Details of the parties, including full names according to the constituent documents.

- Signatures and seals of participants. A certificate of completed work for individuals does not require a seal, since a seal is not provided for citizens when entering into civil transactions.

and: In Word format: Certificate of acceptance of completed work (in Word .doc format) (35.0 KiB, 40,861 hits)

; in Excel format

Form of work completion certificate (in Excel .xls) (11.1 KiB, 16,781 hits)

If the customer avoids signing a two-sided document, then the solution for the contractor is a unilateral AVR, provided for in clause 4 of Article 753 of the Civil Code of the Russian Federation. It is advisable to draw up an appendix to the work completion report indicating the absence of claims from the customer during a certain period, and reflect a list of material costs. This can serve as evidence of fulfillment of obligations in court.

: Sample act of completion of work (in Word) (37.0 KiB, 13,923 hits)