Special tax systems are designed to make life easier for certain types of business activities. A common practice is to combine SNA to maximize the optimization of the tax burden, i.e. if there are several types of activities, choose the most favorable tax regime for a specific type of activity.

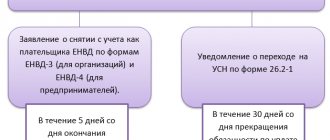

Since UTII will be canceled with the onset of 2022, it will not be possible to use the previous combinations of SNO.

In this article, we will consider who, how and under what conditions will be able to combine tax regimes in 2022, as well as how to do this effectively.

What and how you can combine in 2022

After canceling UTII, there are only 4 special modes to choose from:

- STS (simplified taxation system);

- PSN (patent taxation system);

- Unified Agricultural Tax (Unified Agricultural Tax);

- NPI (professional income tax).

It is prohibited to combine the simplified tax system and the operating tax system. The reason is that SNO data applies to the entire business, and not to individual registered activities.

As for SNO for the self-employed (NSE), no combinations are provided for this option.

This leaves only two options: OSN or simplified tax system with a patent.

And due to the fact that PSN can only be used by individual entrepreneurs from the micro-business category, only they will have the opportunity to combine SNA in 2022.

There is also the possibility of using a patent with the Unified Agricultural Tax, but this option is much less common than the simplified tax system + PSN, which will be discussed in more detail later.

How to reduce the tax on insurance premiums using the simplified tax system + patent

The simplified tax system “Income” and the patent can be reduced by insurance premiums for individual entrepreneurs and for employees.

As a general rule, contributions for individual entrepreneurs are distributed between the simplified tax system and the patent in proportion to income. For individual entrepreneurs without employees, a simpler option is possible - to take into account all contributions in one mode of your choice. It is advisable to fix the method of reducing taxes on contributions in the accounting policy.

Contributions for employees are taken into account where those employees are employed. The simplified tax system tax can be reduced only by contributions for employees engaged in activities under the simplified tax system. And the same with a patent.

Important: make sure that the total amount to be reduced does not exceed the amount of insurance premiums paid.

What to do with contributions for employees who are employed throughout the business (for example, an office manager)?

The principle is the same as with contributions for individual entrepreneurs - take into account contributions for such employees in proportion to income for each tax system.

How to take into account contributions if all employees are employed in a business on a patent, but there are no employees on the simplified tax system?

You reduce the patent by half by contributions for employees and contributions for individual entrepreneurs. The remaining part of the individual entrepreneur contributions is taken into account when calculating the simplified tax system, which you can reduce completely.

Income limit

According to paragraph 6 of Art. 346.45 of the Tax Code of the Russian Federation, the limit on annual revenue should not exceed 60 million rubles if an individual entrepreneur wants to combine the simplified tax system and the PSN.

Exceeding this value leads to the loss of the opportunity to use the patent from the beginning of the tax period. If the established limit is exceeded, the individual entrepreneur loses the right to apply the patent from the beginning of the tax period.

The tax period is equal to the validity period of the patent. The validity period of a patent can be 1 – 12 months.

If an individual entrepreneur has several patents received during the year, he loses the right to apply PSN for the type of activity for which the income limit was exceeded. Consequently, in this area, the individual entrepreneur will switch to the simplified tax system from the beginning of the tax period

The individual entrepreneur received two patents:

- from February 1 to July 30;

- from August 1 to December 31.

In September, the entrepreneur exceeded the limit (60 million rubles) cumulatively since the beginning of the year. Despite the fact that the excess was in September, the transition to the simplified tax system due to the excess will be counted from August, i.e. from the beginning of the second patent.

This means that the individual entrepreneur must re-calculate the tax base from August 1, take into account income and, if necessary, expenses that were incurred after August 1 under the patent (letter of the Ministry of Finance dated August 7, 2019 No. 03-11-11/ 59523).

Combination of patent and simplified tax system for individual entrepreneurs - 2022

By combining modes, an individual entrepreneur can save on taxes by purchasing a patent for activities for which the simplified tax system is higher than the cost of the patent. Both the “simplified tax” and the patent exempt individual entrepreneurs from paying personal income tax on business activities, VAT (except for import) and property tax (except for some objects).

The special regime of the simplified tax system (Chapter 26.2 of the Tax Code of the Russian Federation) can be applied to almost all types of activities, except those listed in Art. 346.12 of the Tax Code of the Russian Federation, and is valid throughout the entire territory of the Russian Federation. An individual entrepreneur who uses the “simplified tax” should not produce excisable goods and cannot be a payer of the Unified Agricultural Tax. You can switch to the simplified tax system only from the beginning of the year.

The tax can be imposed either on “income”, to which a rate of 6% is applied, or on “income minus expenses” - in which case the rate will be 15% (regions may apply lower rates).

The average number of employees of individual entrepreneurs should not exceed 100 people, and the income received under this special regime is 150 million rubles. in year. From 2022, these limits will be increased to 130 people and 200 million rubles. accordingly, but at the same time you will have to pay an increased tax - 8% or 20% (we talked more about the new limits here).

Every year, no later than April 30, “simplified” individual entrepreneurs submit a single tax return under the simplified tax system. Quarterly, before the 25th day of the month following the quarter, advances are paid to the budget, and at the end of the year, before April 30, the tax calculated based on the results of the tax period.

Unlike the simplified tax system, a patent (Chapter 26.5 of the Tax Code of the Russian Federation) allows you to conduct business on a much smaller scale. The special regime can be applied to a limited list of types of business activities - all of them are listed in paragraph 2 of Art. 346.43 Tax Code of the Russian Federation. In 2022, there will be 63 such types - retail trade, various household services, trucking, veterinary medicine, rental, real estate rental, etc. Regions can supplement the list of household services to which the PSN applies. If activities are carried out under simple partnership or trust management agreements, PSN cannot be applied. Also, the patent is not applicable to trade in goods subject to mandatory labeling (today these are furs, shoes, medicines), since such trade for PSN is not recognized as retail (clause 1, clause 3, article 346.43 of the Tax Code of the Russian Federation).

An individual entrepreneur with a patent can attract hired workers, the average number of them for the tax period should not exceed 15 people. The maximum amount of income that can be received on the PSN for all types of “patent” activities is 60 million rubles. year to date. The area of the sales floor for retail trade should not exceed 50 square meters. m

The cost of a patent is calculated not from actual revenues, but based on the potential annual income of an individual entrepreneur for the corresponding type of business (its size is set by the regions) and a tax rate of 6% (can be reduced by the authorities of the constituent entities of the Russian Federation). There is no tax reporting on the patent.

An individual entrepreneur can acquire any number of patents. The validity period of a patent is from 1 to 12 months within one calendar year. The patent is valid only in the constituent entity of the Russian Federation whose territory is indicated in the document itself.

A patent can be applied only to those types of businesses for which it was acquired, and the “simplified” patent can be applied to all activities of an individual entrepreneur. But it must be taken into account that it is impossible to apply the IP simplified tax system and a patent simultaneously for one type of activity within the same subject of the Russian Federation. For example, it will not be possible to have two retail stores in the Moscow region, one of which operates under the simplified tax system, and the other under a patent - both outlets must operate only under one special mode. But if the same type of business is conducted in different constituent entities of the Russian Federation, in one subject it is possible to apply the simplified tax system to it, and in another - a patent (letter of the Ministry of Finance dated July 24, 2013 No. 03-11-12/29381). There is an exception to this rule: when leasing out his own real estate, an individual entrepreneur has the right to apply PSN only to those objects that are indicated in the patent issued to him. In relation to other immovable objects, incl. those located in the same subject of the Russian Federation can use the simplified tax system (letter of the Federal Tax Service dated September 20, 2017 No. SD-4-3/18795).

When trading goods that are and are not subject to mandatory labeling, you can apply a patent and simplified tax system: an individual entrepreneur has the right to apply the “simplified tax system” to trade in furs, shoes, medicines (since for the SSN this is not retail trade), but to other trade recognized as retail – patent (letter of the Ministry of Finance dated January 15, 2020 No. 03-11-11/1277).

Despite the fact that under the STS, reporting is not submitted, in order to avoid fines, it is necessary to submit a declaration under the “simplified tax” when combining regimes, and even if there were no transactions for activities on the simplified tax system in the tax period, you need to submit a zero report.

Average headcount

This restriction does not have a completely unambiguous interpretation due to the fact that the letter of the Ministry of Finance (letter of the Ministry of Finance dated September 20, 2018 No. 03-11-12/67188) states that the number of employees can be kept separately. Hence the question - how many employees can you hire when combining the simplified tax system and the PSN: 130 or 145?

130 people can be hired by combining the simplified tax system and the PSN.

The basis for this is clause 5 of Art. 346.43 of the Tax Code of the Russian Federation, which establishes that a patent can only have 15 employees.

The limit on the number of employees in the simplified tax system is 130 people and it applies to the entire legal entity or individual entrepreneur, and not to a separate type of activity. (Clause 15, Clause 3, Article 346.12 of the Tax Code of the Russian Federation)

Thus, the situation is as follows - when combining the simplified tax system and the PSN, you can hire a total of no more than 130 people, of which no more than 15 people can work for the PSN, while no one prohibits keeping their records separately.

The individual entrepreneur has a wholesale and retail store, in which the same employee records goods.

The letter of the Ministry of Finance of the Russian Federation dated 07/02/2013 No. 03-11-06/3/25138 indicates the need to take into account such employees also in the combined SNO, in this case PSN.

Thus, care should be taken to ensure that the total number of employees participating in the PSN does not exceed 15 people.

Residual value of fixed assets

According to this, the Ministry of Finance and the tax authorities have a similar position; the residual value of fixed assets should not exceed 150 million rubles.

Also, in its letter dated 03/06/2019 No. 03-11-11/14646, the Ministry of Finance indicated that only funds that are included in the simplified tax system should be taken into account.

But Article 346.12 of the Tax Code of the Russian Federation does not clearly define this limitation. In addition, based on paragraph 4 of Art. 346.12 of the Tax Code of the Russian Federation, previously, when combining the simplified tax system and UTII, the residual value of fixed assets was determined for the entire enterprise, and not just according to the simplified tax system.

Therefore, in this matter, it is also worth adhering to the established limit, because otherwise, there is a risk of losing the opportunity to use the PSN.

Restrictions on combining the simplified tax system + patent regimes

The legislation imposes restrictions on the simultaneous use of these two tax regimes according to the following indicators:

- revenue for the year;

- staff;

- OS cost.

Limits on the main indicators on the Simplified system:

- annual revenue – up to 200 million rubles;

- number of employees – up to 130 people;

- cost of fixed assets – up to 150 million rubles.

Limits on the main indicators on a patent:

- annual revenue – up to 60 million rubles;

- number of employees – up to 15 people;

- cost of fixed assets - no restrictions.

Limits on the main indicators when combining simplified tax system + patent:

- annual revenue – up to 60 million rubles;

- number of employees – up to 130 people;

- cost of fixed assets – up to 150 million rubles.

Combination of tax regimes for one type of activity in one region

The next restriction is the ban on conducting activities on two aids to taxation (STS and PSN) in the same region for the same type of activity.

This prohibition is described in the letter of the Federal Tax Service of the Russian Federation dated March 28, 2013 No. ED-3-3/1116. This is justified by the fact that the patent is valid within the region as a whole and is not limited to any object or objects.

There is also a letter from the Ministry of Finance dated 04/05/2013 No. 03-11-10/11254, in which the position is the opposite, i.e. the use of simplified taxation system and PSN in one region within one region at different facilities is permitted.

As a result, here is another “slippery” situation in which everything will depend on how the above documents are interpreted, so before applying for a patent, it is worth getting clarification on this issue from your Federal Tax Service.

If for the same type of activity the PNS is used for one object and the simplified tax system for another, but they are located in different regions, then you do not violate any restrictions.

Features of combining simplified taxation system and PSN

If you are an individual entrepreneur using the simplified tax system, then nothing prevents you from applying another tax regime, for example, PSN, at the same time as the simplified system.

True, only in relation to those types of activities for which a patent has been obtained (clause 2 of Article 346.43, Article 346.45 of the Tax Code of the Russian Federation). Combining a simplified system with a patent system has its own characteristics

Firstly, if an individual entrepreneur works only in one type of activity, but in different regions of Russia, then within a year he can switch to a patent only in any one region. And in relation to income received in other regions, apply the simplified tax system. If the patent is not applied in this one region, then the entrepreneur there will have to switch to the “simplified” version.

Secondly, if an individual entrepreneur carries out several types of business in one region, then during the year for certain types of activities he can switch to PSN. And in relation to income received from other types of activities, apply the simplified tax system.

Thirdly, if an individual entrepreneur carries out only one type of activity in one region, then within a year he can switch to the patent system for this type of activity, while remaining in the “simplified” system.

How to keep records when combining PSN and simplified tax system

Accounting should be kept separately, namely:

- income and expenses;

- property;

- obligations;

- business transactions.

Accounting for income and expenses when combining simplified taxation system and PSN

As for the distribution of income, the question most often arises of how to distribute non-operating income. Such income cannot be confidently attributed to any one of the combined activities.

In such cases, the point of view of the Ministry of Finance is that this type of income cannot be distributed between combined SNOs.

The Federal Tax Service believes that income from such a plan should be taken into account in full in calculations for the simplified tax system.

An example of such income is the sale of a fixed asset (letter of the Ministry of Finance dated January 29, 2016 No. 03-11-09/4088).

Expenses that relate to the business as a whole, for example, office rent, accountant's salary and the like, must be distributed proportionally between both types of activities.

This requirement is described in paragraph 8 of Art. 346.18 Tax Code of the Russian Federation.

The individual entrepreneur combines the simplified tax system “income minus expenses” and a patent. To distribute expenses, he uses the revenue “on payment” received on an accrual basis from the beginning of the year. The indicators for the first quarter of 2022 are as follows:

revenue from the simplified tax system - 7 million rubles;

revenue from PSN - 3 million rubles;

expenses for distribution (salary of an accountant, logistics specialist and office rent) - 500 thousand rubles.

Calculation

Total revenue for the 1st quarter: 7 + 3 = 10 million rubles.

Share of revenue on the simplified tax system in the total amount: 7 / 10 = 70%.

The amount of distributed costs that will be taken into account when calculating the simplified tax for the first quarter of 2022: 500 × 70% = 350 thousand rubles.

Unfortunately, the Tax Code of the Russian Federation does not have a clear rule by which this proportion is drawn up. It is not indicated, for example, what type of revenue accounting to use: by shipment or by payment.

In the case of combining the simplified tax system and UTII, by letter of the Ministry of Finance dated September 29, 2009 No. 03-11-06/3/239, it was agreed to use revenue accounting “by shipment”.

However, PSN differs from UTII in this regard. When working on a patent, accounting occurs in the same way as in the simplified tax system, i.e. upon payment.

For expenses, the cash method is used similarly. In addition, in the above letter the requirement to keep records was presented for legal entities, and not for individual entrepreneurs.

The next question that arises is which billing period to use to calculate the proportion. The problem is that for the simplified tax system the tax period is equal to one calendar year. While a patent can be issued for a month or two, up to 1 year.

It is worth noting that for combining the simplified tax system and the PSN, the procedure for determining the billing period is not described. However, when combining the simplified tax system and UTII, the Federal Tax Service recommended keeping records on a monthly basis, cumulatively from the beginning of the year (letter of the Ministry of Finance of the Russian Federation dated March 29, 2013 No. 03-11-11/121).

Thus, there are two ways out of this situation: act by analogy with the scheme for the simplified tax system + UTII, or develop and consolidate your own calculation scheme in the accounting policy.