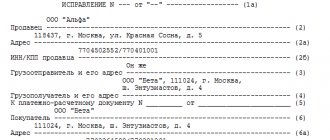

Upper part of the Invoice (header)

- Number and Date . The number must correspond to the numbering of documents approved in the accounting policy of your organization. The date indicated is current at the time of creation of the Invoice.

- Correction and Date . The correction number must correspond to the document numbering approved in the accounting policies of your organization. The date indicated is current at the time the Invoice is corrected. When drawing up an Invoice, before making corrections to it, a dash is placed in this line.

- Column Seller , the full and abbreviated name of the legal entity or individual entrepreneur (seller) is indicated.

- Column Address , the full address (with index) of a legal or individual entrepreneur (seller) is indicated.

- The seller's TIN/KPP column indicates the TIN and KPP of the legal entity (seller). An individual entrepreneur indicates only the TIN.

- The column Shipper and his address indicates the full and abbreviated name of the legal entity or individual entrepreneur (shipper), as well as his full address (with index). If the Invoice is drawn up for services performed (rendered) or property rights, then a dash is placed in this line.

- Column Consignee and his address , the full and abbreviated name of the legal entity or individual entrepreneur (consignee), as well as his full address (with index) is indicated. If the Invoice is drawn up for services performed (rendered) or property rights, then a dash is placed in this line.

- Column For payment and settlement document No. , indicates the number and date of the payment and settlement document (payment order) or cash receipt.

- Column Buyer , the full and abbreviated name of the legal entity or individual entrepreneur (buyer) is indicated.

- Column Address , the full address (with index) of a legal or individual entrepreneur (buyer) is indicated.

- The TIN/KPP column indicates the TIN and KPP of the legal entity (buyer). An individual entrepreneur indicates only the TIN.

- Column Currency: name, code , indicates the name of the currency and its code in accordance with the OKV classifier. The specified currency must be the same for all listed goods (works, services), property rights.

- Column Identifier of government contract, agreement (agreement) , indicates the identifier of the government contract, agreement or agreement. If there is no government order in the invoice, then a dash is added.

Invoice for services If the Invoice is drawn up for services performed (rendered) or property rights, then the two columns “ Consignor and his address ” and “ Consignee and his address ” are not filled in, you can put a dash (“–”) or a triple dash (“- — -“). If, when drawing up an invoice for services, you still fill in these two columns, then this will not be a mistake. In this case, this information will be additional information to the required details and cannot serve as a basis for refusing to deduct VAT.

Filling out an invoice line by line

Rules for filling out an invoice line by line:

- the first line is the serial number of the document in accordance with the established document flow rules;

- the date of preparation is not earlier than the date of the original document;

- date and correction number are filled in if necessary;

- in the line “Seller” the full or abbreviated name is indicated in accordance with the constituent documents;

- the postal address is indicated in the “Address” line;

- in line 3, “same person” is entered if the seller and the shipper are the same person. Otherwise, you must provide the shipper's mailing address. When filling out an invoice for services and property rights, a dash is placed in this line;

- in term 4, according to the same rules, the data of the consignee is written;

- in line 5 “to the payment and settlement document” a dash is placed if the form is drawn up upon receipt of payment, partial payment or for upcoming deliveries using a non-cash form of payment;

- for line 7, the currency codes are given above.

The columns are filled in as follows:

- Column 1 indicates the name of the product or service provided;

- in column 2 - unit of measurement, if possible. A dash is placed upon receipt of payment or partial payment for upcoming deliveries. Columns 2 and 2a are filled out taking into account the All-Russian Classifier of Units of Measurement, introduced by Decree of the State Standard of the Russian Federation dated December 26, 1994 No. 366;

- Column 3 indicates the quantity or volume of the goods. If this indicator is not defined or is missing, you must put a dash. A dash is also added when payment or partial payment is received for upcoming deliveries;

- Column 4 (product price) is filled out according to similar rules;

- in column 6, if there is no excise tax amount, a corresponding note is made;

- in column 7 (tax rate) for transactions specified in paragraph 5 of Article 168 of the Tax Code of the Russian Federation, an entry “without VAT” is made;

- Column 8 is filled out according to similar rules;

- Columns 10-12 are filled in if the country of origin of the goods is not Russia, in accordance with the OK of the countries of the world (MK (ISO 3166) 004-97), - 025–2001.

This is what a completed invoice looks like:

If the form is an advance or correction form, this should be indicated in the document. As well as what changes are made to the form and on what basis. It depends on the agreement of the parties whether a stamp is placed on the invoice - it is not a mandatory detail, but is more often placed (for example, at the request of the buyer) if the legal entity issuing the document uses it according to the charter.

All forms are stored in chronological order for at least 4 years, recorded in the journal of received and issued invoices, in the book of purchases and sales in order to be able to verify the calculation and payment of VAT.

List of goods and services in the Invoice

The table with the list of goods and services is filled with data in accordance with the column headings.

- Column 1 - Product name , indicates the name of the product, work and service.

- Column 1a - Product type code , when exporting goods abroad, indicates the HS code, otherwise a dash is added.

- Column 2 and 2a - Unit of measurement , indicate the name and code of the unit of measurement of the product or service, in accordance with the OKEI classifier. If there are no indicators, a dash is added.

- Column 3 - Quantity (volume) , indicates the quantity of goods, works and services. If there are no indicators, a dash is added.

- Column 4 - Price (tariff) per unit of measurement , indicates the price per unit of goods without VAT. If there is no indicator, a dash is added.

- Column 5 - Cost of goods (work, services), property rights without tax - total , indicates the amount of goods without VAT.

- Column 6 - Including the amount of excise tax , indicates the amount of excise tax on excisable goods. If there is no indicator, “without excise tax” is indicated.

- Column 7 - Tax rate , indicates the tax rate (for example, 0%, 10%, 18%). For operations specified in clause 5 of Art. 168 of the Tax Code of the Russian Federation is indicated “without VAT”.

- Column 8 - Amount of tax presented to the buyer , indicates the amount of VAT. For operations specified in clause 5 of Art. 168 of the Tax Code of the Russian Federation is indicated “without VAT”.

- Column 9 - Cost of goods (work, services), property rights with tax - total , indicates the amount of goods, work, services including VAT.

- Column 10 and 10a - Country of origin of the goods , indicate the name and code of the country of origin of the goods in accordance with the OKSM classifier. For goods produced in the Russian Federation, a dash is added.

- Column 11 - Registration number of the customs declaration , indicates the number of the customs declaration. For goods produced in the Russian Federation, a dash is added.

Total payable - the sums of the numbers in columns No. 5, 8 and 9 are summed up.

Filling out a corrective invoice for services

The adjustment invoice for services should reflect:

- the exact name of the document (i.e. “Adjustment Invoice”);

- number, as well as date of compilation;

- numbers and dates of generation of invoices, according to which the cost or volume of services provided is adjusted;

- names of the seller and buyer, their addresses, TIN;

- names of services for which price adjustments are made or volume indicators are clarified;

- indicators of the volume of services (if any) before and after adjustments;

- name of settlement currency;

- government contract identifier (if available);

- price per unit of measurement of service;

- cost of services provided without VAT - before and after adjustments to prices and volumes of services;

- tax rate;

- VAT amount - before and after adjustments;

- cost of services provided including VAT - before and after adjustments;

- the difference between the figures on the original invoices and those resulting from the adjustments.

For a sample of filling out an adjustment invoice, created on a current form, see the material “Sample for filling out an adjustment invoice.”

And about the differences between an adjustment and a corrected invoice, read the article “In what cases is a corrected invoice used?” .

ConsultantPlus experts explained how a customer can issue invoices for services under an intermediary agreement. Get trial access to the system and upgrade to the Ready Solution for free.

Bottom of the Invoice (footer)

The lower part contains the signatures of the responsible persons:

- Head of the organization or other authorized person - the full name is indicated and the signature of the head of the organization or other authorized person is affixed.

- Chief accountant or other authorized person - the full name and signature of the chief accountant or other authorized person is indicated.

- Individual entrepreneur - the full name and signature of the individual entrepreneur are indicated, and the details of the certificate of state registration of the individual entrepreneur are indicated.

In organizations, in addition to the manager and chief accountant, a “other” authorized person can sign, but only with a valid intra-organizational order with the right to sign accounting documents.

An individual entrepreneur signs only one column, Individual Entrepreneur .

Adjustment invoice

Changes in the primary invoice form entailed corresponding changes in the adjustment invoice form:

- in column 1 the serial numbers of the lines are now indicated, and the name of the goods (works, services) has been moved to column 1a. The numbering corresponds to the lines with goods, works, services from the original (erroneous) invoice, which is being adjusted;

- indicators of changes in value and product type code are now indicated in columns 1b and 1c;

- added columns 10-13 for traceable goods. They correspond to the columns of the invoice to which the adjustment is made.

Universal transfer document (UDD)

The UTD form is a recommended one, so taxpayers can make changes to it themselves. It combines the details of the invoice and primary documents, for example, invoices TORG-12 or M-15, acceptance certificate for services rendered, etc.

UPD with status 1 replaces an invoice for VAT deductions if all required details are filled out in the form. From July 1, 2022, if you draw up a UPD with status 1, you need to independently add line 5a “Shipment Document”, as in the new invoice (Letter of the Federal Tax Service No. ЗГ-3-3 / [email protected] dated June 17, 2022 ).

Invoice “Without VAT”

Goods and services not subject to VAT From January 1, 2014, when performing transactions that are not subject to VAT, in accordance with Art. 149 of the Tax Code of the Russian Federation, there is no need to issue Invoices, keep logs of received and issued Invoices, purchase books and sales books. Changes have been made to clause 5 of Art. 168 of the Tax Code of the Russian Federation and clause 3 of Art. 169 of the Tax Code of the Russian Federation.

Please note that 0% VAT and “No VAT” are not the same rate, and each is applied for its own purpose. When performing transactions with a zero rate, indicating 0% VAT in the Invoice is mandatory.

Thus, there is no need to issue invoices for goods from January 1, 2014. But at the request of the counterparty, you can issue an Invoice “Without VAT”; this is not a violation. The requirement to issue an Invoice “Without VAT” can be presented by budgetary and government institutions. According to the specifics of their work, the treasury cannot make a payment without presenting an invoice.

New invoice form

From July 1, 2022, Russia begins to control the movement of certain imported goods - household refrigerators, monitors, projectors, etc. To track each batch of goods, a registration number is assigned. It must be indicated in all documents and reports on transactions with traceable goods, including the invoice.

The new edition of the form and the rules for filling it out were approved by Government Decree No. 534 of April 2, 2022. It is used by all VAT payers, and the new columns in the tabular section are filled out only by participants in the goods traceability system.

What has changed in the invoice:

- in column 1 the serial number of the line with goods, works or services is now indicated, and their name has been moved to column 1a. The code of the type of goods, which is indicated when exported from the Russian Federation to the territory of a member state of the EAEU, has been moved to column 1b;

- in column 11 you now need to indicate the batch number of goods subject to traceability. If the imported product is not traceable, the declaration number is entered in the column as before;

- columns 12 and 12a - code and symbol of the quantitative unit in which the traceable product is measured. They are taken from the classifier of units of measurement - OKEY. For example, if a product is measured in pieces, the code will be “796”, the symbol will be “pcs”;

- column 13 - quantity of traceable goods in the specified units of measurement;

- added line 5a for the number and date of the document on the shipment of goods (performance of work, provision of services) - invoice, acceptance certificate, etc. They are entered under the same serial number as in the invoice lines. For example, an invoice indicates three items of goods. They were shipped using invoice No. 105 dated 07/05/2021. In line 5a you need to write: “Shipment document No. 1-3 No. 105 dated 07/05/2021.” If there are several documents, the details are separated by a semicolon. If the invoice is replaced by a UPD with status 1, in line 5a you need to repeat the details of this UPD.

For untraceable goods, new columns 12-13 are not filled out. If the invoice is in electronic form, they are marked with dashes. If on paper, columns 12-13 do not need to be formed.

Invoice - creation of invoice forms Kazakhstan

In the Mybuh.kz service, you can create all primary documents. To create a new invoice, go to the “ Documents”

» personal account.

Select the appropriate item “ Invoice”

".

Click on the " Add

" button. We remind you that an invoice is created on the basis of a certificate of completion (sale of services) or an invoice (sale of goods).

For greater clarity, there is a video instruction section in your mybuh.kz personal account (top right).

You can watch video instructions for creating an invoice here

To register on the site, you can click on the picture at the very end of the article.

Test mode for testing and creating primary documents 3 days.

Invoice filling out form

In the invoice form that opens, fill in all the required fields, many of them are mandatory. To save the entered data, click on the “ Save

”

List of saved invoices

Your invoice will be saved and can be found in the main list of documents, as shown in the figure.

Download the finished invoice

To view the finished invoice and perform various operations with the document: “ Download

” “

Edit

” “

Print

” “

Send

” click on the invoice number in the list.

A sample invoice can be downloaded or sent to the client.

Sample invoice with stamp and signature

To generate an invoice with a stamp and signature, you need to add a stamp and signature.

Go to the section My details - documents Here you can add a company logo, seal and signature below is an example.

Next, in the printed invoice form, activate the print and signature button.

Invoicing video

Invoice, general provisions with Tax Code.

Article 412. General provisions

1. When making a turnover for the sale of goods, works, services, the following are required to issue an invoice:

1) payers of value added tax provided for in subparagraph 1) of paragraph 1 of Article 367 of this Code;

2) taxpayers in cases provided for by regulatory legal acts of the Republic of Kazakhstan adopted for the purpose of implementing international treaties ratified by the Republic of Kazakhstan;

3) a commission agent who is not a payer of value added tax, in the cases established by Article 416 of this Code;

4) a forwarder who is not a payer of value added tax, in the cases established by Article 415 of this Code;

5) taxpayers in case of sale of imported goods;

6) a structural unit of the authorized body in the field of state material reserve when it releases goods from the state material reserve.

2. An invoice is issued in electronic form, with the exception of the following cases when the taxpayer has the right to issue an invoice on paper:

1) the absence of a public telecommunications network at the taxpayer’s location within the boundaries of the administrative-territorial units of the Republic of Kazakhstan.

Information about the administrative-territorial units of the Republic of Kazakhstan, on the territory of which there are no public telecommunications networks, is posted on the Internet resource of the authorized body;

2) occurrence of technical errors in the information system of electronic invoices, confirmed by the authorized body.

After technical errors are eliminated, an invoice issued on paper is subject to registration in the electronic invoice information system within fifteen calendar days from the date the technical errors are eliminated.

3. An invoice in electronic form is issued in the electronic invoice information system in the manner and form determined by the authorized body.

3-1. The list of goods for which electronic invoices are issued through the “Virtual Warehouse” module of the electronic invoice information system is approved by the authorized body and posted on its Internet resource.

4. An invoice is issued on paper in the manner prescribed by paragraphs 5 – 12 of this article, in a form determined by the taxpayer independently.

5. The invoice must indicate:

1) serial number of the invoice;

2) identification number of the supplier and recipient of goods, works, services;

3) in relation to individuals who are recipients of goods, works, services - last name, first name, patronymic (if it is indicated in the identity document);

in relation to individual entrepreneurs who are suppliers or recipients of goods, works, services - last name, first name, patronymic (if indicated in the identity document) and (or) name of the taxpayer;

in relation to legal entities (structural divisions of legal entities) that are suppliers or recipients of goods, works, services - name. At the same time, in terms of indicating the organizational and legal form, it is possible to use an abbreviation in accordance with customs, including business customs;

4) date of issue of the invoice;

5) in the cases provided for in Article 416 of this Code, the status of the supplier is the principal or commission agent;

6) in the case of the sale of excisable goods, the amount of excise duty is additionally indicated in the invoice;

7) name of goods, works, services sold;

size of taxable (non-taxable) turnover;

9) value added tax rate;

10) the amount of value added tax;

11) the cost of goods, works, services, taking into account value added tax; 12) comes into effect from 01/01/2021 in accordance with the Law of the Republic of Kazakhstan dated 12/25/2017 No. 121-VI.

6. In the invoice, the amount of taxable turnover is indicated separately for each item of goods, work, and services.

In case of issuing invoices on paper

It is allowed to indicate the total amount of turnover if such an invoice is accompanied by a document containing the data specified in subparagraphs 7) - 11) of paragraph 5 of this article. In this case, the invoice must contain an indication of the number and date of the document, as well as its name.

7. Cost and amount values in an invoice issued on paper are indicated in the national currency of the Republic of Kazakhstan.

Cost and amount values in an invoice issued in electronic form are indicated in the national currency of the Republic of Kazakhstan, with the exception of the following cases in which it is possible to indicate in foreign currency:

1) for transactions (operations) concluded (performed) within the framework of a production sharing agreement (contract);

2) for transactions (operations) for the sale of goods for export, taxed at a zero rate of value added tax in accordance with Articles 386, 447 and 449 of this Code;

3) on turnover from the sale of international transportation services, taxed at a zero rate of value added tax in accordance with Article 387 of this Code;

4) on sales turnover taxed at a zero rate of value added tax in accordance with paragraph 3 of Article 393 of this Code.

8. If on behalf of a legal entity its structural unit acts as a supplier of goods, works, services and, by decision of the legal entity, invoices are issued by such structural unit, as well as if on behalf of the legal entity the structural unit acts as a recipient goods, works, services, in order to perform:

1) the requirements established by subparagraphs 3) and 5) of paragraph 5 of this article; the details of a structural unit of a legal entity may be indicated in the invoice;

2) the requirement established by subparagraph 2) of paragraph 5 of this article, the identification number of the legal entity is indicated in the invoice. In this case, if the details of a structural unit of a legal entity are indicated in accordance with subparagraph 1) of this paragraph, the identification number of such structural unit is indicated.

9. Taxpayers indicate in the invoice or other document provided for in paragraph 1 of Article 400 of this Code:

1) for turnovers subject to value added tax - the amount of value added tax;

2) for non-taxable turnover, including those exempt from value added tax - o.

10. Taxpayers have the right to indicate additional information not provided for in this article in an invoice issued on paper.

11. A paper invoice is issued in two copies, one of which is transferred to the recipient of goods, works, services.

12. An invoice issued on paper is certified:

for legal entities - signatures of the manager and chief accountant, as well as a seal containing the name and indication of the organizational and legal form, if this person, in accordance with the legislation of the Republic of Kazakhstan, must have a seal;

for individual entrepreneurs - a seal (if any) containing the last name, first name, patronymic (if indicated in the identity document) and (or) name, as well as the signature of the individual entrepreneur.

An invoice may be certified by the signature of an employee authorized to do so by order of the taxpayer. In this case, a copy of the order must be available for visual inspection by recipients of goods, works, and services.

The recipient of goods, works, services has the right to contact the supplier of these goods, works, services with a request to submit a copy of the order certified by an authorized person to appoint a person authorized to sign invoices, and the supplier is obliged to fulfill this requirement on the day the recipient of the goods, works, services.

A structural unit of a legal entity that is a supplier of goods, works, services, by decision of the taxpayer, has the right to certify invoices issued by it with the seal of such a structural unit containing the name and indication of the legal form of the legal entity, if this person, in accordance with the legislation of the Republic of Kazakhstan, must have seal.

An invoice issued by an authorized representative of the participants of a simple partnership (consortium), in the cases provided for in paragraph 2 of Article 200 of this Code, is certified by the seal of the authorized representative containing the name and indication of the organizational and legal form, as well as the signatures of the head and chief accountant of such an authorized representative.

If, in accordance with the requirements of the legislation of the Republic of Kazakhstan on accounting and financial reporting and accounting policies, the manager or individual entrepreneur maintains accounting records personally, instead of the signature of the chief accountant, “not provided” is indicated.

An invoice issued in electronic form is certified by an electronic digital signature.

13. An invoice is not required in the following cases:

1) sales of goods, works, services, payments for which are made:

in cash with presentation to the buyer of a check from a cash register and (or) through payment terminals for services;

using equipment (device) intended for making payments using payment cards;

2) sales of goods, works, services to individuals, payments for which are made by electronic money or using electronic payment means;

3) making payments through second-tier banks, postal operators for utilities and communication services provided to an individual;

4) registration of passenger transportation by rail or air transport with a travel ticket on paper, an electronic ticket or an electronic travel document;

5) gratuitous transfer of goods to an individual who is not an individual entrepreneur or a person engaged in private practice;

6) provision of services provided for in Article 397 of this Code;

7) provision of services for the activities of a casino, slot machine hall, betting shop and bookmaker's office.

The provisions of subparagraphs 1) and 2) of part one of this paragraph do not apply in the case of the sale of goods, works, services to persons specified in paragraph 1 of Article 436 of this Code.

14. In the cases provided for in subparagraphs 1) and 2) of part one of paragraph 13 of this article, the recipient of goods, works, services has the right to contact the supplier of these goods, works, services with a request to issue an invoice, and the supplier is obliged to fulfill such a requirement, taking into account provisions of this article, including in terms of indicating in the information about the recipient of goods, works, services the details of a legal entity through whose authorized representative the acquisition of goods, works, services is carried out, or an individual entrepreneur purchasing goods, works, services. Moreover, in the cases provided for in subparagraphs 3) and 4) of paragraph 13 of this article, an invoice is issued at the place of sale of goods, works, services.

In the case provided for in subparagraph 4) of part one of paragraph 13 of this article, the recipient of services has the right to request a document confirming the fact of travel of an individual, or an invoice to the supplier of such services, and the supplier is obliged to fulfill such a requirement, taking into account the provisions of this article, including in terms of indicating in the information about the recipient of the work, services, the details of the individual to whom the transportation service was provided.

15. Peculiarities of issuing invoices in certain cases are established by Articles 414 – 418 of this Code. Footnote. Article 412 as amended by the Law of the Republic of Kazakhstan dated 04/02/2019 No. 241-VI (shall be enforced from 01/01/2019).

Article 413. Deadlines for issuing invoices

1. The invoice is issued:

1) when selling electric and (or) thermal energy, water, gas, utilities, communication services, transportation services by rail, services for transporting passengers, luggage and cargo by air, services under a transport expedition agreement, services of a wagon operator (containers), services for the transportation of goods through the main pipeline system, with the exception of main gas pipelines, system services provided by the system operator, services for providing credit (loan, microcredit), subject to value added tax, banking operations, as well as when selling goods, works , services under contracts concluded for a period of one year or more, to persons specified in paragraph 1 of Article 436 of this Code - based on the results of the month in which goods were supplied, services were provided, no later than the 20th day of the month following the month for which such goods and services have a sales turnover date;

2) in the case of export of goods with placement under the customs export procedure, an invoice is issued no later than twenty calendar days after the date of the sales turnover;

3) when transferring property into financial leasing in terms of the accrued amount of remuneration - based on the results of the calendar quarter no later than the 20th day of the month following the quarter based on the results of which the invoice is issued;

3-1) when selling goods on the basis of documents of title confirming the provision of identified goods at the disposal of the buyer - no later than the 20th day of the month following the month on which the date of sale turnover for such goods falls;

4) in other cases - no earlier than the date of the sale turnover and no later than fifteen calendar days after such date.

2. In order to fulfill the requirements of paragraph 14 of Article 412 of this Code, an invoice is issued on the day or after the date of the turnover, but within the limitation period established by Article 48 of this Code.

3. A corrected invoice is issued if it is necessary to make changes and additions to a previously issued invoice.

4. The deadlines for issuing an additional invoice are established by Article 420 of this Code.

If the requirements of Article 197 of this Code are not met, an additional invoice is issued by the lessor no later than fifteen calendar days from the date of such a case. Footnote. Article 413 as amended by the Law of the Republic of Kazakhstan dated 04/02/2019 No. 241-VI (shall be enforced from 01/01/2019).

Article 414. Peculiarities of issuing invoices for the sale of printed publications and other media products

In the case of sales of periodicals or other media products, including those posted on an Internet resource in public telecommunications networks, an invoice is issued no later than fifteen calendar days after the date of sale.

The taxpayer has the right to issue an invoice earlier than the date of turnover for the entire sales turnover, the date of which falls within a calendar year. In this case, the invoice separately indicates the amount of sales turnover and the corresponding amount of value added tax attributable to each tax period included in such calendar year.

Article 415. Peculiarities of issuing invoices by forwarders

1. Issuance of invoices for the performance of work, provision of services under a transport forwarding agreement for the party that is the client under such an agreement is carried out by the forwarder.

The invoice is issued by the forwarder on the basis of invoices issued by carriers and other suppliers of work and services who are payers of value added tax.

If the carrier (supplier) is not a value added tax payer, the invoice is issued by the forwarder on the basis of a document confirming the cost of work and services.

2. The invoice issued by the forwarder indicates the taxable (non-taxable) turnover, taking into account the cost of work and services performed and provided by carriers and (or) suppliers under the transport expedition agreement:

who are payers of value added tax;

who are not payers of value added tax.

In order to fulfill the requirements of subparagraphs 2) and 3) of paragraph 5 of Article 412 of this Code, in the invoice issued by the forwarder, as details:

supplier – details of the forwarder are indicated;

recipient – details of the taxpayer who is the client under the transport forwarding agreement are indicated.

3. When carrying out activities under a transport expedition agreement, the freight forwarder draws up a tax register in accordance with Article 215 of this Code, disclosing information about carriers and (or) suppliers of work and services provided under such an agreement, as well as their cost.

4. An invoice issued in accordance with the specified requirements is the basis for offsetting the amount of value added tax by the party who is the client under the transport expedition agreement.

Article 416. Peculiarities of issuing invoices under contracts, the terms of which correspond to the terms of the commission agreement

When selling goods, performing work, or providing services on terms that comply with the terms of the commission agreement, if the principal and (or) the commission agent are payers of value added tax, the issuance of invoices to the buyer of goods, works, and services is carried out by the commission agent.

The amount of turnover for the sale of goods, works, services in the invoice issued by the commission agent is indicated based on the cost of goods, works, services at which the commission agent sells them to the buyer.

The invoice is issued by the commission agent taking into account the following data:

an invoice issued to the commission agent by the principal, who is a payer of value added tax. In this case, the amount of taxable (non-taxable) turnover indicated in the invoice issued to the commission agent by the principal is included in the taxable (non-taxable) turnover in the invoice issued by the commission agent to the buyer;

a document confirming the cost of goods, works, services, issued by a principal who is not a value added tax payer. In this case, the cost of goods, works, services indicated in such a document is included in the non-taxable turnover in the invoice issued by the commission agent to the buyer.

The amount of turnover in the invoice issued by the principal to the commission agent is indicated based on the cost of goods, works, services at which they were provided to the commission agent for the purpose of sale.

The amount of turnover in the invoice issued by the commission agent to the principal is indicated based on the amount of the commission agent's commission and the cost of work and services, which is the commission agent's turnover for the acquisition of work and services from a non-resident.

When the principal issues an invoice to the commission agent for the sale of goods, works, services on terms consistent with the terms of the commission agreement, in order to fulfill the requirements of subparagraphs 2) and 3) of paragraph 5 of Article 412 of this Code, as details:

supplier – details of the principal are indicated indicating the status “committee”;

recipient – details of the commission agent are indicated indicating the status “commission agent”.

When the commission agent issues an invoice to the recipient of goods, works, services in order to fulfill the requirements of subparagraphs 2) and 3) of paragraph 5 of Article 412 of this Code, the details of the commission agent are indicated as the details of the supplier, indicating the status “commission agent”.

When the commission agent transfers to the principal the goods purchased for the principal on the terms corresponding to the terms of the commission agreement, as well as when performing work or providing services by a third party for the principal under a transaction concluded by such a third party with the commission agent, the issuance of invoices to the principal is carried out by the commission agent.

The provisions of this paragraph apply if the commission agent and (or) the person from whom the commission agent purchases goods, works, services for the principal are payers of value added tax.

The amount of turnover for the sale of goods, works, services in the invoice issued by the commission agent is indicated taking into account the cost of goods, works, services purchased by the commission agent for the principal under the terms of the commission agreement.

The invoice is issued by the commission agent taking into account the following data:

an invoice issued to the commission agent by a third party who is a payer of value added tax. In this case, the amount of taxable (non-taxable) turnover indicated in the invoice issued by a third party to the commission agent is included in the taxable (non-taxable) turnover in the invoice issued by the commission agent to the principal;

a document confirming the cost of goods, works, services, issued by a third party who is not a value added tax payer. In this case, the cost of goods, works, services indicated in such a document is included in the non-taxable turnover in the invoice issued by the commission agent to the principal, except for the works, services that are the turnover of the commission agent for the acquisition of works, services from a non-resident;

a document confirming the cost of goods, works, services, which are the turnover of the commission agent for the acquisition of works, services from a non-resident.

The amount of the commission agent's commission and the cost of work, services, which are the commission agent's turnover for the acquisition of work, services from a non-resident, are indicated on separate lines in the invoice issued to the principal. Moreover, if the commission agent is not a payer of value added tax, the amount of remuneration is indicated with o.

When a commission agent issues an invoice to the principal for goods, works, and services purchased for the principal under the terms of a commission agreement in order to fulfill the requirements of subparagraphs 2) and 3) of paragraph 5 of Article 412 of this Code, as details:

supplier – details of the commission agent are indicated indicating the status “commission agent”;

recipient – details of the principal are indicated indicating the status “committee”.

When a third party, who is a supplier of goods, works, services, issues an invoice to a commission agent in order to fulfill the requirements of subparagraphs 2) and 3) of paragraph 5 of Article 412 of this Code, the details of the commission agent are indicated as the recipient's details.

Article 417. Peculiarities of issuing invoices for the sale (purchase) of goods, works, services carried out under joint activity agreements

1. In cases where the sale of goods, works, services is carried out by an attorney on behalf and (or) on behalf of the participant (participants) of the joint activity agreement:

1) the invoice is issued on behalf of one of the participants in the joint activity agreement or on behalf of the attorney, indicating in the line reserved for the supplier (seller), the details of the participant (participants) in the joint activity agreement;

2) when issuing invoices, the total amount of turnover is reflected, as well as the amount of turnover attributable to each of the participants in accordance with the terms of the joint activity agreement.

2. If an invoice is issued on paper, the original invoice is issued both to the buyer of goods, works and services, and to each of the parties to the joint activity agreement.

3. In cases where a participant (participants) in a joint activity agreement or an attorney purchases goods, work or services within the framework of such activity, the invoices received from the supplier (seller) must highlight:

1) details of the participant (participants) in the agreement on joint activity, depending on the number of participants in the joint activity or attorney;

2) the amount of the acquisition, including the amount of value added tax, attributable to each of the participants in the joint activity agreement.

4. In the case of issuing an invoice on paper, the number of original invoices issued must correspond to the number of participants in the agreement on joint activities for which goods, works or services are purchased.

5. The provisions of this article do not apply when selling (purchasing) goods, works, services by the operator in the cases provided for in paragraph 3 of Article 426 of this Code.

Article 418. Peculiarities of issuing invoices in individual cases

1. When selling (purchasing) goods, works, services by the operator in the cases provided for in paragraph 3 of Article 426 of this Code, an invoice is issued in accordance with the requirements of this chapter indicating the details of the operator as a supplier (buyer).

2. The issuance of an invoice to the buyer of goods, works, services sold on the terms corresponding to the agency agreement is carried out by the principal, and in the cases provided for in paragraph 2 of Article 374 of this Code, by the attorney in the manner prescribed by this section.

Information on ESF (electronic invoices) can be found here

Is it required by law?

Issuing an invoice for taxpayers on the simplified taxation system is optional. This is due to the fact that they are not payers of value added tax (VAT). In practice, there are cases when counterparties require an invoice. In this case, a zero invoice can be issued for the counterparty. Its special feature will be a mark in the value added tax payment column with the words - without VAT.

IMPORTANT: in the VAT payment column, you should not indicate a zero rate, putting 0% in numbers. When entrepreneurs and organizations that are on a simplified taxation system enter 0% in the VAT payment column, they are making a mistake.