About legal entities

When to transfer personal income tax from salary According to the current fiscal legislation, the last date of settlements with the budget

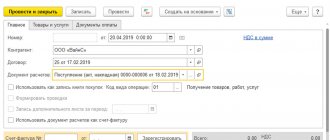

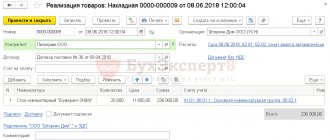

Display with Payroll Document Suppose we need to enter a tax adjustment. Let's create a new document

If data on employees does not need to be adjusted In this case, the report includes only

When to pay salary for December 2021 Days from December 31, 2022 to January 9

All organizations and individual entrepreneurs (insurers) will have to fill out a new calculation of insurance premiums (DAM) for the first time.

Capital gain in absolute terms, that is, profit is an indicator of the success of such a market entity

The Plato system is designed to compensate for damage caused to roads by heavy trucks. Coating wear rate

Excise goods are middle distillates, which mean mixtures of hydrocarbons in a liquid state (with

February 3, 2022 #Starting a business #Tax optimization This article was first published at the beginning

KUDIR is a book of income and expenses that must be maintained by all organizations and