Why do you need the 1-Enterprise statistics form?

Along with tax and accounting reporting, Russian companies are required to generate and submit statistical reporting to the state in cases established by law.

In particular - in the form of form 1-Enterprise. How to find out what statistical reporting and in what time frame you must submit in 2022, read here.

This form must be filled out and submitted to Rosstat once a year (before April 1 in the year following the reporting year) by all legal entities (except those related to small and medium-sized enterprises, budgetary structures, financial institutions and insurance companies).

Information provided by businesses in Form 1-Enterprise is used by Rosstat as part of statistical studies of key performance indicators of organizations (turnovers, expenses) with Russian “registration” and foreign ones that do business in the Russian Federation.

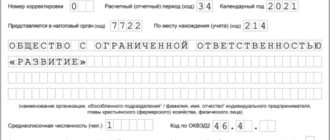

Form 1-Enterprise is approved by Rosstat annually. Its most recent version was put into circulation by Rosstat order No. 411 dated July 24, 2020. Using this document, businessmen must report to statistics for 2022 by April 1, 2021.

Instructions for filling out Form 1-Enterprise can be found in Rosstat Order No. 2 dated January 13, 2020 (as amended by Order No. 873 dated December 31, 2020).

Studying the structure and features of filling out the current Form 1-Enterprise is useful for correctly entering the data required by the statistical authority.

So, let's look at the specifics of filling out the form for 2022.

Form 1-Enterprise consists of 9 sections. Conventionally, they can be classified into those that reflect:

- basic facts about the company (sections 1–4, 8, 9);

- data on the company's income and expenses (sections 5, 6, 7).

Let's study the specifics of filling out the specified sections of form 1-Enterprise in more detail.

Instructions for filling out the report: what to pay attention to

When filling out Form 1-enterprise, you should keep in mind that:

- The data reflected in the form for the year preceding the reporting year (for example, in section 8 - for revenue) must match those shown in the report for that year. If there are discrepancies, written explanations must be submitted to Rosstat.

- Line 401 of Section 4 reflects the figure corresponding to the sum of the number of separate divisions increased by 1, that is, the parent organization is also taken into account. If there are no separate divisions in the company, then the number 1 is entered.

- The information in sections 5–8 is reflected for the legal entity as a whole for all types of activities.

- The types of activities reflected in sections 8 and 9 are determined in accordance with the list in Appendix 1 to the instructions for filling out the form, approved by Rosstat Order No. 39 dated January 30, 2018.

Indicators in form 1-enterprise can be determined taking into account data from other forms of statistical reporting. Let's look at them.

Filling out 1-Enterprise according to instructions: general legal and financial information about the company

In Sect. 1 records general information about the reporting organization.

In paragraphs 101, 102 forms 1-Enterprise indicate:

- date of registration (or re-registration) of the company;

- date of actual start of business activities of the company.

In paragraphs 103–108 you need to indicate:

- method of formation of a legal entity;

- whether there was a reorganization of the legal entity.

In Sect. 2 reflects information about the authorized capital of the company.

Its total volume is indicated on page 201. In paragraphs 202–210 - its shares by categories of owners specified in the corresponding list.

Having circled clauses 211 or 212, it should be noted, respectively, the fact of participation or non-participation of foreign entities in the formation of the authorized capital. In this case, only in the first case does the company need to fill out Section. 3 forms 1-Enterprise (on page 301 the total amount of foreign capital is recorded, on page 302 - the state affiliation or nationality of its holders).

In Sect. 4 reflects data on the organizational structure of the reporting company.

Pages 401 and 402 indicate information on the number of separate divisions, and paragraph 403 - on the number of subsidiaries.

In Sect. 8 records data on the company’s activities in relation to OKVED2, as well as such indicators as:

- staff size;

- payroll fund;

- revolutions

In Sect. 9 records similar information, but divided into those that reflect activities:

- parent organization;

- structural divisions of the company.

Among the most voluminous sections of form 1-Enterprise is section. 5. It reflects information about the company’s production and shipment of products, services, and works. That is, about the company’s income, as well as other related indicators (such as, for example, the volume of products shipped to a third party on one or another basis).

ConsultantPlus experts spoke about the nuances of filling out Form 1-Enterprise. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

It will be useful to consider its contents in more detail.

Form 1-enterprise (basic information about the organization’s activities): document structure

The form of the report in question is presented:

- Title page.

- Section 1, which provides general information about the organization, including how it was formed or reorganized in terms of participation in mergers and business divisions.

- Section 2, which reflects information about the ownership of the authorized capital (shares) by certain persons.

- Section 3, which separately provides data on the participation of foreign persons in the authorized capital of the organization.

- Section 4, which reflects the organizational structure of the company in the context of quantity:

- divisions (in general and located in other constituent entities of the Russian Federation);

- subsidiaries.

- Section 5, which reflects data on the enterprise’s revenue generated in various areas of activity.

- Section 6, which records the company’s expenses for various items.

- Section 7, which reflects the costs associated with ordering certain services from third-party business entities.

- Section 8, which reflects the types of activities of the company. For each of them it is indicated:

- average number of employees;

- salary fund;

- revenue for the reporting year;

- revenue for the previous year.

- Section 9, in which the economic indicators reflected in Section 9 are presented separately for the parent organization and separate divisions.

All data, unless otherwise provided by the structure of the form, is indicated for the reporting year.

Filling out the form has quite a few nuances. Let's look at them.

Information about the company’s income (section 5 of form 1-Enterprise)

On page 501 section. 5 indicates the total turnover of the company for the reporting year.

On pp. 502–505 indicators are recorded for the volume of products, services and work performed by the company itself, on p. 505 - revenue from processing customer-supplied raw materials, on p. 506 - revenue from repair work, on pp. 507–511 - revenue from resale, on page 512 - income from the sale of goods and materials previously purchased for the own production of goods.

Pages 513, 514 indicate revenue, respectively, from construction and scientific and technical work performed by third-party legal entities and individuals under subcontracts.

Pages 515, 516 record the cost of manufactured products, which are credited to fixed assets, corresponding respectively to:

- to industrial goods;

- agricultural goods.

Page 517 indicates the cost of construction and installation work carried out by the company for its own needs.

Page 518 records the cost of products that are given to third-party legal entities and individuals free of charge, and paragraph 520 records the cost of agricultural products transferred to internal divisions (not engaged in agriculture).

Page 519 indicates the cost of produced feed and fertilizers that are used for the own production of agricultural products.

Pages 521, 522 record the cost of produced building materials and structures used in construction and installation work, respectively:

- reporting organization;

- by third parties.

In paragraphs 523, 524 indicate data on budget subsidies if they were received by the company.

Page 525 indicates the number of months in the reporting year during which the company carried out commercial activities.

Clause 526 records the amount of customs duties that must be paid by the company for the reporting year.

Probably the most voluminous section of form 1-Enterprise is section. 6. It reflects information about the company’s expenses for the production and sale of products, services and work, as well as related indicators (such as, for example, balances of purchased goods and materials).

It also makes sense to study the structure of the relevant section in more detail.

Information on company expenses (sections 6, 7)

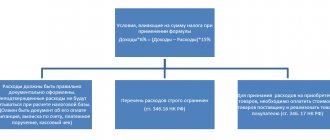

Actually, the company's expenses in Sec. The 6 forms are classified into those that:

- committed for the purpose of purchasing goods for resale (indicated on pp. 601–609);

- associated with the acquisition of raw materials, materials, components (indicated on pp. 610–615);

- reflect the purchase of fuel, energy, water (recorded on pp. 616–625);

- related to land reclamation (reflected on page 626);

- related to employee remuneration (reflected in pp. 633–636, 646–650);

- related to rent (recorded on pp. 639–645);

- related to depreciation (indicated on pages 637, 638).

A separate category of expenses under section. 6 forms 1-Enterprise - taxes and fees that are included in the calculation of the cost of products, services and work of the company. They are recorded on pp. 651–655. Page 670 reflects the amount of VAT that must be received from customers for goods, services and work sold in the reporting year.

Other specific categories of expenses Sec. 6 forms 1-Enterprise:

- those related to contracts for the purchase and sale of forest plantations (indicated on page 656);

- those related to payment for work and services of third-party companies (indicated on page 657);

- other costs that are not classified in section. 6, but are related to the production and sale of products, services and works (recorded on page 658).

The total expenses of the company for all reasons are indicated on page 659, section. 6.

Separately in Sect. 6 forms are indicated:

- cost of inventory balances for resale (pp. 606–609);

- the cost of residual inventories and fuel for production and sale (pp. 627–630);

- the cost of the remains of finished industrial and agricultural products (pp. 662, 663, 666, 667);

- the cost of inventory items transferred free of charge to other companies (p. 631);

- the cost of inventory and fuel purchased for production, but sold without processing (p. 632);

- cost of raw materials supplied by customers (p. 660);

- the cost of inventory items transferred to third-party companies for processing (p. 661);

- the cost of goods in work in progress (pp. 668, 669);

- cost of fattening animals (pp. 664, 665).

In Sect. 6 of Form 1-Enterprise, the reporting company also indicates the amount of investment in fixed assets (p. 671).

In Sect. 7 indicates the company's expenses for paying for the work and services of third-party companies in relation to the list reflected in pp. 701–737.

Composition of the report

The current report form was approved by Rosstat order No. 411 dated July 24, 2020. It consists of a title page and nine sections. The following information is included in the report:

- general information about the legal entity;

- distribution of authorized capital (fund) between shareholders (founders);

- contributions of foreign legal entities and individuals to the authorized capital;

- organizational structure of the legal entity in the reporting year;

- information on the production and shipment of goods, works and services;

- costs of production and sale of products;

- expenses for payment for certain types of work and services of third-party organizations;

- types of economic activity in the reporting year;

- information about the head unit and territorially separate units.

Fill out and submit to Rosstat via the Internet all reports for a medium-sized enterprise for free Submit for free

Where is the form 1-Enterprise for 2020

On our website you can download:

- Form 1-Enterprise form used for 2022;

- a sample of the corresponding report for 2022, prepared by ConsultantPlus experts. To do this, get a free trial demo access to the K+ system using the link below:

For late delivery, the organization will be fined under Art. 13.19 Code of Administrative Offenses in the amount of up to 70,000 rubles. A fine is imposed not only on the company, but also on officials from 10,000 to 20,000 rubles. See here for details.

If your company did not operate in the reporting year, you need to pass zero or write a letter. Read about the nuances in the material “Should I submit zero reporting to Rosstat.”

Results

All Russian legal entities, as well as foreign ones that have representative offices in the Russian Federation, must annually submit a reporting document to Rosstat - Form 1-Enterprise. It records the main performance indicators - turnover, expenses, as well as their distribution into various categories.

You can find out what other reports you must submit to statistics using our instructions.

Sources: Code of Administrative Offenses

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What to look for in other reports for Rosstat

So, when filling out the form in question, you should take into account that:

- Line 671 contains data similar to what is reflected in field 01 in column 1 of form P-2 (invest).

- Columns 1–3 of sections 8 and 9 reflect data taking into account indicators from reports P-1 and P-4. Since the indicators are monthly, they must be summed up for the entire reporting year to compare them with the form in question.

We are talking about data:

- About the average size of the organization's staff (line 801, column 1). It must correspond to the indicators on line 01 in column 01 of form P-4.

- The size of the wage fund (line 801, column 2). Must correspond to the value recorded on line 01 in column 7 of form P-4.

- Revenue (line 801, column 3). Must correspond to the sum of indicators on lines 01 and 02 of form P-1. A similar algorithm is used to determine the data reflected in Section 9.

- Shipped goods and services (line 502 in section 5). Must correspond to the indicator reflected in line 21 in column 1 of form P-1.

If any data in the 1-enterprise report is corrected, corresponding changes must be made to the other specified reporting forms to Rosstat, and vice versa (letter of the Rosstat representative office in the Perm Territory dated March 13, 2018 No. VP-27-204/625-DR) .

Indicators in Form 1-enterprise must in some cases be compared with information from the financial statements. Let's look at them.