The chief accountant is one of the key positions in almost all organizations; when concluding an employment contract, it is advisable to think through all the important points relating to this position.

The Labor Code of the Russian Federation (LC RF) establishes special rules that regulate the legal status of persons holding the position of chief accountant at an enterprise.

The hiring of an employee to the position of chief accountant is formalized by concluding an agreement for a certain period by agreement of the parties, which cannot exceed five years. The main condition is a voluntary decision, without pressure from the employer. Additional conditions for concluding such an agreement are not required; the fact of acceptance of the agreement specified in Part 2 of Art. 59 of the Labor Code of the Russian Federation position.

As you know, the probationary period for all employees is limited to three months. But for the chief accountant this period can be set longer, up to six months , this allows for clause 5 of Art. 70 Labor Code of the Russian Federation. The validity period of the employment contract and the probationary period are required to be indicated in the employment contract.

For the chief accountant, the following must be indicated in the employment contract form:

- contract expiration date;

- reasons for concluding a fixed-term contract with reference to the rule of law.

At times, employers are cunning and, in order to avoid difficulties during the dismissal of a chief accountant who has not completed the probationary period, they enter into a fixed-term employment contract with the employee for a period of three to six months. After which they can renew these contracts more than once, thereby depriving the employee of the guarantees provided to him by law.

If the matter comes to the courts, decisions in most cases are made in favor of the employees, and contracts with them are reissued to be concluded for an indefinite period. But the employer has the right to play it safe and designate a probationary period when hiring. Let me remind you that the trial period cannot exceed 6 months. It follows from this that if a fixed-term employment contract with a validity period of six months is concluded, the probationary period in this case should not exceed 14 days , in accordance with Part 6 of Art. 70 Labor Code of the Russian Federation.

The chief accountant reports directly to the head of the organization. Cash settlement documents, financial and credit obligations without the signature of the chief accountant are considered invalid and are not accepted for execution . In general, the responsibilities of the chief accountant are enshrined in the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”.

The requirements of the chief accountant for processing business transactions and submitting the necessary documents and information to the accounting department are mandatory for all employees of the enterprise. This requirement is prescribed in the relevant local regulations of the company.

Write down all the general conditions and information in the employment contract with the chief accountant. Taking into account the specifics of the organization and the category of the employee’s position, indicate a list of job responsibilities and additional terms of the contract.

Together with the head of the organization, the position of chief accountant is one of the main ones, therefore, when hiring, it is necessary to take into account all the nuances regulated by the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”, hereinafter referred to as Law No. 129-FZ. If the employment contract does not take into account the specifics of such an employee’s work, the company will be fined 50 thousand rubles.

The specifics of formalizing labor relations with the chief accountant are important not only for the parties signing the employment contract, but in some cases also relate to the company’s relationships with third parties. Before concluding an employment contract with the chief accountant, it is a good idea to make sure that he is not disqualified as an official at his previous place of work . The check can be carried out on the official website of the Federal Tax Service using the “Search for information in the register of disqualified persons” service. The same request can be officially submitted to the territorial bodies of the Federal Tax Service, the response time limit is no more than five working days.

The position of the only accountant included in the staff can be called both “accountant” and “chief accountant” - this will not cause complaints from regulatory authorities. But in the case when it is called “Accountant” according to the professional standard, it will be implied that the functions of the chief accountant were assumed by the head of the company.

Additional clauses to be included in the employment contract with the chief accountant

Since this position involves access to information that is confidential and classified, it is worth including a clause in the employment contract obliging him to observe trade secrets. Law No. 129-FZ uses the concept of “trade secret” for information contained in accounting registers and internal accounting reports. Persons authorized to have access to such information must be responsible for its disclosure.

In addition, the specifics of the work of a chief accountant require a busy schedule. Therefore, irregular working hours can be included in an employment contract as one of the main conditions. Of course, this mode of work, specified in the contract, gives the employee the right to the guarantees specified in Part 1 of Art. 119 of the Labor Code of the Russian Federation, including for additional paid days to the main vacation.

The law determines the minimum amount of additional leave for an irregular working day at three days. However, internal labor regulations or a collective agreement may increase the number of days of additional leave if additional features of work with irregular working hours are provided.

Due to the nature of the work performed, the chief accountant is not entrusted with any material assets. This position is not on the list of positions with which it is necessary to conclude agreements on full individual financial responsibility. The job responsibilities of the chief accountant do not include receiving funds and material assets. Consequently, the agreement on full liability with him has no legal force and will be declared invalid in any court .

The employer has the opportunity to protect itself from fraud when concluding an employment contract with the chief accountant by adding to the document a clause on the employee’s full financial liability in the event of damage to the organization, in accordance with Art. 243 Labor Code of the Russian Federation.

Material damage can be caused by careless actions of the chief accountant, as well as improper performance of his duties. Only untimely taxes transferred to the budget can result in large fines. In accordance with Art. 243 of the Labor Code of the Russian Federation, a clause on full financial liability is prescribed in the employment contract; in this case, the employer has the right to withhold the entire amount of damage caused from the chief accountant. Otherwise, the deduction from the chief accountant can be made once within the limits of the average monthly salary.

But it should be noted that in judicial practice there are cases when they refuse to recover damages even if there is a provision for compensation for damages in the employment contract. For example, if, through the fault of the chief accountant, a fine was imposed on the organization for not submitting reports on time (Appeal ruling of the Moscow City Court dated December 18, 2015 N 33-45565/15).

Standard rules for drawing up a contract

As in any other employment contract, the contract with the accountant must contain the following details of the employer and employee:

- The legal and commercial name of the organization employing the accountant. Banking and tax details, including individual taxpayer number.

- A link to the power of attorney, on the basis of which an employee of the enterprise negotiates with a candidate for a vacant accountant position and signs an employment contract. Last name, first name, patronymic and position of this authorized representative of the employer.

- Full passport details of the new employee, including his registration at the place of residence, TIN, status of marriage or divorce, document re-registration, etc.

A detailed and specific description of working and rest conditions allows the applicant for the position of accountant to really evaluate all the pros and cons of working in this organization before signing an agreement with the employer. The mandatory standard terms of an employment contract are as follows:

- Description of the accountant's workplace, preferably indicating the office equipment used (computer, printer, scanner, bill counting machines, calculators, etc.).

- Assessment of working conditions in accordance with current labor legislation, and for newly created jobs, their general properties and attributes are sufficient.

- The full name of the vacant position and an indication of the job description attached to the employment contract, in accordance with which the employee is subsequently obliged to perform his official duties.

- The work and rest schedule at the enterprise and for a specific accounting position, as well as the start date for a new employee.

- The amount of remuneration for an accountant, including the official salary, the size and terms of payment of bonuses, the thirteenth salary, and other incentive bonuses to wages.

- Contributions to social and health insurance, obligations of the organization and employee to timely transfer them to the social insurance authorities.

- The date of entry into force of the employment agreement, the duration of its validity and extension, taking into account all the requirements of Russian labor legislation.

- Mandatory indication of part-time work, provided that the accountant combines several positions in a given organization or at different enterprises.

Labor function of an accountant

After the HR department employee indicates all the mandatory conditions and information in the employment contract, it is necessary to spell out in detail all the responsibilities of the future chief accountant of the enterprise. The employee needs to clearly understand what duties he will perform and what he is responsible for.

The labor function can be specified in the employment contract, but I recommend that it is better to consolidate the responsibilities in the job description. The instructions themselves can be issued as a separate document or as an annex to the employment contract. Please note that the responsibilities of the chief accountant depend directly on the organization’s application of the professional standard . If the qualification requirements do not apply to an accountant, indicate the approximate functionality of the employee.

In the “Employee Rights and Responsibilities” section, indicate:

- rights and obligations that are provided for by law and are mandatory for all employees. You can take the professional standard “Accountant” as a basis;

- rights and responsibilities provided in the organization for a specific position.

The question is often asked whether it is legal to enter into an employment contract with the chief accountant without the right to sign. If such a condition is necessary, then the contract states that the right to sign is assigned to the director (Order No. 0 dated 00.00.00).

Job description of the chief accountant. The organization does not apply professional standards.

Qualification requirements for chief accountants are established by the professional standard “Accountant” (Order of the Ministry of Labor of Russia dated February 21, 2019 N 103n). If these requirements apply to the chief accountant, then describe the employee’s labor functions based on the order of the Ministry of Labor.

According to the new requirements of the professional standard, depending on the category of the position, the chief accountant must have certain qualification requirements. He must have at least seven years of experience in this position, with secondary specialized education. If he has a higher specialized education, then five years of experience is enough to be employed as a chief accountant.

An additional advantage when hiring will be the availability of certificates of completion of professional retraining programs for accountants, as well as advanced training courses.

Job description of the chief accountant taking into account the requirements of the professional standard.

The employer has the right to establish other requirements for the candidate if they relate to business qualities, are related to the specifics of the enterprise's production activities and are not related to discrimination.

When compiling the section “Rights and Obligations of the Employer”, rely on Art. 22 of the Labor Code of the Russian Federation. If necessary, you can indicate additional rights and obligations of the employer that are not expressly provided for by law. For example, the employer’s obligation to provide an employee with a voluntary health insurance policy.

Filling out the nature of the job

In small enterprises, chief accountants are often forced to travel to the bank, tax office, Pension Fund, Social Insurance Fund and other government agencies. In this case, the question arises: how to organize a trip of this type?

There is no clear answer to this question. Therefore, if the chief accountant will have to frequently travel to other organizations, it is recommended that he be assigned a traveling nature of work with compensation for the corresponding expenses, and the employee’s job description can indicate how often and where he will travel.

When a civil law contract is concluded with the chief accountant

If a company or individual entrepreneur has a small number of transactions per year, then the constant presence of a chief accountant (or simply an accountant) in the workplace is not necessary. In such cases, you can settle on concluding a civil law agreement. It must indicate the amount of work that the contractor must complete in a certain period of time. This could be, for example, submitting reports (quarterly, annual) by a certain deadline.

It is very important to draw up a GPC agreement in such a way that, during an inspection, the regulatory authorities do not reclassify it as a labor contract. This often happens with regular payments to the contractor - here the option of dividing the contract period into intermediate stages, for example quarterly, is suitable. With this division, regular payment for services can be justified as an advance payment for individual stages - submission of quarterly reports, and not wages.

The standard conditions discussed in the GPC agreement are usually the following:

- complete information about the parties to the contract - the customer and the contractor;

- the total amount of work that must be completed and the time frame allocated for this;

- payment amount.

The agreement is certified by the signatures of both parties and sealed, if available.

Is it legal to conclude a fixed-term employment contract with a chief accountant? Read the answer to this question in ConsultantPlus. Study the material by getting trial access to the K+ system for free.

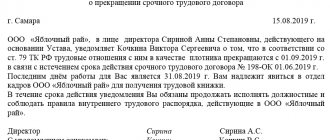

Termination of an employment contract with the chief accountant

In the “Change and termination of the employment contract” section, indicate the procedure for changing the contract and its termination. The chief accountant may be dismissed for additional reasons:

- when the owner of the enterprise changes (Article 81 of the Labor Code of the Russian Federation);

- for an unreasonable decision, due to which the company’s property was not preserved, was used for other purposes, or when damage was caused to the employer (Clause 9, Part 1, Article 81 of the Labor Code of the Russian Federation).

We will pay special attention to the termination of employment relations when the owner of the organization changes. This is an additional basis for termination established by clause 4 of Art. 81 of the Labor Code of the Russian Federation, is regulated in detail by other norms of the Labor Code of the Russian Federation. The new owner has three months if he wants to fire the chief accountant (Part 1 of Article 75 of the Labor Code of the Russian Federation). In this case, no evidence of dishonesty or insufficient qualifications of the chief accountant is required; the only necessary condition is a change of owner.

If the new owner signed an additional agreement with the chief accountant. agreement to the employment contract (changes in wages, duties, other conditions), then after this it is impossible to formalize dismissal, since this is unlawful, even within a three-month period.

The signing of the agreement is documentary confirmation that the new owner has decided to work with the chief accountant on new terms. After all, the legislation gives the new employer the right to choose - to continue working with the chief accountant or to fire him. If a decision is made to part with an employee, compensation must be paid, and the law defines a minimum amount - no less than three times the average monthly salary (Article 181 of the Labor Code of the Russian Federation).

In the “Final Provisions” section, describe the procedure for resolving possible disputes and disagreements between the employer and employee.

Some tips

When hiring a new employee as an accountant, and especially as a chief accountant, the employer must pay special attention to the legally competent execution of the employment contract, since the accounting employee has great financial responsibility for the safety of property and the correct redistribution of the enterprise’s financial flows.

Specification and detailing of the terms of the employment contract guarantees both parties the absence of mutual claims and labor disputes in the future, and the employer - full compensation for damage if it arises due to the fault of the chief accountant.