Why is notification needed?

The role of this notification is quite prosaic: it is necessary to inform the relevant government supervisory structures about the migrant’s activities.

In other words, with the help of a notification, specialists of the Russian Migration Service can track the movement and actions of a foreign citizen on the territory of our country.

As you know, all foreigners are required to obtain the appropriate permit or buy a patent in order to carry out work activities. Without one of these documents, a foreigner does not have the right to work in the Russian Federation and, if a violation of the current procedure is established, he may be deported.

The only exceptions are citizens of neighboring states (residents of Kazakhstan, the Republic of Belarus and Armenia), who are equal to citizens of Russia, as well as those who have obtained a residence permit in our country.

Hiring highly qualified specialists

In order to conclude an employment contract with a highly qualified specialist (HQS) who arrived from a country that has a visa regime with Russia, the employer may not apply for a permit to hire foreign workers. But the HQS himself is required to obtain a work permit in the Russian Federation. In this case, the employer will be required to submit a number of documents necessary for issuing such a permit (Clause 6, Article 13.2 of Law No. 115-FZ).

When drawing up an employment contract, you need to take into account that the salary of a highly qualified foreign worker cannot be below the threshold value. In general, this value is equal to 167,000 rubles. per month (subclause 3, clause 1, article 13.2 of Law No. 115-FZ). But for some jobs a reduced size is set. For example, the salary of a HQS hired to work as a resident of a technology-innovative special economic zone cannot be lower than 58,500 rubles. per month. And foreign specialists - residents of industrial-production, tourist-recreational or port special economic zones must receive more than 83,500 rubles. per month.

When employed, a highly qualified specialist is required to present a VHI policy. Or the employer himself must enter into an agreement to provide paid medical services to such an employee (Clause 14, Article 13.2 of Law No. 115-FZ).

Notice deadlines

Companies are given three days from the date of signing the employment contract to fill out the form on Form 19 and transfer data to the migration service about hiring foreigners.

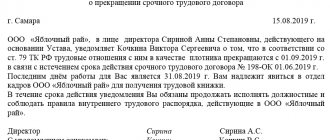

By the way, within the same time frame, the employer must notify the department about the dismissal of an employee, regardless of the reasons and on whose initiative it occurred.

Within 24 hours after this, the migration service employee must notify the employer of receipt of the notification.

Sample documents from 2022

Further, using direct links from our website, you can download free samples of documents required from 2022 to notify the Ministry of Internal Affairs about a foreign worker.

Appendix No. 1 to the order of the Ministry of Internal Affairs dated July 30, 2020 No. 536: Appendix No. 3 to the order of the Ministry of Internal Affairs dated July 30, 2020 No. 536: Appendix No. 5 to the order of the Ministry of Internal Affairs dated July 30, 2020 No. 536: Appendix No. 7 to the order of the Ministry of Internal Affairs dated July 30, 2020 No. 536: Appendix No. 8 to the order of the Ministry of Internal Affairs of July 30, 2020 No. 536:

Fine for failure to comply with the form and/or procedure for notifying the Ministry of Internal Affairs (Part 3 of Article 18.15 of the Code of Administrative Offenses of the Russian Federation):

- for officials – from 35,000 to 50,000 rubles;

- for organization – from 400,000 to 800,000 rubles. or suspension of activities for a period of 14 to 90 days.

How to send a notification

You can send a notification in different ways:

- The most common and correct transfer is considered to be in person “from hand to hand” from the employer to a specialist from the migration department.

- Sending via Russian Post by registered mail with acknowledgment of delivery.

Both of these options guarantee receipt of the document by the addressee, which means there will be no further claims from regulatory authorities.

Today, it is also permissible to notify the migration service through electronic means of communication, including the State Services website, but only on the condition that the organization has a digital signature registered in accordance with all the rules.

How to correctly submit a notice of hiring and dismissal of a foreign worker

The new notice forms are printed on both sides of a sheet of paper, but still take up several sheets of paper. You cannot intentionally shorten or shorten a notice so that it fits on one sheet of paper. If there are not enough cells in the notification for some information, additional sheets must be filled out.

Editor's note:

- in what time frame, where and in what form should a notification of the conclusion of an agreement be sent, read in the article in our Knowledge Base “Notification of the admission of foreign citizens to the Ministry of Internal Affairs (step-by-step instructions)”

- when, where and in what form should a notice of termination of the contract be sent, read in our Knowledge Base article “Notification of termination of a contract with a foreign citizen (step-by-step instructions)”.

The administrative regulations of the Ministry of Internal Affairs clearly state that notices of the conclusion and termination of an employment contract and appendices to them, consisting of two or more sheets, are stitched. If the notice is not stitched, but simply stapled, then this is considered a violation.

How to correctly stitch together notices of concluding and terminating a contract with a foreigner

To correctly submit a notice of hiring or dismissal of a foreigner, use the instructions:

- Arrange all the sheets in order: the notification sheets come first, followed by all the additional sheets. You can add a final, blank sheet to make it easier to certify the notice. Please note that in some regions the Ministry of Internal Affairs asks you to attach a copy of the agreement with the foreigner to the notification.

- Remove all paper clips and clips from the sheets.

- Number all sheets of the notice and its annexes.

- After this, make three or two holes along the left edge, through which thread a fairly strong thread. Both ends of the inserted thread should end up in the same place on the last page of all materials.

- Glue a white piece of paper over the threads.

- On the sheet write “The document contains ___ sheets stitched and numbered.”

- Write the position, surname and initials of the director or employee responsible on behalf of the company to sign and submit notifications to the Ministry of Internal Affairs.

- The director or authorized representative must personally sign the document. Facsimiles cannot be used.

- Enter the date the notification was posted.

- Place the organization's seal on top so that it takes up space both on the glued sheet of paper with the certification inscription and on the last sheet of the bound documents.

When preparing a notice of conclusion and termination of a contract, be careful; any deviation, any mistake entails administrative liability for the employer.

Employer's liability for incorrectly bound notice

An employer may receive a fine not only for failing to submit a notice of conclusion or termination of a contract with a foreigner to the Ministry of Internal Affairs or for doing so late. But also for the fact that the notification was submitted in violation of the form or procedure for notification. And the requirement that notifications be bound, numbered and certified are requirements for the filing procedure.

Therefore, if a notification is submitted, but not stitched or stitched incorrectly, then the employer will face a fine under clause 3, article 18.15 of the Code of Administrative Offenses of the Russian Federation - from 400 to 800 thousand for each notification. Therefore, the qualifications of the employee who handles the migration document flow in the company is the company’s protection. And the better the specialist understands the migration field, the more reliable the protection.

What to pay attention to when filling out the notification

Form 19 refers to unified forms that are mandatory for use.

It has a convenient structure and fairly clear content and includes all the necessary information about the company - the employer and the employee of foreign origin.

The notification must be issued only in Russian, in capital or block letters, clearly and legibly.

It is also possible to fill it out on a computer, but in this case the document should be printed on both sides on one sheet. All lines and cells must be filled in, gaps are not allowed.

The document must not contain any errors, corrections, blots, abbreviations or abbreviations - if there are any, it may be declared invalid and the migration service will require re-registration.

The form must be endorsed by a representative of the organization, and it must be stamped using a seal only in cases where the use of stamps to certify documentation is enshrined in the local regulations of the company.

Employment of “visa-free” foreign citizens

A foreigner who arrived in the Russian Federation on a visa-free basis must present a patent issued by the Russian Ministry of Internal Affairs when applying for a job. This document confirms that the candidate has fulfilled all the requirements of migration legislation: he has an in order migration card, a health certificate and documents on knowledge of the Russian language. You will also need a VHI policy (if the employer is not ready to pay for medical care for such an employee).

REFERENCE

The total validity period of a “labor” patent, taking into account extensions, cannot exceed 12 months from the date of its issue.

During this period, it is necessary to make monthly fixed advance payments for personal income tax. The amount of the payment is indexed annually taking into account the deflator coefficient and the regional coefficient (clauses 2 and 3 of Article 227.1 of the Tax Code of the Russian Federation). The amount of personal income tax on the income of a foreigner working on the basis of a patent can be reduced by fixed “advances” paid during the period of its validity. To do this, the tax agent must receive a corresponding notification from the tax office (clauses 5 and 6 of Article 227.1 of the Tax Code of the Russian Federation). As already mentioned, the exception is workers from Belarus, Kazakhstan, Kyrgyzstan and Armenia. These countries, together with Russia, are parties to the Treaty on the Eurasian Economic Union. This international document allows citizens of the EAEU member countries to work in Russia without obtaining permits and patents (Clause 1, Article 97 of the Treaty). Therefore, when concluding an employment contract, candidates from these countries, with the exception of Belarus, must additionally present only a migration card and a VHI policy. As for citizens of Belarus, they do not need a migration card for employment, and medical care is guaranteed at the interstate level (Article 8 of the Treaty between the Russian Federation and the Republic of Belarus dated December 25, 1998 “On equal rights of citizens”).

Taxes and contributions on the income of foreigners received in Russia

The tax rate for personal income tax is determined based on the status of a foreign citizen - if he stays in the Russian Federation for more than 183 calendar days in a row, he is recognized as a tax resident of Russia, and the rate for him is 13%. If his stay in the country is less than 183 days, the rate for him is 30%, as for a tax non-resident.

However, a feature of the calculation of personal income tax for Belarusians is the determination of the tax rate depending on the duration of the employment contract, and not the time of stay in the Russian Federation.

Belarusians pay personal income tax on their income at a rate of 13% if the employment contract is concluded for a period of 6 months or more. In this case, the foreigner is a tax resident. If the agreement is concluded for a short period of time, less than six months, the personal income tax rate will be 30%, since the Belarusian will be a tax non-resident.

What insurance premiums are charged on the income of Belarusians located in Russia and employed by Russian companies or entrepreneurs depends on several points:

- Only contributions for injuries are calculated from the income of highly qualified specialists (this is done if, due to the type of activity of the company, there is a possibility of accidents occurring).

- If a citizen of Belarus has the status of a temporary stayer, contributions for social insurance and compulsory pension insurance are assessed. Contributions to the compulsory medical insurance fund are not provided.

- If a citizen has a residence permit or temporary residence permit and resides in Russia permanently or temporarily, respectively, then deductions are made to all funds - pension, social, medical insurance and contributions for injuries.

- If a Belarusian has opened his own individual entrepreneur (he can also find work as an employee), contributions to pension and health insurance are deducted.

Hiring a foreigner with temporary residence permit

A foreigner who has a document of temporary residence in the Russian Federation does not need to obtain a work permit or a “labor” patent. But he can get a job on the staff of an organization only in the constituent entity of the Russian Federation in whose territory he is allowed temporary residence (subclause 1, clause 4, clause 5, article 13 of Law No. 115-FZ). Therefore, when signing an employment contract with such an employee, you need to pay attention to the region of his residence.

Foreigners temporarily residing in Russia do not have to present a VHI policy when applying for employment. Such persons are recognized as insured in the compulsory medical insurance system and have the right to receive free medical care in the same volume as Russians (Clause 1, Article 10 of the Federal Law of November 29, 2010 No. 326-FZ).

Compose HR documents using ready-made templates for free

List of documents that must be provided to the employer upon employment

Belarus is our partner in the EAEU, which means that the movement of labor occurs in a simplified manner. In accordance with this, the employment of foreigners from the Republic of Belarus will be similar to the employment of Russian citizens, in accordance with the provisions of Article 65 of the Labor Code of the Russian Federation.

When applying for a job, the applicant must provide the following package of documents:

| № | Document | Clarifications |

| 1 | Application for admission | It will reflect the applicant’s desire to occupy a certain position in the organization. |

| 2 | Passport or other identification document of a foreign citizen | If the documents are not in Russian, a notarized translation is required |

| 3 | (Insurance certificate of compulsory pension insurance) SNILS | Currently not issued (stored exclusively in electronic format in the database of the Pension Fund of the Russian Federation), but can be in hand if the citizen has previously worked in Russia. If the certificate is missing, the employer can himself request the information he is interested in from the Pension Fund of the Russian Federation, or ask the employee to obtain this information. |

| 4 | Employment history | Both old Soviet forms and modern Russian ones can be used. National labor books do not have legal force on the territory of Russia, and entries are not made in them. If necessary, you need to issue a new employment form. It should be borne in mind that entries from the national document are not transferred to the new book. |

| 5 | Documents confirming the level of education of a foreign citizen | They are provided as needed (if the job requires high qualifications). If the diploma is completed in a foreign language, the entries must be translated into Russian and duly certified (by a lawyer or consulate) |

| 6 | Additional documents (if necessary) | In some areas of activity it is necessary to have a medical book, a certificate of good conduct |

IMPORTANT!

A citizen of Belarus can take out a compulsory medical insurance policy and receive medical care free of charge. But you won’t need a voluntary health insurance policy when you are employed.

It is imperative to remember that all translations of documents and their notarization are paid for by the applicant for the position. The employer does not bear such expenses

. In general, the list of documents that a foreigner will need for official employment is the same as for Russian citizens.