From the article you will learn:

What is the difference between an employment contract and a work contract? At first glance, the difference may seem insignificant. After all, in both cases, the parties interact completely legally, formalize their cooperation in writing and pay taxes. However, judicial practice demonstrates that replacing labor relations with civil law ones has many negative consequences, and primarily for the employer. How to “not confuse” similar agreements and formalize everything correctly - briefly about the main thing in our article.

The concept of an employment contract and a work contract

If a person gets a job, an employment contract . This is a special agreement between the employee and the employer, according to which:

- the hired subject undertakes to perform the labor function assigned to him and to comply with the internal labor regulations;

- The employer undertakes to provide work, provide suitable working conditions, and pay wages on time and in full.

The concept and features, as well as the mechanism for concluding and terminating a labor contract are regulated by labor legislation (Section III of the Labor Code of the Russian Federation).

A work contract is a civil law transaction, according to which one party performs certain work ordered by the other party and delivers the result to the customer. The latter, in turn, undertakes to accept the work and pay for the work of the performer. The features of this format of cooperation are provided for in Chapter 37 of the Civil Code of the Russian Federation.

The difference between an employment agreement and a work contract

An employment contract has much in common with a contract agreement. Both the first and second agreements involve the performance of certain work and the payment of remuneration for the work. However, there is a fundamental difference between these two treaties. An employment contract is drawn up when it comes to labor relations. In this situation, the person performing the work is more unprotected, since by law he is subordinate to the employer. When it comes to a contract, you need to remember that the parties to such an agreement are equal from the point of view of the legislator. They are counterparties, free in their decisions and not bound by subordination.

Below is a table that compares an employment contract and a work contract according to their main characteristics.

Table No. 1. The difference between an employment contract and a work contract.

| Comparison criterion | Employment contract | Work agreement |

| Regulatory regulation | Labor legislation standards, in particular the Labor Code of the Russian Federation. | Norms of civil legislation, in particular the Civil Code of the Russian Federation. |

| Parties | Employer and employee. | Contractor and customer. |

| Equality of sides | No. | Yes. |

| Subject of the agreement | The process of an employee performing his or her job function. | Specific result of the work. |

| Personality trait | The work is performed by the employee personally. | The task can be completed by the contractor personally or with the involvement of third parties. |

| Work mode | The employee is obliged to comply with the internal labor regulations in force in the organization. | The contractor sets his own working hours. |

| Place of work | Provided for by the contract. Typically, a person works at the location of the employer. However, the Labor Code of the Russian Federation allows for a mobile, traveling nature of work, as well as a home-based and remote format. | The contractor independently chooses the location for performing the customer’s assignment. In some cases, the place of work is determined by the specifics of the order. |

| Material support | The employer must provide the employee with everything necessary to perform his job function. | The contractor works on his own equipment. In some cases, the customer may provide the contractor with material for the work. |

| Reward | Guaranteed regular wages. Salaries are transferred at least twice a month. | The amount of remuneration and the procedure for its payment are agreed upon by the parties. Availability of reward depends on the result. |

| Duration of the agreement | Typically, an employment contract is concluded on an indefinite basis. Cases when it is possible to draw up a fixed-term employment contract are established in the Labor Code of the Russian Federation. | The deal is concluded for a certain period. |

| Social guarantees | An employee can count on a number of social guarantees, including paid sick leave, paid vacation, severance pay, wages not lower than the minimum wage, and more. | The guarantees provided for by labor legislation do not apply to participants in civil transactions. |

| Conclusion of an agreement | The law regulates the age at which a person has the right to work under an employment contract. Unreasonable refusal to conclude an employment contract is not permitted and can be appealed in court. When concluding an employment contract, the employee must provide the employer with a list of required documents. | The parties are free to enter into a deal. Usually, the passports of the parties are sufficient to conclude a transaction. |

| Contract form | Written. | Written. |

| Recording in the work book | A record of hiring must be made in the work book. | Not fixed. |

| Termination of cooperation | Dismissal is permitted only on the grounds listed in Art. 77 Labor Code of the Russian Federation. | The parties may terminate the agreement at any time. Payment in this case is made in proportion to the completed part of the work. |

| Material liability | The employee bears financial responsibility within the limits of his average monthly earnings, unless an agreement on full financial responsibility is concluded with him. | The contractor is responsible for failure to complete the work or for poor quality work in full. |

Next, we will consider some points from the table in more detail.

Scope of regulation and parties

When concluding an employment contract, the parties are guided by the current Labor Code of the Russian Federation. Based on the signed agreement between the employer and the hired person, an employment relationship arises. Civil transactions, including a work contract or a contract for the provision of paid services (which are also often replaced by an employment contract), are subject to regulation by the Civil Code of the Russian Federation.

In labor relations, one of the parties is the employer, the other is the employee. These subjects are not equal, since the hired person is subordinate to his employer. The legislator recognizes workers as a more vulnerable category and establishes special social guarantees for this group, including:

- the right to annual paid leave;

- the right to benefits in connection with the onset of temporary disability;

- right to overtime pay;

- the right to additional guarantees for work in hazardous or unhealthy conditions;

- other.

An employee is always an individual, but the role of an employer can be an individual, an organization, or an individual entrepreneur.

The parties to a contract, like participants in any other civil transaction, are equal. Neither the contractor nor the customer has the right to count on any social guarantees or additional compensation provided for by labor legislation. Each party to civil legal relations can be an individual or legal entity or a private entrepreneur.

Subject of the agreement and specifics of the work

The subject of the employment contract is the work process itself. An employee must regularly perform work of a certain type, which is determined by his job function. A contract implies that one party undertakes to perform a specific task assigned by the other party.

The employer provides the employee with everything necessary to perform his job function, including organizing a workplace and providing access to equipment and materials. The employee, in turn, must fulfill his obligations and comply with internal labor regulations.

For example:

If the working day according to the schedule begins at 9:00, then the person does not have the right to come to work at 10:00, and then make up for the lost hour in the evening or during the lunch break.

The contractor has the right to organize his regime independently. The task can be performed at a time of day or night when it is convenient for the performer. It is only important that the result is ready before the date specified by the customer. The latter usually does not have the right to control the work process of the counterparty. However, the parties may agree on additional terms regarding the manner in which the task will be performed in the contract.

For example:

The organization hires a construction team to carry out cosmetic renovations to some of the main office premises. When concluding a transaction, the customer stipulates that repair work must be carried out from 17:00 to 22:00.

As a rule, the contractor must take care of the place to perform the task (if this place is not determined by the terms of the order), as well as equipment and materials.

Remuneration and taxes

For his work, the employee receives a salary, which is paid at least twice a month. An employer may use different remuneration systems; this point is recorded in the internal regulations of the organization. The salary is structured, it consists of a salary or tariff rate, bonuses, allowances and other additional payments. The minimum wage is set by law and is revised every year.

The amount of remuneration under the contract is determined by the parties. There are no restrictions regarding the frequency or size of payments.

The accounting department necessarily deducts 13% personal income tax from wages. In addition, the employer pays contributions to the Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund for each employee.

If an individual acts as a contractor , then the customer must also contribute 13% of personal income tax and contributions to the Pension Fund and the Compulsory Medical Insurance Fund to the state income. There is no need to pay contributions to the Social Insurance Fund for the performer.

If the contractor is registered as a private entrepreneur , then he pays all taxes independently, based on what taxation system he is on.

From an employee who is a debtor in enforcement proceedings, the employer, on the basis of a bailiff's order, is obliged to make deductions in favor of the claimant. For example, if there is arrears in alimony, up to 70% of the amount can be recovered from an employee’s salary “in hand.”

Validity

Most often, an employment contract is of an open-ended nature. To conclude a fixed-term employment agreement, at least one of the grounds listed in Art. 59 Labor Code of the Russian Federation. For example, employment contracts for a certain period are signed to perform seasonal or temporary work, to replace the main employee during his absence, and also if the hired subject is a manager, a creative worker, an old-age pensioner, and others.

The contract is always urgent. The parties agree on the duration of the transaction, and, as a rule, this period coincides with the period of completion of the work. Although in practice there are cases when the customer and the contractor enter into an agreement for a long period of time, during which the contractor periodically receives orders.

GPC agreement

When concluding a civil law agreement (hereinafter referred to as the civil law agreement), the employer does not enter into an employment relationship with the contractor. They agree on specific work, services, the deadline for their completion and the price for them. According to the GPC agreement:

- The performing person performs pre-agreed work or services, and he is not subject to the internal corporate rules and labor regulations of the organization.

- When concluding a contract, specific deadlines for the execution of the contract are immediately discussed and agreed upon, after which the work must be completed.

- Under the GPC agreement, the procedure for paying wages can be determined by agreement of the parties.

- The employer must withhold personal income tax, pay contributions to the Pension Fund and the Compulsory Medical Insurance Fund, but at the same time he does not pay contributions to the Social Insurance Fund (exception: the employer is obliged to pay contributions for injuries if this is specified in the contract).

Benefits for the employer:

- under the contract, the GPC may not issue a social package to the executor;

- there is no need to provide a workplace to the person performing the work;

- gets rid of the transfer of insurance premiums to the Social Insurance Fund (unless otherwise specified in the contract).

Disadvantages for the employer:

- cannot monitor the work progress of a freelance employee;

- does not have the right to involve an employee in the internal regulations of the company.

Benefits for the performer:

- you can combine work in several places;

- You can involve third parties to perform work (subcontractors).

Disadvantages for the performer:

- lack of social package;

- The customer can terminate the contract at any time. A situation may arise that the employee was not paid for the work he performed, then the employee can receive money through the court by proving that the contract was terminated without good reason and the work was completed in full.

Materials from the newspaper “Progressive Accountant”,

Hello, Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

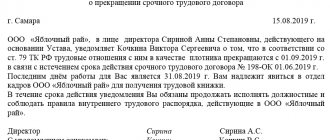

Registration and recording of an employment contract and a work contract

An employment contract and a work contract are concluded in simple written form. In order to formalize a contract, as a rule, only the passports of both signatories are needed. In some cases you may also need:

- certificates of registration and tax registration of a legal entity (if the party to the transaction is an organization);

- permits or patents for certain types of work;

- powers of attorney for representation of interests or statutory documents of a legal entity.

The conclusion of an employment agreement is reflected in the work book. To complete the paperwork, the employee will need a whole package of papers - passport, SNILS, military ID, education documents and others.

The period of work under an employment contract is counted in the insurance period, the duration of which determines the right to an old-age pension.

Pros and cons for the employer and contractor

Advantages for the employer:

- A small range of responsibilities in relation to the hired employee.

- Due to the absence of contributions for accidents, a reduction in insurance premiums.

- There is no need to provide the performer with equipment, tools and provide him with a workplace.

- No pay for vacations and sick leave.

Disadvantages for the employer:

- The contractor cannot be held liable for violating the labor regime.

- If elements of labor relations are included in the agreement, then the document may subsequently be recognized by the court as an employment contract, which will attract fines and damages to the contractor.

- The risk of an employee failing to complete specified tasks.

Benefits for the employee:

- Free work schedule.

- The final price includes the contractor's costs.

- Reducing the personal income tax tax base.

Disadvantages for the performer:

- If documents are not submitted to the pension fund on time, the employment and insurance period is interrupted due to the lack of an entry in the book.

- Non-payment of vacations and sick leave.

- The risk of non-payment for work done due to improper fulfillment of obligations.

- Due to the fact that the work is not unlimited, after completing all the tasks you will have to look for a place again.

- With an official appointment, refusals are possible due to the fact that there is no entry in the work book, and the employer may mistake this for a lack of work experience.