To prepare documents for LLC registration, you can use the free online service directly on our website. With its help, you can create a package of documents that meets all requirements for completion and legislation of the Russian Federation.

Any business requires start-up capital, at least small. If an individual entrepreneur starts his own business, he simply uses the property and money that belong to him as an individual. But the founders of an LLC must know how to contribute authorized capital, because this money will become the property of the company.

What is authorized capital and why is it necessary to contribute money to form it?

Authorized capital (hereinafter - MC) is one of the funds of a legal entity that performs several important functions:

1. When creating a company, the MC is used as a primary material resource for starting business activities.

2. The distribution of shares in the management company between the owners determines their ability to influence the management of the legal entity and receive dividends based on the results of its activities.

3. If the company has problems with solvency, the management company is a guarantee that at least part of the debt (within the limits of its amount) will be repaid.

The size of the management company and the shares attributable to each founder are prescribed in the company's charter.

The minimum amount of the capital company established by law must be paid in cash (clause 2 of article 66 of the Civil Code of the Russian Federation). Therefore, for any business company, the operation of depositing money to pay for the management company is mandatory.

NOTE! The maximum amount of the authorized capital of an LLC has not been established. But when determining the size of the authorized capital, it is necessary to take into account that the LLC must ensure that it has net assets in an amount not less than the size of the authorized capital, since if in the future the value of net assets becomes less than the authorized capital and does not increase within two years, then it will be necessary to either reduce the authorized capital capital, or make contributions to property to increase net assets.

And the minimum size of the charter capital is approved by law. Let's consider which one for LLC and JSC.

What amount of authorized capital should be deposited into the account?

The amount of the authorized capital must be determined before registering the LLC and indicated in the constituent documents.

The minimum authorized capital of 10,000 rubles must be paid in cash. And amounts in excess can be contributed with money and property, for example, equipment or securities (Clause 2 of Article 66.2 of the Civil Code of the Russian Federation). The maximum size is not limited.

The size of the authorized capital is an indicator of the company’s reliability. It will protect the finances of creditors if the company defaults and goes bankrupt. Therefore, banks and counterparties are slightly distrustful of organizations with a minimum authorized capital. But many respectable companies still limit themselves to the minimum amount, as this makes starting a business cheaper.

| Small authorized capital | Large authorized capital | |

| Advantages |

|

|

| Flaws |

|

|

Taking this into account, entrepreneurs should think in advance about the amount of funds that will ensure comfortable work at the start: it will allow them to purchase equipment, rent premises, hire employees, etc. The optimal size of the authorized capital is the one that maintains a balance between the needs of the business and the capabilities of the founder.

How to deposit money when forming a management company and what is the minimum contribution amount?

To find out how to deposit authorized capital into a current account, you need to decide what organizational and legal form we are dealing with. The period established for full payment of the management company and the minimum size of the management company depend on it.

For a limited liability company (LLC) this is 4 months from the date of registration. The size of the charter capital for an LLC must be at least 10,000 rubles. For a joint stock company (JSC), payment for the placed shares must be made in full within 1 year from the date of establishment of the enterprise; in addition, at least 50% of the outstanding shares must be paid for within 3 months. The amount of the minimum capital for a joint-stock company depends on whether the company is public or not, i.e. whether it has the right to distribute its shares by public subscription. For a public joint stock company, the minimum size of the capital is 100,000 rubles, for a non-public company - 10,000 rubles.

Therefore, in accordance with the requirements of the Civil Code of the Russian Federation, the amount of cash contribution to the management company (or payment in cash for placed shares) must be no less than the specified minimum amount for each of the legal forms of the enterprise.

ConsultantPlus experts told us in what order the authorized capital is paid. Get trial access to the system and move on to the Ready-made solution.

Procedure for contribution of authorized capital

The deadlines for contributing the authorized capital are established by Article 16 of the Law “On LLC” - no more than four months from the date of registration of the company. However, an earlier date may be specified in the agreement on establishment or in the decision of the sole founder.

There is no special administrative sanction for violating the deadline for contributing the authorized capital of an LLC upon creation. But when this period exceeds a year, the organization may be forcibly liquidated at the initiative of the Federal Tax Service.

If only some of the founders have not contributed their share to the authorized capital, then their unpaid shares pass to the company. It is also possible to provide in the establishment agreement for the collection of penalties in the form of a fine or penalty in relation to such debtors.

Participants can deposit funds to pay their share in cash or transfer them by bank transfer. If money is deposited into the cash register, then confirmation of payment will be a cash receipt order. But the organization does not always have a cash register, then you need to make a non-cash payment.

How to deposit the authorized capital into the LLC current account? There is nothing complicated about this procedure. A transfer to an organization's account can be made from your individual account or deposited in cash through a bank. The main thing is that any document confirming the contribution of a share to the capital company should indicate its purpose. For example, “Payment by the founder of a share in the authorized capital” or “Contribution of a participant to the authorized capital.” The payment order, PKO or payment receipt must be kept by the participant.

If the share in the company is contributed by property, then the registration procedure will be different. After receiving an independent assessment and approving it at the general meeting, an act of acceptance and transfer of property is drawn up.

The act must indicate:

- data of the parties (the company itself and the participant);

- information about the size and nominal value of the paid share;

- description of the property and its estimated value.

- confirmation that the property belongs to the participant by right of ownership and is transferred to pay for his share in the authorized capital.

In addition, if property is transferred, the ownership of which requires state registration (real estate, transport, shares, etc.), then additional documents must be drawn up. We recommend that you obtain a free consultation on this issue.

Free consultation on business registration

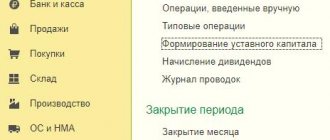

Accounting entries when depositing money to form a management company

Accounting for settlements for the formation of the Criminal Code is kept on the account. 80 “Authorized capital”. In this case, he corresponds with the account. 75 “Settlements with founders” and (depending on the chosen option) with cash accounts (50, 51, 52).

Posting Dt 75.1 - Kt 80 forms the debt of the founders for contributions to the management company.

Further, various methods of paying for the management company in cash are possible.

The founder can first deposit money into the cash register: Dt 50 - Kt 75.1.

Then they are deposited into the bank account: Dt 51 - Kt 50.

Also, the founder can immediately transfer money to the current account: Dt 51 - Kt 75.1.

For a practical example of postings for contributing authorized capital with money and property, see here.

If the founder is a non-resident, then he has the right to make a contribution in foreign currency. This follows from the legislation on currency control (Article 6 of the Law “On Currency Regulation” dated December 10, 2003 No. 173-FZ): Dt 52 - Kt 75.1.

In this case, exchange rate differences appear. In accordance with clause 14 of PBU 3/2006, these differences should be attributed to additional capital (account 83):

- Dt 75.1 - Kt 83 - if the exchange rate has increased and the resulting differences are positive;

- Dt 83 - Kt 75.1 - in the event of a fall in the exchange rate and the occurrence of negative differences.

This shows that exchange rate differences that arose when the exchange rate fell in this case must be compensated for by additional capital. But a newly created organization, as a rule, has not yet formed additional capital. Therefore, before replenishing additional capital, the enterprise may develop a negative account balance. 83.

Read about where to find the authorized capital on the balance sheet here.

Free transfer of property

This option is convenient to use if you need to transfer objects from a subsidiary to the parent company.

A “daughter gift” is not subject to income tax in accordance with paragraph 11 of Art. 251 Tax Code of the Russian Federation. To do this, the receiving company must own more than 50% of the authorized capital of the transferring one.

It is important to remember that the parent company, having received the property, cannot transfer it to third parties within a year. Otherwise, you will have to pay income tax.

Sometimes tax authorities try to reclassify a “daughter gift” as a payment of dividends, but the courts, including the highest authority, in this case are on the side of taxpayers (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 4, 2012 No. 8989/12).

The approach of the inspectors to VAT here is generally similar to the contribution to property, which was discussed above. But since the transfer of an object from a subsidiary to a parent company can hardly be considered an investment, then most likely the businessman will have to accept the position of the tax authorities. Those. the transferring company charges VAT, but the receiving company cannot deduct it.

Tax consequences of depositing money to form a management company

Receiving contributions to the management company does not form a tax base for profits on the basis of subclause. 3 p. 1 art. 251 Tax Code of the Russian Federation. This article states that the contribution of any property (which, in accordance with paragraph 2 of Article 130 of the Civil Code of the Russian Federation, includes funds) as contributions to the Criminal Code does not increase the taxable base.

Contributions to the management company are not subject to VAT, since in accordance with subparagraph. 4 p. 3 art. 39 of the Tax Code of the Russian Federation they are not implementation.

Exchange differences in this case also do not affect the profit tax (clause 1 of Article 277 of the Tax Code of the Russian Federation). This article states that receiving payment for placed shares or shares does not lead to the issuer's profit (loss).

Consequently, making money as a contribution to the management company does not have any impact on the taxation of a legal entity.

Failure to fulfill a participant’s obligation to pay for a share in the authorized capital often brings the founders to court. ConsultantPlus experts have collected the latest judicial practice on this issue into a single review. Explore the analytical selection for free by getting trial access to K+.

conclusions

An LLC participant can pay for his contribution in property. It is important to make sure that the thing that he wants to contribute to the authorized capital can really act as a contribution - for this you should study the provisions of the agreement on the establishment of the LLC.

An independent assessment should be carried out in relation to the contributed item, and the value determined by the appraiser should be agreed upon at a general meeting of the organization.

Upon entry of property into the management company, the company’s accountant reflects the corresponding entries in the accounting records as of the date of the transaction.

Results

The authorized capital is one of the most important funds of an enterprise formed during its creation. It performs 3 main functions - distribution, logistics and guarantee. The management company, in terms of its minimum size, must necessarily be formed by depositing money. To account for the replenishment of the capital account, accounts 75, 80, as well as accounts for accounting for cash flows (50, 51, 52) are used. Replenishing capital assets with cash does not have any impact on the tax base.

Sources: Law “On Currency Regulation” dated December 10, 2003 No. 173-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.