Estimated liabilities are liabilities with an uncertain amount and/or maturity. This term was introduced by PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”. It is similar to the concept of provisions under IAS 37 Provisions, Contingent Liabilities and Contingent Assets. This article will discuss how to calculate estimated liabilities in 1C: ZUP 3.1.

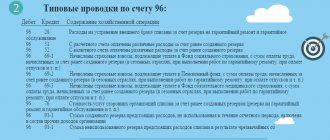

When accruing vacation in 1C: ZUP without use, the following entries are made:

- Debit expense account (for example, 20) – Credit payroll account (70);

- Debit the cost account (for example, 20) – Credit the accrual account (69).

As a result, during the annual holiday period the costs will be very high. To prevent this from happening, even before employees take vacations, the costs for them are already reflected in the cost account. The accounting entry looks like this:

- Debit of the cost account (for example, 20) – Credit of account 96 (sub-accounts of account 96 correspond to the accrual of vacation pay and contributions).

In order to accrue vacation now, write off the vacation reserve from account 96:

- Debit account 96 – Credit payroll account (70);

- Debit account 96 – Credit accrual account (69).

Please note that we will not talk about accounting accounts, but only about how to correctly calculate estimated liabilities ZUP 3.1 - the entries will be generated in the accounting system where regulated accounting is maintained.

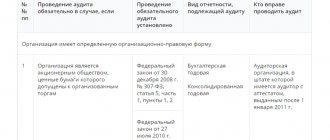

Mandatory accounting reserves 2020–2021: classification, types, regulations

Accounting reserves can be divided into 3 groups:

- clarifying - intended to adjust the book value of certain assets (reserves for impairment of inventories and (or) financial investments, reserve for doubtful debts);

- contingent - reserves associated with the emergence of conditional facts of economic activity at the company (due to the occurrence of highly probable events in the future: a obviously unsuccessful trial; restructuring of the company, etc.);

- targeted - reserves for upcoming expenses for specific purposes (for example, warranty repairs, upcoming vacation payments, etc.).

The first group of reserves is reflected in accounts specially designated for them:

- 14 “Reserves for reduction in the value of material assets”;

- 59 “Provisions for impairment of financial investments”;

- 63 “Provisions for doubtful debts”.

Get acquainted with the nuances of a doubtful reserve using the material “Reserves for doubtful debts in accounting.”

Each of the specified types of reserves in this group is subject to its own legal requirements:

- from 2022, it is necessary to evaluate inventories and resolve the issue of creating/adjusting reserves for their impairment at each reporting date (Section III FSBU 5/2019 “Inventories”). Previously, the reserve was created based on the results of the annual inventory (clause 25 of PBU 5/01);

The procedure for working with the reserve for impairment of inventories according to the rules of the new FAS 5/2019 is described in detail in the Ready-made solution from ConsultantPlus. Get trial access to the system for free and proceed to the material.

- If there are signs of impairment of financial investments, a reserve is created in accordance with paragraphs. 37–39 PBU 19/02 “Accounting for financial investments” (approved by order of the Ministry of Finance of the Russian Federation dated December 10, 2002 No. 126n);

- the appearance of doubtful debts requires the company to create a reserve in accordance with clause 70 of the regulations on accounting and reporting (approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n), clause 11 of PBU 10/99 “Organization expenses” (approved by order of the Ministry of Finance of the Russian Federation dated 05/06/1999 No. 33n).

Reserves from the 2nd and 3rd groups are called estimated liabilities and are formed based on the requirements of PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets” (approved by order of the Ministry of Finance of the Russian Federation dated December 13, 2010 No. 167n).

In the following sections we will dwell on the nuances of forming one of the mandatory accounting reserves - for payment of upcoming vacations.

Accounting

To account for each of the above valuation reserves, 3 accounting accounts are used, respectively: 14, 59, 63.

The main feature of these accounts is that they are not reflected in the financial statements as separate lines, but reduce the corresponding indicators for the lines “Inventories”, “Financial investments” and “Accounts receivable”.

Finished works on a similar topic

Coursework Accounting for estimated reserves 410 ₽ Abstract Accounting for estimated reserves 230 ₽ Test work Accounting for estimated reserves 250 ₽

Receive completed work or specialist advice on your educational project Find out the cost

The creation of valuation reserves is carried out at the expense of profit, that is, it is charged to the account of other income and expenses 91.

Note 1

It is worth noting that estimated reserves are not exact values, as they are calculated based on the professional judgment of the chief accountant or an engaged expert.

Reflection of the objects under consideration in the accounting system is mandatory for all economic entities. The exception is those of them that have the right to maintain simplified accounting and have enshrined this in their accounting policies. The creation of a reserve and its subsequent adjustment, as well as checking for changes in conditions obliging the creation of a specific valuation reserve, is carried out once a year before preparing annual reports. If necessary, an economic entity can secure a more frequent implementation of this procedure. However, since this is a rather labor-intensive process for accounting workers, accounting practice is usually limited to compliance with the generally accepted annual obligation.

Let's consider accounting for each of these valuation reserves separately.

Vacation Obligations - Reservation Rules

The estimated obligation to pay for upcoming vacations is one of the mandatory reserves in accounting. When forming it, it is important to remember that:

- the creation of an accounting vacation reserve is the responsibility of every company that has employees (except for representatives of small businesses that conduct simplified accounting (clause 3 of PBU 8/2010));

- the formation of a reserve is associated with the need to fulfill the requirements of labor legislation on the need to provide employees with paid leave (Articles 114–115 of the Labor Code of the Russian Federation);

- The amount of the vacation reserve reflected in the reporting allows its users to draw correct conclusions about the existence of vacation obligations at the reporting date.

The scheme for its formation is not regulated by law, however, when developing it, it is important to take into account several fundamental rules:

- periodicity rule - the vacation valuation liability is created for each reporting date;

- rule of rationality - the company has the right to choose a reservation criterion (separately for each employee, for divisions or for the company as a whole) depending on the size of the company and business conditions;

- rule of account identity - the expense items to which vacation reserves are allocated coincide with the expense item, which includes employee salaries.

The material “Accounting for wages in accounting (nuances)” will tell you which accounts and by what transactions the accrued salary is reflected.

How to determine the reserve amount

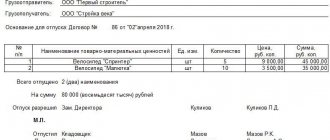

Let's say you decide that your company has an estimated liability. Now we need to calculate the amount for which we will create a reserve. The specific procedure for determining the amount of contributions to the reserve is not defined in PBU 8/2010. The reserve is created in an amount that reflects the most reliable monetary estimate of the expenses necessary to repay the obligation. This assessment is determined by you independently based on available facts or experience of similar operations, and sometimes with the help of independent experts. Be sure to draw up a document and record the cost assessment carried out. 15, 16 PBU 8/2010.

When calculating the amount of the reserve, you must adhere to certain rules. Let's show with examples.

Example 1. Determining the amount of reserve for a legal claim

/ condition / As of the reporting date, the organization is a party to the legal proceedings. Based on the lawyers' conclusions, it was concluded that it is more likely that the court decision will not be made in her favor. It is expected that with an 80% probability the amount of losses will be 300-500 thousand rubles. or with a probability of 20% - from 600 thousand rubles. up to 1000 thousand rubles.

/ solution / First, we calculate the arithmetic mean of the largest and smallest values of the interval:

- (300 thousand rubles + 500 thousand rubles) / 2 = 400 thousand rubles. — probability 80%;

- (600 thousand rubles + 1000 thousand rubles) / 2 = 800 thousand rubles. — probability 20%.

The weighted average is taken as the reserve amount:

400 thousand rubles. x 0.80 + 800 thousand rubles. x 0.20 = 480 thousand rubles.

The estimated liability for the trial is recognized in accounting in the amount of 480 thousand rubles.

If the expected payment period for the estimated liability exceeds 12 months after the reporting date, then when calculating the amount of the reserve, the discount rate must be taken into account. 20 PBU 8/2010.

Example 2. Determining the amount of the reserve taking into account the discount rate

/ condition / The organization calculates the amount of the estimated liability as of December 31, 2014. The estimated amount of the liability to be repaid is 1,500 thousand rubles. The maturity date of the obligation is July 15, 2016. The discount rate adopted by the organization is 14%.

/ decision / We calculate the value of the estimated liability at the reporting date (it is called the present value).

We determine the CD: 1 / (1 + 0.14)1.5 = 0.8216.

So, let's look at what we have achieved over the years.

| date | Expenses that increase the amount of the estimated liability, thousand rubles. | Present value of the estimated liability, thousand rubles. |

| December 31, 2014 | — | 1232.4 (1500 thousand rubles x 0.8216) |

| December 31, 2015 | 172.5 (1232.4 thousand rubles x 0.14) | 1404.9 (1232.4 thousand rubles + 172.5 thousand rubles) |

| June 30, 2016* | 95.1 (1404.9 thousand rubles x 0.0677**) | 1500.0 (1404.9 thousand rubles + 95.1 thousand rubles) |

* To simplify the calculations, it was decided to determine the present value based on a deferment period of 1 year 6 months, that is, until 06/30/2016. It was decided not to take into account the 15 days remaining until payment (07/01/2016—07/15/2016) when discounting, since the effect of this procedure is insignificant.

**Semi-annual discount rate is 6.77%.

Each year the amount of the estimated liability will increase due to an increase in its present value.

I would also like to say a few words about the formation of a reserve for obviously unprofitable contracts. 2 PBU 8/2010.

Example 3. Determining the amount of provision for unprofitable contracts

/ condition / The organization has entered into an agreement for the supply of products it produces. The expected revenue is 800 thousand rubles. (without VAT). The organization estimates that due to rising prices for raw materials, the cost of producing the products provided for in the contract will amount to 1,100 thousand rubles. (without VAT). As of the reporting date, the company has not yet begun to fulfill its obligations under the contract. The penalty for termination of the contract will be 400 thousand rubles.

/ decision / The contract is obviously unprofitable, since the inevitable costs of its execution (1,100 thousand rubles) exceed the expected revenues under it (800 thousand rubles). The loss will be 300 thousand rubles. (1100 thousand rubles – 800 thousand rubles). And if the company refuses to fulfill the contract, it will have to pay a penalty (400 thousand rubles).

In this case, the estimated liability is recognized in accounting in the amount of the possible net loss during the execution of the contract (300 thousand rubles), which is less than the amount of the penalty for non-fulfillment of the contract (400 thousand rubles).

If the organization decided to terminate the contract and pay a fine, then the amount of penalties (400 thousand rubles) would be reflected in the accounting.

Methods for calculating vacation obligations

The company creating the vacation reserve is free to choose the methodology for calculating the amount of the vacation obligation. The only requirement is that the algorithm used must provide the most reliable result.

Among the techniques that have become widespread in practice are (for example):

- regulatory method (tax) - calculation of contributions to the reserve is carried out according to the rules of the Tax Code of the Russian Federation (Article 324.1 of the Tax Code of the Russian Federation);

- IFRS method (see example below);

- proportional method - it is based on the following scheme: for the first month worked after vacation or hiring, the company's obligation to the employee is approximately 1/11 of the salary accruals; similarly, at the end of subsequent months worked, the vacation obligation is calculated in proportion to the number of months worked: 2/11 , 3/11, 4/11, etc.;

- average daily (group or individual) method - the amount of vacation obligation is calculated for a group of employees or individually for each of them based on the number of earned unused vacation days for each reporting date and the amount of average daily earnings.

Let's look at an example of how to calculate the vacation liability using the IFRS method.

Example

The structure of Winsor LLC has 3 divisions:

- administrative and economic (AHP);

- production and technical (PTP);

- supply and sales (SSP).

The accounting policy of Winsor LLC establishes:

- the volume of contributions to the reserve for vacation pay is determined based on the salary accruals of each department (including insurance premiums);

- accruals to newly hired and resigned employees during the month are not included in the calculation;

- each month worked in full entitles the employee to 2.33 days of annual paid leave;

- the amount of contributions to the reserve is determined monthly, which allows you to take into account all salary changes (increase or decrease in salary);

- formula for calculating contributions to the reserve for each division (OD):

OR = (payroll + insurance premiums per month) / 28 × 2.33.

For example, on October 31, entries were made in the accounting of Winsor LLC related to salary accruals and deductions to the vacation reserve:

| Debit | Credit | Amount, rub. | Decoding the wiring |

| 26 | 70,69 | 478 956 | Salaries accrued to AHP employees |

| 20 | 70,69 | 1 437 237 | Salaries accrued to PTP employees |

| 44 | 70,69 | 321 523 | Salaries accrued to SSP employees |

| 26 | 96 | 39 856 (478 956 / 28 × 2,33) | A reserve has been accrued for vacation pay for AHP employees |

| 20 | 96 | 119 599 (1 437 237 / 28 × 2,33) | A reserve has been accrued for vacation pay for PTP employees |

| 44 | 96 | 26 755 (321 523 / 28 × 2,33) | A reserve has been accrued for vacation pay for SSP employees |

For an example of calculating the vacation reserve in another way, see the material “Reflection of the reserve for vacation pay in accounting.”

Whether it is possible to use the reserve created in accounting to pay for vacation provided in advance or to pay for study leave, find out in the ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Find out in the next section whether it is possible to make vacation booking easier.

Support for automatic calculation of reserves for doubtful debts in 1C: Accounting 8 (rev. 3.0)

In the 1C: Accounting 8 program, edition 3.0, the automatic calculation of reserves for doubtful debts is set to:

- in accounting - in the Accounting policy form (section Main -> Settings -> Accounting policy);

- for profit tax purposes - in the Taxes and Reports Settings form (Section Main -> Settings -> Taxes and Reports).

By default, the formation of provisions for doubtful debts in the program is disabled.

If reserves for doubtful debts are created in accounting, then in the Accounting policy form you need to set the flag Provisions for doubtful debts are formed.

If a reserve for doubtful debts is created in tax accounting, then in the Tax and Report Settings form in the Income Tax section, you need to set the Create reserves for doubtful debts flag.

If at least one of the specified flags is set, then the routine operation Calculation of reserves for doubtful debts will be included in the Month Closing processing. If there is no doubtful debt, then the document will still be created, but will not have any movements in the registers.

Doubtful debt for the purposes of automatic formation of a reserve in accounting and tax accounting in the program is considered to be outstanding debt reflected in accounts 62.01 “Settlements with buyers and customers” and 76.06 “Settlements with other buyers and customers”.

Please note that in the program reserves are formed only for contracts in rubles.

To calculate the period of occurrence of doubtful debts, the following indicators are used:

- The deadline for payment of debt by buyers, set in the accounting parameters settings (Fig. 1). Accounting parameters can be accessed via the hyperlink of the same name from the Administration section;

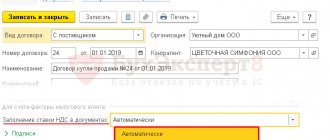

- The payment period under the agreement is established - in the form of an agreement with the counterparty (Fig. 2).

Rice. 1. Setting up accounting parameters

Rice. 2. Setting the payment deadline in the contract with the buyer

The date from which the period for the occurrence of doubtful debts is calculated in the program is determined as follows:

- if the agreement establishes a payment period, then the debt is considered doubtful if it is not repaid (in whole or in part) after a specified number of days, starting from the date the receivable arose;

- If the agreement does not specify a payment period, then a debt that is not repaid (in whole or in part) after the number of days specified in the accounting settings, starting from the date the receivable arose, is considered doubtful.

Please note that for the purposes of creating reserves for doubtful debts, the program does not check whether the receivables are truly doubtful (not secured by guarantees, collateral, etc.). You can set up such a check in the program indirectly through the value of the indicator The payment term has been set under the agreement in the agreement card with the counterparty. If the organization has received security for the debt from the buyer or it has confidence in its solvency, then to exclude this debt from the calculation of reserves for it, it is enough to indicate in this indicator a obviously long payment period (in calendar days).

The calculation and adjustment of the reserve for doubtful debts in accounting and tax accounting in the program is carried out using the routine operation Calculation of reserves for doubtful debts.

By default, the program suggests performing this routine operation monthly. Organizations that submit income tax returns once a quarter, in order to comply with the principle of rational accounting, can also calculate reserves once a quarter (in March, in June, in September and in December). To refuse to perform the routine operation Calculation of reserves for doubtful debts, before performing month closing in the first and second months of each quarter, select the Skip operation command in the context menu of the routine operation.

Regular operation Calculation of provisions for doubtful debts is carried out in two stages:

- doubtful accounts receivable are calculated. From 2022, if there are counter-obligations to the counterparty, in order to calculate the reserve, the receivables of the counterparty are reduced by the accounts payable to the counterparty. This change is supported in the program starting from version 3.0.46.19;

- reserves are calculated and entries are generated in the accounting register and entries in the information register. Calculation of reserves for doubtful debts. The amount of contributions to the reserve is calculated as a percentage of the debt amount depending on the duration of the delay (interval method), that is, according to the rules of tax accounting (clause 4 of Article 266 of the Tax Code of the Russian Federation). In tax accounting, the amount of the reserve is determined taking into account the limitation calculated by the regulatory operation Calculation of shares of write-off of indirect expenses.

When performing the routine operation Calculation of shares of write-off of indirect expenses, the amount of the reserve for doubtful debts is normalized, which can be accepted in tax accounting for income tax.

The maximum amount of the reserve at the end of the tax period is limited to 10% of the revenue of the reporting year. The maximum amount of the reserve at the end of the reporting period from 2022 is calculated as the greater of two values: 10% of revenue for the specified reporting period or for the previous year. This change is supported in the program starting from version 3.0.46.19.

In practice, this norm means the following: if the total amount of reserves calculated based on the period of debt occurrence exceeds the maximum amount, then the amount of the reserve for each debt, recognized as a non-operating expense, is normalized by multiplying by a coefficient. The coefficient is calculated as the ratio of the amount of reserves according to the standard to the total amount of reserves calculated based on the period of debt occurrence. The coefficient calculated in this way is entered into the indicator Reserves for debts of the information register Share of write-off of indirect expenses.

Formation of a vacation reserve: is it possible to bring the rules in accounting and tax accounting closer together?

A company may decide to create a vacation reserve only in accounting (BU), since creating a similar reserve in tax accounting (TA) is not necessary. In such a situation, it is impossible to avoid differences according to PBU 18/02 “Accounting for calculations of corporate income tax” (approved by order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n).

When creating a vacation reserve simultaneously in accounting and accounting records, the following should be taken into account:

- in the accounting system there are no legally established algorithms for creating a vacation reserve, but in the reporting the calculated amount of vacation obligations to employees must be reflected in a reliable estimate;

- In NU, the regulations for creating a reserve are spelled out in Art. 324.1 of the Tax Code of the Russian Federation: the following aspects should be reflected in the accounting policy:

- reservation method;

- maximum contribution amount;

- monthly percentage of deductions.

In general, if an employee goes on another vacation, and his vacation pay is already reserved:

- vacation pay is accrued at the expense of the reserve (Dt 96 Kt 70);

- recognition of expenses: in accounting, expenses are recognized at a time for the entire amount of vacation pay;

- in NU - in those months that include actual vacation days (see letter of the Ministry of Finance of the Russian Federation dated January 09, 2014 No. 03-03-06/1/42);

In addition, it should be noted that the reserve for vacation pay in NU is created directly for vacations of the reporting year and at the end of the year it rarely has a balance. In accounting, the vacation reserve includes all the company's obligations to employees for earned but not used vacation pay for the entire period of their work in this company.

These circumstances do not allow recognizing expenses for the formation of a vacation reserve in financial accounting and accounting according to identical algorithms, and it will not be possible to do without temporary differences entirely.

For details on creating a tax reserve for vacation pay, see the material “Creating a reserve for vacation pay in tax accounting”.

Inventory of estimated liabilities and reserves

In December, the total accrual of OO is summed up. For this, the same document “Vacation Reserves” for the month of December is used. It calculates estimated liabilities for each employee, and the IFRS method is used for both accounting and financial statements, as it is more accurate. Next, the data obtained by comparing the accrued estimated liabilities with the final calculation for the year is read out.

- That is, for each employee, the number of unused vacation days and his average earnings are calculated (the same as when calculating vacation). Next, the product of these quantities is calculated;

- The amount of OO accrued in previous periods is deducted;

- The difference between the calculated and accumulated amounts is calculated;

- The same algorithm is used to calculate contributions and “injuries”;

- The result is consolidated by department and transferred to the accounting system.

An example of such a document is given below.

Fig. 8 Calculation of estimated liabilities for the month of December

It can be seen that the data on accounting and accounting standards coincide, that is, temporary differences (which arose because the accrual method according to IFRS) disappeared in the accounting system.

In accounting, amounts of excessively accrued estimated liabilities (amounts with a minus sign) are written off by posting:

- Debit of account 96 (subaccounts of account 96 correspond to the accrual of vacation pay and contributions) - Credit of account 91.

It is important to note that when you set the “Revaluate monthly” checkbox in the accounting policy settings for estimated liabilities (Fig. 1), negative amounts will be written off monthly.

If the amount is obtained with a “plus” sign, it is necessary to additionally accrue estimated liabilities using the same posting:

- Debit of the cost account (for example, 20) – Credit of account 96 (sub-accounts of account 96 correspond to the accrual of vacation pay and contributions).

Results

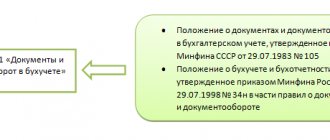

In accounting, reserves are formed for the purpose of reliable assessment of assets and the need to provide users with real reporting data on the company's liabilities. Methods for the formation of reserve amounts for accounting purposes are not regulated by law, so they must be developed independently.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.