When do you need to maintain your average salary while studying?

The legislation clearly establishes the circumstances that give the employee the right to claim payment of the income he usually receives during his studies. So, according to Art. 197 of the Labor Code of the Russian Federation, all workers have the right to vocational training and additional vocational education. When sending an employee on the initiative of the employer for training outside of work, the company is obliged to maintain his average earnings (Article 187 of the Labor Code of the Russian Federation). It is accrued to the student for days or hours (with cumulative accounting of working hours) of absence in accordance with his planned work schedule.

The described guarantees are provided to the employee only at the main place of work; when working part-time, the right to them does not arise (Article 287 of the Labor Code of the Russian Federation).

In addition, employees receiving general, secondary vocational or higher education for the first time or at the direction of the employer are annually granted educational leave with preservation of earnings. At the same time, the calculation of the average monthly salary for educational leave and for periods of retraining and retraining has some differences. These guarantees apply only to education in officially accredited institutions.

However, a company can establish in local regulations the possibility of paying for training time in organizations without accreditation.

An employee can receive education in two educational institutions at once; in this case, payments are made to him only for part of the time spent studying in one of them of his choice.

What does it mean - maintaining the average wage?

This concept means that for a certain period of time, instead of the standard salary, the employee is accrued the average daily earnings for each day.

It can be retained by the employee for a certain period of time in full or as a percentage of this value.

The procedure and cases are enshrined in the Labor Code of the Russian Federation, Federal Law No. 255 of December 29, 2006, and Decree of the Government of the Russian Federation of June 15, 2007 No. 375.

After establishing this value for 1 day (taking into account the above rules), the accounting department can only multiply this value by the number of days for which the employee is entitled to payments.

In what cases is it accrued to the employee?

Payment based on average earnings is retained by the employee in full in the following cases:

- when taking part in collective negotiations, developing agreements and collective agreements;

- transfer without consent for a period of no more than 1 month;

- in emergency circumstances (natural and man-made);

- when replacing another employee due to the above circumstances;

- the employment contract is terminated due to a violation of labor legislation that occurred through the fault of the employer, when it is not possible to continue the employment relationship (in this case we are talking about severance pay);

- receiving compensation for unused vacation (both upon dismissal and at the request of the employee);

- when an employee goes on basic leave;

- in case of downtime due to the fault of the employer (payment is made for the entire period of downtime, in the amount of not less than 2/3 of the amount in question) and in cases where downtime occurred without the fault of the employer and employee (for example, an order was issued to temporarily stop the activities of the organization );

- being on a business trip;

- if the employee is involved in the performance of public or state duties (in this case, the average salary will be paid to him by the organization that engaged him to perform the duties);

- when providing certain types of study leave;

- when severance pay is calculated in the amount of average earnings for a period of 2 to 3 months in case of staff reduction or liquidation of the enterprise. For employees of organizations located in the Far North under similar circumstances, average earnings will remain for a period of 3 to 6 months. But terminating the contract on the same basis with seasonal workers will provide them with only a one-time payment in the amount of 0.5 of the average monthly earnings);

- severance pay in the amount of average earnings for 2 weeks in the following cases:

- employee refusal to transfer to another job (if there are medical contraindications) or to another location;

- departure for military service;

- recognition of the employee by the court as fully or partially incompetent;

- upon dismissal by agreement of the parties (in this case, average earnings are considered as one of the possible amounts paid as compensation to the employee).

- employees undergoing routine medical examinations (for example, annual medical examination of state civil servants, etc.).

- donation (payment in the amount of the average daily wage is calculated for the day of donation and an additional day of rest).

- participation in educational programs to confirm, change or improve the level of professional training of an employee, initiated by the employer.

- transfer of an employee: to a position paid lower, if such a need is due to medical reports (for one month);

- preservation of his average earnings as a result of temporary loss of ability to work, which is associated with illness or injury received at work (until the restoration of ability to work or until the moment of its permanent loss).

- when paying for forced absence and reinstatement of an illegally dismissed or transferred employee.

- When transferring a pregnant employee (her application or medical recommendations).

- For the period of maternity leave - 100%, when taking leave to care for a child up to one and a half years old - 40%. (it is worth remembering that for the cases specified in this paragraph, the calculation is carried out for 2 years, not 1).

- If the employer's organization has changed ownership, he has the right to terminate employment contracts with the current manager, his first deputy and chief accountant, providing each of them with a one-time compensation payment in the amount of not less than three times the average monthly salary.

How to calculate the average salary during training

In general, the procedure for calculating the average salary for the period of study will depend on what type of study is being carried out: retraining, additional vocational education or obtaining a full-fledged secondary or higher education.

In the first case, training is carried out in the form of short-term courses and payment is due for working days according to the schedule during absence from the workplace. In the second case, educational leave is paid in calendar days.

To implement the calculation using the above formulas, it is necessary (clause 9 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922):

- Determine the amount of average daily or average hourly earnings.

- Calculate the duration of the employee’s absence due to study in days or hours.

- Multiply the received data.

If the employee did not have income during the billing period, then a similar time period of previous years is used for calculation. If there is no accrued earnings at all, the salary and the employee’s tariff rate are used for calculation.

What payments should I take into account?

To calculate average earnings, the following types of income are taken into account:

- wages accrued to employees at tariff rates (salaries) for time worked;

- wages accrued to employees for work performed at piece rates;

- salary accrued to employees for work performed as a percentage of revenue from sales of products (performance of work, provision of services), or commission;

- salary paid in non-monetary form;

- monetary remuneration accrued for time worked to persons holding government positions;

- fees accrued in editorial offices of mass media and art organizations for employees on the payroll of these editorial offices and organizations, and (or) payment for their labor, carried out at the rates (rates) of author's (production) remuneration;

- salary accrued to teachers of professional educational organizations for hours of teaching work in excess of the reduced annual teaching load (counted in the amount of one tenth for each month of the billing period, regardless of the time of accrual);

- the difference in the official salaries of employees who transferred to a lower-paid job while maintaining the amount of the official salary at the previous place of work;

- salary finally calculated at the end of the calendar year, determined by the remuneration system (taken into account in the amount of one twelfth for each month of the billing period, regardless of the time of accrual);

- allowances and surcharges to tariff rates (salaries) for professional excellence, class, qualification category (class rank, diplomatic rank), length of service (work experience), special conditions of civil service, academic degree, academic title, knowledge of a foreign language, work with information , constituting a state secret, combining professions (positions), expanding service areas, increasing the volume of work performed, performing the duties of a temporarily absent employee without release from his main job, leading a team;

- payments related to working conditions, including payments determined by regional regulation of wages (in the form of coefficients and percentage bonuses to wages), increased wages for hard work, work with harmful and (or) dangerous and other special working conditions, for work at night, payment for work on weekends and non-working holidays, payment for overtime work;

- bonuses and remunerations, including remuneration based on the results of work for the year and one-time remuneration for length of service;

- other types of payments in accordance with the existing remuneration systems in the organization.

How to determine average daily or average hourly earnings

Depending on what type of study time is paid, the procedure for calculating average daily earnings will differ. In all cases, the calculation period is 12 months preceding the month of training or passing exams (Article 139 of the Labor Code of the Russian Federation).

The difference will only be in the denominator of the formula, since for retraining and advanced training it is enough to count only the days (hours) actually worked. But to calculate the average daily earnings for study leave, calendar days will be used. With a fully worked period, it is enough to multiply 12 by the average monthly number of days in a month - 29.3.

The calculation of average earnings for an incomplete month worked will look different. In such a situation, the sum of days in partial months is added to the product of the number of complete months and the average monthly number of days (29.3).

Which days are excluded from the billing period?

Also, the resolution on calculating average earnings contains a list of types of time excluded from the total duration of the billing period. So it does not include:

- periods of vacations, sick leave, business trips;

- downtime due to the fault of the employer and for reasons beyond the control of the parties;

- days when the employee did not participate in the workers’ strike, but could not continue to work due to this;

- other cases of release from work with or without maintaining average earnings.

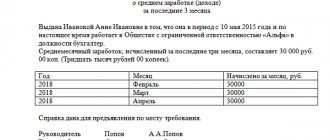

Examples of calculation of SZ

Let's give an example of what payment is based on average earnings for a business trip.

Employee Ivanov I.I. sent on a business trip on November 15, 2021. The billing period in this case is the previous 12 months: from 11/01/2020 to 10/31/2021 (clause 4 of the Regulations).

During the calendar year, the employee went on vacation for 28 days and did not take out sick leave. The total is calculated: 365 - 28 = 337 days. The total income for this period is 550,000 rubles. The duration of the trip is 5 days.

SZ = (550,000 / 337) × 5 = 8160.24 rubles.

And here is how wages are paid based on average earnings for vacation pay.

Employee Petrov P.P. goes on vacation from 12/01/2021 for 14 days. The billing period is from 12/01/2020 to 11/30/2021. The monthly salary, taking into account additional payments and allowances, is 60,000 rubles, that is, income for 12 months is 720,000 rubles. No sick leave or other deviations were recorded from the employee.

SZ = 720,000 / (29.3 × 12) × 14 = 28,668.92 rubles.

And another example is the calculation of SZ for sick leave.

Employee Sergeeva S.S. filed for temporary disability from 10/01/2021 to 10/10/2021. The billing period is 2019-2020. Earnings for 2022 amounted to 500,000 rubles, for 2022 - 650,000 rubles.

SZ = (500,000 + 650,000) / 730 = 1,575.34 rubles. Based on this average daily earnings, the accountant will calculate temporary disability benefits.