Lawyers, accountants, tax specialists, and officials have been arguing for years about what the traveling nature of work is. Although the Labor Code of the Russian Federation itself contains such a concept, there is still little specificity. Obviously, when the tax authorities see that contributions and personal income tax have not been paid on some amount paid to employees, this will raise questions in their minds. Therefore, in order not to pay extra fees and taxes, the traveling nature of the work must be formalized by the company’s local regulations, included in employment contracts and selected all the necessary documents confirming the fact of the expenses.

Before preparing documents, the head of the company, personnel officer and accountant must develop for themselves the basic criteria for traveling work. The fact is that the same work can be considered both traveling and unrelated to it.

In order for a job to fall under the concept of traveling, it must have at least one sign by which it can be attributed to this type of work.

What is traveling work?

The Labor Code mentions the traveling nature of work twice. Article 57 states that the conditions defining it must be included in the employment contract. Article 168.1 talks about reimbursement of expenses associated with such work. However, no obvious signs of traveling work are given. There is no consensus on them among specialists, although this topic has been discussed by representatives of taxpayers and authorities for several years.

Therefore, employers need to take care of the registration themselves - prepare local regulations, amendments to employment contracts, and always draw up documents that confirm travel. Only in this case can you count on the tax authorities recognizing the legitimacy of exempting compensation amounts from taxes and fees.

First of all, you need to decide what will be considered traveling work . Depending on what is stated in the documents, the same functions of employees may be assessed differently.

Traveling nature of work, organization and recording of working time.

Answer

1. The labor process you described cannot be called a rotational one, since you also perform your work duties at the location of your employer.

As for daily work of 12 hours at the location of the employer’s customers, such work is overtime work, it can only be carried out with the written consent of the employees and on the basis of a written order of the employer and must be paid for the first two hours of work at least one and a half times the amount, for the following hours - no less than double the amount.

Work on a day off can also be carried out only with the consent of the employee, on the basis of a written order from the employer, and must be paid at double the rate.

2. Current legislation does not regulate the traveling nature of work on the territory of third-party employers. The work and rest schedule is specified in the internal labor regulations, and if it differs from the general rules in force at the employer, then it is specified in the employment contract.

Normal working hours should be no more than 40 hours per week. Daily working hours are established only for preferential categories of workers (disabled people, workers employed in jobs with harmful and (or) dangerous working conditions, etc.). The duration of weekly uninterrupted rest cannot be less than 42 hours. With a five-day work week, employees are given two days off per week. The general day off is Sunday, and the second day off must be determined in the internal labor regulations.

Legal basis

The rotation method is a special form of carrying out the labor process outside the place of permanent residence of workers, when their daily return to their place of permanent residence cannot be ensured (Part 1 of Article 297 of the Labor Code of the Russian Federation).

A shift is considered a general period, including the time of work performed at the site and the time of rest between shifts (Part 1 of Article 299 of the Labor Code of the Russian Federation).

According to Part 2 of Art. 57 of the Labor Code of the Russian Federation, one of the mandatory conditions of an employment contract is the conditions that determine, in necessary cases, the nature of the work (mobile, traveling, on the road, other nature of work), the working hours and rest time (if for a given employee it differs from the general rules in force for given employer).

According to Art. 152 of the Labor Code of the Russian Federation, overtime work is paid for the first two hours of work at least one and a half times the rate, for subsequent hours - at least double the rate. Specific amounts of payment for overtime work may be determined by a collective agreement, local regulations or an employment contract. At the request of the employee, overtime work, instead of increased pay, can be compensated by providing additional rest time, but not less than the time worked overtime.

According to Art. 99 of the Labor Code of the Russian Federation, overtime work is work performed by an employee on the initiative of the employer outside the working hours established for the employee: daily work (shift), and in the case of cumulative accounting of working hours - in excess of the normal number of working hours for the accounting period.

An employer’s involvement of an employee in overtime work without his consent is permitted in the following cases:

1) when carrying out work necessary to prevent a catastrophe, industrial accident or eliminate the consequences of a catastrophe, industrial accident or natural disaster;

2) when carrying out socially necessary work to eliminate unforeseen circumstances that disrupt the normal functioning of centralized hot water supply, cold water supply and (or) sewerage systems, gas supply systems, heat supply, lighting, transport, communications;

3) when performing work the need for which is due to the introduction of a state of emergency or martial law, as well as urgent work in emergency circumstances, that is, in the event of a disaster or threat of disaster (fires, floods, famine, earthquakes, epidemics or epizootics) and in other cases, threatening the life or normal living conditions of the entire population or part of it.

In other cases, involvement in overtime work is permitted with the written consent of the employee and taking into account the opinion of the elected body of the primary trade union organization.

The duration of overtime work should not exceed 4 hours for each employee for two consecutive days and 120 hours per year.

The employer is required to ensure that each employee's overtime hours are accurately recorded.

In accordance with Art. 113 of the Labor Code of the Russian Federation, work on weekends and non-working holidays is prohibited, except in cases provided for by the Labor Code of the Russian Federation.

Involvement of employees to work on weekends and non-working holidays is carried out with their written consent if it is necessary to perform unforeseen work, on the urgent implementation of which the normal work of the organization as a whole or its individual structural divisions or an individual entrepreneur depends in the future.

Involving employees to work on weekends and non-working holidays without their consent is permitted in the following cases:

1) to prevent a catastrophe, industrial accident or eliminate the consequences of a catastrophe, industrial accident or natural disaster;

2) to prevent accidents, destruction or damage to the employer’s property, state or municipal property;

3) to perform work the need for which is due to the introduction of a state of emergency or martial law, as well as urgent work in emergency circumstances, that is, in the event of a disaster or threat of disaster (fires, floods, famine, earthquakes, epidemics or epizootics) and in other cases, threatening the life or normal living conditions of the entire population or part of it.

In other cases, involvement in work on weekends and non-working holidays is permitted with the written consent of the employee and taking into account the opinion of the elected body of the primary trade union organization.

Employees are recruited to work on weekends and non-working holidays by written order of the employer.

According to Art. 153 of the Labor Code of the Russian Federation, work on a day off or a non-working holiday is paid at least double the amount:

- piece workers - no less than double piece rates;

- employees whose work is paid at daily and hourly tariff rates - in the amount of at least double the daily or hourly tariff rate;

- employees receiving a salary (official salary) - in the amount of at least a single daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if work on a day off or a non-working holiday was carried out on within the limits of the monthly working time standard, and in an amount of at least double the daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if the work was performed in excess of the monthly working time standard.

Specific amounts of payment for work on a day off or a non-working holiday may be established by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of employees, or an employment contract.

At the request of an employee who worked on a day off or a non-working holiday, he may be given another day of rest. In this case, work on a weekend or a non-working holiday is paid in a single amount, and a day of rest is not subject to payment.

The working time regime should provide for the length of the working week (five-day with two days off, six-day with one day off, a working week with days off on a sliding schedule, part-time work), work with irregular working hours for certain categories of workers, the duration of daily work ( shifts), including part-time working days (shifts), start and end times of work, time of breaks in work, number of shifts per day, alternation of working and non-working days, which are established by internal labor regulations in accordance with labor legislation and other regulatory legal acts containing labor law norms, collective agreements, agreements, and for employees whose working hours differ from the general rules established by a given employer - an employment contract (part . Article 100 of the Labor Code of the Russian Federation).

Normal working hours cannot exceed 40 hours per week (Part 2 of Article 91 of the Labor Code of the Russian Federation).

The duration of weekly continuous rest cannot be less than 42 hours (Article 110 of the Labor Code of the Russian Federation).

According to Art. 111 of the Labor Code of the Russian Federation, all employees are provided with days off (weekly uninterrupted rest). With a five-day work week, employees are given two days off per week, and with a six-day work week - one day off.

The general day off is Sunday. The second day off in a five-day work week is established by a collective agreement or internal labor regulations. Both days off are usually provided in a row.

Signs of traveling work

A job that satisfies at least one of the following conditions can be considered traveling

- In order to perform his duties, the employee must leave the workplace. This is how, for example, window installers, repairmen of large household appliances, and insurance agents work.

- The company is registered at one address, and the immediate place of work is located at a great distance from it.

- The employee is not tied to a specific workplace. This is how drivers, couriers, and correspondents work.

- Travel is provided for in the employee’s job description and is carried out by order of the manager. Examples include sales representatives or point-of-sale supervisors.

- Due to the nature of the activity, the workplace is constantly moving. This happens, for example, when constructing road infrastructure facilities and when a company provides services on the customer’s premises.

We can confidently talk about the traveling nature of the work in the case when the employee’s main functions are associated with travel. And these are not only specialists from specialized companies, for example, service departments, construction organizations, insurance agencies and others. Such workers can be found in many companies, for example, they are drivers or couriers.

If there is no collective agreement

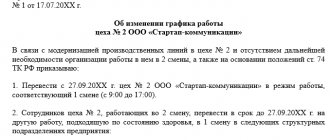

In the absence of a collective agreement, the organization has the right to approve, by order (instruction) of the manager, the provision on the traveling nature of work as a local regulatory act of the organization.

This provision should specify in detail the amount and procedure for reimbursement of expenses associated with business trips of employees, as well as a list of jobs, professions, and positions of these employees.

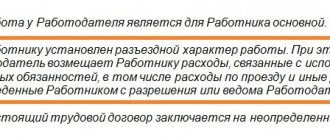

At the same time, the traveling nature of the work of employees whose permanent work is carried out on the road or has a traveling nature must be established by an employment contract.

Paperwork

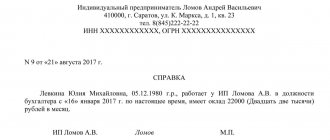

It was mentioned above that the condition regarding the traveling nature of the work must be in the employment contract. If the agreement has already been concluded, an additional agreement is drawn up to it.

When traveling work is carried out by one or more specialists, all conditions can be specified in the contract with each of them. If there are many such employees, it is advisable to adopt internal regulations that describe all the details of traveling work and payment of compensation for this. Labor functions related to traveling must be included in job descriptions or regulations. Then in the employment contract it will be possible to make a reference to these documents, rather than specifying all the details.

Among other things, it is necessary to specify for which positions traveling work is introduced , as well as the procedure for reimbursement of expenses. You can reimburse the costs of travel and accommodation, daily allowance and field allowance, as well as additional expenses agreed with the employer.

An employee may perform functions that require constant travel, and at the same time sometimes go on business trips. In this case, you need to arrange everything correctly. For example, if the traveling nature of the work is associated with one locality, and the employee is sent to another, then this is already a business trip .

Benefits of traveling employment

The traveling nature of an employee’s work has certain advantages for the company, expressed in the following points:

- Reducing document flow for business trips reduces their administration.

- It makes it easier to record working hours and calculate payments, since there is no need to maintain advance reports. This results in a more accurate assessment of the overall future labor costs.

- Labor costs are reduced. Instead of the average earnings accrued during business trips, the worker is paid his official salary. If there are additional payments to the salary, its value will be lower than the average earnings.

The company receives tax advantages due to the absence of the need to create a separate division in the locality (territory) where the company employee is employed.

Exemption from personal income tax and contributions

Compensation for the traveling nature of work is not subject to:

- Personal income tax in accordance with Article 422 of the Tax Code (clause 1, subclause 2);

- insurance premiums on the basis of Article 20.2 of Law 125-FZ on social insurance.

The Ministry of Finance, in letter dated January 17, 2019 No. 03-15-05/1909, draws attention to the fact that in order to exempt these payments from taxes and contributions, it is necessary that these expenses be documented . This means:

- defining the traveling nature of work in internal regulations or an employment contract;

- availability of primary and other documents for each operation.

Surcharge

In accordance with Article 168.1 of the Labor Code of the Russian Federation, the employer may provide a bonus for employees whose work involves traveling. Payment conditions and accrual procedures should be specified in local regulations or a collective agreement.

Most often, the bonus is determined as a percentage of the salary or rate. According to experts, an increase of up to 15-20% . A higher percentage may raise questions from tax authorities. Therefore, it is better to take care of supporting documents and justification for such payment in advance.

Unlike the amount of compensation for traveling work, the allowance is subject to personal income tax and insurance contributions.

What to compensate

The following expenses are subject to reimbursement to the employee (Article 168.1 of the Labor Code of the Russian Federation):

- travel;

- rental housing;

- additional expenses associated with living outside your place of permanent residence;

- other expenses with the permission or knowledge of the employer.

Moreover, now the employer is obliged to reimburse expenses associated with business trips to employees whose permanent work is carried out on the road or has a traveling nature; the changes also affected the rules for reimbursement of additional expenses. The norms and procedure for compensation are not established by law and the organization has the right to establish the amount and procedure for compensation itself. According to the old version of the Labor Code of the Russian Federation, expenses were compensated in amounts no less than those established for travel expenses (Resolution of the Ministry of Labor No. 51 of June 29, 1994). Today, although expenses include the same types of compensation as business trips, the amounts can be established by an employment contract and there are no restrictions on the amount of expenses for business trips.