Based on the labor legislation of the Russian Federation, working time standards are determined depending on how many hours the working week lasts. The erroneous opinion of many is that the production calendar is approved by the Government of the Russian Federation, in particular the Ministry of Labor.

The Ministry of Labor issues a Decree every year, which indicates the number of working days, holidays, and weekends in each month.

In addition, the document indicates the transfer of weekends in 2022 to other days, as well as days on which the working day can be shortened by one hour. This information is necessary to calculate payments to employees by the employer.

The legislative framework

The Labor Code of the Russian Federation has a fairly specific definition regarding working time standards. The vast majority of workers work eight hours a day and work forty hours a week. This situation is due to the fact that organizations and enterprises work mainly five days a week. The working day is usually eight hours a day.

In this regard, future employees who are seeking employment can be advised to carefully familiarize themselves with the work schedule at the enterprise or organization. Often, it is during an interview that a potential employee’s length of working day is determined.

Calendar days of the billing period

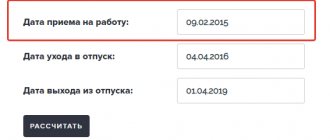

Employee Mishina’s vacation is 14 days from 04/06/2015 to 04/19/2015. The billing period is the period from 04/01/2014 to 03/31/2015. Mishina’s monthly salary is 30,000 rubles. From 03/02/2015 to 03/17/2015 (16 days) Mishina was on sick leave. In the billing period, Mishina worked 11 full months and 15 calendar days in an incomplete month (March 2015). (15 days = 31 days - 16 days of sick leave). Salary in March 2015 amounted to 10,000 rubles. In total, 340,000 rubles were accrued in the billing period. (30,000 rubles x 11 months + 10,000 rubles) Now we determine the number of calendar days in an incomplete month (March 2015): We use the above formula 3: 29, 3: 31 days. x 15 days = 14, 25 days. The total amount of vacation pay was: 340,000 rubles. : (29.3 x 11 months + 14.25 days) x 14 days vacation = 14,143.50 rub. From May 25 to June 21, 2015, Petrov was granted basic paid leave. Duration of vacation is 28 calendar days. The billing period - from May 1, 2014 to April 30, 2015 - has been fully worked out. During the billing period, the employee was accrued 360,000 rubles. (RUB 30,000 x 12 months) This amount is fully included in the calculation of vacation pay in 2015. The average daily salary of an employee is: 360,000 rubles. : 12 months : 29, 3 days = 1023.89 rub. The total amount of vacation pay was: 1023.89 rubles. x 28 days = 28,668.92 rub.

- salary accrued for time worked;

- allowances and additional payments (for class, length of service, combination of professions, etc.);

- compensation payments related to working hours and working conditions - regional coefficients and percentage increases in wages, additional payments for work in hazardous and difficult working conditions, at night, in multi-shift work, on weekends and holidays and overtime;

- other bonuses and rewards.

- The coefficient of the average number of days worked by an employee becomes equal to 29.3.

- The average salary of a specialist is taken into account.

- The calculation period is taken into account. It is based on the amount of money earned in one day.

- The time worked in the company is also taken into account. When an employee goes on vacation after six months rather than after 12 months, vacation pay is calculated based on the shorter period.

Average number of working days per month in 2022

Not least important in the labor process is the average number of days an employee works. There are a lot of really important details in the calculation itself. Thus, the average number of working days per month in 2022 is about 21 days (excluding holidays).

If we consider the average number of working days each month, then a lot depends on the specific month. For example, months that have many holidays, such as January or May, will have the fewest number of working days compared to others.

In January, out of 31 days, there are only 17 working days. In May, only 18 out of 31 are considered working days. Along with holidays, there are 13 days off.

The above-mentioned number of working days in January and May is valid for a five-day working week.

Labor legislation allows employers to increase the working week by one more day each week, and it turns out that the number of working days in such a situation will be greater, because Saturday will be a working day and Sunday will be a day off.

It is important to understand that the number of working hours per week should not exceed forty hours.

Average daily earnings

Once the employee’s earnings for the pay period have been determined, you need to calculate the average daily earnings. The procedure for determining average daily earnings depends on whether the employee has worked the entire pay period and whether he is given leave in calendar or working days. If the billing period is fully

and vacation is provided in calendar days, the average daily earnings are determined by formula 1:

| daily earnings | Earnings accrued for the billing period | 29, 3 days (average monthly number of calendar days) |

The indicator “29.3 is used exclusively for the purpose of determining average earnings for the payment of vacation pay and compensation for unused vacation.

Hour limits and working hours in 2022

The length of the working day (or week) may vary and depend on the following factors:

- the employee's health status;

- employee age;

- working conditions of the employee.

For some people, there are certain norms of working time in relation to the length of the working week:

| Length of work week (in hours) | Employee category and comment |

| 24 hours a week | Teenagers (14-16 years old) can work no more than 24 hours a week. They can only work during school holidays. |

| 35 hours per week | Disabled people of groups I and II according to labor legislation can work 35 hours a week. But at the request and health status of a disabled employee, the length of the working week can be increased |

| 36 hours a week | Workers who work in conditions that are potentially hazardous to health and life. Teenagers aged 16 to 18 years |

Some professions require special working conditions, namely:

- for doctors - the length of working hours may depend on the presence of an epidemic in the locality; doctors in such a situation work overtime due to the importance of eliminating diseases;

- for teachers - the length of working hours may depend on the period of study for schoolchildren or students (including the presence of exams for students);

- for women - some managers may try to make their work easier and reduce their working hours; this may be due to the fact that a woman, for example, has a disabled child or children under 14 years of age in her care.

All of the above factors that affect the length of the work week are the most common and common. In labor legislation, there are other categories of citizens who have the right to work part-time.

We add that work in excess of the established norm must be classified as overtime and calculated and paid on the basis of other tariff rates. The employee’s consent to work beyond the norm is mandatory, because otherwise the employer’s actions may be classified as illegal. Overtime work provides incentives for subordinates.

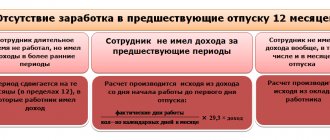

Vacation pay calculation

- Received payment in the form of average earnings (with the exception of breaks for feeding the child in accordance with the law). For example, the time of a business trip or other paid leave;

- Was on sick leave or maternity leave;

- Didn’t work due to downtime through no fault of his own;

- Did not participate in the strike, but due to it could not work;

- Used additional paid days off to care for disabled children and people with disabilities since childhood;

- In other cases, he was released from work with full or partial retention of wages or without pay. For example, vacation time at your own expense or parental leave.

- All payments accrued to the employee for the time excluded from the payroll period. They are listed in clause 5 of the Regulations. For example, average earnings for days of business trips and in other similar cases, social benefits, payments for downtime;

- All social benefits and other payments not related to wages. For example, financial assistance, payment of the cost of food, travel, training, utilities, recreation, gifts for children (clause 3 of the Regulations);

- Bonuses and remunerations not provided for by the remuneration system (clause “n. 2 of the Regulations”).

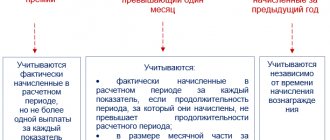

Important ! Non-working days to which holiday weekends are postponed are included in the calculation. If the day off coincides with a holiday, then the Government of the Russian Federation issues a resolution setting the date to which the day off and holiday is transferred.

For example, in 2022, February 23 fell on a Saturday, and the day off from that day was moved to May 10. If an employee is on vacation on May 10, this day must also be paid.

- During the billing period, immediately before or during vacation;

- The increase occurred in relation to payments not of one or several employees, but in relation to the entire organization, its branch or at least a structural unit (clause 16 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922). For example, if the salaries of all employees of the “Accounting of the enterprise” department were increased, then it is necessary to apply the coefficients when calculating vacation pay for all accountants of the enterprise. If salaries were increased only for salary accountants, the coefficient does not apply.

From May 25 to June 21, 2015, Petrov was granted basic paid leave. Duration of vacation is 28 calendar days. The billing period - from May 1, 2014 to April 30, 2015 - has been fully worked out. During the billing period, the employee was accrued 360,000 rubles. (RUB 30,000 x 12 months) This amount is fully included in the calculation of vacation pay in 2015. The average daily salary of an employee is: 360,000 rubles. : 12 months : 29, 3 days = 1023.89 rub. The total amount of vacation pay was: 1023.89 rubles. x 28 days = 28,668.92 rub. For what period are vacation pay accrued? The determining factor for this is the length of time the employee has worked for a given employer before going on leave. . The calculation period for calculating vacation pay directly depends on whether the employee has worked for the employer for a full year or not. If you have worked with the employer for more than a year before going on vacation, the period for calculating vacation pay includes 12 calendar months before the month the employee goes on vacation.

The period for calculating vacation pay is calculated according to the actual length of the month - from the 1st to the last day of the month inclusive (for example, in August on the 31st, in February on the 28th or 29th, etc.) The labor legislation of the Russian Federation determines the minimum duration of labor leave in the amount of 28 calendar days. In addition to the minimum labor leave, legislation may grant an employee the right to additional leaves, due to which the total duration of labor leave is increased. Calculation of the number of vacation days in this case will include additional days of vacation for work in harmful (dangerous) working conditions, in conditions of irregular working hours, etc. Certain categories of workers also have the right to extended vacation: military personnel, medical workers, miners, etc. The coefficient shows the average number of days in a month excluding holidays. Until April 2, the number 29.4 was written in Article 139 of the Labor Code of the Russian Federation.

Meanwhile, the number of holidays increased from 12 to 14 days back in 2012, when January 6 and 8 were added. Hence it turns out: (365 days - 14 days) / 12 months. = 29.25. Officials rounded this figure to 29.3. The previous figure 29.4 is still stated in paragraph 10 of the Regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922. This norm should also be changed in the near future.

Until this is done, you still need to focus on the new coefficient. Average Number of Calendar Days in a Month

Read on the Russia-Ukraine website:

- Average Consumption of Water and Electricity in the Apartment

- Statute of Limitations for Loans from Bailiffs

- Storage periods for Time Sheets

- Standard Tax Deductions for a Disabled Child from Childhood 3 Groups

- Standard Child Tax Deduction for Alimony

Attention!

Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you free of charge - write your question in the form below.

How to calculate working hours per month?

In order to calculate the standard working hours in a particular month, you must do the following:

length of the working week / 5 X by the number of working days according to the five-day calendar per month minus the number of hours in the month by which working time is reduced before holidays (non-working days).

In order to calculate the standard working hours for the year, you must do the following:

length of the working week / 5 X by the number of working days according to the five-day calendar per year minus the number of hours per year by which working time is reduced before holidays (non-working days).

Example of calculating working time standards:

In August 2022, with a five-day work week that includes two days off, there will be:

- 23 working days;

- 8 days off.

In August 2022, the working hours will be:

- with a 24-hour work week - 110.4 hours (4.8 × 23);

- with a 36-hour work week - 165.6 hours (7.2 × 23);

- with a 40-hour work week - 184 hours (8x23).

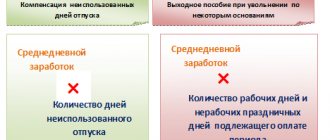

What data is used to calculate vacation pay?

When calculating monetary remuneration for employees going on vacation, the following data is used:

- accrued allowances;

- required bonuses;

- surcharges at certain rates;

- the total number of positions held by the official and the salaries for them;

- additional payments for qualifications or class;

- increase for length of service;

- allowances for work in difficult conditions, for example, northern payments.

Paid allowances and bonuses must be approved by the director of the enterprise.

The accountant indicates the amount of all possible additional payments and the amount of vacation pay without them; the manager chooses which one to approve.

The following payments cannot affect the amount of vacation pay:

- funds allocated for business trip expenses;

- material aid;

- "sickness" payments;

- funds for transportation costs;

- compensation for food;

- payment for loss of ability to work.

Calendar for postponing holidays in 2022

Decree of the Government of the Russian Federation dated September 16, 2021 N 1564 provides for the following replacement of days off in 2022:

- from January 1 (Saturday) to May 3 (Tuesday);

- from January 2 (Sunday) to May 10 (Tuesday);

- from March 5 (Saturday) to March 7 (Monday).

Thus, due to the postponement of holidays in 2022, Russians are expected to traditionally have a long weekend for the New Year. They will last 10 days - from December 31, 2022 to January 10, 2022.

The next period of long rest falls in March - from March 6 to March 8.

Traditionally, May will be generous for holidays and long vacations. In May 2022, Russians will have a holiday from May 1 to 3 in connection with the Spring and Labor Festival, as well as from May 7 to 10 in connection with Victory Day.

In November, in connection with the celebration of National Unity Day, the weekend will last from November 4 to November 6, 2022.

Calculation of vacation pay if the month is not fully worked

An employee has not worked the entire month if:

- received an average salary (was on secondment...);

- was ill or received maternity benefits;

- was on leave without pay, etc.

| Average daily earnings of the billing period not fully worked | Number of calendar days of vacation |

| Average daily earnings of the billing period not fully worked | = |

| Earnings accrued for the billing period | |

| Number of calendar days in incomplete calendar months |

If the employee has not worked the entire month

, then the number of days in this month must be recalculated using formula 3:

| Number of calendar days in an incomplete month worked | 29, 3 days | Number of calendar days in this month (28, 29, 30 or 31 days) | Number of days worked in this partial month |

Example 3

Employee Mishina’s vacation is 14 days from 04/06/2015 to 04/19/2015. The billing period is the period from 04/01/2014 to 03/31/2015. Mishina’s monthly salary is 30,000 rubles. From 03/02/2015 to 03/17/2015 (16 days) Mishina was on sick leave. In the billing period, Mishina worked 11 full months and 15 calendar days in an incomplete month (March 2015). (15 days = 31 days - 16 days of sick leave). Salary in March 2015 amounted to 10,000 rubles. In total, 340,000 rubles were accrued in the billing period. (30,000 rubles x 11 months + 10,000 rubles) Now we determine the number of calendar days in an incomplete month (March 2015): We use the above formula 3: 29, 3: 31 days. x 15 days = 14, 25 days. The total amount of vacation pay was: 340,000 rubles. : (29.3 x 11 months + 14.25 days) x 14 days vacation = 14,143.50 rub.

The procedure for calculating vacation pay was changed in 2016, in particular, the coefficient used to calculate vacation compensation for employees of enterprises changed. The change in the coefficient is due to the increase in the number of holidays in the country. The coefficient for calculating vacation pay in 2022 now has a different value, which we will discuss in this article.

We will also explain in detail how vacation pay is calculated.

Table: Working hours standards for 2022

By number of working days

| Month / Quarter / Year | Amount of days | ||

| Calendar | workers | Weekends | |

| January | 31 | 16 | 15 |

| February | 28 | 19 | 9 |

| March | 31 | 22 | 9 |

| April | 30 | 21 | 9 |

| May | 31 | 18 | 13 |

| June | 30 | 21 | 9 |

| July | 31 | 21 | 10 |

| August | 31 | 23 | 8 |

| September | 30 | 22 | 8 |

| October | 31 | 21 | 10 |

| November | 30 | 21 | 9 |

| December | 31 | 22 | 9 |

| 1st quarter | 90 | 57 | 33 |

| 2nd quarter | 91 | 61 | 31 |

| 3rd quarter | 92 | 66 | 26 |

| 4th quarter | 92 | 64 | 28 |

| 2022 | 365 | 247 | 118 |

By number of working hours

| MONTH / QUARTER / YEAR | WORKING TIME (HOUR) | ||

| 40 HOURS/WEEK | 36 HOUR/WEEK | 24 HOURS/WEEK | |

| January | 128 | 115,2 | 76,8 |

| February | 151 | 135,8 | 90,2 |

| March | 175 | 157,4 | 104,6 |

| April | 168 | 151,2 | 100,8 |

| May | 144 | 129,6 | 86,4 |

| June | 168 | 151,2 | 100,8 |

| July | 168 | 151,2 | 100,8 |

| August | 184 | 165,6 | 100,4 |

| September | 176 | 158,4 | 105,6 |

| October | 168 | 151,2 | 100,8 |

| November | 167 | 150,2 | 99,8 |

| December | 176 | 158,4 | 105,6 |

| 1st quarter | 454 | 408.4 | 271.6 |

| 2nd quarter | 480 | 432 | 288 |

| 3rd quarter | 528 | 475.2 | 316.8 |

| 4th quarter | 511 | 459,8 | 306,2 |

| 2022 YEAR | 1973 | 1775.4 | 1182.6 |

The article was edited in accordance with current legislation 01/05/2022

This might also be useful:

- Holidays and weekends: how are workers paid?

- Additional agreement to the employment contract on salary changes

- Entry in the work book about dismissal

- How to issue pay slips

- Order on approval of the staffing table

- How to obtain a duplicate work book

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!