The transition to online cash registers, carried out in accordance with, was intended to ensure maximum transparency of trading operations. The state thus controls business activity and facilitates the work of the tax service, reducing the number of checks, and businessmen have no other options but to work “in the dark.”

In this article, we explain what an online cash register is, what it can be, how it is related to accounting and warehouse accounting software, who is required to use it, and what is the procedure for switching to online cash registers.

Who should use online cash registers

Almost all. According to this obligation, only individual entrepreneurs who:

- have no employees;

- sell goods of their own production, provide services or perform work.

The transition of such individual entrepreneurs to online cash registers must be carried out no later than July 1, 2022.

What is an online cash register and what does it consist of?

To make it easier to perceive the essence of the innovations, let’s compare them with what was before the entry into force of 54-FZ on online cash registers, which regulates the work with cash registers.

Let's start with what we now mean by the concept of “cash desk”.

| This was before the transition to online cash registers | Became after the transition to online cash registers |

| Cash desk = Iron box with a printer that prints receipts | Cash desk = Iron box with printer (fiscal recorder) + Cashier workstation + Fiscal data operator |

There are four types of online cash registers:

- Autonomous online cash registers and smart terminals.

These are devices with cash register programs, ready to use and do not need to be connected to a computer or terminal. Can be portable, battery powered. A number of models support working with EGAIS. - Fiscal registrars.

They only work together with the device on which the cash register program is installed. They fiscalize checks, print them out and transmit information to the tax office through the OFD. - POS systems.

Sets of equipment, usually including a POS computer, fiscal recorder, keyboard and scanner. Used mainly by large retail chains. - Online cash registers for online stores.

They connect to the site management system and send electronic receipts to customers.

When choosing a cash register, you need to take into account the specifics of your business. For example, to sell alcohol you need a cash register that works with EGAIS. Please make sure that the model is approved for use. You can check this.

Our partners offer rental and purchase of cash registers that comply with the requirements of 54-FZ for online cash registers on favorable terms.

View the best options

Before making the transition of individual entrepreneurs to online cash registers, understand what this equipment consists of.

Fiscal storage

A component of the online cash register, which is used to receive, process and transmit data on transactions through the OFD to the Federal Tax Service. The fiscal attribute key has a validity period (13, 15 or 36 months), after which it must be replaced.

If there is no Internet connection for 30 days, the fiscal drive in your cash register will be blocked and will resume operation automatically after connecting to the network and transferring all data during the period of no connection.

Important:

if within 30 days, while there was no Internet, not a single check was issued, the fiscal drive is not blocked.

Fiscal data operator (FDO)

Fiscal data operator (FDO) is a commercial organization created for the purpose of storing and transmitting cash information (fiscal data).

She is an intermediary between the entrepreneur and the tax service. The list of OFDs is small, since they must fulfill certain technical and information requirements, and if they are not met, they can be fined up to a million rubles.

Before you begin the transition to online cash registers for individual entrepreneurs on the simplified tax system, select a fiscal data operator from the list on the Federal Tax Service website.

To interact with the OFD and the taxpayer’s personal account on the Federal Tax Service website, a qualified electronic signature (CES) is required, issued to the manager or person authorized to sign.

To issue it, you will need a meeting with the OFD or certification center (CA) to whom you have entrusted this procedure.

Cashier's workplace

The cashier's workstation is a third-party program (shell) that simplifies working with the cash register, inventory, and also allows for in-depth analysis of sales through your personal account. She must print receipts with the obligatory indication of the nomenclature, and also send them upon request by email or SMS to the buyer.

There are currently two types of jobs on the market:

1. Linked to equipment (Mercata, Cassby, i-Retail), as well as cash registers from manufacturers (immediately with software) - they cannot be purchased separately from a set of equipment; manufacturers tie the buyer to both hardware and their software , which currently severely limits integration with third-party services.

| pros | Minuses |

| ready-to-use online cash register kits | lack of integration of the online cash register with accounting and accounting software |

| technical support for hardware and software in one window | limited choice and replacement of components |

| mobility | additional costs for software and support |

2. Workplaces without connection to equipment (“1C: Retail”, “MoySklad”) - they can be used with any certified cash register system permitted by the Federal Tax Service, they are tightly integrated with various inventory and accounting software.

| pros | Minuses |

| online cash register is connected to accounting and accounting software | you need to independently select a cash register that prints checks (fiscal registrar) |

| easy to integrate | hardware and software support in different places |

| freedom of choice in hardware | initial setup |

It’s up to you to decide which procedure to switch to online cash registers – buy a ready-made kit or assemble it yourself. Let us only note that the proposed functions of the cashier’s workplace are very useful and often greatly facilitate further work with information.

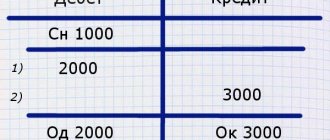

Equipment maintenance

When accounting for online cash registers, the costs of equipment maintenance and repair are included in expenses. This applies to expenses for routine repairs, the purchase and replacement of components, and payments for central service centers. Such costs are reflected in the entry Dt 44 - KT 60 for the amount of repairs performed. The same posting applies to payments for monthly maintenance.

When making an advance payment for the period specified in the agreement, costs are written off in equal parts over the duration of the agreement. For the amount of the advance payment, the posting DT 60 - KT 51 is made, for monthly write-off - DT 44 (20, 26) - KT 60.

Important! The useful life of cash register equipment is indicated in the documentation supplied with the device.

Online cash register and accounting

The transition to online cash registers for individual entrepreneurs and LLCs using the simplified tax system and other taxation systems is associated with a number of changes in accounting. Now inspectors have the opportunity to access most information about cash flow online, so reports KM-1, KM-2, KM-3, KM-4, KM-5, KM-6, KM-7, KM- 8 and KM-9. New documents have appeared:

- shift opening report;

- report on closing the fiscal drive;

- correction check, which allows you to correct the situation if the main check was not cleared, for example, due to a malfunction in the cash register;

- a “receipt return” check, which is used when returning money to the buyer or correcting errors.

The online cash register changes accounting by simplifying it: you will have to generate fewer reports, because... Some of the data is transferred to the tax office automatically.

Working with cash documents

Managing the organization's cash desk involves conducting operations for receiving and issuing funds with daily summing up.

In 1C, such operations are carried out from the section Bank and cash desk – Cash desk – Cash documents.

Coming

The receipt of funds in 1C is carried out by the Cash Receipt document, which can be created from the Cash Documents using the Receipt .

Cash receipts have several types of transactions, by choosing which, depending on the operation being carried out, you can quickly fill out a document in 1C and correctly reflect the operation in accounting.

For most types of operations in 1C the following are automatically installed:

- Settlement account;

- Income item.

Transaction type Other income is used for non-standard transactions with any settlement account and type of income (type of cash flow).

More details, generation of the Cash Receipt when:

- sale to the buyer;

- return of unused accountable amounts;

- payment of the management share in cash.

Consumption

Cash expenses are documented in the Cash Issue document from the Cash Documents using the Issue .

Cash withdrawal in 1C 8.3 Accounting

Cash Withdrawal document also has several types of transactions with predefined settlement accounts and expense types.

Other expenses - for facts of economic life that are not provided for by other types of transactions in the Cash Issue .

More information about the formation of the Cash Withdrawal for:

- issuance of accountable amounts.

Goods accounting with online cash register

Accounting for goods with and without an online cash register is no different; in any case, there should be order in the warehouse. By automating warehouse accounting, you will receive several advantages at once:

- you will be able to plan purchases taking into account real demand and balances, which will not allow goods to linger on shelves or spoil;

- simplify and speed up inventory;

- reduce the likelihood of theft - when all moves are recorded, it is difficult to steal;

- eliminate accounting errors that lead to overpayment of taxes.

We offer a comprehensive solution for owners of retail and wholesale stores - “1C: UNF” or “My Warehouse” (work with online cash registers) for warehouse accounting + Finguru online accounting.

Find out how to keep your trading business running smoothly

Procedure for switching to online cash registers

- Start your transition to online cash registers by obtaining a qualified electronic digital signature. To get it, you need to contact one of the accredited certification centers, submit an application, pay about 2,000 rubles and wait about three days. The validity period of the digital signature is one year.

- Select online cashier. Make sure the model is included in the approved registry.

- Enter into an agreement with the OFD from the list on the Federal Tax Service website and get access to your personal account.

- Register the fiscal registrar with the Federal Tax Service. This can be done online, through the personal account of an individual entrepreneur or legal entity on the department’s website.

- The transition to online cash registers is complete! Now that the online cash register is set up and the accounting is in place, you can legally conduct your business.

Payment card transactions

Reception and return of funds through electronic means of payment - payment cards, electronic money (Yandex, Kiwi, etc.) - are not related to the receipt and payment of cash, but relate to actions at the cash desk, as they require the use of cash register equipment ( KKT). Therefore, in 1C, documents on such transactions are available from the section Bank and cash desk – Cash desk – Transactions on payment cards.

Transactions on payment cards and bank loans in 1C 8.3

With payment cards in 1C, operations with the following types are possible:

- Retail revenue - used for retail sales through a manual point of sale (NTP), i.e. when it is impossible to account for goods sold at retail on a daily basis;

- Payment from the buyer - used: for retail sales through an automated point of sale (ATP), i.e. when records of goods sold at retail are kept daily;

- in distance sales with payment via the Internet;

- for wholesale sales, when payment is made by corporate payment card;

Document Payment card transaction type of transaction Payment from the buyer is used in 1C for ATT, when payment and shipment of goods are separated in time (for example, prepayment via the Internet). If the goods are paid for at the point of purchase, payment by payment card will be reflected in the Retail Sales Report document.

To use payment card transactions in 1C, you must:

- set up a warehouse of a retail outlet (Directories – Goods and services – Warehouses): ATT - with the warehouse type Retail store ;

- NTT - with warehouse type Manual point of sale;

- ATT - at sales prices;

Liability for violation of 54-FZ on online cash registers

- If you do not make the transition of an individual entrepreneur or LLC to online cash registers on time, you may be fined at least 30,000 rubles. The fine for officials is from 10,000 rubles.

- For systematic violation of the requirements of 54-FZ, officials face disqualification for a period of one to two years, entrepreneurs and organizations - suspension of activities for a maximum of 90 days.

- If the CCP used does not comply with the requirements of the law, officials will receive a warning or a fine of 1,500 to 3,000 rubles, individual entrepreneurs and legal entities will receive a fine of 5,000 to 10,000.

- If you do not provide the client with a check upon his request, the sanctions will be as follows: for officials - a warning or fine of 2,000 rubles, for an entrepreneur or organization - a warning or fine of 10,000 rubles.

- For failure to provide information and documents at the request of the Federal Tax Service or for doing so late, officials face a warning or a fine of 1,500 to 3,000 rubles; individual entrepreneurs and legal entities face a warning or a fine of 5,000 to 10,000.

Now you know the procedure for switching to online cash registers and will do everything in accordance with the law.