Every citizen who receives income or owns property must pay taxes in accordance with current legislation. Similar rules are established for individual entrepreneurs, as well as various organizations. But it is not always possible to do this in a timely manner.

If there are tax debts, the Federal Tax Service assesses penalties and fines and may go to court to initiate a procedure for forced collection of debt. After the judicial act comes into force, the debtor will have to deal with the bailiffs. They will be able to seize accounts, write off money from them, and even foreclose on property. But sometimes the problem with tax debt can be solved by writing it off during a debt amnesty or in other ways.

When the Federal Tax Service recognizes tax debts as bad

Sometimes the Federal Tax Service may recognize tax debts as bad and stop collecting them. This can only happen in the cases listed in Art. 59 of the Tax Code of the Russian Federation. In particular, this is possible in the following situations:

- death of the taxpayer;

- declaring a citizen or individual entrepreneur bankrupt;

- issuance by the court of acts refusing to collect payments due to the expiration of the established deadlines for filing an application;

- return of documents from the FSSP to the claimant due to termination of proceedings due to the debtor’s lack of property and funds, if at least 5 years have passed from the date of formation of the debt.

Another situation where tax debts may be considered hopeless is the debtor’s attempts to declare bankruptcy if the procedure was terminated due to lack of funds to carry it out.

Debtors will be forgiven their “tax sins.” Who will benefit from this?

The president announced a large tax amnesty of 80 billion rubles. It will affect only individuals: due to the imperfection of the system, 42 million citizens have debts to the state

Photo: Grigory Sobchenko/BFM.ru

Vladimir Putin announced a large tax amnesty. It will affect only individuals, and the volume of debts written off is almost 80 billion rubles. The president proposed to forgive arrears at the annual press conference. In addition, he voiced several more important economic theses. They are related to the actions of the Central Bank and raising the retirement age.

The president was asked several times about the actions of the Central Bank, and in response to all questions he supported the Central Bank. Raising the retirement age: judging by the statement of the head of state, the decision has been made. It remains to understand when they will increase it and by how much.

Vladimir Putin, President of the Russian Federation “Now all European countries, all the countries that surround us, including Belarus, Kazakhstan, the same in Ukraine, have all already decided to raise the retirement age. We were the only ones who didn't do this. As supporters of raising the retirement age say, it should be increased equally: for both men and women. Well, our women still give birth at the age of 55. Thank God, and God bless them!”

The most mysterious idea seemed to be Putin’s idea of a tax amnesty for individuals. It turns out that due to the imperfection of the system, they owe the state 41 billion rubles. We are talking about 42 million citizens. On average, a thousand per person. Later, Vedomosti, citing a federal official, explained: this is a property tax that citizens have not paid for three years. Taxadvisor partner Dmitry Kostalgin suggests how the gigantic arrears were formed:

Dmitry Kostalgin partner.

By the way, the Federal Tax Service already held such an amnesty six years ago. Then 31 billion rubles were written off from individuals, also over three years, and all for the same reasons. This time, the president announced that the debts of individual entrepreneurs would also be written off. This is 15 billion for almost three million people. Putin gave an example: a citizen became an individual entrepreneur, but the business did not take off, and taxes were still accrued and accrued. This actually happens quite often. But at the same time, fraudsters will also be forgiven, notes senior partner of the law firm Forward Legal Alexey Karpenko:

Alexey Karpenko, lawyer, senior partner at Forward Legal “Situations where an individual entrepreneur’s tax debt grew as a result of the fact that he used his status to evade taxes, to participate in various schemes, these situations really exist. If the state forgives everyone and forgives their “tax sins,” I think that it will mainly be the swindlers, not the entrepreneurs, who will benefit from this.”

At the same time, the Federal Tax Service will write off taxes on conditional income. This, according to media reports, is 22 billion rubles, and they are connected with banks. Let’s say a person’s loan is written off. For example, in the process of personal bankruptcy. The tax office believes that if a citizen has not paid a debt to the bank, it means that he has generated income, and a tax must be taken from him. True, according to the law, this cannot be done in bankruptcy, but the Federal Tax Service usually does not know why the debtor was forgiven. But in the end, those who have already been forgiven will be forgiven.

And the most important thing is that debtors will not have to go or apply anywhere, judging by the president’s words. The tax authorities will write everything off themselves. In the end, those who at one time did not pay or look into it turned out to be right. In a country, sometimes everything heals on its own.

As for business taxes, the president once again confirmed that they will not be raised until the end of next year. But it’s too early to talk about what will happen next.

Add BFM.ru to your news sources?

Amnesty of tax debts of individuals

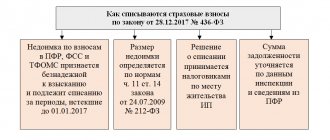

On December 28, 2022, Federal Law No. 436-FZ was adopted in the Russian Federation. Thanks to him, a tax amnesty was held in the country. It consisted of writing off the following types of taxes:

- property for individuals persons (transport, land, etc.) for debts incurred before January 1, 2015;

- for taxes of individual entrepreneurs, for debts that arose before 01/01/2015, even if at the time of the amnesty the entrepreneur stopped conducting business;

- for insurance premiums that were payable before 01/01/2017 (in the amount of up to 8 minimum wages).

The procedure did not provide for any obligations for the taxpayer. In fact, all expenses fell on the budget. But at the same time, the tax amnesty did not affect organizations in any way, even from the small and medium-sized business segment.

What debts will be written off for individuals

According to this document, debts on transport, property and land taxes incurred before January 1, 2015 are “recognized as uncollectible and subject to write-off.” Accrued penalties and fines on these taxes will also be written off.

A pleasant bonus is the fact that the taxpayer does not have to do anything to cancel the resulting debt - the tax authorities will do everything on their own. True, this process can be controlled by contacting the tax service at your place of residence with a request for debt availability. This can also be found out through the online service on the Federal Tax Service website.

It is worth mentioning separately that writing off these debts does not mean that citizens who have paid their taxes in a law-abiding manner can count on a refund.

In addition, income of citizens “received by taxpayers from January 1, 2015 to December 1, 2022, upon receipt of which tax was not withheld by a tax agent,” is recognized as not subject to taxation. True, there is a caveat here - this income should not be received as remuneration for work, dividends and interest, intangible benefits (for example, interest on a loan with a rate lower than that established in the Tax Code), gifts, or winnings and prizes.

How to take advantage of the tax amnesty

A tax amnesty was carried out by the Federal Tax Service. The tax service automatically selected citizens with debt from the database, wrote it off and made the necessary adjustments to the accounting documents. The participation of the taxpayer in it was not required.

Currently, the tax amnesty procedure is completely completed. Whether it will ever be repeated is unknown. There is no point in hoping for this in the foreseeable future. It is better to look for other options for getting rid of debt obligations.

Who does this amnesty apply to?

After a brief consideration of the meaning of the amnesty and the principles of its operation, the next question naturally arises - who concerns and how to take advantage of this very amnesty? As mentioned above, its general effect applies to absolutely all individuals who are citizens of Russia, as well as to all individual entrepreneurs.

As for the transport tax amnesty specifically, as you might guess, it applies only to those citizens who own a car (and these persons must be the owners who pay all the necessary motor transport fees and taxes).

It is extremely important to note the fact that its direct action is absolutely not limited by anything, it does not depend on:

- is a motorist who will be exempt from motor vehicle tax

- unemployed, working or retired; - on the amount of income of the person with tax debts (as well as the income of his family members);

- place and region of residence of this payer;

- the time during which he owns the vehicle;

- engine power and other similar vehicle characteristics;

- reasons why taxes were not paid on time (it could be forced, for example, due to a lack of funds or an emergency, or simply be caused by the person’s reluctance to pay taxes).

In all these cases, the debt will still be written off. In addition, perhaps the most important point is the fact that absolutely any amount credited to the debtor as of January 1, 2015 will be written off.

Let's give an example: a certain individual has a debt on motor vehicle tax, which by the beginning of 2015 amounted to 11,000 rubles. Also, in the period that followed (until 2018), due to non-payment of tax, this person was assessed additional penalties in the amount of about 4,000 rubles. In total, the total amount to be paid became 15,000 rubles. As a result of the tax amnesty, this entire amount will be completely written off from the debtor’s account (as well as any other amount - there are no restrictions on its size in the amendments that Putin’s decree introduced to tax legislation).

Now let's look at the write-off procedure itself - what will the car owner need to provide to the tax office at his place of residence in order for the debt write-off described above to occur?

Nothing at all, really. You do not need to bring any certificates, declarations or other papers to the tax office, nor do you need to pay any duties or government fees. The tax authorities themselves will deal with the write-off of accumulated debts, and no participation of the debtors themselves will be required. Moreover, part of the debts (including transport tax) will most likely be written off “automatically” - they will simply be deleted from the electronic system of the tax service (the taxpayer will be able to check the fact that this write-off has occurred by simply logging into his personal account on the tax service website - however, for this you need to be registered there).

It is also worth noting the important point that, according to the amendments that have come into force, all taxes, fines and penalties are written off unilaterally by the tax service itself, without the participation of the debtor citizen, but at the same time the service notifies about the fact that the debt has been successfully removed this very citizen is not obliged. In fact, this moment should not cause serious inconvenience to individuals - after all, the most important thing is that the debt will be deleted for everyone at once, without any exceptions, and, therefore, there is absolutely no reason for concern here.

As for those car enthusiasts who still want to personally verify that their debt is gone, we can recommend two options for solving this problem.

- The first of them is to go to the tax service website and check the status of the debt in your personal account (which has already been mentioned above, however, it is worth repeating - for this you need to be registered in the system).

- The second way is to come in person to the nearest tax office and ask there for information about the status of the debt. As a rule, this procedure is quite fast, and the total time that will have to be spent when checking the account status using this method depends directly on the presence of queues.

The essence of tax amnesty: history of the issue

Such a term as “tax amnesty” is not disclosed in legislative acts, but more often this concept most often means exemption:

- from actual obligations to pay (calculate and pay) taxes for one reason or another;

- liability for violations of certain obligations related to the payment (calculation and payment) of taxes.

Here are some examples of tax amnesties that were carried out relatively recently:

| When | What happened |

| 1993 | A tax amnesty was carried out. Legal entities and individuals could openly declare their arrears and transfer them to the treasury without consequences. The amnesty lasted a month and 3 days. |

| 2007 | – the amnesty period extended to the entire year 2007; Only individuals - individual entrepreneurs and ordinary citizens - could participate in the event; – income received before 2006, i.e. in 2005, was presented for redemption. |

| 2015 | The state allowed some taxpayers to file special declarations indicating their assets in the form of property and funds previously kept secretly for six months - July-December 2015. Reason: Federal Law dated June 8, 2015 No. 140-FZ. |

It is worth noting that the above definition of “tax amnesty” and the amnesty of previous years provided that taxpayers are obliged to either pay taxes to the budget without penalties or submit a tax return. However, there was no complete forgiveness of the debt. Therefore, it would be a stretch to call them large-scale amnesties.