Today, Russian citizens who have the right to receive subsidies by paying property taxes can fill out a corresponding application. It is necessary to enter information into the form according to KND 1150063, an example of which can be filled out in this article, without a single mistake. This should be done, for example, if you receive a disability status that gives you the right to benefits, or if you own several taxable objects.

The KND form consists of several sheets, each of which is dedicated to a specific piece of property owned by an individual and subject to taxes. When submitting an application to the Federal Tax Service, filling out all pages of the form is not required. The taxpayer should enter data only on the sheets he needs.

Submitting a form that confirms the right to receive tax benefits is a right, not an obligation, of an individual.

A citizen is not required to provide supporting documents to the tax service, since, if necessary, INFS inspectors will independently request information about them from the relevant authorities, and then inform the taxpayer about the decision made.

An individual can submit the KND form through the personal account of the Federal Tax Service or in person.

forms according to KND 1150063

General procedure for filling out the form according to KND 1150063

Currently, there are certain features of drawing up an application, on the basis of which citizens receive the right to apply for benefits on property, transport and land taxes.

The procedure for filling out the form according to KND 1150063 is regulated by current tax legislation. However, in order to learn how to fill out the form correctly, you should familiarize yourself with its ready-made example.

An example of filling out a form to receive benefits

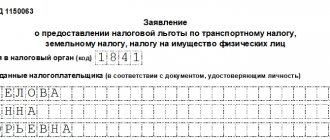

The first page indicates the data of the tax authority (code), TIN and full name of the taxpayer, his date and place of birth, passport and contact information, as well as the method of informing about the results of the review, date and signature. In the lower left corner of the form, the information of the authorized person is written down if his representative submits the document for the taxpayer.

On the second page of the form, fill in the abbreviated full name of the person on whose behalf the application is being submitted. A code is selected in the tax benefit column. The details of the make and license plate number of the vehicle, as well as the period for granting the benefit, are detailed below. The following indicates the basis for obtaining the right to a subsidy. In the example above, this document is a certificate of disability. But in your case another document may be involved. In the next column, information is entered about the authority that issued the document, its date of receipt and validity period, as well as the series and number.

On the third page of the application, the abbreviated full name of the taxpayer is again entered. The next column indicates the cadastral number of the land plot, the validity period of the benefit, as well as the details of the document on the basis of which it is issued. The information is filled in similarly to the information on the second sheet.

On the fourth page, the abbreviated full name of the person receiving the property tax benefit is written down. Just below, select the type and indicate the number of the property. The deadline for granting the benefit must be entered, and the details of the document on the basis of which the taxpayer receives it are entered.

Sample of filling out an application for property tax relief

Among the beneficiaries are pensioners who have received this right since 2015. They can be exempt from taxation for each object of different types - for one garage, for one share, etc.

How to write an application for a property tax benefit for a pensioner manually:

- use black paste to fill out the form;

- You need to fill out 1 copy;

- You cannot correct errors in the form - incl. using a corrector;

- use a separate cell for each symbol;

- In each column, indicate one value;

- write in block letters and capital letters;

- fill out the columns from left to right;

- in columns where nothing is indicated or there are empty cells left, put a dash.

The Federal Tax Service of Russia has detailed instructions for filling out this form - each sheet, which you can view here .

Sample application for property tax benefits for pensioners:

The second sheet of an example of filling out an application for property tax relief:

Each page must be signed and dated - do not date it in advance if you do not intend to submit the application that day. If you do not remember your TIN or cannot find the 2-2-Accounting certificate, then it is easy to find out through the tax service “Find out TIN”:

- Login to the site.

- Hover over the citizens block.

- Go to service. Enter your passport details here.

- Get the result.

The period for consideration of your application is 30 days, as stated in Article 12 of Federal Law No. 59-FZ 05/02/2006 “On the procedure for considering applications from citizens of the Russian Federation.” If the Federal Tax Service cannot review the form you submitted, you will be notified of this within 10 days from the date of submission (see letter of the Federal Tax Service of Russia dated May 21, 2018 N BS-4-21 / [email protected] ). The answer will be sent to you in a way that is accessible to the inspection - it will be announced to you at the time of registering your application.

Who should fill out the KND form?

The form for granting tax benefits must, according to tax legislation, be filled out by the person who personally owns the property. Data in the application form can also be entered by his representative, if he has a power of attorney. However, in this case, the authorized person will have to fill out the application on his own behalf.

Composition of the form according to KND

The application for tax benefits includes:

- title page;

- tax benefit reminder;

- benefit form.

Each page of the form must be numbered on both sides at the top in a special field.

Rules for the design of the title page

The items that will be filled out by tax officials are marked with a special mark. All others are required to be completed by the applicant. This includes:

- code of the tax authority that will consider the application;

- FULL NAME;

- Date and place of birth;

- passport series and number;

- identification code;

- applicant's mobile phone;

- authorship (directly the recipient of benefits or his authorized representative);

- date and signature.

Rules for preparing the form for KND

The application for a tax benefit must be filled out by hand or on a computer. If data is entered manually, then it must be entered into the document with a black helium pen.

The form is drawn up in 1 copy without any blots. It is strictly prohibited to use proofreaders and other means to correct errors. If incorrect information is entered, the application must be rewritten.

For each type of data, the form has special fields with cells in which the corresponding numbers, letters and symbols must be entered.

Filling out the title page

The title page contains information in all fields, except for those about. The data is entered by the taxpayer personally or by his authorized representative.

The TIN column indicates the code assigned by the tax authority to a citizen who is registered as an individual entrepreneur. If a person is an ordinary individual, then in the TIN line he must indicate the number of his personal document.

Point No. 1 specifies the Federal Tax Service code, which was selected by the taxpayer when filling out the form. The tax office is assigned based on the registration or location of the property.

Point No. 2 indicates the taxpayer’s personal data without abbreviations, his information from his passport and information about the authority that issued the document.

Next, contact information is filled in on the title page. When specifying a phone number, spaces cannot be inserted, and all remaining cells must contain even dashes.

In paragraph No. 3, in the column with the phrase “The application was drawn up on...” you should indicate the number of completed pages of the document. In the next line you need to enter the total number of pages to be copied. These sheets prove the right of an individual to receive tax benefits legally due to him.

Point No. 4 clarifies the accuracy of all information filled out above. To do this, the person filling out the document must put the current date and signature. Below in the column with details, you should write down the data from your passport if the application is drawn up by a representative of the payer.

There is no signature or date on the title page if the document is filled out electronically and sent through the taxpayer’s personal account.

How to fill out an application for property tax relief?

Property tax is municipal. It means that:

For this reason, most benefits to citizens are provided at the local level. Federal beneficiaries are listed in Article 407 of the Tax Code of the Russian Federation - disabled people, veterans, pensioners, families who have lost a military breadwinner, etc.

You can find out about municipal benefits at your inspectorate or on the Federal Tax Service website. The way to obtain information through the Federal Tax Service website:

- Taxation in the Russian Federation.

- Applicable taxes and fees.

- Property tax for individuals.

- Privileges.

- Go to the service.

- Reference information about rates and benefits.

.

Important! If you are a beneficiary on several grounds, you still cannot sum them up: if you are given a benefit as a pensioner for one apartment, then you have to pay for the second, despite the fact that you are also disabled and a participant in hostilities.

An application to the tax office for the abolition of the real estate tax is submitted to the Federal Tax Service in accordance with the norms of Article 407 and Article 361.1 of the Tax Code of the Russian Federation - the second regulates the procedure for obtaining transport tax benefits, but clause 3 also applies to real estate.

Key points:

- filing an application for exemption from property tax in any form is not allowed; there is a special form approved by the Federal Tax Service of Russia, which must be used;

- if you wish, you can attach supporting documents to the form (confirming the existence of a reason - pension, disability, etc.), but it is not necessary to attach them;

- if the documents are not attached, the Federal Tax Service will independently request them from the Pension Fund of the Russian Federation, Rosreestr, etc., but if these departments do not have the necessary information, the applicant will be notified of the need to submit the documents himself;

- if you have several objects of the same type (for example, 2 apartments, 2 shares, etc.), then exemption is given only for one of them, unless otherwise provided by local laws;

- if there are several homogeneous objects, the Federal Tax Service applies an exemption to the one for which the largest amount of tax is payable;

- you can choose the object yourself; to do this, submit a special notification approved by order of the Federal Tax Service;

- notification, unlike an application, is provided before November 1 of the year; if you submit after this deadline, your choice will be taken into account in the next tax period;

- During the year, you can submit a revised notification to change your choice.

You can submit an application:

- in your Federal Tax Service - have a passport with you, it is advisable to know your TIN, but not necessary;

- in the MFC, which has entered into an agreement on interaction with your Federal Tax Service (as a rule, such a center is located in the same area as the inspection) - it is also enough to present a passport for identification;

- online - through the “Taxpayer’s Personal Account”;

- through the government services portal;

- send by mail - both the application and other documents, along with a list of the contents, must be certified by a notary;

- transfer through a representative who has a power of attorney certified by a notary.

Important!

The application must be submitted to the Federal Tax Service at the location of the preferential property.

If you have questions or need help, please call Free Federal Legal Advice.

How to correctly enter information into the sheets with an application for a tax benefit?

Sheets with data on tax benefits must be filled out according to information about the property and the type of tax that implies preferential tax conditions.

If you, as a taxpayer, are entitled to receive several types of benefits, then a separate form must be drawn up for each property.

At the top of the application, the surname and initials of the payer, as well as his TIN, are entered. The next paragraph indicates information about the property using a code and full name. Then the validity period of the benefit and the details of the document that is the basis for receiving it are specified. At the end of the page there is a date and signature.

Application for benefits

An application for a transport or land tax benefit must be filled out in the prescribed form.

There is only one for both taxes, and you will find it in the order of the Federal Tax Service dated July 25, 2022 No. ММВ-7-21/377. If you are claiming a transport tax benefit, you will fill out a cover page and section 5. For a land tax benefit, you will fill out a cover page and section 6.

If you have benefits for both taxes, then fill out the title page and both sections.

The benefit can be in the form of a complete exemption from paying tax, a reduction in the amount of tax or a reduction in the rate. Thus, for transport tax (field 5.5), these are codes 20210, 20220, 20230, respectively. They are provided on the basis of Part 3 of Article 356 of the Tax Code of the Russian Federation and are given in Appendix No. 1 to the said order.

There are more benefits for land (the code is entered in field 6.3). In addition to the similar ones established by paragraph 2 of Article 387 of the Tax Code of the Russian Federation (codes 30022400, 30022200, 30022500), there is also a tax deduction, a benefit in the form of a share of the land tax-free area of a land plot, as well as a number of benefits that are provided to individual organizations on the basis of Article 395 of the Tax Code RF. These are institutions of the penal system, foundations, organizations of the disabled, folk crafts, SEZ residents and others.

Since benefits are provided by regional authorities, the application must provide information about the law and fill out:

- fields 5.6 - 5.6.3 for transport tax;

- fields 6.4 - 6.4.3 for land.

In fields 5.6.3 of the application for a transport tax benefit and 6.4.3 for a land tax benefit, you must indicate the so-called “structural units”. This is an article, part, clause, subclause, paragraph or other elements of a regional law establishing a benefit. The order in which you fill out the application describes how to fill out these fields.

There are four familiarization spaces for each structural unit. The field is filled in from left to right. If the attribute has less than four characters, the empty spaces to the left of the value will be filled with zeros. For example, if the corresponding tax benefit in the form of a tax-free amount is established by Article 2, paragraph 3, subparagraph “a” of the regulatory legal act of the representative body of the municipality, then the submitted line indicates 000200000003000a00000000.

Deadlines for submitting the KND form

Individuals and individual entrepreneurs who are legally entitled to receive tax benefits must submit an application under KND 1150063. The form and deadlines for its submission are approved by the Government of the Russian Federation and regulated by current tax legislation.

According to the orders of the Federal Tax Service of the Russian Federation, the time frame for drawing up and submitting an application for benefits is not limited. In this regard, the tax authorities do not have the right to refuse to accept it.

The timing of the provision of benefits, on the contrary, is limited. Having received your documents, inspectors of the Federal Tax Service are required to review them and approve them within 24 hours.

Sheet 2 “Transport tax benefit”

Select the “ Sheet 2 ” tab and add this sheet to the application if you have a vehicle.

We fill out everything on this page “ manually ”. First, all the data about the vehicle according to the title, below is the data about the document confirming the right to the benefit.

If you own several vehicles and your region allows benefits for several of them, then fill out information about other vehicles below.

more than one Sheet 2 . That is why in the program it is marked as sheet 2(1). By clicking on “ ++ ” you can add 2 sheets as many as necessary.

Responsibility for failure to provide documents

The taxpayer needs to apply for tax benefits personally, so filling out and submitting the form under KND 1150063 is his direct interest. The legislation does not provide for the imposition of penalties for the late transfer of documents to the Federal Tax Service, and therefore documents can be submitted at any time.

Thus, an individual and an individual entrepreneur have the right to apply with a completed form to receive a tax benefit for transport, land or real estate to the Federal Tax Service or through the taxpayer’s personal account. He can obtain information about benefits on the website of the Russian Tax Service or through a service containing reference information on rates and benefits for property taxes.

☎️ Still have questions after reading the article? Get a free consultation from a qualified lawyer. Call now! +7 800 302-76-57

Application in the program

The application can be completed using the software and printed. It is recommended to use the Courier New font with a height of 16-18 points.

You can use a free program for this from the Federal Tax Service of Russia Taxpayer Legal Entity.

“Taxpayer Legal Entity” will help you not only fill out the application form for property tax benefits, but also check that all fields are filled out correctly. In addition, if you subsequently want to change the object to which the benefit will apply, you will have a completed application where you just need to make changes to the object.

Rules for submitting documents

Documentation KND 1150063 is submitted by citizens entitled to receive tax benefits. Based on the provisions of the Federal Tax Service of the Russian Federation MMV-7-21/897, the deadline for submitting documents is not limited by time. Tax authorities do not have the right not to consider applications due to non-compliance with deadlines. Decisions on submitted documents are made by the inspectorate in the shortest possible time.

Also, the tax legislation of the Russian Federation does not provide for any penalties for delays in filing forms. It is assumed that receiving benefits is the personal responsibility of citizens.