The application form for the provision of tax benefits for land and transport tax and the procedure for filling it out have been approved (Order of the Federal Tax Service of the Russian Federation dated July 25, 2019 N ММВ-7-21 / [email protected] ), applicable since 2022.

The due date has not been set. We recommend submitting your application starting from 01/01/2020 and no later than 30 working days before the tax payment (advance payment) deadline.

- Application for property tax relief

- Saving, printing and sending an application

Application for property tax relief

Composition and procedure for filling out the application

The application form consists of:

- from the title page;

- a sheet on which the transport tax benefit is declared;

- a sheet on which the land tax benefit is declared;

- a sheet in which a property tax benefit is declared.

The title page is always filled out. The rest - if you claim a benefit for the relevant tax. Therefore, the application must consist of a minimum of 2 and a maximum of 4 sheets. There is no need to submit blank sheets to the inspection.

Example: You have made an application for a benefit.

Situation 1 You receive one tax benefit. This is a land tax. Then the application will consist of 2 sheets. The first one is the title one. The second is for land tax benefits.

Situation 2 You receive a benefit on two taxes. This is land and transport tax. Your application will consist of 3 sheets. The first one is the title one. The second is for land tax benefits. The third is for transport tax benefits.

General filling rules

The application can be filled out:

- on the computer;

- by hand.

In the first case, fill out the document in “Courier New” font size 16 - 18 points. Secondly, in black ink. Fill out the application from left to right in block capital letters. Enter one letter or number in one cell. In all empty cells that do not contain data, put a dash (horizontal line).

After completing all the necessary sheets, enter their serial number. The title page is always number “001”, the next page is number “002”, etc. d.

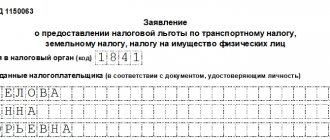

How to fill out the title page

1. Enter your Taxpayer Identification Number. If you don’t know it, you can find it out using our “Find out your TIN” service. If you wrote your TIN in the application, then you do not need to indicate the date and place of birth on the title.

2. Enter the code of the tax office to which the application is sent. If you receive a land tax benefit, it must be sent to the location of the land plot on which the tax is paid. Your place of residence (registration) does not matter. You can find out the address, name and number of the tax office by following the link.

3. Next, write down your full name (from left to right in capital block letters). Write each letter in a separate cell.

4. Indicate the date and place of birth indicated in the passport.

5. Provide the code of the document that proves your identity. If this is a passport of a Russian citizen, code 21. Here are the codes of all documents that can prove identity:

Codes of types of documents that prove identity:

| Document type | Its code |

| Passport of a citizen of the USSR Attention! Do not confuse it with a passport of a Russian citizen. His code is 21 (see below) | 01 |

| Birth certificate (indicate if a child is applying for benefits) | 02 |

| Certificate of release from prison | 05 |

| Military ID | 07 |

| Temporary certificate issued in lieu of a military ID | 08 |

| Foreign citizen's passport | 10 |

| Certificate of consideration of an application for recognition of a person as a refugee on the territory of the Russian Federation on its merits | 11 |

| Residence permit in the Russian Federation | 12 |

| Refugee ID | 13 |

| Temporary identity card of a citizen of the Russian Federation | 14 |

| Temporary residence permit in the Russian Federation | 15 |

| Certificate of temporary asylum on the territory of the Russian Federation | 18 |

| Passport of a citizen of the Russian Federation Attention! Do not confuse it with the passport of a citizen of the USSR. It has a different code - 01 (see above) | 21 |

| Birth certificate issued by an authorized body of a foreign state | 23 |

| Identity card of a military personnel of the Russian Federation | 24 |

| Seaman's passport | 26 |

| Reserve officer's military ID | 27 |

| Documents confirming the fact of registration at the place of residence | 60 |

| Certificate of registration at place of residence | 61 |

| Residence permit for a foreign citizen | 62 |

| Other documents that are recognized under Russian or international laws as identity documents | 91 |

6. Enter the series and number of the document, and also indicate the date of its issue.

7. Fill in the “Issued by” field. Here you can find information about the department that issued the passport. Everyone faces the same problem when filling out this field. It is not enough to fill out the cells in the form. There are not enough of them to enter the name of the police department or migration service in full. Therefore, you will have to reduce this data as much as possible. For example, if the document says “Branch of the Federal Migration Service for the Khovrino District of Moscow,” then this name can be shortened to “OFMS FOR KHOVRINO DISTRICT.”

8. Next, in the application, indicate your contact phone number without spaces or dashes in the format X(ХХХ)ХХХХХХХ. For example, 8(999)1234567.

The completed lines will look like this:

9. Then fill out the box that discusses how you will receive the results of your application. Put it there:

- 1 - if you plan to find out about the results directly from the inspection;

- 2 - if you want to receive results by mail.

This cell does not need to be filled out by those who have gained access to the taxpayer’s personal account. You can find out the results in your personal account.

10. Indicate the number of sheets of your application (minimum two) and the number of sheets of those documents that confirm your right to benefits and are attached to the application. For example, an application is drawn up on 2 sheets and documents on 5 sheets are attached to it. Then “002” and “005” will be written in these cells.

11. In the section “Accuracy and completeness of information...”:

- if you fill out and submit the application in person, put “1”;

- if you are submitting an application through your representative, put “2”.

12. If the application was made by you, please sign and date it. There is no need to fill in any other information.

The specified data on the title page can be filled out as follows:

How to fill out the benefit data sheet

This is the third sheet in the application. If you claim a benefit only for this tax, then its number will be “002”.

There are 2 blocks on this sheet. They contain the same data. If you are claiming a benefit for only one plot of land, it is enough to fill out the first block. If there are two, then the first and second. If there are more objects, an additional sheet will be required. Indicate information about the third and fourth objects in it. In this situation, he will have the number “003”.

Here you need to provide all the data on the object for which you are claiming a benefit. Its type (residential building, apartment, room, etc.), number (cadastral or conditional or inventory), the period for providing the benefit or an indication that it is unlimited, as well as the details of the document that confirms your right to the benefit. A copy of this document must be attached to the application.

Perhaps you have been entitled to a benefit for a long time, but you have not used it. In this situation, the tax that you paid will be returned to you. But only the amount from the date of payment of which 3 years have not passed. Amounts paid earlier will not be refunded. As we said above, in order to get a tax refund, you need to submit not one, but two applications to the inspectorate: an application for a tax benefit (see below) and an application for a tax refund (see the link). Accordingly, in your application for benefits you can write the date from which you are claiming a tax refund.

Example A person retired in March 2006. From that moment on, he received the right not to pay property tax on the value of his apartment. But I didn’t take advantage of the benefit and paid tax. He applied for the benefit only in 2022. In column 6.3. He set the “term for providing tax benefits” to “1” (that is, indefinitely). And in the line “from...” he can indicate - 03/01/2006. The tax office is obliged to refund him taxes for 2016, 2022 and 2018.

Here is a sample of a completed sheet with information about the benefit. Let's take as a basis the situation when an old-age pensioner claims a benefit for his apartment. He retired on May 10, 2018. The sheet can be filled out like this:

How to apply for benefits

Submit an application for a transport or land tax benefit using the form approved by Order of the Federal Tax Service of Russia dated July 25, 2019 No. ММВ-7-21/ [email protected]

The procedure for filling out the application was approved by the same order.

The Application form includes:

- title page;

- a sheet with information about the claimed tax benefit.

In this case, section 5 is filled out if you are claiming a transport tax benefit, and section 6 is a land tax benefit.

If an organization has the right to a benefit for more than one car or land plot, the corresponding sheet is filled out separately for each taxable object.

Previously on the topic:

Report benefits on transport and land taxes to any Federal Tax Service

What to consider when filling out an application for a transport tax benefit

In section 5 “I ask for a tax benefit for transport tax” you should indicate:

- in field 5.1 – type of vehicle. In this case, each type of vehicle corresponds to a separate code. For example, enter code “01” if you are claiming a benefit for a passenger car, and code “02” if you are claiming a benefit for a truck;

- in field 5.2 - information about the make or model of the car;

- in field 5.3 – state registration number of the car;

- in field 5.4 - the period of validity of the tax benefit according to the document confirming the right to it;

- in field 5.5 – tax benefit code for transport tax.

In addition, you will need to provide information about the regional law that introduced the transport tax benefit, and in fields 5.7.1 – 5.6.5 information about the document that gives the right to use the benefit.

More on the topic:

When to pay advance payments for transport tax in Moscow?

Rules for paying transport tax in 2022

Read in the berator “Practical Encyclopedia of an Accountant”

Application for benefits