Declarations on taxes on transport and land were canceled

Since 2022, legal entities do not file declarations on transport and land on the basis of clause 9 of Art. 3 of the Law of April 15, 2019 No. 63-FZ. Accordingly, for 2022 these calculations are not required to be sent to the Federal Tax Service.

The Federal Tax Service in Letter dated October 31, 2019 No. BS-4-21/ [email protected] indicates under what circumstances tax authorities will still have to accept land or transport tax declarations:

- you need to submit an adjustment return for periods before 2020;

- you need to submit an adjustment declaration if the initial calculation is submitted during 2022 during the reorganization of the company.

Also, an economic entity submits a declaration on land or transport when it wants to use deductions for periods before 2020 and for the period during 2022 upon liquidation or reorganization of the company (Clause 3 of Article 55 of the Tax Code of the Russian Federation).

Important! If a company claims benefits for periods before 2022 through an application, the tax authorities will not accept it. They will invite the subject to submit a declaration. This is indicated in the Letter of the Federal Tax Service dated September 12, 2019 No. BS-4-21/ [email protected]

In the above situations, companies need to generate a transport declaration in the form regulated by the Order of the Federal Tax Service of December 5, 2016 No. ММВ-7-21/ [email protected] , and a land declaration in the form from the Order of the Federal Tax Service of May 10, 2017 No. ММВ- 7-21/ [email protected]

Tax reporting simplified

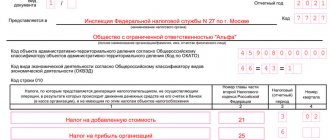

At the end of 2022, organizations and individual entrepreneurs must submit a declaration using a new form. To fill out a declaration under the simplified tax system, use the form approved by Order of the Federal Tax Service of Russia dated December 25, 2020 No. ED-7-3 / [email protected]

Compared to the previous form, the following innovations can be distinguished:

- changed barcodes;

— the OKVED code was removed from the title page;

— entered the tax rate attribute code. He is brought to Sect. 2.1.1 and 2.2. If the taxpayer applies general rates, then the field reflects code “1”, if increased rates - “2”. Let us remind you that if you slightly exceed the income or employee limit from 2022, you can remain on the simplified tax system, but the rates are higher;

- in section 2.1.1 and 2.2 a new line has appeared to justify the rate according to the law of the subject of the Russian Federation.

The composition of the declaration depends on the object of taxation - the simplified tax system “Income” or the simplified tax system “Income minus expenses”.

Organizations submit declarations under the simplified tax system at different times.

Organizations submit a declaration for the year no later than March 31 of the following year (clause 1 of Article 346.19, subclause 1 of clause 1 of Article 346.23 of the Tax Code of the Russian Federation).

At the end of the year, individual entrepreneurs submit a declaration no later than April 30 of the following year (clause 1 of Article 346.19, subclause 2 of clause 1 of Article 346.23 of the Tax Code of the Russian Federation).

Organizations always submit a declaration to the inspectorate at their location (clause 1 of Article 346.23 of the Tax Code of the Russian Federation).

If there are separate divisions, the declaration is still submitted to the inspectorate, where the parent organization is registered. There is no need to submit it at the location of the units.

Entrepreneurs submit reports at their place of residence (clause 1 of Article 346.23 of the Tax Code of the Russian Federation).

The income limit for maintaining the right to the simplified tax system in 2022 is 219.2 million rubles, increased rates apply for incomes above 164.4 million rubles. (deflator coefficient - 1.096).

The Federal Tax Service did not provide control ratios for checking the current declaration form under the simplified tax system as of November 1, 2022. But, given the nature of the changes made to the declaration, to analyze its indicators (and independently search for errors in them), simplifiers can obviously use the ratios that were given in the Letter of the Federal Tax Service of Russia dated May 30, 2016 No. SD-4-3 / [email protected ] in relation to the previous report form.

From July 1, 2022, in Moscow, the Moscow and Kaluga regions and Tatarstan they plan to introduce a new tax regime, “STS-online”. Advantages:

- no need to submit a declaration, 6-NDFL, RSV and pay fees;

- Personal income tax for employees is calculated and transferred by the bank;

- The tax is considered by the Federal Tax Service according to the bank or cash register.

However, the rate for the income simplified tax system is 8%, and for the income-expenditure system 20%. Limitations: income ‒ 60 million rubles. per year, number 5 people. Existing organizations will be able to switch to the simplified tax system online from 2023 (Project No. 20281-8).

See more information:

How to fill out a declaration under the simplified tax system “Income” for 2022.

How to fill out a declaration under the simplified tax system “Income minus expenses” for 2021.

Sample of filling out a declaration under the simplified tax system with the taxable object “Income” for 2022.

Sample of filling out a declaration under the simplified tax system with the taxable object “Income minus expenses” for 2022.

The deadlines for transferring taxes on transport and land have been changed

Starting from 2022, companies are required to pay taxes on transport and land, as well as advances on them on other dates (clauses 68, 77 of Article 2 of Law No. 325-FZ of September 29, 2019).

Before the changes were made, the deadlines were determined by the regional laws of a specific subject of the Russian Federation (for transport) or a specific municipal entity (for land). And these dates could not be earlier than the dates for submitting the declaration, i.e. before February 1 of the next year.

In accordance with the adjustments made, uniform deadlines for payment of advance payments and the transport and land tax itself have been established for all companies. From 2022, taxes must be paid no later than March 1 of the year following the previous tax period. As for advance payments, they must be paid no later than the last day of the month following the previous reporting period - quarter (clause 1 of Article 363 of the Tax Code of the Russian Federation, clause 1 of Article 397 of the Tax Code of the Russian Federation).

Accordingly, in 2022 the following payment deadlines are established for transport and land taxes:

- March 1 – tax for 2022;

- April 30 – advance payment for 1 sq.m. 2022;

- August 2 – advance for 2 quarters. 2022 (postponed from July 31 holiday);

- November 1 – advance for 3 quarters. 2022 (rescheduled from October 31st holiday).

Attention! Regional legislation of a constituent entity of the Russian Federation or a municipal entity may cancel advances for land or transport taxes. Then companies have the right to pay tax only based on the results of the tax period - the year (clause 2 of Article 263 of the Tax Code of the Russian Federation, clause 2 of Article 397 of the Tax Code of the Russian Federation).

Advance payments for transport tax for legal entities

Organizations are required to make advance payments on technical tax three times a year (after the 1st, 2nd and 3rd quarters) throughout the year. The terms for payment of advances are established by regional legislation. Typically, periodic payments are due before the end of the month following the end of the quarter. Such deadlines are established, for example, in St. Petersburg, where advance payments must be made no later than:

- April 30;

- July 31;

- October 31.

However, not all regions have the same deadlines, and in some, advance payments are not made at all. The rules for payment of TN should be clarified in local legislation. View the procedure for making advances on car tax for legal entities. persons depending on the region, you can use the table of rates by region. You will find it at the beginning of the article.

Advance payments for TN for each quarter are calculated using the following formula:

- Advance = ¼ x (Tax base) x (Tax rate) x (Kp coefficient) x (Kp coefficient)

Simply put, the advance is equal to ¼ of the total transport tax for 1 car.

Let's look at an example of how to calculate advances on transport tax when selling a car by a legal entity, that is, in the case when the company did not own the car for a full year.

Let's say a Moscow company sold a car on September 13th. Car engine power (i.e. tax base) = 75 hp. How to calculate an advance for one quarter:

1We determine the tax rate for a passenger car with a power of 75 hp. for Moscow according to the table. Rate = 12 rub.

2The cost of our car does not exceed 3 million rubles, so we do not take into account the Kp coefficient;

3We count the full months of car ownership to determine the coefficient Kv. From January to August (September is not counted as a full month, since the car was deregistered before the 16th) 8 months have passed. Kv = 8/12.

To calculate full months, we take into account the date of re-registration of the car to the new owner in the traffic police, and not the date of sale.

3Substitute the values into the formula: ¼ x 75 x 12 x 8/12 = 150.

So, the company at the end of each quarter must pay 150 rubles for this car. advance

Introduced the need to submit applications for land and transport tax benefits

Declarations on transport and land were cancelled. Instead, companies were offered the option of submitting applications to receive benefits on these taxes (clause 3 of Article 361.1 of the Tax Code of the Russian Federation, clause 10 of Article 396 of the Tax Code of the Russian Federation). It turns out that in order to take advantage of the benefit, the taxpayer needs to submit a corresponding application to the Federal Tax Service. Its form is regulated by Order of the Federal Tax Service dated July 25, 2019 No. ММВ-7-21/ [email protected]

This application requires indicating the objects of taxation - specific plots of land and vehicles. In addition, it is necessary to indicate the benefits that are due, indicating the details of regulatory legal acts and information about documents that prove the right to benefits.

One application is drawn up for different objects (land and transport). In addition, the application may simultaneously indicate different checkpoints assigned at the location of the objects. The Federal Tax Service indicated this in Letter dated 02/03/2020 No. BS-4-21/ [email protected]

Taxpayers have the right to submit an application for benefits along with supporting documentation to any tax office. Documents can be submitted in person, through TKS, by mail or through the MFC. In addition, the law does not establish any time limits for submitting a package of documents. Thus, a taxpayer can apply for a deduction in any way convenient for him and at any time.

If the taxpayer does not submit an application, he is not deprived of the right to receive benefits. If the Federal Tax Service Inspectorate has information about the benefits that a taxpayer is entitled to, it calculates taxes on land and transport for 2022 taking into account these benefits.

However, if the taxpayer does not independently declare the receipt of the benefit, there is a possibility that the Federal Tax Service, even if the information is available, will not provide him with the benefit. The subject will then receive a notice of overpayment of tax. In this regard, tax authorities informed business entities in January 2022 that they would need to apply for tax breaks on transport and land during the 1st quarter of 2022.

Transport tax benefits for legal entities. persons

Tax benefits for transport tax for legal entities are enshrined in paragraph 2 of Art. 358 Tax Code of the Russian Federation. Thus, you do not need to pay auto tax for:

- fishing vessels;

- vessels that are intended for cargo and passenger transportation;

- agricultural transport;

- drilling ships and installations, offshore platforms, etc.

In addition to federal ones, there are also benefits established by regional legislation. For example, in Moscow, organizations providing passenger transportation services on public transport are completely exempt from paying car tax.

You can see what benefits exist for legal entities in your region, as well as on what basis they are provided, using the table of regional rates at the beginning of the article.

To obtain the right to a benefit, you must submit the appropriate application and documents confirming this right to the tax authority in advance.

We will establish smart data exchange for your 1C

- Let’s “make friends” of your programs with each other;

- We will set up integration with both 1C solutions and external systems;

- We will bring data from Accounting, ERP, CRM, ZUP, BI and other software to a single denominator;

- We work with Axapta, SAP, Navision, Oracle, Bitrix, etc.;

- We will correct errors and figure out how to prevent them from occurring;

- We will eliminate the possibility of duplicating documents;

- We will simplify the interaction between branches;

- We optimize the work of different departments and combine related business processes.

More details Order data exchange in 1C

Filing an excise tax return

Select the form of the excise tax declaration depending on the type of excisable goods:

- for excise taxes on ethyl alcohol, alcoholic and (or) excisable alcohol-containing products, as well as on grapes, fill out the form that is approved by Order of the Federal Tax Service of Russia dated August 27, 2020 No. ED-7-3/ [email protected] ;

- for excise taxes on tobacco (tobacco products), tobacco products, electronic nicotine delivery systems and liquids for electronic nicotine delivery systems, fill out the form that is approved by Order of the Federal Tax Service of Russia dated February 15, 2018 No. ММВ-7-3/ [email protected] ;

- for excise taxes on motor gasoline, diesel fuel, motor oils for diesel and (or) carburetor (injection) engines, straight-run gasoline, middle distillates, benzene, paraxylene, orthoxylene, aviation kerosene, natural gas, passenger cars and motorcycles, fill out the form that is approved By Order of the Federal Tax Service of Russia dated October 13, 2020 No. ED-7-3/ [email protected]

There are other forms of reporting on excise taxes.

There are different declaration forms for different types of excisable goods. There are general submission deadlines for them. General deadlines for submitting excise tax declarations: taxpayers submit excise tax declarations at the end of each tax period “month” (Article 192, paragraph 5 of Article 204 of the Tax Code of the Russian Federation). As a general rule, the deadline for submitting declarations is no later than the 25th day of the month following the previous one.

And for taxpayers who pay excise taxes on a deferred basis, special deadlines for submitting declarations have been established:

- for ethyl alcohol, alcoholic and (or) excisable alcohol-containing products, as well as for grapes;

- for refined oil and gas products, cars and motorcycles.

In addition, if you import excisable goods from the EAEU, then reflect import excise taxes and VAT in the declaration of indirect taxes when importing from the EAEU. Submit the declaration no later than the 20th day of the month following the month in which the imported goods were registered.

Ready-made solutions from SPS ConsultantPlus will tell you how to act in a specific situation: step-by-step instructions, sample documents, links to legal acts.

Introduced messages from the Federal Tax Service about tax amounts for transport and land

Starting from 2022, the Federal Tax Service will send messages to legal entities about the calculated tax amounts for transport and land (clause 4 of Article 363, clause 5 of Article 397 of the Tax Code of the Russian Federation). The form of these messages is regulated by Order of the Federal Tax Service dated July 5, 2019 No. ММВ-7-21/ [email protected]

In the message, tax authorities will indicate the object of taxation, the taxable base, the tax period, the tax rate and the amount of the calculated tax. To calculate the tax, information will be taken from the Unified State Register of Real Estate, as well as from government agencies registering rights to real estate or transport.

The Federal Tax Service will send a message through telecommunication channels or the taxpayer’s personal account. In addition, the option of sending by mail is possible if the taxpayer is not able to receive electronic documents from the tax office.

Sending messages from the Federal Tax Service does not cancel the obligation of taxpayers to independently calculate and pay tax and advances on it. Messages will be transmitted after the end of the tax period (year) and after the deadline for their payment. Thus, information about the tax will arrive after the taxpayer must fulfill his obligation to pay tax on transport or land.

In such a situation, a logical question arises: why are messages from the Federal Tax Service needed if the taxpayer calculates the tax himself and meets payment deadlines without prompting from the tax authorities?

The Ministry of Finance responded to this in Letter dated June 19, 2019 No. 03-05-05-02/44672. The purpose of such messages is to inform taxpayers about the amount of tax calculated by tax authorities. In the future, this information will be used to collect arrears if the entity did not pay taxes on time.

When a company receives a message from the Federal Tax Service, it has the right, if it does not agree with the amount, to file objections with the tax authorities. You need to attach your own tax calculation to them, as well as some supporting documents, for example, applying for benefits.

Objections must be submitted within no more than 10 days from the date of receipt of this tax message about the amount of tax (clause 6 of Article 363 of the Tax Code of the Russian Federation, clause 5 of Article 397 of the Tax Code of the Russian Federation). But this deadline is not final - even if the company submits explanations for the objection and additional documentation at a later date, tax authorities must analyze them and, if there are legal grounds, recalculate the amount of tax.

If the Federal Tax Service does not send a message to the company about calculated taxes within a year, the organization is obliged to independently notify the tax authorities about the availability of transport and land facilities. To do this, use the form regulated by the Order of the Federal Tax Service dated February 25, 2020 No. ED-7-21/ [email protected] Such notification must be submitted no later than December 31 of the current year.

You can purchase services that help you work as an accountant here.

Do you want to install, configure, modify or update 1C? Leave a request!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Filing a water tax return

Fill out the water tax declaration in the form approved by Order of the Federal Tax Service of Russia dated November 9, 2015 No. ММВ-7-3/ [email protected]

Pay the water tax for each quarter, no later than the 20th day of the month following this quarter (Article 333.11, paragraph 2 of Article 333.14 of the Tax Code of the Russian Federation).

See more information:

How to fill out and submit a water tax return in 2022.

Typical situations in SPS ConsultantPlus will allow an accountant to quickly resolve issues that he encounters on a daily basis.

Single simplified declaration

The EUD form and the procedure for filling it out were approved by Order of the Ministry of Finance of Russia dated July 10, 2007 No. 62n.

Organizations and individual entrepreneurs fill out only the first page of the form. The procedure for filling it out is common for all taxes, with the exception of filling out line 010. Payers of the simplified tax system will fill it out in a special order.

Organizations and individual entrepreneurs can submit a unified (simplified) tax return (hereinafter referred to as the EUD) if the following conditions are simultaneously met during the reporting (tax) period (clause 2 of Article 80 of the Tax Code of the Russian Federation):

- there are no objects of taxation for the taxes for which they are payers;

- there was no movement of money through bank and cash accounts.

That is, you had no income, expenses, wages and taxes, you did not issue or receive advances (Letter of the Ministry of Finance of Russia dated June 28, 2018 No. 03-11-11/44580).

There is an exception to this rule for personal income tax returns.

Filing an EUD is a right, not an obligation. That is, instead of the EUD, you can submit to the inspectorate zero tax returns for which you are the payer.

The EUD replaces two zero declarations - for income tax and VAT.

The EUD is submitted to the tax office quarterly: no later than the 20th day of the month following the expired quarter, half-year, 9 months, calendar year. If the 20th falls on a weekend or another non-working day, then the last day will be the next working day (clause 7, article 6.1, clause 2, article 80 of the Tax Code of the Russian Federation).

See more information:

How to fill out the single (simplified) declaration form

Unified (simplified) declaration on the simplified tax system