Average number of employees: general procedure and calculation formula

When calculating the average headcount, you should be guided by the procedure that Rosstat prescribes to use for filling out the statistical form P-4.

This procedure was not approved by Rosstat order No. 711 dated November 27, 2019. IMPORTANT! Starting from reporting for January 2022, data in form No. P-4 will be provided in accordance with the new order of Rosstat dated November 24, 2021 No. 832.

However, Order No. 711 is still in effect. You can get acquainted with the features it provides for calculating the SSC indicator in a special material posted in the ConsultantPlus system. Get a free trial.

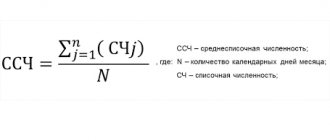

The general formula for calculating the average number of employees per year can be presented as follows (clauses 79.6, 79.7 of Rosstat instructions No. 711):

Average year = (Average 1 + Average 2 + … + Average 12) / 12,

Where:

Average number of years is the average headcount for the year;

Average number 1, 2, etc. - the average number for the corresponding months of the year (January, February, ..., December).

In turn, to calculate the average number of employees per month, you need to sum up the number of employees for each calendar day of the month, including holidays and weekends, and divide this amount by the number of calendar days of this month.

An example of calculating the average headcount for a month from ConsultantPlus: As of 08/01/2021, the organization has 24 full-time employees. On August 10, one of the workers went on maternity leave. The number of employees... You can view the full example in K+. Trial access is free.

For information about who submits information about the average number of employees and within what time frame, read the material “Submitting information about the average number of employees.”

Providing information on the average number of employees

A report on the average number of personnel is necessary to comply with legal requirements when filling out the following declaration forms:

- Calculation of accrued and paid insurance contributions for compulsory social insurance (Form 4-FSS);

- Calculation of accrued and paid insurance contributions for compulsory pension insurance (form RSV-1 PFR);

- Information on the average number of employees for the previous calendar year (KND form 1110018);

- Information on the number, wages and movement of workers (form P-4);

- Information on the main performance indicators of a small enterprise (Form N PM);

The average number of employees depends on:

- Possibility of obtaining tax benefits if an enterprise uses the work of disabled people (VAT, income tax, property tax and land tax);

- And the need to send declarations for the previous year to the tax service in the form of an electronic document if the number of employees of the enterprise is higher than one hundred people. (Article eighty of the Tax Code of the Russian Federation);

Information on the average number of employees must be prepared by the company regardless of whether the company has employees or whether the company is actively operating. If there are no personnel on the company’s staff, the number zero must be entered in the corresponding field of the reporting form. The average headcount is calculated both for a long-running enterprise, and for a newly created one (before the twentieth day of the month that follows the month the company was founded) and for a closing enterprise (information should be prepared not for the month, but for the specific date of liquidation of the company).

Average headcount of a newly created organization: an important feature

When calculating, newly created organizations sum up the average number of employees for all months worked in the corresponding year and divide the resulting amount by 12, and not by the number of months of work, as one might assume (clause 79.10 of Rosstat instructions No. 711).

For example, an organization was created in September. The average number of employees in September was 60 people, in October - 64 people, in November - 62 people, in December - 59 people. The average number of employees for the year will be 20 people:

(60 + 64 + 62 + 59) / 12.

The procedure for calculating the average headcount may be determined by the specifics of the tax regime. So, there are nuances when using PSN.

Online calculator for calculating the average number of employees

The average headcount should be calculated automatically in personnel accounting and payroll systems (for example, in 1C). You can also calculate the average number of employees in 2022 using our online calculator. To calculate for a month, you must enter data on the payroll number for each date of the month in the appropriate cells of the table. Weekends are highlighted in orange (Attention, weekends correspond to the 2015 calendar! To calculate the average headcount for 2016, you need to edit the formulas in the cells in accordance with the schedule of weekends and working days).

The number of employees: what is it and how to calculate it

The headcount is the number of personnel in an organization on a specific calendar day of the month. It includes all employees with whom employment contracts have been concluded, including temporary and seasonal ones. And not only those who actually worked that day, but also those who were absent from work, for example, on a business trip, on sick leave, on vacation (including at their own expense) and even skipped work (see the full list). in paragraph 77 of Rosstat instructions No. 711).

Categories of workers not taken into account in the payroll are given in paragraph 78 of Rosstat instructions No. 711. In particular, these are:

- external part-time workers;

- working under GPC agreements;

- owners who do not receive a salary from the organization, etc.

Employees on maternity leave or “children’s” leave are generally included in the payroll, but are not taken into account in the average payroll. But if they work part-time or at home while maintaining benefits, they are taken into account in the SSC (clause 79.1 of Rosstat instructions No. 711). From 2022, an employee fired on Friday does not need to be included in the payroll for Saturday and Sunday (clause 76 of Rosstat instructions No. 711).

Who is included in the calculation of the average headcount?

To calculate the average number of employees in 2022, it is necessary to take into account the following categories of workers:

- Owners of the company who work and receive salaries in it;

- Employees on the company's staff who have employment contracts with the company;

- Part-time workers, if they are not employees of this company;

- Students who undergo industrial practice at the enterprise during the holidays (if GPC agreements have been drawn up with them);

- Military personnel, as well as those serving sentences in penal colonies, if they are involved in the work of the company under relevant agreements with government agencies;

Both the company’s employees who showed up for work and those employees who are absent from work due to any circumstances (for example, sent on a business trip, sick, on vacation, etc.) should take part in the calculation of the average headcount.

The following categories of workers are not included in the calculation of the average number of employees:

- Women during periods of maternity leave;

- Company employees who have taken parental leave;

- Employees of the enterprise who took additional study leave without pay;

- Employees of the company who are passing entrance exams to universities and have taken additional leave without pay;

- Performing work under copyright contracts;

- Individual entrepreneur, if the entrepreneur works under a GPC agreement;

- Full-time employees of the company who are at the same time external part-time workers, or who work in parallel under a GPC agreement with their organization (they are counted only once, as a full-time unit);

- Employees who wrote a letter of resignation and did not return to work after that;

- Employees who were transferred to work in another organization or sent to work abroad;

- Employees sent for off-the-job training;

- Persons with whom a student agreement has been concluded who receive a scholarship during their studies;

- Lawyers, military personnel and members of cooperatives (without an employment contract);

Employees with less than normal working hours (normal - forty hours per week) are taken into account in the average headcount in a special way. Their number should be taken into account in direct proportion to the time worked. For example, an employee who was assigned a 20-hour work week (“part-time”) should be counted in the payroll as 0.5 staff units.

It is important that this category does not include employees with reduced working hours. The Labor Code of the Russian Federation establishes reduced working hours for disabled people, workers under the age of eighteen, and also, in some cases, workers combining work with training.

In cases where personnel are transferred to part-time work at the initiative of the company (for example, production volume has decreased and everyone works 4 days a week for 8 hours instead of the usual 5), employees must be counted in the average headcount according to standard rules - as entire staff units.

How to count part-time workers

It all depends on the basis on which part-time employment is applied.

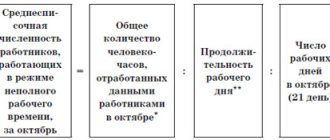

If part-time work is an initiative of the employer or a legal requirement, such workers are considered a full-time employee. And if part-time work is established by an employment contract, staffing schedule or with the written consent of the employee, then in proportion to the time worked in the following order (clause 79.3 of Rosstat instructions No. 711):

- Calculate the total number of man-days worked. To do this, divide the man-hours worked by the length of the working day, based on the length of the working week:

- with a 40-hour work week - by 8 hours (with a 5-day work week) or by 6.67 hours (with a 6-day work week);

- at 36-hour - by 7.2 hours (with a 5-day work week) or by 6 hours (with a 6-day work week);

- at 24-hour - by 4.8 hours (with a 5-day work week) or by 4 hours (with a 6-day work week).

An example of calculating the “man-days” indicator to determine the average number of part-time workers from ConsultantPlus: At LLC Alfa, two employees - Sidorov A.D. and Samokhin N.I. - work part-time. One - 6 hours a day, the other - 5 hours a day. Both employees have part-time working hours by agreement of the parties. In July 2022, Sidorov A.D. worked 23 days, Samokhin N.I. 22 days. The organization operates on a five-day workweek schedule, so the working day is 8 hours (40/5). You can view the entire example in K+ by getting free trial access.

- The average number of part-time workers for the reporting month is determined in terms of full employment. To do this, divide the person-days worked by the number of working days according to the calendar in the reporting month. At the same time, for days of illness, vacation, absences, the hours of the previous working day are conditionally included in the number of man-hours worked.

Let's explain with an example (for a regular 40-hour 5-day work week).

The organization had 7 employees working part-time in October:

- four worked 23 days for 4 hours, we count them as 0.5 people (4.0 / 8 hours);

- three - 3.2 hours a day for 23, 15 and 10 working days, respectively - that's 0.4 people. (3.2 / 8 hours).

Then the average number will be 2.8 people:

(0.5 × 23 × 4 + 0.4 × 23 + 0.4 × 15 + 0.4 × 10) / 22 working days in October.

For information on how long working hours can be, read the material “Normal working hours cannot exceed?” .

Results

The calculation of the average number of employees is carried out by all employers and submitted annually to the Federal Tax Service.

In 2020-2021, when calculating the average number of employees, you must be guided by the rules approved by Rosstat Order No. 711. From 2022 - by the rules according to the new order No. 832 dated November 24, 2021. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Providing information on the average number of employees

Individual entrepreneurs provide data on the average number of employees at the place of registration. LLCs submit information at the location of their office. There are three ways to provide information - in person to the Federal Tax Service, by mail or electronically via telecommunication channels.

The deadline for submitting a certificate of average number of employees is until the twentieth of January. For newly established enterprises - until the twentieth day of the month following the date of establishment of the company.

The fine for failure to submit a certificate of average number of employees is 200 rubles.