Separate special accounts for state defense orders. Using a government contract identifier when using tagged money. Features of banking support

Who needs statistics and why The task of statistics is to track the process of replenishing budgets at different levels.

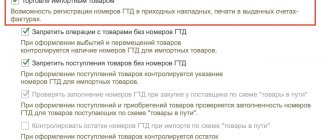

Features of accounting for import transactions Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service.

To fulfill its obligations under labor, tax and accounting legislation, the employer must use

How is the amount of the quarterly advance payment calculated? The amount of the quarterly advance payment is calculated based on the actual

Why do you need a waybill? A waybill performs several functions at once, therefore it is one of

From January 1, 2022, you will pay VAT at a rate of 20 percent (Federal

General rules for filling out 6-NDFL in 2021 General rules for filling out the new 6-NDFL form in

Kontur.Accounting - 14 days free! Personnel records and employee reports, salaries, benefits, travel allowances

Maternity leave: main points Is income tax calculated on maternity leave? This question concerns both