Is optimization always necessary?

VAT exemption affects whether it is convenient to work with you.

If you, as the seller, do not charge VAT, then the buyer will not be able to recover the tax. Therefore, if you work mainly with large companies, then without VAT you are less competitive. Losing one or two key customers can be much worse than paying a large VAT. On the other hand, if you pay VAT, then it is beneficial for you to work with suppliers who pay this tax. It is worth working with non-payers if they give a discount comparable to the VAT rate.

One more point: in business there can be both VAT-taxable and non-VAT-taxable areas. Then, to apply tax benefits, you will have to keep separate records. But if the preferential direction is insignificant compared to the entire volume of business, separate accounting may cost more than saving on VAT.

Therefore, when applying optimization schemes, take into account the risks, benefits and reactions of counterparties.

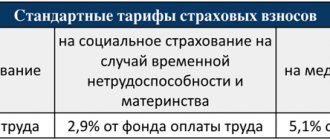

Insurance premium schemes

Scheme No. 1.

Replacing part of your salary with payments that are not subject to taxes is considered the safest way of tax optimization. Instead of raising wages, the employer can compensate employees for the costs of training, fitness, treatment, pay interest on the loan, give gifts, etc. Employees may also be paid compensation for delayed wages. But to do this, there must be no money in the company’s accounts to pay it.

Scheme No. 2.

Concluding a student contract instead of an employment contract is beneficial only if the first document is real. This scheme works. But if an employee accepted as an apprentice sends a complaint to the Federal Tax Service, the Social Insurance Fund, or the labor inspectorate, then the costs of such a scheme will cover all the benefits.

Scheme No. 3.

A contract instead of an employment agreement relieves the company of the obligation to pay taxes and contributions for injuries. For example, a company fires a manager and hires him as an individual entrepreneur. He pays all taxes and fees for himself. The company does the same with other employees. The inspectors can question any of them. If it turns out that the individual entrepreneur or other entrepreneurs were previously employees of the company, the scheme will collapse.

Scheme No. 4.

Accountable amounts are not returned by employees. In this case, the courts recognize the amounts received as employee income, from which taxes and contributions will need to be paid. The scheme will be quickly revealed when checked.

Scheme No. 5.

Paying salaries in envelopes and cashing them out will attract the attention of not only tax authorities, but also law enforcement agencies. If it is revealed that the employer is engaged in cashing or paying “gray” wages, this will result in criminal liability. You won't be able to prove that you're right.

To find out in more detail about the possibilities of using each of the schemes for your company, taking into account the specifics of your business, you can contact the specialists of Samitov Consulting for advice. They will tell you in detail about the features of each tax optimization method and help you implement the one that will be the safest in your situation.

Working in special mode

The last resort is not to pay VAT at all. This is possible if you apply a special tax regime: simplified tax system, PSN, unified agricultural tax or UTII (cancelled from 2022). Special regimes also exempt from taxes on property and profits. Instead of several taxes, you pay one and usually at a lower rate. Compare your tax burden across different taxation systems using our free calculator.

Each special regime has its own set of conditions that the business must meet: revenue, cost of fixed assets, participation of other companies in the authorized capital, number of employees.

Some special modes can be combined with OSNO: PSN, UST, UTII. They can also be combined with each other: simplified tax system + UTII, simplified tax system + PSN, simplified tax system + ESKHN. You will have to maintain separate accounting and reporting for each mode.

Sometimes a business is divided into several legal entities or individual entrepreneurs, so that each part operates under its own tax regime. But this method of optimization is dangerous: tax authorities may consider this a fragmentation of the business, recognize the entire direction as a single company operating on OSNO and charge additional taxes (and also impose fines and penalties). And if the arrears exceed 5 million rubles, the tax office may initiate a criminal case under Art. 199 of the Criminal Code of the Russian Federation.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Income tax schemes

Scheme No. 1.

The formation of reserves is considered the safest way of tax optimization. When creating and spending a reserve, it is enough to follow the requirements established in Chapter 25 of the Tax Code of the Russian Federation.

Scheme No. 2.

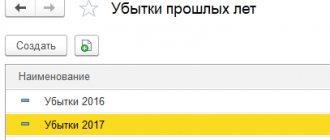

The addition of other people's losses may arouse interest from the Federal Tax Service. But if the new owner can explain the business purpose, then the scheme will work. For example, one can justify such an accession by increasing the customer base and reducing costs per unit of production.

Scheme No. 3.

The use of low-tax intermediaries is suspicious if the intermediary is a company that does not carry out activities. This may be evidenced by the lack of reporting or its improper execution, lack of labor, material and other resources.

Scheme No. 4.

Reverse transactions will be safe only with leaseback. In all other cases, there are tax risks, which especially applies to affiliated and interdependent companies.

Scheme No. 5.

Fragmenting a business to preserve the right to the simplified tax system is considered a profitable, but dangerous method of optimizing the tax burden. Before you start using it, you should study the letter of the Federal Tax Service No. SA-4-7 / [email protected] dated 08/11/2017. Judicial practice in this case is ambiguous.

VAT exemption

Businesses can be exempt from paying VAT on certain transactions or types of activities (Article 145 of the Tax Code of the Russian Federation). This is a privilege; it is given for up to a year to companies without import operations. Also, you cannot trade excisable goods. To obtain this right, you must submit an application.

It is important that during this period the enterprise’s revenue excluding VAT for three consecutive calendar months does not exceed 2 million rubles. Otherwise, the right to the privilege is lost.

And for certain types of goods and services there is an exemption from VAT (Article 149 of the Tax Code of the Russian Federation). These are, for example, medicine, child and disabled care, arts services, financial services, and research.

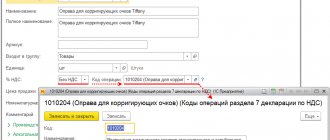

Main errors in the VAT return

What errors in the VAT return can be corrected by filing an amended return with a tax reduction? There aren't many of them. They are mainly associated with technical errors or carelessness of performers. We do not consider the method of reducing tax in the declaration as one of the forms of tax optimization in this article.

Let's start with such an error as the unreasonable issuance of an invoice in the absence of actual sales - such an error overestimates the amount of tax payable:

The situation with an extra invoice is the exact opposite of the situation with a forgotten invoice. When a real invoice for some reason was not reflected in the purchase book, the amount of the deduction was underestimated, and an increased tax will have to be paid to the budget on such a declaration:

Understating deductions in the tax return leads to an unfavorable situation for the taxpayer - he overpays the tax, which diverts funds from circulation (which usually has a deficit). Considering that the taxpayer may not use VAT deductions (this is not an obligation, but his right), he has the right to make an appropriate decision - to declare forgotten deductions or not. If you decide to declare a deduction, there is a need to reduce the VAT in the declaration by submitting an amendment with deductions increased by the forgotten amounts.

We talk about other features that need to be taken into account when claiming VAT deductions here .

Often the cause of errors in invoices, purchase and sales books and, as a result, in the VAT declaration is the banal inattention of the performers. Then, from an invoice that fully complies with the norms of the Tax Code of the Russian Federation, inaccurate (distorted) data ends up in the purchase book or sales book. The consequences of such inattention depend on how quickly technical errors are identified by the taxpayer himself:

- If, before drawing up the declaration for the reporting quarter, all invoices are re-checked with the books of purchases and sales, the error will be corrected in time and the correct information will be included in the declaration.

- Otherwise, you cannot do without an updated declaration.

If you do not submit an updated return with correct information about sales, your counterparties will have problems receiving VAT deductions.

Advance payments

Work with advances usually begins at the end of the quarter. The optimization scheme works if the company receives an advance for goods or services in one quarter and sells them in the next. It consists of the following: the organization receives an advance from the buyer and transfers funds to its supplier for another product, which receives an advance and transfers funds to its supplier, and so on. The tax is paid by the participant in the chain who did not manage to make an advance payment to their supplier.

Keep in mind that the tax office is well aware of this scheme and does not welcome it. If you regularly use advances to defer VAT payment, you may receive an unscheduled tax audit.

You must also pay VAT on advances received. And the seller can enter into a supply agreement at the end of the quarter, and, by agreement with the buyer, transfer the advance payment to the beginning of the next quarter. Then the seller will pay tax three months later.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

You can defer VAT payment by more than a quarter using borrowed funds. Then the seller takes a loan from the buyer in the amount of the advance. And after shipment, they offset the debts on the loan and for the goods sold. The issuance of a loan is not subject to VAT, so tax is charged only upon sale. Although this scheme does not violate the law, the tax authorities are displeased with it, so it is not suitable for regular use.

It is important to consider the interests of the buyer when working with advances. When the buyer makes an advance payment, but uses it to deduct VAT on this amount. So it is not profitable for him to postpone the payment deadline or work with the loan.

How to defer payment of VAT at customs

For various reasons, the importer may not have his own funds to pay customs. But without paying customs duties, the company will not receive the imported goods. In addition, if a company misses the deadline for paying VAT, customs officers will charge penalties.

Customs legislation allows firms to defer payment. As collateral, you can use guarantees from banks and insurance organizations included in the register of the Federal Customs Service of Russia (Order of the Federal Customs Service of Russia dated June 2, 2011 No. 1165).

This opportunity is currently used by the majority of participants in foreign economic activity.

A bank guarantee ensures that Russian importers fulfill their obligations to pay VAT at customs, and also allows them not to divert significant working capital to pay this tax upon import.

In accordance with the requirements of customs legislation, the list of banks and insurance organizations is subject to mandatory publication (Article 142 of the Federal Law of November 27, 2010 No. 311FZ).

Please note that if the amount of VAT payable at customs is less than 500 euros at the Bank of Russia exchange rate established on the day of filing the customs declaration, no security is required (clause 2 of Article 85 of the Customs Code).

Include shipping costs in the product price

If you sell goods at a VAT rate of 10%, it is beneficial for you to include the costs of transporting goods to the buyer in the price of the goods and not allocate the delivery amount. In this case, you will pay 10% of the entire amount of the goods, and for the services of transport companies you will deduct 20%. To do this, write down in your accounting policy a provision that the cost of the goods includes delivery costs, and in the contract with the buyer indicate that the cost of the goods includes delivery.

Work with VAT in the Kontur.Accounting web service. The system makes it easy to keep records, pay salaries, and report online. The service will help you optimize VAT and tell you how to reduce your payment. The first two weeks of operation are free for all new users.

Deduction without sale

Often newly created, as well as small companies, do not have revenue in certain tax periods. Nevertheless, at this time they purchase goods, materials, and use the services of other companies (for example, they pay rent for premises). Can a company, working without sales, deduct input VAT?

You will find the full answer to this question in Berator, type in the search bar: “VAT deduction if there is no sale”

.

Install Berator for Windows for free

According to specialists from the tax and financial departments, the deduction can be applied. This follows from letters of the Ministry of Finance of Russia dated November 19, 2012 No. 03-07-15/148, Federal Tax Service of Russia dated December 7, 2012 No. ED-4-3 / [email protected] and dated February 28, 2012 No. ED-3-3 / [email protected] According to these letters, the absence of a VAT tax base in the corresponding quarter should not be a reason for refusing to accept VAT for deduction.

This position is consistent with the conclusions made in the Resolution of the Presidium of the Supreme Arbitration Court of Russia dated May 3, 2006 No. 14996/05. This document states that the norms of Chapter 21 of the Tax Code do not establish the dependence of VAT deductions on purchased goods (works, services) on the actual calculation of tax for specific transactions for which these goods (works, services) were purchased. Moreover, the sale of goods (work, services) for specific transactions in the same tax period is not a condition for the application of tax deductions.