How is the amount of the quarterly advance payment calculated?

The amount of the quarterly advance payment is calculated based on actual profit. The following algorithm is used:

- determine the amount of tax accrued for the reporting period;

- summarize advance payments for the reporting period;

- The amount of advance payments paid is subtracted from the amount of accrued tax.

Let us remind you: the reporting periods for income tax are 1st quarter, half a year, 9 months. That is, tax calculations are carried out on an accrual basis from the beginning of the year.

If the cumulative total profit for a given reporting period is less than for the previous one, the advance payment does not need to be transferred.

If an additional payment was received at the end of the reporting period, the advance payment for the previous quarter must be made no later than the 28th day of the month following this quarter.

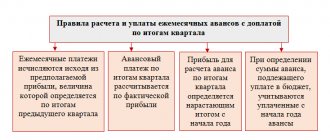

Monthly advance payments

There are two ways to pay monthly advance payments:

- 1. based on the tax amount for the last quarter;

2. based on actual profit for the month.

Firms that pay advances in the first way - based on the amount of tax for the last quarter, must transfer advance payments no later than the 28th day of each current month, that is, in advance. For example, an advance payment for January must be paid by January 28th.

The amount of the monthly advance payment is equal to:

- the amount of the monthly advance payment for the fourth quarter of the previous year – in the first quarter of the current year;

- 1/3 of the advance payment amount for the first quarter of the current year – in the second quarter of the current year;

- 1/3 of the difference between the amount of the advance payment for the first half of the year and for the first quarter of the current year - in the third quarter of the current year;

- 1/3 of the difference between the amount of the advance payment for nine months and for six months - in the fourth quarter of the current year.

At the end of the quarter, the company compares the amount of tax calculated from actual profits with the amount of monthly advance payments.

If the tax is more than the amount of advances, then at the end of the quarter it will have to be paid. This must be done before the 28th day of the month following the reporting quarter.

If the tax turns out to be less than the amount of advances, then an overpayment will occur. The company can offset it against upcoming tax payments or return it to its current account.

According to the second method, the company immediately calculates the amount of advance payments based on the actual profit received for each month. And the advance payment for the past month must be paid by the 28th of the next month.

Features of filling line 300

Despite the fact that the declaration is compiled quarterly, the data in it is formed from the beginning of the year on an increasing basis. The resulting calculated values of tax and advance amounts are rounded to full rubles in accordance with the rules of mathematics.

If a profit is not received at the end of the quarter, or a loss is made, then the advance amount indicator will be less than zero, the tax is not paid and its amount does not appear in the declaration - the legislator prohibits indicating negative tax indicators for payment.

The data on page 300 is linked to line 190 of Sheet 02, the values of which are involved in calculating advance amounts:

| Period | Value page 300 L 02 corresponds |

| line 300 of the income tax return for the 1st quarter of the reporting year (OG) | page 190 L 02 per 1 sq. OG |

| line 300 of the income tax return for the half year OG | page 190 L 02 for the half-year OG - page 190 L 02 for 1 quarter. OG |

| line 300 of the income tax return for 9 months OG | page 190 L 02 for 9 months. OG - page 190 L 02 for the half-year OG |

| line 300 of the declaration for the reporting year | not filled in |

So, on page 300 the amounts of monthly advances for non-taxable income appear, which serve as a guideline for tax payments in the next quarter. On page 300 of the declaration for the 1st quarter, the amount of the advance due for payment in the 2nd quarter is recorded. Advances calculated in the 1st quarter are also reflected in line 190 of Sheet 02.

In the DNNP for the half year, on page 300, advances payable in the 3rd quarter appear. The indicator is calculated as the difference between the values of page 190 declarations for the half year and the 1st quarter.

In DNNP for 9 months. on page 300 indicate advances to be transferred in the 4th quarter, and the amount in the line is formed as the difference between the value of page 190 of Taxpayer Tax for 9 months. and half a year.

Note that the figure on page 300 is the summed value of advances for each month of the quarter, which represents a monthly payment tripled.

But in the declaration generated at the end of the tax period (year), page 300 is not filled out, as are pages 290 and 310. The amount of the taxable income is not indicated in them, since the report is prepared on the basis of the results for the year, and a final tax liability is formed. , adjusted to the amount of advance payments made throughout the entire period. After all calculations are completed, the remaining amount of tax payable is transferred at a time in one payment, and pages 290-310 of Taxpayer Tax for the year remain empty.

How are advance payments reflected in the income statement?

With the first two methods described above, calculating the amount of advances is the final result of the calculation given in the declaration. It does not require any additional charges or reflections in the tax report.

For those using the third method, in the income tax return (including for the 3rd quarter in the half-year report), special lines are provided in sheet 2 to indicate the total amount of advances additionally accrued for payment in the quarter following the reporting period.

A peculiarity of filling out a declaration when calculating income tax for the 3rd quarter (9 months) is the need to additionally indicate in it (both in sheet 2 and in subsection 1.2 of section 1) the amount of advances that will need to be paid in the 1st quarter of the year following the current one .

We will give a step-by-step calculation of advance payments due at the end of 9 months (3 quarters) and advance payments that will need to be paid during the 4th quarter of the current year and the 1st quarter of the next year.

- We calculate and reflect in the declaration the amount of tax (advance payment) for 9 months:

- In the declaration in sheet 02 on lines 210, 220, 230 we show the calculated tax (advance payments) based on the results of the six months.

- We calculate advance payments subject to additional payment/reduction in the 4th quarter based on the results of 9 months. They are calculated as the difference between the accrued tax amount on a cumulative basis for 9 months and calculated in advance payments for six months (clause 2 of Article 286 of the Tax Code of the Russian Federation).

The amounts of tax to be paid additionally are calculated and reflected in the context of budgets on lines 270, 271 of the declaration as follows:

Tax amounts to be reduced are calculated and reflected in the context of budgets on lines 270, 271 of the declaration as follows:

- If the organization pays quarterly and monthly advance payments within a quarter, then we calculate and show in lines 290–310 of the declaration the advance payments that must be paid in the 4th quarter as follows:

- If an organization pays quarterly monthly and advance payments within the quarter, then in the declaration on lines 320–340 for 9 months it shows advance payments that must be paid in the 1st quarter of the next year.

In subsection 1.2 of the declaration, the amount of advance payments to be paid is indicated monthly. If the amount of the quarterly payment cannot be divided by 3 without a remainder, then the remainder is added to the payment for the last month of the quarter.

If the organization pays only monthly advance payments, then lines 320–340 in the declaration for 9 months are not filled in.

How to calculate advance payments if a loss was incurred or there was a reorganization, read here.

A special appendix (No. 5) to sheet 02 in the declaration will have to be filled out by organizations that have separate divisions.

To learn how the amount of tax accrued for the period is distributed among separate divisions, read the material “An example of calculating advance payments for income tax through a responsible division .

IMPORTANT! Actually paid advance payments are not reflected in the income tax return. In the declaration, when calculating advance payments, only the accrued amounts of advances for income tax are indicated!

How to fill out an income tax return for 9 months?

If you pay monthly and quarterly advance payments,

fill out the declaration for 9 months in the following order:

- Appendix No. 1 to sheet 02;

- Appendix No. 2 to sheet 02;

- sheet 02;

- subsection 1.1 section. 1;

- subsection 1.2 section. 1;

- title page.

The remaining subsections, sheets and appendices need to be included in the declaration only if there is information that should be reflected in them.

If you only pay quarterly payments,

You fill out a declaration for 9 months according to the general rules, taking into account some features. In particular, subsection 1.2 section. 1 does not need to be included in the declaration, and in sheet 02 lines 290 - 340 you do not fill out.

If you pay monthly advance payments based on actual profits,

fill out the declaration for 9 months in the following order:

- Appendix No. 1 to sheet 02;

- Appendix No. 2 to sheet 02;

- sheet 02;

- subsection 1.1 section. 1;

- title page.

The remaining subsections, sheets and appendices need to be included in the declaration only if there is information that should be reflected in them.

Regardless of the order of payment of advance payments

The declaration for 9 months does not need to include Appendix No. 4 to sheet 02, as well as sheets 07, 08, 09.

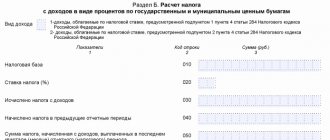

What information does line 300 of the income tax return contain?

Line 300, together with the value of line 310, forms page 290, which records the amount of monthly advance payments payable in the quarter following the reporting one. This distinction is due to the fact that income tax is transferred to two budgets - federal (3% of the profit) and local (17%). It is information about the amount of advance tax intended for payment to the federal budget (FB) that should appear in line 300.

This line, like the entire block of lines 290 - 310, is required to be filled out only by those companies that pay tax in monthly advance payments with additional payment of the missing amounts of NPT based on the results of the completed reporting quarter. This method is enshrined in Art. 286 Tax Code of the Russian Federation. It is as follows:

- at the end of the quarter or year, advance monthly payments and directly NNP are calculated;

- Advances are calculated throughout the year as follows:

| Indicator – monthly advance for the period | How is the monthly advance calculated? |

| 1st quarter of the reporting year (OG) | Equal to the monthly advance due in Q4. previous year |

| 2nd quarter OG | 1/3 of the advance amount for 1 sq. OG |

| 3rd quarter OG | 1/3 x (advance for half a year OG – advance for 1 quarter OG) |

| 4th quarter OG | 1/3 x (advance for 9 months of the fiscal year - advance for six months of the fiscal year) |

What is the procedure for filling out advance payments in the income tax return?

In order to fill out lines 290-310 of sheet 02 in the Income Tax Declaration, the following should be noted:

Lines 290-310 indicate the amount of monthly advance payments payable in the quarter following the reporting period for which the declaration is submitted (clause 5.11 of the Procedure).

When filling out the Declaration for the 1st quarter on line 290 in accordance with clause 5.11 of the Procedure, the amount of monthly advance payments payable in the 2nd quarter must be indicated, namely: line 290 of the Declaration for the 1st quarter = line 180 of the Declaration for the 1st quarter.

On line 290, in accordance with clause 5.11 of the Procedure, the amount of payments is determined as the difference between the amount of calculated income tax for the reporting period, reflected on line 180, and the amount of calculated income tax, indicated on the same line of Sheet 02 of the Declaration for the previous reporting period. If such difference is negative or equal to zero, then no monthly advance payments are made.

Let us immediately note that this norm is fully applicable when calculating the specified line for six months and 9 months, that is:

- the amount of monthly advance payments for the third quarter will be:

- line 180 of the declaration for the half-year - line 180 of the declaration for the first quarter;

- the amount of monthly advance payments for the fourth quarter will be:

- line 180 of the declaration for 9 months - line 180 of the declaration for six months.

In the Declaration for the tax period (year), lines 290-310 are not filled in.

In accordance with paragraph 1 of Art. 287 of the Tax Code of the Russian Federation based on the results of the reporting (tax) period, the amounts of monthly advance payments paid during the reporting (tax) period are counted when paying advance payments based on the results of the reporting period. Advance payments based on the results of the reporting period are counted against the payment of tax based on the results of the next reporting (tax) period.

In the tax return, the amount of income tax payable to the federal budget and the budget of a constituent entity of the Russian Federation is reflected on lines 270 and 271, respectively, provided that the amount of tax calculated for the reporting period is greater than the amount of accrued monthly payments for the same period (the difference between the lines 190 and 220 and lines 200 and 230, respectively).

If the amount of tax calculated for the reporting period is less than the amount of accrued monthly payments for the same period (the difference between lines 190 and 220 and lines 200 and 230, respectively), lines 280 and 281 indicate the amount of income tax to be reduced in the federal budget and the budget of a constituent entity of the Russian Federation, respectively (clause 5.10 of the Procedure).

Deadlines for paying income tax at the end of the year

At the end of the year, the company calculates the amount of tax it must pay based on the actual profit received. It is defined as the difference between the accrued tax amount and the amount of advance payments for the year.

This difference between the final tax and the amount of advances paid must be transferred to the budget by March 28 inclusive. The tax return for the year is submitted at the same time.

If the amount of advances turns out to be more than the tax at the end of the year, the company can offset the overpayment against future payments or return it. To do this, you need to submit a corresponding application to the tax office. And don't make a mistake with the timing.

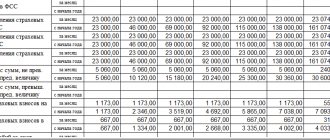

Filling out sheet 02 of the income tax return

Before proceeding with the registration of L02, it is necessary to fill out all the necessary applications, the information from which is transferred to it. Begin filling out the sheet by indicating the payer’s characteristics. As already noted, the number of statuses has increased to 14, and the company will have to select the appropriate one (they are indicated in the sheet).

Next, they proceed directly to calculating the tax base and amount, generating the data line by line.

| № lines L02 | What does it reflect? | How is it formed |

| 010 | income from core activities | = page 040 P1 to L02 |

| 020 | non-operating income | = page 100 P1 to L02 |

| 030 | production costs | = page 130 P2 to L02. |

| 040 | non-operating expenses | = page 200 P2 to L02 + page 300 P2 to L02 |

| 050 | losses | = page 360 P3 to L02 |

| 060 | calculation of the result - profit/loss | = page 010 + page 020 - page 030 - page 040 + page 050 |

| 070 | income not included in profit, for example, on some debt obligations | = page 010 L04, page 050 L05, etc. |

| 080 | only for the Central Bank of the Russian Federation | |

| 100 | the tax base | = page 060 – page 070 – page 080 + page 200 P1 to L02 – page 400 P2 to L02 + page 100 L05 + page 530 L06 + page 050 L08 (or - page 050 L08, if the indicator with a “-“ sign) |

| 110 | losses from previous years | In declarations: - for 1 sq. or year in line 110 transfer the loss or part of it from line 150 P4 to L02 - for other periods - from lines 160, 161 P4 to L02 |

| 120 | base for calculating tax. If there is a loss on line 100, 0 is entered on line 120 | = page 100 – page 110 |

| 130-170 | tax rates | |

| 171 | details of the regional law that established the reduced rate | |

| 180 | total tax amount | = page 120 x page 140 /100 |

| 190 | amount of tax payable to the federal budget (FB) | = page 120 x page 150 /100 |

| 200 | tax payable to the local budget (MB) To check page 180 = page 190 + page 200 Enterprises with separate branches calculate tax to the local budget in P5 to L02 | = page 120 x page 160/100 |

| 210-230 | amounts of accrued advances | |

| 240-260 | tax paid outside the Russian Federation and counted towards payment | |

| 265-267 | amount of trade fee paid | |

| 268-269 | tax reduction on the amount of realized investment deduction | |

| 270 | tax to be paid additionally in FB | = page 190 – (page 220 + page 250 + page 268) |

| 271 | additional tax in MB | = page 200 – (page 230 + page 260 + page 269) |

| 280 | tax to be reduced in FB | = (page 220 + page 250 + page 268) – page 190 |

| 281 | tax to reduce the gross bank | = (page 230 + page 260 + page 269) – page 200 |

| 290-310 | amount of monthly advances due in the next quarter, broken down by budget They are not filled out in the annual declaration by enterprises that pay only quarterly advances for reporting periods. | Page 290 = difference between line 180 for the reporting and previous periods. |

| 320-340 | amounts of advances payable in the 1st quarter. next year. Fill in the declaration for 9 months. | |

| 350-351 | filled out by participants of investment projects carried out in the regions |

Read our articles on how to correctly fill out line 300, line 210, line 290, line 030, line 180 of the income tax return.