Deadlines for payment of vacation pay: what does “three days before” mean?

Article 136 of the Labor Code of the Russian Federation regulates the timing of payment of vacation pay - no later than three days before the start of the vacation.

This norm raises several questions among accountants. And the first of them is in what days are we counting, calendar or working days? The answer can be found in the letter of Rostrud dated July 30, 2014 No. 1693-6-1 and information from the Ministry of Labor of Russia dated June 16, 2014. The departments clarify that the period for issuing vacation pay is calculated not in working days, but in calendar days. However, if the payment day falls on a weekend or holiday, payment should be made on the eve of this day. Calculate your salary and vacation pay for free using the web service

And the second important question is whether the day of payment of vacation pay is included in the three days established by the Labor Code of the Russian Federation? Rostrud, in the same letter dated July 30, 2014 No. 1693-6-1, allows this option. This position was supported in their decisions by the Kemerovo Regional Court, the Leningrad Regional Court, etc.

However, according to the latest clarifications from the Ministry of Labor, when an employee goes on vacation on Monday, vacation pay must be paid no later than Thursday of the previous week (letter of the Ministry of Labor dated 09/05/18 No. 14-1/ОOG-7157). This opinion has been encountered in judicial practice before (see the ruling of the Chelyabinsk Regional Court dated September 17, 2015 No. 11-11043/2015 and the ruling of the Rostov Regional Court dated September 16, 2013 No. 33-11864). In this regard, we recommend not to take risks, but to ensure that there are at least three full days (72 hours) between the start of the vacation and the transfer of funds. Labor legislation does not prohibit transferring vacation pay in advance.

Example

The holiday starts on Monday 31 May 2022.

This means that vacation pay must be paid no later than Thursday, May 27. Vacation starts on Thursday, June 17, the deadline for paying vacation pay is Sunday, which is a day off. This means that vacation pay must be paid no later than Friday, June 11.

Calendar or work?

Indeed, the wording used in Art. 136 of the Labor Code of the Russian Federation, does not contain clarifications, transfer vacation pay for three calendar or working days. However, as a general rule, if the deadlines for fulfilling obligations are not established in working days, they should be calculated in calendar days (Article 14 of the Labor Code of the Russian Federation).

Moreover, if the end of the period falls on a weekend or non-working holiday, then vacation pay is transferred on the previous working day (Part 8 of Article 136 of the Labor Code of the Russian Federation, Letter of Rostrud dated July 30, 2014 No. 1693-6-1). Thus, it is correct when vacation pay is transferred three calendar days before the start of the vacation.

But there is still a catch: is it necessary to count the day of payment of vacation pay into the three-day period? Rostrud, unfortunately, does not explain this point, but there is arbitration practice on this issue.

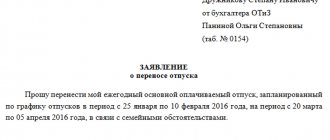

How to pay vacation pay if the vacation is from the next day

Sometimes situations arise when an employee asks for leave from the next day for family reasons. Despite the fact that this is the employee’s initiative, paying vacation pay within such a period is a violation of labor laws. It entails administrative punishment (clause 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation): for officials - a warning or a fine in the amount of 10,000 to 20,000 rubles, for legal entities - a fine of 30,000 to 50,000 rubles.

If the employer does not object to unscheduled leave and is ready to pay vacation pay on the day of application, you should invite the employee to take, for example, unpaid leave for the next three days, and only then paid leave.

Example

The employee contacted the employer on Monday, June 21, 2022, with a request to provide him with another paid leave for family reasons starting Tuesday, June 22.

He will have no claims against the employer if he pays him vacation pay on the 21st or later, and is ready to indicate this in the vacation application. The employer is ready to accommodate the employee, but in order not to violate the deadlines for paying vacation pay, he offered to take vacation only from June 25 (Friday). Payments were made on the day of application.

At the same time, the days from June 22 to June 24 inclusive were registered as leave without pay.

Calculation of vacation pay from the 1st day of the month: what is the difficulty?

Vacation is paid according to average earnings.

It is counted for 12 calendar months preceding the month in which the employee goes on vacation. It would seem that there is nothing difficult in calculating vacation pay in this situation. But we remember that the vacationer needs to pay money no later than three days before the start of the vacation (the days are still calendar days). This means that at the time of calculation, the last month of the billing period has not yet ended and the final earnings for this month may be unknown. What to do? In practice, vacation pay is calculated from the 1st day of the month in one of three ways:

- according to expected salary;

- based on accruals at the time of payment of vacation pay;

- excluding earnings for the last month.

Let's look at each method with examples.

IMPORTANT! The day of payment of vacation pay is not included in these three days. For example, if vacation starts from July 1, when should vacation pay be paid? July 1 is Monday, three days before vacation are Friday, Saturday and Sunday. This means that the employee must be given the money no later than Thursday, June 27.

How to take into account the minimum wage when calculating vacation pay

In accordance with Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 “On the specifics of the procedure for calculating average wages,” the employer is obliged to take into account the minimum wage when calculating vacation pay. Paragraph 18 contains an important requirement: to estimate the average monthly earnings of an employee who, during the billing period established at the enterprise, worked his normal working hours and made standard products/services. This value cannot be less than the federal minimum wage, which from January 1, 2022 is set at 12,792 rubles. Therefore, for all vacations in 2022, we compare the average earnings with the new minimum wage. To do this, it is necessary to determine whether the employee has worked the normal working hours. Depending on the result, the procedure is as follows:

- If an employee works part-time and/or a reduced working day, the vacation is calculated without taking into account the minimum wage, according to the general procedure for calculating average earnings for vacation.

- If working hours are fully worked out, we multiply the average daily earnings by 29.3, and compare the resulting amount with the minimum wage - 12,792 rubles.

- If the average earnings are less than 12,792 rubles, then we must rely on the minimum wage when calculating vacation pay: 12,792 / 29.3× the number of calendar days of vacation.

Example 1

The employee goes on vacation from July 5 to July 18, 2022, his average daily earnings are 420 rubles. 420 × 29.3 = 12,306 12,306 < 12,792 12,792 / 29.3 × 14 = 6,112.22 rubles - the amount of vacation pay accrued based on the minimum wage.

Example 2

The employee goes on vacation from June 21 to July 4, 2022, his average daily earnings are 430 rubles.

430 × 29.3 = 12,599 12,599 < 12,792 In this case, the average earnings will have to be determined based on the minimum wage twice: vacation days in June and July separately: 12,792 / 29.3 × 10 + 12,792 / 29.3 × 4 = 4,365.87 + 1,746.35 = 6,112.22 - the amount of vacation pay accrued based on the minimum wage.

If the average earnings are greater than the minimum wage, then we calculate the average earnings in the general manner.

How are vacation pay calculated?

For each day of vacation, including those that fall on weekends, you are paid the average salary. To calculate the Labor Code of the Russian Federation Article 139. Calculation of the average salary, you need to divide the amount of wages accrued over the last 12 months by 12 and then by 29.3 - the average number of days in a month. Salary in calculations is taken into account with bonuses, allowances, and additional payments for overtime.

Let's say you are going on vacation on August 1, and before that you were on vacation in June last year. Moreover, until January 1 you received 44 thousand a month, from January 1 - 50 thousand, in March you were given a bonus of 5 thousand rubles. Then the calculations look like this:

(5 × 44 + 7 × 50 + 5) / 12 / 29.3 = 1.63 thousand rubles

Accordingly, if you are going on vacation for 10 days, then they will give you 16.3 thousand for it.

If you went on vacation - annual and without pay - took sick leave or were released from work for another reason, these days and the money accrued for them are excluded from the calculations.

For example, in April you took a week off. To find out how many days to take into account when calculating average daily earnings in April, you need to divide 29.3 by the number of days in this month and multiply by the difference between the number of days in the month and the number of days you were not at work:

29,3 / 30 × (30 − 7) = 22,4

Accordingly, the formula for calculating average daily earnings will also change. It will change the number of working days, and vacation pay for April will be excluded from total earnings:

(5 × 44 + 6 × 50 + 30.24 + 5) / (11 × 29.3 + 22.4) = 1.61 thousand rubles

If the vacation coincides with a holiday

Employers often have a question: how to correctly calculate vacation pay if the period chosen by the employee falls on holidays or transfer days?

According to Art. 120 of the Labor Code of the Russian Federation, non-working holidays are not included in the number of calendar days of vacation, but transfer days no longer fall under this rule. Transfer days are, in fact, weekends that coincide with holidays. It is the weekends that are transferred, so they are included in the duration of the vacation and are paid in the general manner.

Example

The employee goes on vacation for two weeks from June 7 to June 20. Payment is due within 13 days, as this period falls on an official public holiday - June 12th. June 12 in 2022 falls on a Saturday, so the day off June 14 also became a day off due to the postponement of Saturday. Therefore, only one day is excluded.

If an employee asks to be paid wages along with vacation pay

Article 136 of the Labor Code of the Russian Federation dictates an important rule - to pay wages at least twice a month, at least every half month. Each employer sets specific payment terms individually by internal labor regulations.

There is no requirement or prohibition in the regulatory framework to pay this or that part of the salary before the due date, and the employer can accommodate the employee and pay, for example, an advance along with vacation pay. Especially when it comes to payments through the cash register. If payments are made through a bank card, then there is no need for early payments - the money will be transferred by the accounting department on time. In any case, the accountant must ensure that wages will be paid at least every half month.

Let's look at a few examples. We define the deadline for transferring wages as the 10th day of the month following the billing month.

Example

Vacation starts on June 29, 2022, which means vacation pay must be paid no later than June 25.

By this time, the employee will have already received wages for the first half of the month and vacation pay. An accountant cannot make a full calculation for a full month - he will not have accurate information about the amount of time the employee worked. If the employer nevertheless decides on early payment, then the salary should be calculated for the actual time worked, and the remaining amount should be calculated later, when the monthly calculation for all employees has been made.

How does a salary increase affect vacation pay?

As you know, wage indexation entails a change in the amount of vacation pay. Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 considers several options for increasing average earnings, which directly affects the calculation of vacation pay:

- if an increase in tariff rates, salaries, or remuneration occurred during the billing period, then all payments in this period are subject to indexation,

- if the increase occurred after the billing period, but before the basis for payments taking into account the average earnings, then the average earnings calculated for the billing period increase;

- if an increase in tariffs/salaries, etc. occurred during the main vacation, then average earnings increase only from the moment the tariff rate is increased until the end of the vacation.

As average earnings increase, payments in absolute amounts do not increase.

These provisions apply only to situations where salary increases occur within an organization/structural unit. If the salary of only one employee has increased, there will be no indexation of average earnings.

Example 1

The plant employee is on vacation from June 1 to June 28.

He has a salary of 30,000 rubles and a bonus of 10%. The average salary for vacation will be equal to (30,000 + 3,000) × 12 / (12 × 29.3) = 1126.28 × 28 = 31,535.84. On June 18, the company increased salaries by 5%. This means that the average salary must be indexed from June 18, that is, the employee must receive an additional payment for vacation in the amount of 5% for the period from June 18 to June 28: ((30,000 + 3,000) × 1.05 × 12 / (12 × 29 ,3) – 1126.28) × 11 = 56.31×11 = 619.41

Example 2

The employee was on leave from June 4 to June 28, 2022.

He was paid a salary of 30,000 and a production bonus of 5,000. His average salary for vacation is (30,000 + 5,000) × 12 / (12 × 29.3) = 1194.54, the amount of vacation pay is 1194.54 × 25 = 29863 ,5. Vacation pay was paid no later than May 31. From June 1, there is a 5% increase in salaries. That is, the increase occurred after the billing period, but before the onset of vacation. Thus, the average earnings for the entire vacation period are indexed. At the same time, the employee receives a bonus, determined not as a percentage of the salary, but as a specific amount.

The amount of the surcharge will be calculated as follows: (30,000 × 1.05 + 5,000) × 12/ (12 × 29.3) = 1245.73

1245,73 × 25 — 29 863,5 = 1279,75

Please note that all amounts given in the examples are rounded to the nearest hundredth. In real calculations you will end up with a long line of digits after the decimal point. In the recommendations of the Federal Tax Service and the Ministry of Labor there are no special instructions on rounding amounts, but in the letter of the Ministry of Health and Social Development of the Russian Federation dated December 7, 2005 No. 4334-17, department specialists recommend using intermediate values when calculating average earnings, rounded according to mathematical rules to two decimal places, that is, to hundredths .

Example

The employee was on vacation from June 1 to June 28, 2022. He receives a salary of 30,000 and a bonus of 20%. Based on this, the calculation of average earnings for a vacation looks like this:

(30 000 + 6 000) × 12 / (12 × 29,3) = 36 000 / 29,3 = 1 228,668941979…

1228,67 × 28 = 34 402,76

1228,669 × 28 = 34 402,732

1228,6689 × 28 = 34 402,7292

Rounding options show that more decimal places in intermediate calculations provide greater calculation accuracy. However, it should be taken into account that payments are calculated in rubles and kopecks, and therefore it is advisable to round the amounts to the nearest hundredth of a decimal point for the accuracy of calculations.

How to reflect vacation pay in 6-NDFL

In reporting form 6-NDFL, vacation payments are reflected in sections 1 and 2. Section 1 includes vacation pay withheld in the last quarter of the reporting period. Field 021 indicates the last day of the month in which vacation pay was paid, and field 022 indicates the tax withheld. In section 2, in lines 110 and 112, include the amount of income, in line 140 - the calculated tax, in line 160 - personal income tax withheld from vacation pay.

If vacation pay is paid in one month, and vacation begins in the next, then all income is included in 6-NDFL in the payment period.

Example

The employee went on vacation from July 1 to July 14.

The vacation began on Thursday, July 1, and vacation pay in the amount of 30,000 rubles was paid on June 25. In section 1 in line 021 you need to enter the date “06/30/2021”, and in line 022 indicate the amount of 3,900 rubles - personal income tax withheld from vacation pay. In section 2, lines 110 and 112 indicate the amount of vacation pay - 30,000 rubles, in lines 140 and 160 the calculated and withheld tax, respectively - 3,900 rubles each. Calculation of vacation pay and orders in one program.

Contour.Salary - three months free Learn more

Deadline for payment of personal income tax on vacation pay

In accordance with sub. 1 clause 1 art. 223 of the Tax Code of the Russian Federation, the date of actual receipt of income is defined as the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties - when income is received in cash.

Consequently, the date of actual receipt of income in the form of vacation pay is the date of their payment in cash or transfer to the employee’s bank card (letters of the Ministry of Finance of Russia dated 06.06.2012 N 03-04-08/8-139, dated 26.01.2015 N 03-04-06/ 2187, dated 01/17/2017 N 03-04-06/1618, dated 03/28/2018 N 03-04-06/19804).

Clause 1 of Art. 226 of the Tax Code of the Russian Federation establishes that employers from whom or as a result of relations with which the taxpayer received income are required to calculate, withhold from the taxpayer and pay the amount of personal income tax.

Based on clause 4 of Art. 226 of the Tax Code of the Russian Federation, tax agents are required to withhold the calculated amount of personal income tax directly from the taxpayer’s income upon their actual payment.

According to paragraph 2 of clause 6 of Art. 226 of the Tax Code of the Russian Federation, when paying income to a taxpayer in the form of vacation pay, tax agents are required to transfer the amounts of calculated and withheld personal income tax no later than the last day of the month in which such payments were made.

Consequently, the organization is obliged to calculate and withhold personal income tax on vacation amounts when they are actually paid, and transfer them to the budget no later than the last day of the month in which such payments were made. Since in this case the payment of vacation pay took place in July, personal income tax should be transferred to the budget no later than July 31, 2022 (letters from the Ministry of Finance of Russia dated 03/28/2018 N 03-04-06/19804, dated 01/17/2017 N 03-04-06/ 1618).

At the same time, the dates of recognition of expenses for corporate income tax established in Chapter 25 “Organizational Income Tax” of the Tax Code of the Russian Federation do not matter for the purposes of personal income tax (letter of the Ministry of Finance of Russia dated August 28, 2019 N 03-03-07/66078 ).