Claim with VAT or not

Question: The organization performed work for the customer.

For failure to comply with safety regulations during the execution of work, the customer filed a claim under the terms of the contract. Should the contractor, when transferring the amount of the claim to the customer, charge VAT on it, how to reflect the amount of the claim in accounting and tax accounting? Are penalties (fines, penalties) under business contracts included in the VAT tax base?

Reply from 06/18/2012:

According to Art. 146 of the Tax Code of the Russian Federation, the object of VAT taxation is the sale of goods, works, and services. In addition, based on paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, the tax base for VAT increases, in particular, by amounts associated with payment for goods sold (work, services). The amount of the claim paid by the contractor for failure to comply with safety regulations is not related to the sale of goods (performance of work, provision of services), therefore VAT is not charged on it.

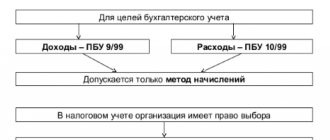

In accounting, this operation is reflected by the following entries:

Dt 91.02 Kt 76.02 – claim recognized

Dt 76.02 Kt 51 – the amount of the claim has been paid

In tax accounting, the amount of the claim transferred to the counterparty is included in non-operating expenses in accordance with paragraphs. 13 clause 1 art. 265 Tax Code of the Russian Federation. According to this clause, these expenses include expenses in the form of fines, penalties and (or) other sanctions for violation of contractual or debt obligations recognized by the debtor or payable by the debtor on the basis of a court decision that has entered into legal force, as well as expenses for compensation for damage caused.

According to the letter of the Federal Tax Service for Moscow dated March 18, 2008 No. 20-12/025119, the following documents are the basis for recognizing expenses in the form of sanctions for profit tax purposes:

- an agreement providing for the payment of sanctions;

- bilateral act;

- a letter from the debtor or another document confirming the fact of violation of the obligation, allowing to determine the amount of the amount recognized by the debtor.

How to ask a question

Causing damage to the company by unknown persons

In some cases, the person who caused damage to the company remains unknown. In this case, losses may reduce the organization’s income tax base.

The cost of lost (stolen, broken, damaged, destroyed) property can be included in non-operating expenses in full. The main thing here is to confirm the absence of guilty persons with a document issued by an authorized authority (letter of the Ministry of Finance of the Russian Federation dated October 6, 2017 No. 03-03-06/1/65418).

Organizations using the simplified tax system take into account expenses in accordance with the list from clause 1 of Art. 346.16 Tax Code of the Russian Federation. Expenses in the form of theft of property are not included in the list. Consequently, expenses in the form of theft are not taken into account when determining the tax base for the simplified tax (letter of the Ministry of Finance of the Russian Federation dated December 19, 2016 No. 03-11-06/2/76035).

As for VAT, when property is stolen, a taxable object does not arise (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation). The owner of the valuables changes, but the transfer of ownership of the property does not occur, therefore such disposal of property is not its sale (Article 39 of the Tax Code of the Russian Federation).

Meanwhile, paragraph 10 of the Resolution of the Plenum of the Supreme Arbitration Court dated May 30, 2014 No. 33 states that the fact of theft or other disposal of property without transferring it to third parties must be documented, as required by paragraph 1 of Art. 54 Tax Code of the Russian Federation. Otherwise, the company will have to calculate and pay VAT to the budget according to the rules of clause 2 of Art. 154 of the Tax Code of the Russian Federation, as if the company had transferred this property to the thief independently in the form of a gift or in exchange.

Deducting VAT on a claim - is it possible?

Our company provided cargo transportation services by chartering a car for its client from a third-party organization. The recipient of the cargo recorded the shortfall and filed a claim with us, and we filed a claim with the contractor. Now I would like to reduce the amount of the transportation customer’s debt to us by the amount of this claim, and also accept VAT from it as a deduction. However, the customer counterparty refuses to issue an invoice for this amount. What should we do?

First of all, let us remember that in accordance with paragraph 2 of Article 171 of the Tax Code of the Russian Federation, only tax amounts presented to the taxpayer when purchasing goods (services, works, property rights) can be taken into account. The basis for this is an invoice - a document drawn up by the seller upon sale.

However, filing a claim does not constitute implementation. From the point of view of the counterparty who received the cargo, issuing an invoice for the amount of the claim would be a mistake, because there is no basis for this. As well as for your company to deduct the tax included in this amount. Officials of the Ministry of Finance in their letters and judges in their rulings have repeatedly explained that sanctions related to compensation for damage do not relate to sales and are not subject to VAT.

Thus, even if the counterparty issued you an invoice for the amount of the claim, it would still not be possible to deduct VAT on its basis. This amount, including the tax included in it, must be written off as non-operating expenses.

>Claim from the transport company

Confusion with non-taxable transactions

Accountants and business owners do not always clearly understand which transactions are not subject to VAT. The distinctions are unclear, and this often leads to denial of deductions.

One of the companies purchased bearings for its production. But during the inspection it turned out that some of them were defective and could not be used. These bearings were simply sold for scrap metal, without being subject to VAT, as required by law.

A tax audit was carried out, as a result of which the company was required to reinstate input VAT on this part of the bearings. The organization objected: the goods were purchased for production needs, rejection is part of the technological process. The case went to court, where the businessmen lost.

The Supreme Court ruling No. 307-ES20-11243 dated October 27, 2020 states:

- You can deduct input tax on assets if they are used in taxable transactions (clause 2 of Article 171 of the Tax Code of the Russian Federation).

- If the intended and actual use do not coincide, it is necessary to make an adjustment: restore the tax previously claimed for deduction (subclause 2 of clause 3 of Article 170 of the Tax Code of the Russian Federation).

Another interesting example involves a company that was building an apartment building for its employees. Based on subparagraph 10 of paragraph 2 of Article 149 of the Tax Code of the Russian Federation, the transfer of residential premises for use was not taxed. But at the same time, the company reimbursed the input VAT that relates to this construction. The tax inspectorate removed the deductions, and when the company reached a dispute in the Supreme Court, it supported the Federal Tax Service (determination of the Supreme Court of the Russian Federation No. 301-ES20-13644 of October 15, 2022).

Transport company claim

01.08.2011 N 03-07-11/207 Letter from the Ministry of Finance of the Russian Federation dated 01.08.2011 N 03-07-11/207

Question: LLC suffered damage from the carrier - damage to the goods. The goods invoice indicates the price of the goods including 18% VAT.

In accordance with paragraph 2 of Art. 796 of the Civil Code of the Russian Federation, damage caused during the transportation of cargo is compensated by the carrier in the event of a shortage of cargo in the amount of the cost of the missing (damaged) cargo. The carrier confirmed its agreement to compensate for damage in the amount of the cost of the goods according to the invoice, but excluding VAT.

By virtue of clause 59 of the Guidelines for accounting of inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n, the actual cost of shortages and damage in excess of the norms of natural loss is taken into account as the debit of the claims settlement account and written off from the credit of the settlement account ( according to the supplier's personal account). When capitalizing missing materials received from suppliers and subject to payment by the buyer, the cost of materials, transportation and procurement costs and value added tax included in the actual cost of shortages and damage are reduced accordingly.

Is it legal for the carrier to reimburse the damage caused to the LLC based on the cost of the damaged goods excluding VAT?

Answer: MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION

LETTER dated August 1, 2011 N 03-07-11/207

The Department of Tax and Customs Tariff Policy reviewed the letter on the legality of compensation by the carrier for damage associated with damage to goods purchased by the taxpayer, based on the cost of these goods excluding value added tax, and reports that the issues of determining the amount of compensation for damage are not regulated by the Tax Code of the Russian Federation.

At the same time, we inform you that in accordance with paragraph 2 of Art. 171 of the Tax Code of the Russian Federation, amounts of value added tax presented to the taxpayer when purchasing goods (work, services), as well as property rights on the territory of the Russian Federation, or paid by the taxpayer when importing goods into the territory of the Russian Federation and other territories under its jurisdiction, are subject to deductions. , in the customs procedure of release for domestic consumption, temporary import and processing outside the customs territory or when importing goods moved across the border of the Russian Federation without customs clearance, in the case of using the specified goods (work, services), property rights to carry out transactions subject to tax Additional cost. In this regard, if it is impossible to use the above goods in activities subject to value added tax, the tax amounts on these goods are not deductible.

Deputy Director of the Department of Tax and Customs Tariff Policy S.V.RAZGULIN 08/01/2011

Here is what the auditor told me about this: I see no reason to reduce the amount of the VAT claim. You must be reimbursed for the full cost of the lost item. Example:

“A contract for the supply of goods was concluded with the condition that the goods be delivered to the buyer. The contract of carriage stipulates that in the event of loss of goods, the transport company will compensate the cost of the goods. The supplier and the transport company apply a common tax regime. During transportation, the transport company lost part of the goods. Should the transport company reimburse the supplier for the cost of the goods including VAT or without VAT?

Having considered the issue, we came to the following conclusion: In the case under consideration, in our opinion, the amount that was due to be paid for the lost goods by the buyer, including the tax charged to the buyer, is subject to compensation from the carrier. In this case, the owner of the lost goods does not charge VAT on the amount of the refund and does not issue an invoice to the carrier.

Rationale for the conclusion: According to paragraph 1 of Art. 15 of the Civil Code of the Russian Federation, a person whose right has been violated may demand full compensation for the losses caused to him, unless the law or contract provides for compensation for losses in a smaller amount. Losses are understood as expenses that a person whose right has been violated has made or will have to make to restore the violated right, loss or damage to his property (real damage), as well as lost income that this person would have received under normal conditions of civil circulation if his right was not violated (lost profit) (clause 2 of article 15 of the Civil Code of the Russian Federation). In accordance with paragraph 2 of Art. 796 of the Civil Code of the Russian Federation, damage caused during the transportation of cargo or luggage is compensated by the carrier: - in case of loss or shortage of cargo or luggage - in the amount of the cost of the lost or missing cargo or luggage; - in case of damage (damage) to cargo or luggage - in the amount by which its value has decreased, and if it is impossible to restore the damaged cargo or luggage - in the amount of its value; - in case of loss of cargo or luggage handed over for transportation with a declaration of its value - in the amount of the declared value of the cargo or luggage. The cost of cargo or luggage is determined based on its price indicated in the seller's invoice or stipulated by the contract, and in the absence of an invoice or price indicated in the contract - based on the price that, under comparable circumstances, is usually charged for similar goods. Thus, in our opinion, compensation for the loss of goods is subject to an amount no less than the sum of the costs of purchasing the goods and other costs incurred by the owner of the lost goods under the supply contract. It should be taken into account that, since according to paragraph 2 of Art. 171 of the Tax Code of the Russian Federation, VAT amounts are subject to deduction only in the case of the acquisition of goods (work, services) for transactions recognized as subject to VAT, then the VAT amounts on lost property, previously legally accepted by the owner of the goods for deduction, are subject, in the opinion of the Russian Ministry of Finance, to restoration. Recovered VAT amounts are taken into account as part of other expenses associated with production and sales (letter of the Ministry of Finance of Russia dated July 20, 2009 N 03-03-06/1/480). In other words, the VAT amounts charged to the organization when purchasing lost goods are included in its expenses and must also be covered by the compensation received from the carrier. In the case under consideration, the contract of carriage establishes the amount of compensation for the loss of goods equal to its value. By the value of the lost goods we mean the amount that is (was) due to be paid by the buyer (including the tax charged to the buyer), since it is this amount that constitutes the lost income of the owner of the goods. Let us note that in similar situations, arbitration practice proceeds from the fact that the current legislation does not contain restrictions regarding the inclusion of VAT in the calculation of losses; the amount of damage is reasonably calculated taking into account VAT, which corresponds to the actual value of the lost cargo. Such conclusions are presented, for example, in the decisions of the Federal Antimonopoly Service of the Ural District dated June 28, 2011 N F09-3136/11 in case No. A76-20512/2010, dated November 3, 2010 N F09-8115/10-S5 in case N A76-3192/2010 -52-39, dated March 17, 2008 N F09-1666/08-C5, FAS Moscow District dated December 15, 2008 N KG-A40/10183-08. Thus, in the situation under consideration, VAT is not charged on top of the cost of the lost goods, but is part of this cost. Therefore, excluding VAT from the claim amount, in our opinion, does not comply with the law. Indirectly, this conclusion is confirmed by letters from the Ministry of Finance of Russia dated October 13, 2010 N 03-07-11/406 and dated October 7, 2008 N 03-03-06/4/67, in which the position is expressed that the disposal of property for reasons not related to the sale or gratuitous transfer (for example, in connection with loss, damage, battle, theft, natural disaster, etc.), based on the provisions of Art. 39 and 146 of the Tax Code of the Russian Federation, is not subject to VAT. In this regard, in case of compensation of damage by the guilty person in cash, VAT is not charged. In relation to the case under consideration, this means that the owner of the lost goods does not charge VAT for the amount of the refund and does not issue an invoice to the carrier.

Submitting a buyer's complaint to a supplier - sample

The buyer, in accordance with the Civil Code of the Russian Federation, must notify the supplier of discrepancies in the quality and quantity of goods by sending a claim (clause 1 of Article 483 and clause 1 of Article 518 of the Civil Code of the Russian Federation). The claim must contain the following data (see sample):

- date and number of delivery and delivery note;

- name and quantity of low-quality goods in accordance with the supplier’s nomenclature;

- description of marriage and its reasons;

- data on the act of identifying discrepancies in quantity and quality;

- conclusion of the supplier’s commission or an independent expert.

In addition, the complaint must clearly indicate the buyer’s requirements for a defective product: return, replacement, discount, etc. An important issue is the amount of the claim and the rules for including VAT in it, as well as the accounting of claims by the supplier.

Claim to supplier with or without VAT?

Article 475 of the Civil Code of the Russian Federation states that in the event of detection of significant violations of product quality requirements that cannot be eliminated or their elimination entails disproportionate costs, as well as in other cases, the buyer has the right:

- demand a refund for paid goods;

- require replacement of a defective product.

When requesting a refund of the cost of a product, the question arises: does the buyer need to file a claim with or without VAT? In other words, should the claim requirement include the VAT amount?

There are two options to consider:

- 1. If the amount paid included VAT, then the claim must include VAT. The buyer has the right to demand a refund of the full price he paid for the defective product, including VAT;

- 2. If the amount paid did not include VAT, then the claim does not include VAT.

But it is worth considering that the situation is different for a non-resident. In the case of a non-resident supplier, VAT is not included in the amount paid. The VAT that is paid at customs when importing goods of inadequate quality should be compensated as losses (Article 15 of the Civil Code of the Russian Federation). Sometimes an agreement with a non-resident may stipulate that the terms of delivery are not regulated by the laws of the Russian Federation, then the actions will be different - in accordance with foreign legislation.

The VAT claim was submitted by the buyer to the simplified tax system

The buyer may not be a value added tax payer if working on a simplified basis. Is it necessary to allocate VAT when returning low-quality goods in such cases?

Since companies using the simplified tax system are exempt from paying value added tax, there is no need to allocate VAT in the return documents that are included in the package of documents along with the claim. An invoice is also not needed here. Payment of the VAT claim is made by the supplier along with deduction of input VAT on the return. The basis will be an adjustment invoice drawn up by the supplier.

However, if she issues an invoice, then she is required to pay VAT. Moreover, after this she will have to draw up an electronic VAT return.

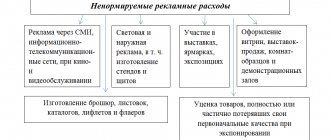

Claims to the supplier without VAT - grounds

According to Article 146 of the Tax Code of the Russian Federation, an object that is subject to VAT is the sale of goods, services or work. If the claim does not relate to the quality (quantity) of the goods, then the amount of the claim to the supplier should not include VAT.

This could be damage to the buyer’s property during delivery of goods, failure to comply with safety regulations during work, etc. The amount of compensation for damage or penalties under the contract in the event of a violation of safety regulations is not subject to value added tax. The invoice will not be issued to the guilty organization.

The supplier must account for the payment of such a claim as non-operating expenses that are not directly related to the production and sale of goods and services.

Is the amount of compensation for damage subject to VAT?

The lessor caused damage as a result of damage to finished products stored in the leased warehouse. Is the amount of compensation for damage subject to VAT? Is it necessary to include VAT in the claim amount when calculating?

On this issue we take the following position:

In the situation under consideration, VAT should not be taken into account when determining the amount of the claim.

In accordance with paragraph 1 of Art. 15 of the Civil Code of the Russian Federation, a person whose right has been violated may demand full compensation for the losses caused to him, unless the law or contract provides for compensation for losses in a smaller amount. In this case, losses are understood as expenses that a person whose right has been violated has made or will have to make to restore the violated right, loss or damage to his property (real damage), as well as lost income that this person would have received under normal conditions of civil circulation, if his right had not been violated (lost profits).

If the person who violated the right received income as a result, the person whose right was violated has the right to demand compensation, along with other losses, for lost profits in an amount not less than such income (clause 2 of Article 15 of the Civil Code of the Russian Federation).

Clause 1 of Art. 1064 of the Civil Code of the Russian Federation establishes that damage caused to the property of a legal entity is subject to compensation in full by the person who caused the damage.

Seizure of land plots

If a company’s land is taken away by purchase for state and municipal needs, the amount of income received can be reduced by expenses associated with its acquisition, and income tax can be paid on the resulting difference (letter of the Ministry of Finance of Russia dated 04/09/2018 No. 03-03-06/ 1/23095).

For a seized land plot, its owner (as well as the legal holder who owns the land under the rights of lease, free use, permanent (perpetual) use or lifetime possession) is provided with compensation (Article 279 of the Civil Code of the Russian Federation, Article 56.8 of the Land Code of the Russian Federation). The amount of compensation includes:

- the market value of the land plot or the market value of other rights to the land plot subject to termination in connection with the seizure;

- losses caused by seizure of a land plot, or losses due to the inability of the copyright holder to fulfill obligations to third parties (for example, under a lease agreement);

- lost profit.

Confiscation of land plots can be carried out either on the basis of an agreement on confiscation of real estate between the government authority and the owner of the plot, or forcibly - by a court decision.

The transfer of ownership of a land plot owned by a taxpayer in connection with its seizure through redemption for state and municipal needs is recognized for tax purposes as the sale of a land plot (Clause 1, Article 39 of the Tax Code of the Russian Federation).

When selling other property (except for securities, products of own production, purchased goods), the taxpayer has the right to reduce income from such transactions by the price of acquisition (creation) of this property (otherwise may be provided for in clause 2.2 of Article 277 of the Tax Code of the Russian Federation), as well as by the amount of certain expenses (paragraph 2, clause 2, article 254 of the Tax Code of the Russian Federation). Consequently, the income received as a result of the purchase of a land plot for state and municipal needs can be reduced by the costs associated with its acquisition, and a tax can be paid on the resulting difference.

Taxation of damage compensation amount with VAT

According to paragraph 1 of Art. 146 of the Tax Code of the Russian Federation recognizes, in particular, transactions for the sale of goods (work, services) in the territory of the Russian Federation as subject to VAT.

The sale of goods, works or services is recognized as the transfer on a paid basis of ownership of goods, the results of work performed by one person for another person, the provision of services for a fee by one person to another person, and in cases provided for by the Tax Code of the Russian Federation, the transfer of ownership of goods, results of work performed works by one person for another person, provision of services by one person to another person - on a free basis (Clause 1 of Article 39 of the Tax Code of the Russian Federation).

By virtue of paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, the VAT tax base is increased by amounts received by the organization, provided that they are related to payment for goods (work, services) sold.

In this situation, the organization makes a claim to the lessor for compensation for losses incurred due to damage to the goods (finished products) located in the rented warehouse due to the fault of the lessor.

Compensation for damage caused to the organization is in no way connected with the sale and payment of goods (work, services), because in this case there is no transfer of ownership of the property on a compensated or gratuitous basis.

Since compensation for damage caused is also not related to payments for goods (work, services) sold, the amount of such compensation does not increase the VAT tax base.

Thus, there is no need to include the amount of compensation for loss in the VAT tax base.

A similar point of view is presented in the letter of the Ministry of Finance of Russia dated July 28, 2010 N 03-07-11/315, which explains that the Tax Code of the Russian Federation does not provide for an increase in the tax base by amounts not related to payment for goods (works, services) sold (see additionally letters of the Ministry of Finance of Russia dated October 26, 2011 N 03-07-11/289, dated October 13, 2010 N 03-07-11/406, Federal Tax Service of Russia for Moscow dated February 7, 2008 N 19-11/11309).

The judges are also of the opinion that the amount of compensation for losses (damage) received by the organization is not subject to VAT, since it is not related to the sale of goods, works, services (Resolution of the Federal Antimonopoly Service of the Moscow District of August 22, 2011 N F05-7956/11, resolution of the Federal Antimonopoly Service of the Ural District dated 25.05.2009 N F09-3324/09-SZ, the transfer of which to the Presidium of the Supreme Arbitration Court for review in the order of supervision was refused by the decision of the Supreme Arbitration Court of the Russian Federation dated 11.09.2009 N 12036/09, resolution of the FAS Volga District dated 05.02.2009 N A55-6696 /2008, Federal Antimonopoly Service of the Volga-Vyatka District dated February 26, 2008 N A82-40/2007-1).

In this regard, we believe that the amount of damage charged to the guilty party is not subject to VAT. Accordingly, an invoice is not issued to the guilty person (clauses 1, 3 of Article 168, clause 3 of Article 169 of the Tax Code of the Russian Federation).

Seizure procedure

The owner must be informed in writing that property in the form of a land plot and the buildings located on it will be seized for state and municipal needs at least a year before the seizure (clause 3 of Article 279 of the Civil Code of the Russian Federation). In this case, the authorities must either buy out the property or, with the consent of the owner, provide other property (land, real estate) in return, including its value in the redemption price (clause 3 of Article 281 of the Civil Code of the Russian Federation).

The redemption price consists of the market value of the property and the amount of losses, including lost profits (clause 2 of Article 281 of the Civil Code of the Russian Federation). For example, if the owner rented out non-residential premises, and when it is withdrawn, he has to terminate the contract with the tenant, then he can insist on compensation for damages in the amount of lost rent.

The authorities can buy property no earlier than one year from the date of notification of the upcoming seizure (Clause 3 of Article 279 of the Civil Code of the Russian Federation). At the same time, with the consent of the owner, the redemption can be completed before this period.

If the owner agrees with the seizure and is satisfied with the amount of compensation, then a repurchase agreement is signed (clause 1 of Article 281 of the Civil Code of the Russian Federation).

Before signing the agreement, the owner has the right not only to continue to use his property, but also to dispose of it at his own discretion, for example, to sell it (Article 280 of the Civil Code of the Russian Federation).

In the commented letter, according to the Ministry of Finance of Russia, the owners of the purchased property have an obligation to pay VAT, since when it is withdrawn for state and municipal needs, a sale occurs, which is recognized as an object of taxation for VAT (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation) .

The same position was set out in an earlier letter from the Russian Ministry of Finance dated July 27, 2018 No. 03-07-11/53236. At the same time, tax officials note that there is no need to charge VAT only on the redemption price for the seized land plot. After all, operations for the sale of land plots are not recognized as an object of VAT taxation (subclause 6, clause 2, article 146 of the Tax Code of the Russian Federation).

However, the courts believe that when property is seized for state and municipal needs, there is no object of VAT taxation (Resolution of the Arbitration Court of the North Caucasus District dated March 24, 2015 No. F08-616/2015).

The judges note that payment of compensation in the amount of the value of property seized for state (municipal) needs does not apply to transactions subject to VAT, since such legal relations are a method established by civil law for compensation for damage caused as a result of seizure of property.

The need to restore VAT amounts accepted for deduction

A closed list of situations in the event of which VAT amounts previously legally accepted for deduction are subject to restoration is established in clause 3 of Art. 170 Tax Code of the Russian Federation. Write-off of inventory items due to their loss, damage, shortage, defects among the cases listed in clause 3 of Art. 170 of the Tax Code of the Russian Federation, does not apply. Consequently, formally, the taxpayer does not have the obligation to restore the amounts of VAT previously claimed for deduction on such goods.

Moreover, until recently, the official position of the regulatory authorities was that VAT in similar cases is subject to restoration. The argumentation of representatives of the Russian Ministry of Finance and tax authorities was as follows.

According to paragraph 2 of Art. 171 of the Tax Code of the Russian Federation, VAT amounts on goods (work, services) acquired for the implementation of transactions subject to VAT are subject to deductions. In turn, paragraphs. 2 p. 3 art. 170 of the Tax Code of the Russian Federation provides that the amounts of VAT accepted for deduction on goods (work, services) are subject to restoration in the event of further use of such goods (work, services, etc.) to carry out the operations specified in clause 2 of Art. 170 of the Tax Code of the Russian Federation (not subject to VAT). Thus, since in the event of shortage, damage, theft, defective goods can no longer be used to carry out transactions subject to VAT, the “input” VAT on them is subject to restoration and payment to the budget. At the same time, it is necessary to restore the amount of tax in the tax period when the missing values are written off from accounting (see, for example, letters of the Ministry of Finance of Russia dated 07/05/2011 N 03-03-06/1/397, dated 07/04/2011 N 03-03-06 /1/387, dated 06/07/2011 N 03-03-06/1/332, dated 04/24/2008 N 03-07-11/161, Federal Tax Service of Russia dated 12/04/2007 N ШТ-6-03/, dated 11/20. 2007 N ШТ-6-03/).

In turn, the decisions of the judicial authorities indicate that paragraph 3 of Art. 170 of the Tax Code of the Russian Federation does not provide for the need to restore VAT previously accepted for deduction, including in cases of damage to goods (see, for example, resolutions of the FAS Moscow District dated July 15, 2014 N F05-7043/14, FAS Volga District dated November 9, 2012 N F06-8238/12, FAS of the North Caucasus District dated November 18, 2011 N F08-7089/11, FAS of the Ural District dated January 22, 2009 N F09-10369/08-S2).

It should be recognized that the position of the authorized bodies on this issue has recently undergone changes.

Thus, in the letter of the Federal Tax Service of Russia dated May 21, 2015 N GD-4-3/ it is indicated that the amounts of VAT previously legally accepted for deduction are not subject to restoration upon disposal of property as a result of a fire, since this case is in paragraph 3 of Art. 170 of the Tax Code of the Russian Federation is not named.

Tax department employees make this conclusion, guided by the decision of the Supreme Arbitration Court of the Russian Federation dated October 23, 2006 N 10652/06, and also cite court decisions that take into account this decision of the Supreme Arbitration Court of the Russian Federation. In addition, tax authorities cite a letter from the Ministry of Finance of Russia dated November 7, 2013 N 03-01-13/01/47571. It, in particular, states that in the case when written explanations of the Ministry of Finance of Russia (recommendations, explanations of the Federal Tax Service of Russia) on the application of the legislation of the Russian Federation on taxes and fees are not consistent with decisions, resolutions, information letters of the Supreme Arbitration Court of the Russian Federation, as well as decisions, resolutions , letters of the Armed Forces of the Russian Federation, tax authorities, starting from the day the specified acts and letters of the courts are posted in full on their official websites on the Internet or from the date of their official publication in the prescribed manner, when exercising their powers, are guided by the specified acts and letters of the courts.

Thus, taking into account the position of the courts, including the Supreme Arbitration Court of the Russian Federation, as well as the changed position of the regulatory authorities, we believe that in the situation under consideration, VAT, previously legally accepted for deduction in the manufacture of damaged products, does not need to be restored.

Found a scythe on a stone, or Disputes surrounding the taxation of compensation for property seized for government needs

In the letter of the Ministry of Finance of Russia dated August 21, 2020 No. 03-03-06/1/73368

issues related to the procedure for taxation of compensation received in connection with the seizure of real estate for state or municipal needs are raised.

Is there any profit from withdrawal?

It happens that a land plot owned by an organization or a citizen falls into the construction zone of a highway or railway, or it is necessary to extend an electricity or gas supply line on this site. For land plots and (or) real estate located on them seized for these and other purposes, the state pays compensation to the owner and compensates for losses caused. What are the features of taxation of funds received? One of the organizations that received money from the state customer to compensate for losses in connection with the seizure of real estate for state needs approached the Ministry of Finance with approximately the same question.

Position of the Ministry of Finance

Answering the question, financiers examined the norms of tax legislation in relation to both the general taxation system and the simplified tax system.

In accordance with Article 247 of the Tax Code of the Russian Federation, the object of taxation for profit tax is the profit received by the taxpayer. Profit is recognized as income received, reduced by the amount of expenses incurred, which are determined in accordance with Chapter 25 of the Tax Code of the Russian Federation. An exhaustive list of income not taken into account when determining the tax base for income tax is established by Article 251 of the Tax Code of the Russian Federation.

Everything seems clear, what else can we talk about? Actually, there is something to talk about.

After all, what follows from the passage of officials? If

you received compensation for the forced confiscation of, say, your land plot (and most often it is the land that is confiscated), then you will have to pay income tax.

In the letter in question No. 03-03-06/1/73368, the matter did not reach this specific conclusion. But there are letters from financiers that directly say this (for example, letter from the Ministry of Finance of Russia dated January 22, 2019 No. 03-11-06/2/2885).

Now as for taxpayers using the simplified tax system. In accordance with Article 346.15 of the Tax Code of the Russian Federation (clause 1), taxpayers applying the simplified tax system, when determining the object of taxation as part of income, take into account income determined in the manner established by Article 248 of the Tax Code of the Russian Federation (clause 1 and clause 2).

According to Article 346.15 of the Tax Code of the Russian Federation (subclause 1, clause 1.1), when determining the object of taxation, the income specified in Article 251 of the Tax Code of the Russian Federation is not taken into account. This article does not name income in the form of compensation for the seizure of real estate through redemption for state needs. In this regard , the amount of monetary compensation received from the budget by the owner of a land plot for its seizure for state needs is subject to a single tax under the simplified tax system

.

According to Article 346.17 of the Tax Code of the Russian Federation (clause 1), the date of receipt of income is the day of receipt of funds in bank accounts or at the cash desk, receipt of other property, work, services, property rights, as well as repayment of debt to the taxpayer in another way (cash method).

Financiers have long and firmly adhered to this point of view (letters from the Ministry of Finance of Russia dated July 11, 2012 No. 03-03-06/1/334, dated April 28, 2014 No. 03-03-06/1/19742, dated February 17, 2016 No. 03-07 -11/8736 and dated 04/09/2018 No. 03-03-06/1/23095).

The tax service's view

Fortunately, the tax authorities (and they are the ones who then have to sue the offended owners) are closer to reality. This is confirmed by the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 23, 2009 No. 2019/09 in case No. A32-7432/2007-56/191-2008-56/23.

In this dispute, the court decided that compensation paid in cases of seizure of a land plot for state needs does not correspond to the concept of income given in Article 41 of the Tax Code of the Russian Federation

.

It does not bring any economic benefit to the former owner of the site. The owner loses the right of ownership to the land plot, and this does not depend on his will. In this regard, compensation for losses

received during the seizure of land for state needs

is not subject to taxation

, since the collection of income tax in this case

violates the principle of full compensation for losses .

Therefore, the Federal Tax Service of Russia (letters dated July 1, 2015 No. GD-4-3/11409, dated July 16, 2015 No. ED-4-3/ [email protected] , dated July 11, 2017 No. SD-4-3/ [email protected] and dated 07/03/2018 No. SD-4-3/ [email protected] ) indicated that local tax inspectors on the issue under consideration should be guided by the position of the Supreme Arbitration Court of the Russian Federation

, and not the Russian Ministry of Finance. Moreover, the financial department, in a letter dated November 7, 2013 No. 03-01-13/01/47571, indicated that in controversial situations, tax authorities should be guided by the decisions of the highest courts.

What about VAT?

The Russian Ministry of Finance, at least, does not consider the funds received as revenue. And that’s good! Let us present the arguments of financiers.

According to Article 146 of the Tax Code of the Russian Federation (clause 1), transactions involving the sale of goods on the territory of Russia are recognized as subject to VAT. Article 162 of the Tax Code of the Russian Federation (subclause 2, clause 1) provides that the VAT tax base includes funds received by the taxpayer related to payment for goods sold by him.

If the money received is not related to payment for goods sold, such money is not included in the VAT tax base.

In this regard , the amounts of money received by the taxpayer from the state customer to compensate for losses in connection with the seizure of real estate for state needs

, which is in his ownership or economic control,

are not funds associated with payment for goods sold by him

. Therefore, these amounts are not included in the VAT tax base (letter of the Ministry of Finance of Russia dated September 26, 2019 No. 03-03-06/1/74014).

And just recently, the Russian Ministry of Finance thought quite differently (letter dated February 19, 2019 No. 03-07-11/10284). It followed from this letter that the funds received by the owner of real estate from state enterprises and commercial organizations under agreements providing for compensation for the seizure of these objects are essentially payment for services to clear the territory for the construction of new objects, which are subject to inclusion in the tax base according to VAT

.

In another letter from the Ministry of Finance of Russia, dated July 27, 2018 No. 03-07-11/53236, it was said that the sale of goods is recognized as the transfer of ownership of goods on a compensated basis, and in cases provided for by the Tax Code of the Russian Federation - the transfer of ownership of goods and on a free basis (clause 1 of article 39 of the Tax Code of the Russian Federation).

Thus, when seizing real estate objects for state needs, the transfer of ownership of these objects is recognized as an object of taxation for VAT

, and

the amount of compensation received for seized real estate objects is the amount of payment for these objects

.

True, in accordance with Article 146 of the Tax Code of the Russian Federation (subclause 6, clause 2), operations for the sale of land plots are not recognized as subject to VAT. It turns out that you have to pay VAT for the confiscated building, but not for the confiscated land underneath it.

Let us note that in the decision of the Administrative Court of the North Caucasus District dated March 24, 2015 No. F08-616/2015 in case No. A32-35014/2013, the court did not agree with the officials. There is no realization when

.

What prompted the Russian Ministry of Finance to reconsider its point of view remains unclear.

Agree, it is doubtful to think that financiers took into account the conclusions of the North Caucasus District Autonomous District, ignoring the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation No. 2019/09.

What if compensation is paid to citizens who are participants in the company?

For seized company property, its member-owners may receive compensation. And, sadly, they will have to be shared with the state. The arguments for this conclusion are given in the letter of the Federal Tax Service of Russia dated October 8, 2020 No. BS-4-11/ [email protected]

.

When determining the tax base for personal income tax:

- all income of the taxpayer that he received both in cash and in kind or the right to dispose of which he acquired (clause 1 of Article 210 of the Tax Code of the Russian Federation) is taken into account;

- the taxpayer has the right to receive a property tax deduction (clause 3 of Article 210 of the Tax Code of the Russian Federation, subclause 2 of clause 1 of Article 220 of the Tax Code of the Russian Federation). The deduction is provided in the amount of the redemption value of the land plot and other real estate located on it (in the event of seizure of these assets for government needs).

However, who was the owner of the property? Company. Who received compensation? Company. Citizen-owners have nothing to do with this and cannot count on a property deduction. So after the participants divide the amount of compensation among themselves, each of them needs to pay personal income tax on this amount in the usual manner.

Inclusion of VAT in the claim amount

Current legislation does not contain restrictions regarding the inclusion of VAT in the calculation of the amount of losses itself, namely the prohibition on taking into account the amount of tax in the value of lost property when determining the amount of damage (see, for example, the decisions of the Eighteenth Arbitration Court of Appeal dated November 12, 2012 N 18AP-10470/12, Fifteenth Arbitration Court of Appeal dated 04/05/2012 N 15AP-2585/12, Ninth Arbitration Court of Appeal dated 06/24/2010 N 09AP-12587/2010).

The amount of loss in the form of VAT, if it is part of the price (cost) of the property subject to compensation, must be reimbursed in full by the counterparty responsible for these losses. This is precisely the position taken by some federal arbitration courts (resolutions of the Federal Arbitration Court of the Ural District dated 08/14/2012 N F09-6939/12, dated 06/28/2011 N F09-3136/11-S5, dated 04/08/2011 N F09-1173/11-S5, FAS North-Western District dated June 22, 2012 in case No. A56-44279/2011, dated February 22, 2011 in case No. A21-8004/2009).

At the same time, we draw attention to the conclusions contained in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 No. 2852/13 in case No. A56-4550/2012. In it, the judges noted that losses in the form of expenses, including VAT, can be reimbursed to the victim if the latter proves that the tax amounts presented to him represent his uncompensated losses. According to the court, the existence of the right to deduct VAT amounts established by Art. 171 of the Tax Code of the Russian Federation, excludes a reduction in the property sphere of the person who suffered damage, and, accordingly, in this case excludes the application of Art. 15 Civil Code of the Russian Federation. The Presidium of the Supreme Arbitration Court of the Russian Federation concluded that a person who has the right to a deduction must know about its existence, must comply with all legal requirements to obtain it, and cannot shift the risk of non-receipt of the corresponding amounts to his counterparty, which in fact is an additional public liability for the latter. legal sanction for violation of a private law obligation.

Thus, an organization does not have the right to demand compensation for losses taking into account the amount of VAT if it has the right to deduct the amount of tax, which excludes a decrease in its property scope. That is, the reimbursement of the amount of VAT by the person who caused the damage and the receipt of a tax deduction from the budget, according to the court, leads to the unjust enrichment of the “victim” by receiving the tax twice - from the budget in the form of a tax deduction and from its counterparty in the form of compensation for damage.

Since in the situation under consideration, VAT on inventories used in the production of products was previously accepted for deduction, and it is not required to restore it when writing off goods, we believe that VAT amounts should not be taken into account in determining the amount of the claim.

The burden of proving the existence of losses and their composition is placed on the victim (resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 N 2852/13, dated July 17, 2012 N 2683/12, dated April 24, 2012 N 16327/11, dated August 29, 2000 N 8926/99 ), and he, as we indicated earlier, on the basis of Art. 15 of the Civil Code of the Russian Federation has the right not only to compensation for the cost of lost goods, but also to compensation for lost profits.

If the tenant determines the amount of damages independently and the landlord agrees with it, then the parties do not need to go to court for judicial protection. Therefore, whether the losses caused are compensated, including VAT, or whether the loss is calculated from the cost of the lost goods excluding VAT, the parties determine independently. In the settlement document, the VAT amount is a separate line, based on clause 4 of Art. 168 of the Tax Code of the Russian Federation, there is no need to separate it, since compensation for losses is not subject to VAT.

Answer prepared by: Expert of the Legal Consulting Service GARANT, professional accountant Molchanov Valery

The answer has passed quality control

September 5, 2016

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.

>Reflection of a claim from the Buyer in accounting

VAT on compensation for damages on a claim

Quote (Armandy1987): Good afternoon! In the event of loss (shortage or damage) of cargo, the forwarder must compensate the client for actual damage, as well as previously paid remuneration, if it is not included in the price of such cargo (That is, you are given sanctions for improper execution of the contract. Here is how the Ministry of Finance explains: Situation: you need Is it possible to pay VAT on penalties in the form of fines and penalties received from the buyer (customer) No, it is not necessary if the penalty is not related to payment for goods supplied (work performed, services rendered). As a rule, receiving a penalty is due to the fact that the buyer ( customer) does not fulfill or improperly fulfills the terms of the contract. An example of improper fulfillment of the contract may be the untimely payment of the buyer to the supplier. In such cases, the resulting penalty is not related to payment for goods (work, services). It is considered as a penalty for late fulfillment of obligations and the tax base for VAT is not included.Such clarifications are contained in the letter of the Ministry of Finance of Russia dated March 4, 2013 No. 03-07-15/6333, which was communicated to the tax inspectorates by the letter of the Federal Tax Service of Russia dated April 3, 2013 No. ED-4-3 /5875. The legality of this approach is confirmed by arbitration practice (see, for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 5, 2008 No. 11144/07). And there are situations when the penalty is directly related to payment for goods supplied (work performed, services rendered). For example, a penalty for excess transport downtime, the amount of which is agreed upon by the parties in the transport expedition or transportation agreement. If the customer delays transport beyond the predetermined time, he pays the forwarder (carrier) a fine, the amount of which depends on the duration of the downtime. Such penalties are associated with payment for services rendered, so they must be included in the VAT tax base. This is stated in the letter of the Ministry of Finance of Russia dated April 1, 2014 No. 03-08-05/14440. It should be noted that in some cases, the funds received from the buyer in the contract are called a penalty (fine, penalty), but in essence they are an element of pricing - a hidden form of payment. When such amounts are received, they must also be included in the VAT tax base. This was stated in the letter of the Ministry of Finance of Russia dated March 4, 2013 No. 03-07-15/6333. Olga Tsibizova, Deputy Director of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia Material from the BSS "System Glavbukh"