From January 1, 2022, you will pay VAT at a rate of 20 percent (Federal Law No. 303-FZ dated August 3, 2018). When managers signed a long-term contract with the buyer, they set the price including tax at a rate of 18 percent.

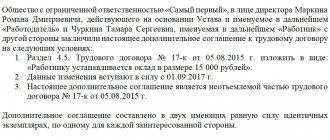

Sample additional agreement (Price including VAT)

Sample additional agreement (Price excluding VAT)

Now the new VAT rate has been approved. And suppliers have time to negotiate changes to contracts with buyers.

To do this, you need to conclude additional agreements to the contracts.

Some contracts may not be amended.

Firstly, if the contract provides for the seller’s right to unilaterally increase the price if legislators increase the VAT rate. But this is a rare situation. Typically, such a condition is not included in the contract.

Secondly, if the price for specific batches of goods of the company is established in specifications or other additional documents to the contract. Read on for another situation where it is not necessary to change the contract.

Warn managers so that in new contracts they immediately take into account the increase in the VAT rate.

If you sell goods taxed at a rate of 10 percent, there is no need to adjust the contracts.

The legislative framework

Let us turn to the Federal Tax Service Letter No. SD-4-3/ [email protected] dated 10.23.2018. It provides clarification on how to deal with this tax during the transition period. From January 1, everyone without exception switched to 20%. And it doesn’t matter when the contract was concluded.

But usually the document strictly states “18 percent.” This means that this condition needs to be officially adjusted. Accordingly, if tax conditions are not specified in the text, then there is no need to sign anything additional.

Some prescribed in advance the possibility of revising the cost unilaterally when amending the legislation. They also don’t need extra documents.

How to indicate tax in a contract under 44-FZ

The contract price is the value of the price offer of the winner of the tender or the cost agreed upon during the purchase with the supplier (Clause 1 of Article 34 of the 44-FZ). It remains unchanged throughout the duration of the contract. Exception: concluding an additional agreement on the grounds provided for by law.

There are no provisions in contract legislation that the tax regime applied by the supplier affects the final cost of GWS, as well as the conditions for participation in procurement. This means that if a supplier wins a tender at a certain cost and upon signing the contract it turns out that he is working according to a simplified approach, then the customer has no reason to reduce the payment for his goods.

The supplier’s additional profit is his legal income, which is justified by the use of a special regime. If the supplier on the site indicated the price without VAT, and the customer forces you to deduct 20% again, this requirement is unlawful.

To avoid controversial situations at the stage of selecting the winner, signing the contract and paying for it, include in the draft contract wording that will suit all participants, regardless of the tax regime they apply.

Example wording:

When closing contracts, the supplier is not obliged to provide the customer with an invoice if the tax regime it uses does not provide for this, even if the obligation to issue an invoice is specified in the contract. This position is confirmed by the resolution of the Court of Justice of the West Siberian District dated August 16, 2019 in case No. A03-16525/2018. The customer refused to accept the goods without an invoice, but the court sided with the supplier.

When a supplier issues an invoice and is a value added tax payer, an obligation to pay it arises. In this case, there is no right to receive tax deductions (clause 5 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 33 of May 30, 2014).

If the customer is a tax payer under the contract, the amount payable to the supplier is reduced by the amount of tax on the basis of clause 2, part 13 of art. 34 44-FZ. This wording has nothing to do with the supplier’s taxation regime (USN or other).

IMPORTANT!

The maximum amount of commission paid by tender winners to the account of trading platforms is specified in GD No. 564 dated May 10, 2018, excluding value added tax.

How to specify a change in the VAT rate in a contract

It all depends on what formulations were used initially. The following options are possible (for example, let’s take the cost of 100,000 rubles).

| Formulation | What to do | New edition |

| 100,000 rub. + VAT | There is no need to change anything, since the exact amount of the tax is not given | – |

| 100,000 rub. excluding VAT | There is no need to change anything, since there is no indication of the amount of tax | – |

| 100,000 rubles + 18% | Change to current value | 100,000 rubles + 20% |

| 118,000 rubles, including value added tax 18,000 rubles | Recalculate taking into account the current value | 120,000 rubles, including value added tax 20,000 rubles |

A letter sent to a counterparty about a change in the VAT rate is an example of the fact that you are trying to prevent all possible omissions in advance.

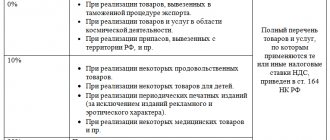

VAT rates from 2022

Starting from January 1, 2022, the following VAT tax rates apply:

| Bid | Terms of Use |

| 0% (no change) | Sales of goods for export that undergo customs clearance; Transportation between countries; Transportation operations for oil and its by-products. |

| 10% (no change) | Sale of food products; Sale of goods intended for children; Sale of medicines and medical supplies; Sale of printed publications and periodicals related to education and culture. |

| 20% (until 01/01/2019 - 18%) | All other transactions that do not fall into the 0% and 10% categories. |

Attention! In addition, in the case where the price already includes VAT, it will be necessary to use the new calculated rate of 20/120 to highlight it.

Additional agreement to change the VAT rate: sample

The additional agreement on changing the value added tax rate should resolve all discrepancies that arose in connection with amendments to the legislation. In general, its structure looks like this:

- A title indicating the number and date of conclusion of the original document.

- Date and city of signing.

- Point to be reformulated.

- Its new edition.

- Effective date of the new provisions.

- Details and signatures.

We discussed above how to correctly specify the VAT rate in the contract. However, in the additional agreement it is advisable to do this as precisely as possible.

But there is another opinion. In accordance with it, during the transition period it is better to refrain from indicating the amount of tax liability. This applies to both percentage and monetary terms. It is better to simply refer to paragraph 3 of Article 164 of the Tax Code.

More about VAT

- recommendations and assistance in resolving issues

- regulations

- forms and examples of filling them out

ConsultantPlus TRY FREE

Rules for signing amendments to the contract

Due to the increase in VAT by 20%, the rules for signing the relevant documents are relevant.

The agreement to the contract does not have a special form at the legislative level; the main thing is the principle of business etiquette. In the middle of the application the name itself is written, and just below it is the name of the document to which the agreement is concluded, in this case, it is an agreement, the date of signing and its number.

The new line on the left indicates the place where the act is drawn up, and on the right the date of this process.

It is necessary to identify each of the parties and sign the last name, first name and patronymic of the persons who represent these organizations. It is indicated that the parties have entered into this contract and its details are specified.

Below is the content section. It is being built according to plan:

- 1 – information on the cost of the goods and separately including VAT 18%, for example, 11,800 rubles and 1,800 rubles, respectively, for a specific period (until the end of 2022).

- 2 – data on the price increase and separately taking into account tax as of January 1, 2022, that is, 12,000 rubles and 2,000 rubles.

- 3 – it displays a phrase indicating the preservation of the remaining conditions.

- 4 – the place where it is written that this agreement is an integral part of the purchase and sale agreement and comes into effect from the moment it is signed.

- 5 – the presence of two copies is prescribed, and both parties have equal legal force.

- Signatures, details and seal, if used.

If the other party is against increasing VAT

Situations with any changes can take different turns and reach controversial points. Often one party neglects the provision of services, payment of VAT and, in general, the performance of duties. The case can lead not only to the termination of mutually beneficial relationships and contracts, but also to litigation.

It is possible that the buyer will refuse the increased cost of the product. Given this fact, the difference in price will be borne by the supplier, and his company will reflect this in the form of a reduction in the selling price.

Often in such cases, the selling company sues and wants to force the other party to sign an additional agreement by order. But here you should not rely entirely on the judicial institution, since this practice is only gaining momentum, and it is not considered possible to predict the judge’s decision.

It is also worth paying attention to the Letter of the inspection body dated October 23, 2022, which states that the additional agreement is not mandatory.

How to negotiate a price increase with the buyer

In order not to lose profit after the VAT increase, sellers raised prices. For example, in 2022 the product cost 118 rubles, 100 rubles is the price excluding VAT. With the new tax rate, it will cost 120 rubles, and the buyer will have to pay 2 rubles more.

Explain to the buyer: but his VAT deduction amount will increase. This is understandable to counterparties under the general tax regime. But simplifiers or imputators do not claim deductions, so they will have to pay more. And if such buyers are against raising prices, you may have to bear the extra costs.

Updating the FDF version

How it will look in real conditions. Based on the experience of 2018, any changes to the FFD will require updating 3 components: the cash register firmware, the cash register driver at the workplace and the accounting system regarding the cash register. Any compromises with the aim of simplifying/reducing the cost of this procedure inevitably led to problems in further work. Accordingly, with every sneeze of the Federal Tax Service, the lucky owners of cash registers will have to pay for:

- License to receive firmware update;

- Operation of the service center for re-flashing the cash register;

- Work as a programmer to update the accounting system and cash register driver

There are nuances on all points. The cost of a one-time license purchase depends on the manufacturer of cash register equipment and ranges from 600-1200 rubles. An annual subscription costs the same - 2000 rubles. Reflashing the cash register can take place according to different scenarios depending on the current firmware version, and on average costs 1200-1500 rubles. Newgers and smart cash registers like Evotor and Atol 92F can generally be updated “over the air,” i.e. they pick up updates via the Internet and install them without the participation of specialists.

As for updating the accounting system (we will consider only 1C, otherwise this text will have to be written until the morning), the price for this pleasure varies much more widely, and its determination requires an individual approach. For example, installing several missed releases on a typical Retail 2.2 will cost about 2,500 rubles, and finishing the deeply modified Trade Management 10.3 can cost 10 or 20 thousand. Those organizations that still keep records in the old TiS 7.7 should stock up on hair dye in order to cover up the gray hair that is rapidly progressing from the price tags they see. Because specialists on the “seven” are systematically dying out and writing new treatments is reluctant and expensive. In terms of the final cost, life will be easiest for users of smart cash registers and standard (unfinished) configurations of 1C Retail 2.2, Trade Management 11 and Enterprise Accounting 3.0.

What needs to be specified in the additional agreement

An additional agreement to the contract is drawn up in the event of a change in the conditions specified in it or the circumstances in which the parties operate. It is drawn up in the same form as the main agreement, and after signing by the parties it becomes an integral part of it.

In the text of the additional agreement, only the clauses that have undergone adjustment are given with reference to their numbers in the main agreement, after which the text of this clause is stated in the new edition.

In addition, the document states:

- date of signing of the main agreement;

- numbers of the main contract and additional agreement;

- place of signing;

- names of the parties;

- Full name of the persons who signed the additional agreement;

- details of the parties and their signatures.

As a general rule, the additional agreement comes into force on the day of signing, but according to Art. 425 of the Civil Code of the Russian Federation, the parties can change this date.

In what form should the contract be drawn up?

The buyer company can include a provision for compensation for losses in contracts for the provision of services, supplies, work, etc. The condition must be stated in the “Special Conditions” or “Responsibility of the Parties” section.

If an agreement has already been concluded with counterparties, then the condition for compensation of losses can be formalized by an additional agreement. But in this case, it is better to additionally indicate that such an additional agreement extends its effect to the period from the moment of signing the main agreement. Otherwise, for all supplies that were made before the additional agreement was signed, the protective condition will not apply.

Attention! Make sure that the contract or additional agreement is signed by a person who has the authority to do so. Otherwise, no guarantees or representations will work. It is not the counterparty who will be held liable, but the individual who signed the document.

How will the VAT increase affect the work of simplifiers?

The tax will increase for simpletons who rent state property, buy scrap metal, order services from foreign companies, etc. That is, simplifiers will pay more in all cases when they pay VAT as a tax agent. You will also need to pay more if the simplifiers issue an invoice at the buyer's request. Indeed, in this case, simplifiers pay VAT in the general manner. The transition to a 20% VAT rate under the simplified tax system when issuing an invoice should follow the same rules as given in the article above.

Commercial risk or force majeure

The position of the Ministry of Finance is that increasing the rate is a commercial risk for the contractor of the government order. According to the law on the contract system, the price of a government contract is fixed and does not change during the entire period of fulfillment of obligations. Procurement participants understand that the contract price cannot be changed and agree to the customer’s terms and conditions by submitting their proposals.

IMPORTANT!

If the supplier fails to fulfill his obligations, for example, delivers a smaller quantity of goods, the customer is obliged to charge a penalty or withhold it from the contract security.