Document that must be filled out under the conditions of the reform State statistical accounting form N 22-ZhKKH (consolidated)

How are the deadlines for submitting 3-NDFL related to the deadlines for paying taxes? What are the deadlines for filing a 3-NDFL return?

Expert consultation From the beginning of 2022, all organizations must switch to FAS 6/2020, since

One of the integral elements of the OSN is the estimated income of an individual entrepreneur. Based on this information

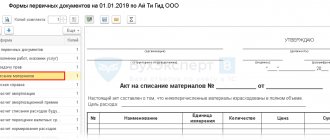

The act of writing off goods in the TORG-16 form is useful when the goods are in a warehouse

As some scientists say: “Our whole life consists of numbers.” They accompany a person everywhere

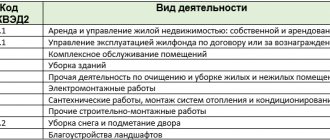

When filling out an application on form P21001, an individual entrepreneur must indicate which areas of business he

Due to the complexity and importance of the work, the chief accountant is constantly at risk. He may be punished

Functions of a bank card Every organization must have a bank account to maintain

Advantages for taxpayers when creating a consolidated group The biggest advantage for members of a consolidated group