When filling out an application on form P21001, an individual entrepreneur must indicate what areas of business he will be engaged in. To do this, codes of the types of activities of an individual entrepreneur are entered into sheet A of the application for registration of individual entrepreneurs.

Codes are digital designations of types of activities; they are selected from the OKVED classifier. For example, if an individual entrepreneur opens a beauty salon, then its OKVED codes will be:

- 96.02 Provision of services by hairdressing and beauty salons;

- 96.04 Sports and recreational activities;

- 96.09 Provision of other personal services not included in other categories.

If, in the course of his activities, an entrepreneur decides to engage in areas of business that were not immediately indicated in the application for registration of an individual entrepreneur, then it is necessary to add OKVED codes. Suppose that a small store selling professional cosmetics will be organized in a beauty salon, in this case it is necessary to inform the tax office about adding OKVED codes for individual entrepreneurs.

We have developed step-by-step instructions for you on how to add OKVED codes for individual entrepreneurs in 2022. With its help, you can independently add new types of individual entrepreneur activities or exclude those that you no longer plan to engage in. Let us consider in detail step by step how an individual entrepreneur can add new OKVED codes in 2022.

Should an individual entrepreneur change OKVED when changing activities?

If an individual entrepreneur has started to engage in a new type of activity, then he must inform the tax authority at the place of his registration within seven working days (sub-clause “o”, clause 2 and clause 5 of Article of the Federal Law of 08.08.01 No. 129- Federal Law; hereinafter referred to as Law No. 129-FZ). For violation of this requirement, a fine of 5 thousand rubles is possible (Clause 3 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation).

From the literal interpretation of the norm in paragraph 5 of Article of Law No. 129-FZ, it follows: the new OKVED code must be included in the register if the individual entrepreneur actually conducts business (and does not carry out one-time transactions) in a type of activity not specified in the Unified State Register of Individual Entrepreneurs.

Check the OKVED codes of “your” individual entrepreneur and his contractors

The legislation does not contain criteria by which one-time transactions can be distinguished from systematic business activities. You need to rely on common sense and the usual understanding of the term “systematic”. Conducting one or two transactions during the year should not be regarded as a systematic activity aimed at generating income from the sale of goods, performance of work or provision of services (i.e., as a type of entrepreneurial activity). Therefore, it is not necessary to formally enter the additional OKVED code into the register in this case.

But there is an important point to consider. For tax purposes, income received from transactions that do not correspond to the declared OKVED codes is considered “non-entrepreneurial” (letter of the Ministry of Finance dated November 22, 2017 No. 03-04-06/77155). This means that when paying income, the counterparty (organization or other individual entrepreneur) must withhold personal income tax, even if the entrepreneur who received this income applies a special regime. If such income comes from an “ordinary” individual, then the individual entrepreneur himself is obliged to include this amount in the personal income tax return. Moreover, in full, without reduction for professional tax deductions.

ADVICE

The additional OKVED code must be entered into the Unified State Register of Individual Entrepreneurs even for a one-time transaction. It is better to do this in advance, before receiving income from such an operation. Otherwise, additional tax charges are possible. Also see “The Federal Tax Service clarified how inspectors should identify unregistered entrepreneurs.”

How to add OKVED through State Services

Currently, on the State Services portal you can only make an application using form No. P24001.

To do this, you need to select the “Services” category on the main page and go to the “Business, Entrepreneurship, NPO” section. Next, click on the link “Registration of legal entities and individual entrepreneurs”. In the window that appears, you need to go to the “Non-electronic services” section, where the link “Making changes to information about an individual entrepreneur contained in the Unified State Register of Entrepreneurs” will be available.

It will not be possible to send an application through the State Services portal to add OKVED codes for individual entrepreneurs in 2022.

Choosing new OKVED

To select the desired code, it is better to use OKVED in electronic form with the ability to search by keywords. It is necessary to indicate the words that correspond to the new type of activity (for example, “rent,” “welding,” “sidewalk,” etc.) and read the description of the groups where they were found.

The classifier is built on the principle: “from the general to the specific.” Therefore, you need to “climb” the grouping higher to codes containing four, three, and then two digits, and study the explanations for them (for example, from code 01.11.31 go first to code 01.11, and then to codes 01.1 and 01). It is quite possible that after studying the “upstream” codes you will understand that the “downstream” code is not suitable for you. Carefully read the explanations for all groups that the new code is included in. Typically, it first describes what activities are covered by the grouping, and then provides exceptions.

If a suitable code is found, then one more question needs to be resolved: enter a “lower” code into the Unified State Register of Entrepreneurs, or “go up” in the grouping above and indicate a code that includes a larger number of possible operations?

IMPORTANT

Include “superior” codes containing four digits in the Unified State Register of Individual Entrepreneurs.

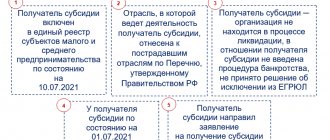

This will expand the list of operations that an individual entrepreneur has the right to engage in, and therefore will reduce the risk of claims from tax authorities. But keep in mind: if an individual entrepreneur applies to receive a state subsidy, then the OKVED code declared in the register must exactly correspond to the code of the type of activity that, according to officials, requires state support. Otherwise, the subsidy will be denied (see “Why can’t an individual entrepreneur qualify for a subsidy?”). If a keyword search does not produce results, you will have to select the code based on the general logic of constructing the classifier. First you need to select a section (they are designated in Latin letters in OKVED), and within it - the most suitable grouping. And already in this grouping, find codes corresponding to “other types of activities not included in other groups.” They are usually at the very end of the group.

Select OKVED codes for free in a special web service

For example, this is exactly what individual entrepreneurs who are engaged in intermediary activities (agents, commission agents) will have to do. There is no special code for them in OKVED. Therefore, when carrying out such activities, you can use code 82.99 “Activities for the provision of other support services for business, not included in other groups.”

Next, you need to analyze how the selected code will affect the amount of tax liabilities of the individual entrepreneur. The fact is that the use of some OKVED codes entails the loss of the right to PSN, a reduced single tax rate under the simplified tax system or reduced insurance premium rates.

If an individual entrepreneur has hired employees, you need to check which class of professional risk the activity belongs to under the new code. It is quite possible that the new OKVED will lead to an increase in the insurance premium rate for injuries.

Reference

Information about the main activity is taken as of January 1 of the year for which the tariff is set (clause 6 of the Rules for classifying types of economic activity as professional risk, approved by Decree of the Government of the Russian Federation dated December 1, 2005 No. 713). Changes made to the Unified State Register of Individual Entrepreneurs after this date do not affect the amount of contributions.

Also see “Taxes for individual entrepreneurs with and without employees in 2021.”

How to add OKVED via MFC

Submitting an application through the MFC is actually no different from submitting this document directly to the Federal Tax Service.

If the entrepreneur himself came to the MFC, he will have to sign the application in the presence of a center employee. Accordingly, this should be done after the operator checks that the document is filled out correctly.

We recommend including several copies of form No. P24001 in the package of documents for a visit to the MFC. They will be useful if a center employee discovers errors or inaccuracies in the completed form. Having blank forms will allow you to immediately make the necessary corrections.

If the application to the MFC is submitted by the entrepreneur’s authorized representative, then the individual entrepreneur’s signature on this document will have to be certified in advance by a notary. The representative will also need a power of attorney certified by a notary. In this case, it will no longer be possible to promptly correct errors discovered during acceptance of the application.

REFERENCE

Not all multifunctional centers provide the same range of services.

Using a special service, you can check whether the MFC accepts an application to add OKVED codes for individual entrepreneurs in 2022. If form No. P24001 is sent through the multifunctional center, documents confirming the entry of the new OKVED code can also be obtained from the MFC (clause 3 of Article No. 129-FZ).

Application for adding OKVED for individual entrepreneurs according to form P24001

When filling out the application, you must consider the following rules.

In section 1 of the title page (page 001), you should enter data about the entrepreneur (OGRNIP and full name) in the same way as they are reflected in the Unified State Register of Individual Entrepreneurs. Accordingly, before filling out the application, it makes sense to order an extract from this register so as not to make mistakes when providing information. In section 2 of this page the number “1” is entered. It means that the application has been submitted to change information in the Unified State Register of Individual Entrepreneurs.

Get a fresh extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs

New OKVED codes are indicated on sheet D of the application in form No. P24001. The codes you need to add to the registry appear on page 1 of this worksheet. Each code must consist of at least four characters (i.e., you cannot indicate “superior” codes that have two or three digits). Please note: if the main type of activity remains the same, you do not need to fill out the first line of page 1 of sheet D.

If some codes specified in the Unified State Register of Individual Entrepreneurs need to be excluded, they should be listed on page 2 of sheet D. Otherwise, page 2 is not filled out.

On sheet E of the application, you must indicate the full name of the applicant (i.e., individual entrepreneur), contact phone number and email address to which the tax authorities must send a document confirming the fact of making changes to the Unified State Register of Individual Entrepreneurs. If necessary, the entrepreneur himself can also receive this document on paper (to do this, enter the value 1 in the corresponding field of the application). It is not possible to send a document on making changes to the Unified State Register of Individual Entrepreneurs by “regular” mail (letter of the Federal Tax Service dated 06/07/18 No. GD-4-14/11058).

There is no need to sign a “paper” application immediately after drawing it up. The autograph must be affixed in the presence of employees of the Federal Tax Service or the MFC, if the individual entrepreneur submits the application in person. Or in the presence of a notary, if the application is submitted by a representative under a power of attorney from the individual entrepreneur.

If the application in form No. P24001 is sent electronically, it must be signed with an enhanced qualified electronic signature (see “Recent amendments to the law on electronic signatures: how and how to sign reports in 2022”). In this case, there is no need to indicate the applicant’s full name on sheet E.

Receive an enhanced qualified electronic signature certificate in an hour

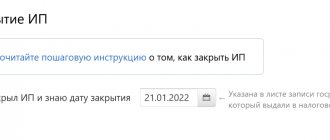

How to make changes to OKVED for individual entrepreneurs in 2022

In most cases, to enter new codes, you only need to submit an application in form No. P24001 (Appendix No. 9 to the Federal Tax Service order No. ED-7-14 dated August 31, 2020 / [email protected] ).

If an entrepreneur plans to carry out pedagogical, educational or educational activities (according to the list approved by Decree of the Government of the Russian Federation of April 16, 2011 No. 285), then it is advisable to attach to the application a certificate of the presence (absence) of a criminal record and (or) the fact of criminal prosecution or the termination of criminal proceedings persecution. The form of the certificate is contained in the order of the Ministry of Internal Affairs dated September 27, 2019 No. 660. The presence of this certificate will speed up the process of considering the application.

If there is a criminal record or the fact of criminal prosecution, then the decision of the commission on affairs of minors and the protection of their rights must be attached to the application. This decision must state that the individual entrepreneur is allowed to carry out these types of activities (subparagraph “d”, paragraph 1, article 22.2 of Law 129-FZ).

The general period for consideration of an application for adding OKVED codes is 5 working days (clause 1 of article and clause 3 of article 22.2 of Law No. 129-FZ).

IMPORTANT

There is no state fee for entering new OKVED codes. There is no need to attach a document confirming the transfer of state fees to the application (subclauses 6-8 clause 1 of Article 333.33 of the Tax Code of the Russian Federation, Article 22.2 of Law No. 129-FZ).

Instructions for adding OKVED for individual entrepreneurs

You can submit an application to change OKVED directly to the registration authority, that is, to the tax office, which deals with registration of individual entrepreneurs.

The entrepreneur himself can bring an application drawn up on form No. P24001 to the Federal Tax Service. He must sign this document in the presence of the inspector.

Any other person can submit an application on the basis of a notarized power of attorney from the individual entrepreneur. In this case, the entrepreneur will have to notarize his signature on the application.

You can submit an application in form No. P24001 without visiting the tax office. Individual entrepreneurs have the right to submit this document through the Multifunctional Center for the provision of state and municipal services, or using electronic services.

Submit documents for registering an LLC/IP or making changes to the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs via the Internet

How to add OKVED in your personal account on the Federal Tax Service website

The Tax Service on its website offers a special service “State registration of legal entities and individual entrepreneurs”.

This service is connected to the taxpayer’s personal account and allows, among other things, to fill out and submit electronically an application in form No. P24001. An application drawn up electronically must be signed with an enhanced, qualified electronic signature before sending. If the individual entrepreneur does not have such a signature, then he will not be able to send the finished document through the Federal Tax Service website.

Receive an electronic signature to log into the taxpayer’s personal account on the Federal Tax Service website Send an application