Expert consultation

From the beginning of 2022, all organizations must switch to FAS 6/2020, since last year was the last year when enterprises kept records in accordance with the accounting procedure PBU 6/01. The “What to do Consult” expert talks about the procedure for transitioning to the new federal accounting standard, as well as all the nuances associated with it.

FSBU 6/2020 “Fixed assets” was approved by Order of the Ministry of Finance of Russia dated September 17, 2020 No. 204n. This federal standard defines the requirements for the formation in accounting of information about fixed assets of organizations.

FAS 6/2020 was developed on the basis of IFRS (IAS) 16 “Fixed Assets”, put into effect on the territory of the Russian Federation by Order of the Ministry of Finance of Russia dated December 28, 2015 No. 217n.

The standard replaces the Accounting Regulations (PBU 6/01) “Accounting for fixed assets”, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n. In connection with the adoption of this standard, from January 1, 2022, the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Which organizations are switching to FSBU 6/2020

All commercial and non-profit organizations are required to use the new standard. The law makes an exception only for public sector employees (clause 2 of FSBU 6/2020). Small enterprises that maintain simplified accounting are also required to switch to the new standard, but may not apply some of its provisions (clause 3 of FSBU 6/2020).

An organization that has the right to use simplified methods of accounting, including simplified accounting (financial) reporting, may not apply clause 23, sub. “b”, “c”, “g” - “o” clause 45, clause 46, FSBU 6/2020 (clause 3 of the standard).

With the help of SPS ConsultantPlus, you will easily navigate the legislation and track all changes in a timely manner.

OS criteria according to FSBU 6/2020

Fixed assets (FPE) are equipment and other expensive property that a company has been using for more than a year. OS differs from inventory, the cost of which is less than the limit; from raw materials and materials used once; from goods and finished products intended for sale (Article 257 of the Tax Code of the Russian Federation, clause 4 of FSBU 6/2020, Letter of the Ministry of Finance of Russia dated July 11, 2018 No. 03-03-06/2/48148).

OS criteria: useful life (USL) is more than 12 months, the initial cost is more than the limit. The limit on the cost of fixed assets in tax accounting is 100,000 rubles, in accounting – any value established in the accounting policy.

Fixed assets in accounting include assets that simultaneously meet the following criteria (clause 4, FSBU 6/2020, Information message of the Ministry of Finance of Russia dated November 3, 2020 No. IS-accounting-29):

1) have a material form;

2) are capable of bringing economic benefits (income) to the organization in the future.

They are intended:

- for use in the production and (or) sale of products (goods), when performing work or providing services, for temporary use for a fee, for management needs, for environmental protection for a period of more than 12 months or a normal operating cycle exceeding 12 months;

- to receive income from the increase in value in the long term (more than 12 months). At the same time, the purchase and sale of such property does not relate to the usual activities of the organization.

Fixed assets are divided (clause 11 of FSBU 6/2020):

- by type, in particular:

- real estate;

- cars and equipment;

- vehicles;

- industrial and household equipment.

- by groups.

Do not apply to fixed assets (clause 6 of FSBU 6/2020):

- capital investments;

- long-term assets for sale.

Change in original cost

As a general rule, the cost of fixed assets in which they are taken into account is not subject to change. The exceptions are cases established:

- PBU 6/01;

- other provisions (standards) on accounting.

Although a change in the initial cost of fixed assets in which they are taken into account is permissible in the following cases:

- completions;

- retrofitting;

- reconstruction;

- modernization;

- partial liquidation;

- revaluation of fixed assets.

Acceptance for accounting of fixed assets

Fixed assets are accepted for accounting in the following order:

- analyze the characteristics and expected conditions of use of the acquired (created) asset. It is important to ensure that it meets the criteria for recognition as an OS object;

- if the criteria for recognizing an asset as an asset are met, then all costs incurred in connection with the acquisition (creation) of the asset and preparing it for use are capitalized on account 08 “Investments in non-current assets”. This is necessary to form the initial cost of the OS.

The procedure for recognizing and assessing costs depends on the reasons for the receipt of fixed assets by the organization (purchase, creation, receipt as a contribution to the authorized capital, etc.);

- Upon completion of capital investments, the following is recorded:

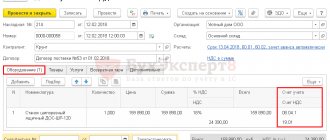

| Contents of operations | Debit | Credit |

| The object is accepted for accounting as part of the OS | (03) |

- determine the useful life, method of calculating depreciation and the salvage value of the fixed assets.

This follows from FSBU 6/2020 “Fixed assets” and FSBU 26/2020 “Capital investments”, which are mandatory for use from 2022, but by decision of the organization can be applied earlier.

At the same time, in accordance with clause 5 of FAS 6/2020, an organization may decide not to apply this standard in relation to assets that are simultaneously characterized by the characteristics established by clause 4 of the standard, but have a value below the limit established by the organization, taking into account the materiality of information about such assets .

For the receipt of low-value fixed assets, the organization’s accounting policy may provide for a different accounting procedure.

Unique analytical materials of SPS ConsultantPlus will help you when difficult situations arise.

What is the cost of fixed assets and how to calculate it

Fixed assets include part of the property owned by the enterprise, which has the following distinctive features:

- minimum cost – 40 thousand rubles (in 2022);

- used for production and commercial purposes;

- is not a product (not for resale).

In accounting, the term “fixed assets” (FPE) is widely used, meaning essentially the same fixed assets, including intangible assets.

During operation, there is a natural decrease in the value of fixed assets as they physically and morally age. The amount of depreciation of assets is transferred to the cost of finished products in the form of depreciation charges, due to which capacity is restored.

Question of price

Should property that costs less than 40 thousand rubles, but has all the other features of a PF, be classified as fixed assets? Organizations have the right to make their own decisions on this matter. Two options are allowed:

- inclusion of production assets reusable for a year or more in inventories;

- assigning them to the OS. In this case, the generally accepted limit of 40 thousand is reduced (for example, to the cost of a used computer, if the company does not have more expensive property);

However, in the vast majority of cases, accounting uses the first option (MPZ). Otherwise, there will be an increase in the fiscal burden on the enterprise. In tax accounting (Articles 374 and 375 of the Tax Code of the Russian Federation), fixed assets are subject to property tax.

Fixed assets costing less than 40,000 rubles are not depreciated.

Why is information about the cost of fixed assets needed and how is it provided?

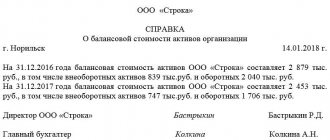

Assessing the real value of an asset is necessary in various situations that arise in the course of commercial activities. A certificate of book value is prepared by the accounting department in the following cases:

- request from the company's owners, who set the goal of analyzing the structure of non-current assets;

- the need to confirm the correctness of income and property tax calculations;

- when insuring property;

- to attract investors.

It should be remembered that all fixed assets are listed on the balance sheet at their residual value, that is, minus depreciation (“Accounting and Reporting Regulations”, paragraph 49).

It is also important that even a fully depreciated fixed asset is not excluded from the balance sheet if it continues to be used for production purposes. However, such objects may not be included in the specified certificate due to a zero residual value.

This document looks something like this:

There is no single officially approved form of a certificate of book value, but in essence it is a table, always with a specified date. The document is valid for a relatively short period of time, usually a month.

An accountant prepares a certificate of the book value of fixed assets based on the balance sheet. Amounts are duplicated in words.

How low-value operating systems are taken into account

Accounting for objects with low cost and a useful life of more than 12 months (more than the operating cycle, if the operating cycle of the organization exceeds 12 months) can be organized in two ways.

Both methods allow you to immediately write off the costs of purchasing (creating) low-value operating systems within the cost limit. The limit on the value of fixed assets for a one-time write-off in accounting is not legally established, so fix it in your accounting policy.

Method 1. Set a cost limit for a set of OS objects. To do this, it is necessary to define in the accounting policy the categories of fixed assets, information about which is obviously insignificant to the organization, taking into account the characteristics of its activities and the structure of assets (that is, it cannot influence the economic decisions of users of the statements). These can be fixed assets of specific types, subtypes, groups, subgroups, segments, etc. (clause 2, Recommendation R-126/2021-KpR “Cost limit for fixed assets”, illustrative example 1 of Recommendation R-100/2019- CPR “Implementation of the requirement of rationality”).

Establish a limit in the accounting policy for the entire set of non-essential assets. The quantitative value of the limit is calculated based on the potential impact on relevant indicators. It can be expressed as a monetary amount or as a percentage of the monetary value of the relevant indicators. The limit must be determined in such a way that the annual costs for the acquisition, creation, improvement, restoration of fixed assets from non-essential categories do not exceed the established value (clause 3, , , Recommendation R-126/2021-KpR “Cost limit for fixed assets”).

Costs for the acquisition, creation, improvement, restoration of fixed assets from non-essential categories, regardless of the cost of individual objects, are written off as expenses or recognized as costs for the creation of other assets (for example, work in progress) in the period of their implementation, in the same way as depreciation on these assets would be recognized (p 5 FSBU 6/2020, clause 8, Recommendation R-126/2021-KpR “Cost limit for fixed assets”).

Method 2. Set a cost limit for an individual OS object. The Russian Ministry of Finance recommends using this particular method of setting a limit (for individual fixed assets, and not for their totality) (Letter No. 07-01-09/68312 dated 08/25/2021).

When determining the limit, it is important to remember that its value should not be significant for the organization. That is, the use of the limit should not lead to a significant impact on reporting indicators. There are no other restrictions regarding the limit amount.

If the initial cost of an individual fixed asset, formed according to accounting rules, is below the limit established by the organization (for example, 100,000 rubles), then it is included in expenses or in the cost of other assets at a time (clause 5 of FSBU 6/2020); if a limit of 100,000 rubles is set in accounting, then this will allow you to bring accounting and tax accounting closer together.

Attention : formally, clause 5 of FSBU 6/2020 allows the recognition of costs for the acquisition (creation) of low-value operating systems during the period of their implementation. However, in practice, this can be done only if it is obvious that the initial cost of the fixed asset, determined on the basis of all costs associated with its acquisition (creation), will not exceed the limit established in the accounting policy. Otherwise, it is recommended to first account for the initial cost of the fixed assets and, only after making sure that it is below the limit, include it in expenses (costs of creating other assets).

Regardless of the method used, it is necessary to ensure control over the presence and movement of low-value OS (clause 5 of FSBU 6/2020). To do this, you can enter an additional off-balance sheet account or limit yourself to warehouse accounting (clause 10 of Recommendation R-126/2021-KpR “Cost limit for fixed assets”).

Typical situations in SPS ConsultantPlus will allow an accountant to quickly resolve issues that he encounters on a daily basis.

Depreciation of fixed assets

Depreciation is accrued for all types of property accounted for as part of fixed assets, with the exception of (clause 28 of FSBU 6/2020):

- investment property accounted for at revalued amounts;

- OS with unchanged consumer properties. These include, for example, land plots, environmental management facilities (water bodies, subsoil and other natural resources), museum objects and collections;

- OS objects mothballed and not used in the organization’s activities, intended for the implementation of the legislation of the Russian Federation on mobilization preparation and mobilization.

For other, temporarily unused and (or) mothballed fixed assets, depreciation is accrued in the usual manner (clause 30 of FSBU 6/2020, Information message of the Ministry of Finance of Russia dated November 3, 2020 No. IS-accounting-29).

Depreciation on an asset is accrued from the date of its recognition in accounting. It is permissible to begin accrual of depreciation from the 1st day of the month following the month of recognition of fixed assets, securing this option in the accounting policy (subparagraph “a”, paragraph 33 of FSBU 6/2020, Information message of the Ministry of Finance of Russia dated November 3, 2020 No. IS-accounting- 29, clause 7 PBU 1/2008 “Accounting policies of the organization”).

Depreciation accrual stops from the date the asset is written off from accounting. But if it is established in the accounting policy in such a way that depreciation is accrued from the 1st day of the month following the month of recognition of the fixed asset, then it stops from the 1st day of the month following the month of write-off of the fixed asset (subparagraph “b” of paragraph. 33 FSBU 6/2020, clause 7 PBU 1/2008).

The method of calculating depreciation is set the same for all fixed assets included in the same group. The chosen method should most accurately reflect the distribution over time of the economic benefits expected to be received from the use of this group of fixed assets (subparagraph “a”, paragraph 34 of FSBU 6/2020, Information message of the Ministry of Finance of Russia dated November 3, 2020 No. IS-accounting-29).

Accumulated depreciation on fixed assets is taken into account on account 02 “Depreciation of fixed assets” (clause 39 of FSBU 6/2020, Instructions for using the chart of accounts). Depreciation on fixed assets is reflected by an entry on the credit of account 02.

The amount of accrued depreciation is included:

- in the cost of work in progress when the fixed assets are used in normal activities (subparagraph “d”, paragraph 23 of FSBU 5/2019 “Inventories”);

- into the cost of a non-current asset, if the OS is used to create or acquire this asset (subclause “c” of clause 10 of FAS 26/2020 “Capital Investments”, clause 23 of Regulation No. 34n);

- for other expenses - in other cases (clause 4 of PBU 10/99). For example, other expenses include depreciation of fixed assets that are temporarily not used in the normal activities of the organization and, therefore, leased.

Liquidation value of fixed assets

According to clause 32 of FSBU 6/2020, the amount of depreciation of an asset for the reporting period is determined in such a way that by the end of the depreciation period the book value of this object becomes equal to its liquidation value.

The liquidation value of an asset is considered to be the amount that the organization would receive in the event of disposal of this item (including the value of material assets remaining from disposal) after deducting the estimated costs of disposal.

Depreciation on fixed assets is suspended if the liquidation value of the asset is equal to or exceeds its book value. If subsequently the liquidation value is less than the book value of the fixed asset, depreciation is resumed (clause 30 of FSBU 6/2020). A similar rule is reflected in paragraph 54 of IAS 16.

Clause 31 of FSBU 6/2020 provides that the liquidation value of an asset is considered equal to zero if:

1) receipts from the disposal of a fixed asset item (including from the sale of material assets remaining from its disposal) are not expected at the end of its useful life;

2) the amount expected to be received from the disposal of a fixed asset item is not significant;

3) the amount expected to be received from the disposal of an asset cannot be determined.

In paragraph 53 of IAS 16 it is noted: the depreciable amount of an asset is determined minus its liquidation value. In practice, the salvage value is often insignificant and, therefore, is insignificant when calculating the depreciable amount.

The encyclopedia of controversial situations SPS ConsultantPlus will allow you to see different points of view on the same issue: what the Ministry of Finance, the tax service, and the courts think.

If payment is not in cash

The initial cost of fixed assets received under contracts providing for the fulfillment of obligations (payment) in non-monetary means is the cost of assets transferred or to be transferred by the organization.

The value of such assets is established based on the price at which, in comparable circumstances, the organization usually determines the value of similar assets.

When it is impossible to determine the value of such assets, the value of fixed assets acquired with them is determined based on the cost at which similar fixed assets are acquired in comparable circumstances.

Capital investments in perennial plantings and for radical land improvement are included in the OS annually in the amount of costs related to the areas accepted for operation in the reporting year, regardless of the completion date of the entire complex of works.

OS revaluation

Revaluation of fixed assets must be carried out if the organization’s accounting policy has fixed such a decision and identified groups of fixed assets subject to revaluation (subparagraph “b”, paragraph 13 of FAS 6/2020, Information message of the Ministry of Finance of Russia dated November 3, 2020 No. IS-accounting-29) .

Investment property is revalued at each reporting date (clause 21 of FSBU 6/2020, Information message of the Ministry of Finance of Russia dated November 3, 2020 No. IS-accounting-29).

The frequency of revaluation of other groups of fixed assets is determined independently based on how susceptible their fair value is to changes, and is fixed in the accounting policy. If a decision is made to revaluate fixed assets other than investment real estate no more than once a year, then they need to be revalued as of the end of each reporting year (clause 16 of FAS 6/2020, Information message of the Ministry of Finance of Russia dated November 3, 2020 No. IS- accounting-29).

The revaluation is carried out on the basis of an order from the manager before the preparation of annual reports and is reflected in the accounting records as of December 31. The purpose of revaluation is to equalize the book value and fair value of fixed assets. This can be done in two ways. The first is to proportionally adjust the original cost and accumulated depreciation. The second is to write off accumulated depreciation and then bring the book value to fair value (clause 17 of FSBU 6/2020).

Average annual cost

Of course, the ideal option would be a “real-time” economic analysis of key performance indicators. A manager, coming to work in the morning, would simply open the appropriate program and see how his management decisions affect capital productivity or profitability. Unfortunately, this is not possible for a number of reasons, including:

- a certain inertia of any economic system;

- multifactorial influence causing ambiguous results;

- high complexity of data collection and calculations.

Therefore, a comprehensive calculation of many parameters, including the cost of fixed assets, is carried out at a given rhythm, usually once a year. For greater efficiency, the figure is taken as the average for the reporting period.

The average annual cost of an operating system can be determined in at least three ways, depending on the required accuracy.

As the arithmetic mean

This is the simplest method that does not involve a “deep dive” into the subtleties, circumstances and chronology of events. To implement it, you just need to take two numbers reflecting the situation at the beginning and end of the year, add them and divide by two.

OSsr = (OSng + OSkg)/2

Where: OSsr – average annual cost of OS. OSng – the cost of the operating system at the beginning of January of the analyzed year. OSkg – the cost of fixed assets at the end of December of the analyzed year.

The method captivates with its simplicity, clarity and compliance with the concept of “average”. However, it also has a significant drawback.

For example, at the very end of last year, the company finally acquired an automatic line, which the general director had long dreamed of. This high-performance equipment was very expensive, but it promises amazing economic benefits. Of course, in the remaining time the equipment did not have time to generate much profit, but its cost was included in the OSkg figure (see formula). If the average annual cost obtained using the arithmetic mean formula is used to calculate the efficiency (profitability) of an investment, then the result, to put it mildly, may be disappointing.

Fortunately, such distortions can be avoided by using other methods.

Calculation based on the full book value of fixed assets

The formula used to calculate the average annual cost of fixed assets using this method takes into account the commissioning of assets to the nearest month, which provides quite acceptable accuracy.

Where: OSsr – average annual cost of OS. OSvv – the cost of assets put into operation. Т1 – number of months of operation of commissioned assets. OSvyv – the cost of decommissioned assets. Т2 – number of months without operation of withdrawn assets.

Using this formula, it is clear how long the new fixed assets have worked, and how long ago the old equipment stopped being used. Despite the complexity, this method is considered the most common.

Balance sheet method

Using this method, an accountant can get by with just the balance sheet lines without opening other reporting documents, which indicates its convenience. The formula looks like this:

Where: OSsr – average annual cost of OS. OSb – book value of fixed assets. OSvv – the cost of assets put into operation. Т1 – number of months of operation of commissioned assets. OSLIK – liquidation value of fixed assets. Т3 – number of months of operation of decommissioned assets.

At its core, this method is similar to the method of calculating using the full accounting value, but requires less labor.

Decommissioning of OS

The carrying (residual) value of an asset is deregistered for the following reasons (clause 40 of FSBU 6/2020):

- The OS physically leaves the organization. This happens, for example, when an object:

- transferred to another person (upon sale, exchange, contribution to the authorized capital, etc.);

- kidnapped;

- destroyed by fire, accident or other emergency;

- OS is not capable of bringing economic benefits to the organization in the future. For example, an object is no longer used:

- due to moral or physical wear and tear;

- due to the expiration of regulatory permissible periods or other limiting parameters of its operation.

Unused operating systems, the operation of which has been permanently discontinued, should not be on the organization’s balance sheet. When decommissioned, such OS must be:

- or written off during the period of discontinuation of operation without prospects for further use and sale (clause 41 of FSBU 6/2020);

- or reclassified. Fixed assets are reclassified as long-term assets available for sale if they are capable of generating economic benefits (income) in the future through sale. In rare cases, unused assets may be transferred to inventory.

The write-off of unused, unusable, morally and physically worn-out or retired assets is reflected in accounting in the same way. Regardless of the reason for the write-off, do the following:

- calculate depreciation on the asset being written off;

- generate the book value of the fixed assets;

- write off the book value of the fixed assets;

- write off the accumulated additional valuation for the asset.

SPS ConsultantPlus will help you correctly fill out tax calculations, determine deadlines and avoid penalties.

Rules for the transition to FSBU 6/2020

As a general rule, the consequences of changes in accounting policies in connection with the start of application of FAS 6/2020 are reflected retrospectively (as if this standard had been applied from the moment the economic facts affected by it arose).

To facilitate the transition to a new procedure for accounting for fixed assets in the financial statements, starting from which FAS 6/2020 is applied, the organization may not recalculate comparative indicators related to fixed assets for periods preceding the reporting period, making a one-time adjustment to the book value of the assets at the beginning of the reporting period (end period preceding the reporting period), that is, apply an alternative method (clause 48, FSBU 6/2020).

For such an adjustment to the carrying value of fixed assets, their original price (taking into account revaluations), recognized before the start of application of FAS 6/2020 in accordance with the previously applied accounting policy, less accumulated depreciation, is considered. In this case, accumulated depreciation is calculated in accordance with FSBU 6/2020 based on the specified initial cost, liquidation value and the ratio of expired and remaining SPI determined according to this standard.

The method chosen by the organization is disclosed in the financial statements for the first reporting period of application of FSBU 6/2020 (clause 52 of FSBU 6/2020, clause 21 of PBU 1/2008 “Accounting Policy of the Organization”).

To transition to FAS 6/2020, the accounting policy stipulates:

- new OS cost limit;

- the beginning of depreciation calculation from the month of acceptance for accounting or from the next month;

- method of accounting for the consequences of revaluation - adjustment of residual value or initial cost and depreciation;

- method of valuing investment property - at market value or at original

Fixed Asset Accounting

Fixed assets are tangible assets that are used by a company:

- For the production or supply of goods and services;

- For administrative purposes;

- For rental to other companies;

- More than one year.

Criteria for recognition of fixed assets:

- The fixed asset must be controlled by the enterprise;

- It is probable that future economic benefits from the property, plant and equipment will flow to the company;

- The initial cost of a fixed asset accepted for accounting can be reliably estimated.

In accordance with IFRS 16, the classification of fixed assets is carried out by the company independently, taking into account the commonality of their types and the specifics of operation, for example:

- Earth;

- Building;

- Facilities;

- Equipment;

- Motor vehicles;

- Furniture and other accessories.

Accounting and valuation of intangible assets

An item of fixed assets is valued at its actual (historical) balance sheet, liquidation, depreciable and fair (estimated) value.

Cost of property, plant and equipment is the amount of cash or cash equivalents paid, or the fair value of other consideration given to acquire the asset, at the time of its acquisition or construction.

Initial valuation of fixed assets

- An item of fixed assets must be valued at its actual cost.

Actual Cost Elements:

- Purchase price less trade discounts;

- Import duties;

- Direct costs of bringing a fixed asset item into working condition for its intended use (delivery, unloading, installation, installation);

- The costs of dismantling and removing a fixed asset item on the occupied site.

The cost of independently produced fixed assets includes:

- Materials;

- Labor costs;

- Other inputs.

Subsequent valuation of fixed assets

After acquiring an item of property, plant and equipment, IFRS 16 allows the following accounting methods to be used:

- Historical cost accounting: An asset is stated at historical cost less accumulated depreciation and impairment losses, i.e. at book value (basic accounting procedure);

- Assessed cost accounting (permitted alternative): The asset is carried at assessed cost, which is the fair value at the date of revaluation less accumulated depreciation and impairment losses.

Book value is the amount at which an item of fixed assets is reflected on the organization’s balance sheet, calculated as the difference between the original or revalued cost of the asset and the amount of accumulated depreciation.

Fair value is the amount for which an asset could be exchanged between knowledgeable, willing parties.

If the acquired item is not measured at fair value, then its actual cost is measured at the carrying amount of the transferred asset.

Revaluation

Revaluation of fixed assets should be carried out regularly.

The amount of revaluation increases the amount of capital. A decrease in the value of fixed assets as a result of revaluation is first written off to reduce the amount of revaluation of the corresponding asset, and the remaining amount is written off as losses for the reporting period.

If a single fixed asset item is revalued, then the entire group of fixed assets to which the given object belongs is subject to revaluation.

Subsequent costs of fixed assets

Subsequent expenditure on fixed assets must be capitalized, i.e. increase their carrying amount when incurred if it is probable that future economic benefits will flow to the entity in excess of the existing asset's originally estimated standard. All other subsequent costs must be recognized as expenses in the period in which they are incurred.

For reference: capitalization is the attribution of costs to the value of an asset, i.e. increase in asset value.

Depreciation of fixed assets

Depreciation is the systematic distribution of the cost of an asset over its useful life.

Depreciation is charged systematically over the useful life of the asset. The method of calculating depreciation should reflect the nature of consumption of economic benefits. Components of fixed assets for which economic benefits are obtained in different ways must be depreciated separately.

Depreciation methods for fixed assets are used when developing the organization's accounting policies and are disclosed in the financial statements.

- Linear method. The annual amount of depreciation is determined as the product of the original cost of a fixed asset and the depreciation rate calculated based on its useful life. After modernization, reconstruction or revaluation of an item of fixed assets, depreciation for which is calculated using the straight-line method, the annual amount of depreciation charges is calculated based on the residual value of the asset, increased by the amount of costs for modernization, reconstruction, the amount of revaluation (or reduced by the amount of evaluation), and the remaining revised useful life. In this case, the residual value of the asset is the difference between the actual cost and the amount of accumulated depreciation.

- Reducing balance method. The annual amount of depreciation is calculated as the product of the residual value of the object at the beginning of the reporting year, the depreciation rate calculated based on the useful life of this object, and the coefficient established by the organization not higher than 3. Specifics of calculating depreciation using the reducing balance method: the amount of accrued depreciation by the end of the useful life of the object is always less than its value by the amount of the remainder, which can be as close as possible to zero, but is not equal to zero. After modernization, reconstruction or revaluation of an asset, depreciation for which is calculated using the declining balance method, the annual amount of depreciation charges is calculated based on the residual value of the asset, increased by the amount of costs for modernization, reconstruction, the amount of revaluation (or reduced by the amount of the valuation), and the remaining revised useful life.

- The method of writing off cost by the sum of the numbers of years of useful life. The annual amount of depreciation charges is determined in the following way. First, the ratio of the number of years remaining until the end of the useful life of the object is calculated to the sum of the numbers of years of the entire useful life. The resulting value is then multiplied by the actual cost of fixed assets. When applying this method, the annual amount of depreciation charges after modernization, reconstruction or revaluation is calculated based on the residual value of the asset, increased by the amount of costs for modernization, reconstruction, the amount of revaluation (or reduced by the amount of evaluation), and the ratio, the numerator of which is the number of years, remaining until the end of the useful life of the object, and the denominator is the sum of the numbers of years of the remaining useful life of this object.

- The method of writing off cost in proportion to the volume of production (work). Depreciation charges are determined by multiplying the natural indicator of the volume of production (work) in the reporting period by the calculated ratio. This ratio is calculated by dividing the initial cost of the asset by the estimated volume of production (work) for the entire useful life of the fixed asset. When choosing this depreciation method, the useful life is calculated based on planned production indicators. With the method of writing off the cost in proportion to the volume of production (work), the annual amount of depreciation charges after modernization, reconstruction or revaluation of fixed assets is determined based on the natural indicator of the volume of production (work) in the reporting period and the ratio of the residual value of the asset increased by the amount of costs for modernization, reconstruction, the amount of additional valuation (or reduced by the amount of depreciation), and the estimated volume of products (work) for the remaining useful life of the fixed asset.

Useful life of a fixed asset:

- Expected (calculated) period of use of the fixed asset, or

- The number of items expected to be produced using this asset.

The useful lives of property, plant and equipment should be reviewed periodically and, if assumptions differ materially from previous estimates, the amount of current and future period depreciation charges should be adjusted.

It should also be borne in mind that the rules for accounting and depreciation of fixed assets according to IFRS 16 may differ from the PBU of the Russian Federation.

Disposal and sale of fixed assets

Salvage value is the amount of cash that an entity expects to receive for an asset when it is disposed of at the end of its useful life, less the costs of disposal.

The residual value is reviewed at least annually and should be equal to the amount that the entity would currently receive if the asset reached the condition expected at the end of its useful life and was used during that life.

Depreciable cost is the difference between cost (or other amount reported instead of cost) and the asset's salvage value.

An item of property, plant and equipment must be written off when it is disposed of, or when a decision is made to cease using the asset and no further economic benefits are expected from its disposal.

Gains or losses arising on the disposal or sale of an item of property, plant and equipment should be determined as the difference between the estimated net proceeds on disposal and the carrying amount of the asset and recognized as income or expense in the income statement.

Disclosure of information about fixed assets

Information on each type of property, plant and equipment is disclosed in the notes and appendices to the financial statements.

Basic requirements for information disclosure:

- Basis for assessment;

- Depreciation methods and rates;

- Amount of depreciation charges;

- The amount of fixed assets under construction;

- Fixed assets pledged as collateral;

- Capital commitments for the acquisition of fixed assets;

- Base and date of revaluation;

- Balance of the revaluation amount.

- Book value.

We recommend attending financial seminars for economists and financiers. Schedule for this quarter >>>