How should salaries be paid?

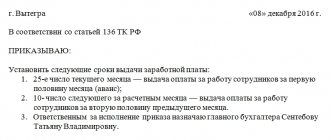

According to Art. 136 and 140 of the Labor Code of the Russian Federation, salaries are paid at least every half month. At the same time, it is also mandatory to issue a pay slip, the form of which is approved by the employer. It is noted there:

- salary elements that are due to the worker for the appropriate time;

- other accrued to the worker (compensation for the employer’s violation of deadlines for paying wages, vacation pay, dismissal payments, other payments);

- deductions with their amount and reasons;

- total payment amount.

The specific date of payment is stipulated by the internal labor regulations, collective or employment agreement. It may be distant from the end of the period that is paid by a maximum of 15 calendar days.

If the date coincides with a weekend or non-working holiday, wages are paid the day before.

Vacation pay is paid at least three working days before the start of the vacation.

Delay of wages: employer's responsibility

Delay in payment of wages creates different types of liability for different persons. This may include:

- criminal, depending on the nuances of a particular case. Threatens the head of an organization, the employer of an individual or the head of a structural unit of a company. This happens because only sane individuals over 16 years of age (in this case) are criminally responsible;

- administrative. Possible for officials (DL), individual entrepreneurs and legal entities, employers or their representatives if their guilt is proven;

- material. The leader answers;

- disciplinary. Affects the employer himself or his representatives.

Now in more detail about each type.

Issues of liability for non-payment of wages

This material has been prepared on the basis of the norms of the current legislation of Russia, taking into account existing judicial practice. If you need to provide legal assistance on the issue of collecting wages, you can contact the lawyers of the Law Office “Domkiny and Partners” who have professional specialization in this area of law.

The publication was prepared on the basis of the law as of 03/05/2011

Non-payment of wages to employees occurs quite often in both private commercial and budgetary organizations. By non-payment we mean both a delay in the payment of wages, regardless of the reasons for this delay, and the deliberate deprivation of wages to an employee under various pretexts. An employee who is faced with such a violation of his rights can and must defend himself by all available legal means and bring the unscrupulous employer to justice.

For employers and heads of organizations (officials) who violate labor legislation, administrative, criminal and financial liability is provided. In addition, the owner of the property can also apply disciplinary sanctions to the head of the institution.

Administrative liability of the employer for non-payment of wages

In accordance with Article 5.27 of the Code of Administrative Offenses of the Russian Federation, persons who have committed violations of labor legislation, including delays in payment of wages, may be held administratively liable. As measures of liability, the legislator provides for the imposition of an administrative fine:

- for officials in the amount of one thousand to five thousand rubles;

- for persons carrying out entrepreneurial activities without forming a legal entity - from one thousand to five thousand rubles or administrative suspension of activities for up to 90 days;

- for legal entities - from thirty thousand to fifty thousand rubles or administrative suspension of activities for up to 90 days.

Repeated violation of labor and labor protection legislation within a year by an official who was previously subjected to administrative punishment for a similar administrative offense entails disqualification for a period of one to three years (clause 3 of article 4.5 and clause 2 of article 5.27 of the Code of Administrative Offenses of the Russian Federation ).

Criminal liability of an employer for non-payment of wages

According to Article 145.1 of the Criminal Code of the Russian Federation, for non-payment of wages, pensions, scholarships, benefits and other payments, the head of an organization (the head of a branch, representative office, or other separate structural unit) may be held criminally liable. Non-payment of wages entails criminal liability only if the organization has funds and the non-payment is due to self-interest or other personal interest of the head of the organization.

In case of partial non-payment (payment in the amount of less than half of the amount payable) for more than three months of wages, pensions, scholarships, benefits and other payments established by law, the specified managers face:

- a fine of up to 120,000 rubles. or in the amount of wages or other income of the convicted person for a period of up to one year;

- deprivation of the right to hold certain positions or carry out certain activities for a period of up to one year;

- imprisonment for up to one year.

In case of complete non-payment of wages, pensions, scholarships, allowances and other payments established by law for more than two months or payment of wages for more than two months in an amount below the minimum wage established by federal law:

- a fine in the amount of 100,000 to 500,000 rubles. or in the amount of wages or other income of the convicted person for a period of up to three years;

- imprisonment for a term of up to three years with or without deprivation of the right to hold certain positions or carry out certain activities for a term of up to three years.

If non-payment (partial or full) has resulted in grave consequences, the head of the organization (branch, representative office, separate structural unit) may be subject to punishment in the form of:

- a fine in the amount of 200,000 to 500,000 rubles. or in the amount of wages or other income of the convicted person for a period of one to three years;

- imprisonment for a term of two to five years with or without deprivation of the right to hold certain positions or carry out certain activities for a term of up to five years.

Thus, both administrative and criminal liability can occur only if there is guilt.

If there is a delay in payment of wages, you can contact the manager with a demand to eliminate the violations of your rights, and with a promise to otherwise contact the law enforcement authorities with a statement to bring the manager to criminal liability. If this document is drawn up correctly, then, most likely, management will make contact. Promises about payments in the next month or quarter should not be trusted. A real confirmation of the intention of the organization’s management to pay you the debt will be the payment of the debt, if not all, then at least part. If your goal is not revenge, but to receive honestly earned money, then you need to use every opportunity to receive your back pay as soon as possible.

The employee also has another way of influencing the employer, which is especially effective if there is debt to a significant number of employees. An employee can exercise the right provided for in Part 2 of Article 142 of the Labor Code of the Russian Federation and suspend work if payment of wages is delayed for more than 15 days. It is very important to correctly document this situation with written documents - it is necessary to notify the employer in writing of the suspension of work on the specified grounds. Please note that an employee can suspend work until it is paid, regardless of whether the employer is at fault (clause 57 of the Resolution of the Plenum of the Armed Forces of the Russian Federation No. 2 of March 17, 2004)

Suspension of work is not allowed:

- during periods of martial law and a state of emergency;

- in military bodies and organizations in charge of ensuring the country's defense and state security, emergency rescue, search and rescue, fire-fighting work, work to prevent or eliminate natural disasters and emergency situations, in law enforcement agencies;

- civil servants;

- in organizations directly servicing particularly hazardous types of production and equipment. At the same time, employees of such organizations, whose rights to timely and full payment of wages have been violated, can appeal to the labor dispute commission, the court, or the state supervisory authorities and control over compliance with labor legislation (Determination of the Constitutional Court of the Russian Federation dated October 19, 2010 N 1304-O-O);

- an employee involved in ensuring the livelihoods of the population (energy supply, heating and heat supply, water supply, gas supply, communications, ambulance and emergency medical care stations).

During the period of suspension of work, the employee has the right to be absent from the workplace. An employee who was absent from the workplace during his working hours during the period of suspension of work is obliged to return to work no later than the next working day after receiving written notification from the employer of his readiness to pay the delayed wages on the day the employee returns to work.

The question regarding the employer’s obligation to pay wages to the employee during the period of suspension of work has different interpretations. According to Letter of the Federal Service for Labor and Employment dated October 4, 2006 No. 1661-6-1, during the suspension of work in the manner prescribed by Part 2 of Art. 142 of the Code, the employee’s wages should not be accrued.

Judicial practice on this issue is extremely ambiguous. The following options can be identified for resolving this issue by the judiciary:

- the law does not provide for the possibility of payment for the period of suspension of labor activity;

- if employees do not work due to lack of payment, the employer must pay for their suspension of work as idle time, i.e. in the amount of 2/3 of the average salary;

- An employee who was forced to suspend work due to a delay in payment of wages for a period of more than 15 days must be compensated for the average earnings he did not receive for the entire period of delay with the payment of interest (monetary compensation) in the amount established by Art. 236 Labor Code.

The latter position is reflected in the Review of Legislation and Judicial Practice for the fourth quarter of 2009 (approved by the Resolution of the Presidium of the Supreme Court of the Russian Federation dated March 10, 2010). It states that refusal to perform work is a forced measure provided for by law for the purpose of stimulating the employer to ensure payment to employees of the wages specified in the employment contract within the established time frame. This right requires the employer to eliminate the violation and pay the delayed amount.

It follows from Article 236 of the Labor Code that in case of delay in payment of wages, the employer is obliged to pay it with interest (monetary compensation) in the amount specified in the article. The amount of monetary compensation paid to an employee may be increased by a collective agreement.

Thus, the employer’s financial liability for delayed payment of wages involves not only compensation for the earnings received by the employee, but also the payment of additional interest (monetary compensation). This measure of employer liability occurs regardless of whether the employee exercised the right to suspend work. Moreover, since the Labor Code does not specifically provide otherwise, the employee has the right to retain his average earnings for the entire time of delay in payment, including the period of suspension of his work duties.

Based on the above, an employee who was forced to suspend work due to a delay in payment of wages for a period of more than 15 days, the employer is obliged to compensate the average earnings he did not receive for the entire period of its delay with the payment of interest (monetary compensation) in the amount established by Art. 236 Labor Code.

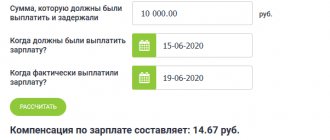

The minimum amount of compensation must be no less than 1/300 of the refinancing rate of the Central Bank of the Russian Federation in force during the period of delay in relation to amounts not paid on time for each day of delay, starting from the next day after the stipulated payment period and ending with the day of actual settlement (inclusive). Thus, the Labor Code of the Russian Federation determines the minimum amount of monetary compensation. The amount of monetary compensation may be increased if this is provided for by the terms of a collective or employment agreement.

In case of failure to pay the employee, simultaneously with the repayment of the debt, monetary compensation in accordance with Article 236 of the Labor Code of the Russian Federation, he can go to court with a demand to hold the employer financially liable in terms of paying interest for the delay in wages.

The employer's obligation to pay monetary compensation arises from the first day of delay in payments due to the employee and is not due to his fault.

From Art. 236 of the Labor Code of the Russian Federation it follows that monetary compensation is calculated on payments due to the employee, i.e. for amounts received after personal income tax withholding. The compensation paid is income exempt from taxation on the basis of clause 3 of Art. 217 of the Tax Code of the Russian Federation, regardless of whether it is provided for in a collective or labor agreement or not. If the specified compensation exceeds the minimum amount established by the Labor Code of the Russian Federation, then the excess amount is also not subject to personal income tax (Letter of the Ministry of Finance of Russia dated November 28, 2008 N 03-04-05-01/450).

Lawyer Nadezhda Domkina

Criminal liability

According to Art. 145.1 of the Criminal Code of the Russian Federation, a fine for non-payment of wages is imposed on the head of an enterprise, an individual employer, or the head of a particular structural unit of the company, if such non-payment was committed by them for selfish or other personal interest.

For partial non-payment (less than 50% of the due amount) for more than three months, the fine will be up to 120,000 rubles. or will be equal to the income of the convicted person for a maximum of one year. Other punishment options for this act are a ban on holding specific positions or engaging in certain activities for a period of up to a year, or forced labor for a period of up to two years, or imprisonment for a maximum of one year.

For complete non-payment of earnings that lasts more than two months, you will be fined 100,000–500,000 rubles. or the amount of the offender’s income for a maximum of three years. Other punishment options in this case may be either forced labor for up to three years with a ban on holding certain positions or carrying out specified activities for the same time or without it, or imprisonment for a maximum of three years with a ban on holding specific positions or working in a certain way ( or without it) for a maximum of three years. Similarly, they will be punished for paying wages below the minimum wage (currently 11,163 rubles) if this continues for more than two months.

In case of serious consequences (loss of ability to work, illness, death of a person, damage or loss of property, graduation due to the inability to pay for it, etc.) that resulted from the above acts, penalties will increase as follows:

- fine for late wages - 200,000–500,000 rubles. or the offender’s income for one to three years;

- imprisonment - two to five years plus a ban on holding certain positions or engaging in any activity (or without it) for a maximum of five years.

How can an employer defend himself against accusations of non-payment of wages?

The whole point is that in order to bring the head of an organization to criminal liability, the conditions for liability for non-payment of wages to employees must be met. It should be noted that in order to impose criminal liability for unlawful actions of an employer in the form of non-payment of wages, in addition to a selfish motive, a number of conditions must be met based on the legislation of the Russian Federation, in particular:

- The employer has a real opportunity to liquidate the resulting debt to the employee or employees, but sells these funds for other purposes, for example, the purchase of equipment, renovation of premises, personal needs;

- Non-payment of wages must be made over a certain period , based on the legislation, this period is more than two months, that is, during this period the employee must not receive any funds from the employer as wages;

- For partial payment of wages, a different period is established; in this case, in relation to an employee, the employer allows partial payment of wages for more than three months. It should be taken into account that partly received wages are considered to be wages in the amount of less than half of the monthly salary.

If the conditions are not met, the accusation against you is brought prematurely and unfoundedly, then our criminal lawyer will build a defense for the accused against this composition and defend the honest name of a law-abiding manager. Read the advice of a criminal lawyer at the link and carry out your defense 100%.

ATTENTION : watch a video about defending the rights of the accused by a lawyer and subscribe to our YouTube channel, you will have access to free legal assistance from a lawyer through comments on the video.

Administrative responsibility

The fine for late payment of wages can also be administrative (under Parts 6 and 7 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation), if there are no signs of a criminal act indicated in the previous section. According to Part 6 (under which a warning is possible instead of a fine), the fine will be for:

- DL (for example, accountant) - 10,000–20,000 rubles. In case of repeated non-payment or incomplete payment of wages on time or if its amount is less than the minimum wage - 20,000–30,000 or disqualification for one to three years;

- IP - 1000-5000 rubles, for repeated violation - 10,000-30,000;

- legal entities - 30,000-50,000 rubles, second time - 50,000-100,000;

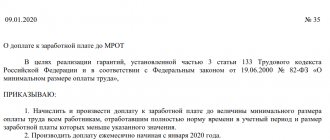

Paying less than minimum wage

According to the position of the Constitutional Court of the Russian Federation, the minimum wage must be provided to all citizens working under an employment contract, i.e. is a general guarantee provided to employees regardless of the location in which the work activity is carried out.

As we have already noted, the minimum wage is established simultaneously throughout the entire territory of the Russian Federation and cannot be lower than the subsistence level of the working population (Article 133 of the Labor Code of the Russian Federation).

From the materials of one case it follows that the amount of workers' salaries paid monthly was not made in full and did not include payments of the regional coefficient and bonuses for work experience in the Republic of Khakassia (Decision of the Supreme Court of the Republic of Khakassia dated October 29, 2019 No. 7R-192 /2019). The punishment for the manager was also imposed within the sanction of Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

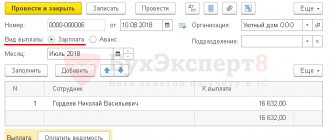

Material liability

According to Art. 236 of the Labor Code of the Russian Federation, violating the established deadline for paying wages, the employer is obliged to return the money with compensation (interest) in the amount of at least 1/150 of the key rate current at that time. On the one hand, this is the minimum with which the Central Bank of the Russian Federation lends to commercial banks for a week, on the other hand, this is the maximum with which the Central Bank of the Russian Federation accepts money from banks for deposits. Now it is 7.25%.

The amount of compensation is calculated from the unpaid amount for each day of delay. The beginning is the day after the payment due date, including the day of actual settlement. Partial payment of wages on time means that the amount of compensation is calculated from the amounts actually not paid on time. The indicated value may be greater due to a collective or labor agreement or local regulation. The employer is obliged to pay such compensation regardless of whether he is guilty or not.

Without trial

There are no universal instructions on how to get your money from your employer; each such case is individual. There are several ways to solve the problem:

- negotiations with the employer;

- refusal to continue working;

- appeal to the special commission on labor disputes, also known as the SCC;

- contacting the labor inspectorate, also known as the State Labor Inspectorate;

- appeal to the prosecutor's office.

Let's look at each method in more detail.

Question: An employee is fired on May 22 (by order). All payments upon termination of the employment contract are made on May 25, including compensation for delayed wages. Is the employer exempt from liability for late payment of wages? View answer

Negotiations with the employer

The employer is obliged to pay wages at least 2 times a month, on certain days. They are prescribed in the employment contract, regulations on remuneration or in the collective agreement (Labor Code of the Russian Federation, Article 136-4). In certain cases, an oral or written appeal to the administration with a demand to repay the debt is sufficient. The same article of the Labor Code states that the administration is obliged to compensate for delayed salaries (calculated at a refinancing rate of 1/300). The rate is applied for each day of delay, the period begins to count after the officially established payment day. In LNA, higher compensation may be established.

On a note! Compensation amounts are calculated on the amount of wages after personal income tax withholding, due “on hand”.

Refusal to work

Refusal to work or suspension of work activity is possible if the administration has not responded to the appeal (Labor Code of the Russian Federation, Article 142, paragraph 2). The timing is important here - 2 weeks of delay in payments gives the right not to go to work after a written application to this effect is submitted to the employer. It is important to officially register it with the secretariat, with a mark on the second copy of the admission document. Some categories of workers are deprived of the right to suspend activities under this article (military, energy workers, gas workers, etc., the article contains a full list of them). According to the Supreme Court of the Russian Federation (review of judicial practice, approved by Resolution dated 10/03/10, issue 4), the time of forced refusal to work should be paid according to the employee’s average earnings.

When considering a case brought by an employee, whose employment relationship has not been terminated, for the recovery of accrued but unpaid wages, it must be taken into account that the employer’s statement about the employee missing the deadline to go to court cannot in itself serve as a basis for refusing to satisfy the claim, since in this case the deadline for going to court has not been missed, since the violation is of a continuing nature and the employer’s obligation to timely and fully pay the employee wages, and even more so the delayed amounts, remains throughout the entire period of validity of the employment contract. View the court's opinion

The employee is obliged to go to work the next day after receiving official notification in writing that they are ready to pay him a salary. The employer is obliged to do this on the day the employee leaves. Salaries are issued with compensation for delays.

Labor Dispute Commission

The CCC is created as a body to resolve individual labor disputes in organizations or their divisions at the initiative of employees and/or employers. The work procedure of the commission is discussed in a number of articles of the Labor Code of the Russian Federation (Articles 382, 384-389). The deadline for contacting the commission is three months from the moment the employee learned of non-payment of wages. If the management does not comply with the CTS decision in favor of the employee, the employee has the right to receive a document confirming the decision in his favor and apply to the FSSP. The bailiffs are obliged to make the decision for execution.

Contacting the labor inspectorate

GIT is another effective way to solve the problem. The State Labor Inspectorate has broad powers to protect the rights of workers in the event of delays in payments. The appeal cannot be anonymous, but the applicant has the right not to disclose his identity to the administration (Labor Code of the Russian Federation, Article 358). This must be indicated in the application. The essence of the complaint must be formulated briefly and to the point, indicating the period of non-payment, amount, and other circumstances important for consideration. It is advisable to attach a copy of the employment agreement as proof of the existence of an employment relationship. The period for consideration of such a complaint is one month. Ignoring the instructions of the State Labor Inspectorate threatens the employer with considerable fines (Labor Code of the Russian Federation, Art. 360, Administrative Code, Art. 5.27), and other liability, even criminal (Criminal Code of the Russian Federation, Art. 145.1).

Contacting the prosecutor's office

The prosecutor's office also accepts allegations of violations of payments under employment contracts. The appeal contains the same information as in the GIT complaint. Be sure to include your own contact information and any known information about the employer who committed the violation. At the end of the application, be sure to put a personal signature and date, attach a copy of the contract, and evidence of non-payment of wages, if any. The review period is the same - 30 days. It may be doubled in exceptional cases. Citizens have the opportunity to contact the prosecutor’s office through the website and the “Internet reception” service, send a letter by mail as a registered letter, or take the appeal to the reception in person.

Disciplinary responsibility

According to Art. 19 Federal Law No. 10 of January 12, 1996, trade unions have the right to independently monitor compliance by employers with labor legislation, including issues of remuneration. The result of such control may be a corresponding statement to the employer about violations committed by management. The employer reviews it within a week, after which measures are taken to eliminate the violation and a certain disciplinary sanction is imposed on the perpetrators, which is reported to the applicant. The punishment is valid for one year from the date of its imposition by an appropriate order.

Thus, if a violation is actually proven, wages withheld through the fault of the manager or DP may give rise to one or another disciplinary sanction (reprimand, reprimand or dismissal) for these persons. This influence on the management of the organization is exerted by the employer.