The organization installed a video surveillance system in the building. The cost of the equipment was 84,000 rubles, including VAT at a rate of 20% - 14,000 rubles. To pay for the installation and installation of equipment, we paid 24,000 rubles, including VAT at the rate of 20% - 4,000 rubles.

In accounting, the video surveillance system was classified as part of fixed assets. According to the accounting policy for accounting and tax accounting, depreciation on fixed assets is calculated using the straight-line method.

In tax accounting, in accordance with the Classification of fixed assets, the video surveillance system was included in the fourth depreciation group with a useful life of five to seven years (code 320.26.30.1 “Communication equipment, radio or television transmitting equipment”) and a service life was established for it, equal to 80 months.

How to reflect the operation of installing a video surveillance system in the accounting and tax records of our organization?

Accounting

Equipment, the commissioning of which is possible only after all its parts have been assembled and attached to the supporting structures of the building, for accounting purposes is equipment that requires installation.

Equipment requiring installation is taken into account in an assessment equal to the contract value paid to the seller (excluding VAT, subject to deduction) (paragraph 2, 3, clause 23 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n).

Installed equipment is accepted for accounting as part of fixed assets at its original cost, formed in this case based on the amount of actual costs for the acquisition of equipment (contractual price paid to the seller without VAT), costs associated with installation of equipment by a contractor (contractual cost of installation work excluding VAT accounting) (clauses 4, 7, 8 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n).

Thus, when a video surveillance system is received by an organization, it is credited to account 07 “Equipment for installation” at the actual cost, equal in this case to its contractual value (excluding VAT) (Instructions for using the Chart of Accounts, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

When transferring equipment for installation, its actual cost is written off from account 07 “Equipment for installation” to the debit of account 08 “Investments in non-current assets”.

The cost of installation work is also reflected in the debit of account 08 “Investments in non-current assets”.

As a result, the initial cost of the video surveillance system will be formed on this account, which, after completion of installation work and when it is put into operation, is transferred to account 01 “Fixed Assets”.

In your situation, the initial cost of the video surveillance system is 90,000 rubles. (84,000 rubles - 14,000 rubles. 24,000 rubles - 4,000 rubles).

How to choose KOSGU and KVR when accounting for the system?

When choosing KVR and KOSGU when taking into account the system, options are also possible, since it can be purchased under different circumstances. For example, a contract for the installation of a video surveillance system from a contractor’s materials can be concluded independently. Also, a video surveillance system can be installed as part of a major renovation or construction (reconstruction) of a building.

More on the topic: KVR 112: how to apply without errors?

When choosing a CVR, it is important to consider the circumstances under which the system is installed. For example, is the installation of a system an independent fact of economic life or is it carried out as part of certain activities: major repairs or construction (reconstruction). At the same time, how the system will be taken into account does not play a role when choosing a KVR - these circumstances will be important when choosing the KOSGU code.

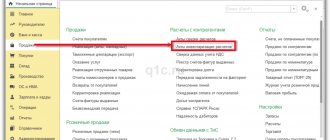

Let us list the KVR and KOSGU codes for the above situations.

KVR options*(1):

- 244 “Other procurement of goods, works and services”, if a separate contract has been concluded for the installation of a system from the contractor’s materials. At the same time, if we are talking about government institutions or authorities (local government), the system should not belong to the field of information and communication technologies;

- 242 “Purchase of goods, works, services in the field of information and communication technologies”, if a separate agreement is concluded for the installation of a system from the contractor’s materials. Moreover, if we are talking about government institutions or authorities (local self-government), the system must relate to the field of information and communication technologies. CVR 242 is not applied by budgetary and autonomous institutions;

- 243 “Purchase of goods, works, services for the purpose of overhaul of state (municipal) property”, if the system is installed as part of the overhaul;

- 407 “Construction (reconstruction) of real estate by state (municipal) budgetary and autonomous institutions”, if the system is installed in a budgetary or autonomous institution as part of the construction (reconstruction) of a building;

- 414 “Budget investments in capital construction projects of state (municipal) property”, if the system is installed by a government agency (authority or local government) as part of construction (reconstruction).

KOSGU options*(2):

- From the system, you can select objects related to fixed assets. The remaining costs are included in the financial result of the current financial year. Since not all costs for installing the system will be charged to account 106 01 “Investments in fixed assets”, but only those that form the cost of fixed assets, costs for installing the system are reflected in subarticle 226 “Other work, Work, services for property maintenance” KOSGU, if the installation of the system is carried out not under an independently concluded contract, but as part of repair work and is included in the general act.

- It is impossible to select objects related to fixed assets from the system. All expenses are written off to the financial result of the current year. Under such conditions, all expenses are written off to the financial result of the current year under subarticle 226 “Other work, Services, work for capital investment purposes” of KOSGU.

- The institution decided to account for the system as a fixed asset. If the commission for the receipt and disposal of assets decides that the installed system is a fixed asset, then the costs are charged to Article 310 “Increase in the cost of fixed assets” of KOSGU.

More on the topic: Incoming balances on settlement accounts for receivables and payables: a new procedure from 01/01/2021 for public sector institutions

Depreciation

The cost of an asset is repaid by calculating depreciation (clause 17 of PBU 6/01).

The annual amount of depreciation charges using the linear method of calculating depreciation is calculated based on the initial cost of the fixed asset and the depreciation rate calculated based on the useful life of this object (clauses 18, 19 of PBU 6/01).

The useful life of an asset is established when it is accepted for accounting based on the expected period of its use (clause 20 of PBU 6/01).

At the same time, for accounting purposes, when establishing the useful life of an object of fixed assets (FA), the organization can be guided by the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation of 01.01.2002 N 1 (paragraph 2 of clause 1 of the Decree of the Government of the Russian Federation N 1).

Thus, in accounting, an organization has the right to set the useful life of an item of fixed assets, the same as in tax accounting.

Depreciation charges for equipment are recognized in accounting as expenses for ordinary activities in the reporting period to which they relate (clauses 5, 8, 16, 18 of the Accounting Regulations PBU 10/99 “Organization Expenses”, approved by Order of the Ministry of Finance Russia dated 05/06/1999 N 33n).

Thus, the amount of accrued depreciation on equipment is included monthly in expenses for ordinary activities.

Depreciation begins on the 1st day of the month following the month in which this object was accepted for accounting, and is carried out until the cost of this object is fully repaid or this object is written off from accounting (clause 21 of PBU 6/01).

Purchase and installation of a video surveillance system for an accountant

- debit KRB 010601310, credit KRB 030219730 reflects the cost of the purchased system installed by the contractor on a turnkey basis

- debit KRB 130219830, credit KRB 130405310 payment under the contract for the installation of a turnkey system at the expense of budgetary funds;

- debit KRB 230219830, credit KIF 220211610 payment under the contract for installation of the system as part of income-generating activities (at the same time, an increase in off-balance sheet account 18 “Retirement of funds from the accounts of the institution” according to KOSGU 310 is reflected);

- debit KRB 010104310, credit KRB 010601410 the video surveillance system was accepted for accounting as a single inventory item at its original cost.

We recommend reading: Find out the registration certificate by Taxpayer Identification Number

Budget accounting: if an institution buys components for a video surveillance system on its own, they should not be included as separate fixed assets, because the video surveillance system is a complex, but unified fixed asset.

VAT

After accepting the equipment for accounting (on account 07 “Equipment for installation”), the organization has the right to deduct the VAT presented by the seller upon transfer of the equipment.

The deduction is made on the basis of the seller’s invoice, drawn up in compliance with the requirements of the law, in the presence of relevant primary documents and provided that the equipment is intended for use in transactions subject to VAT (clause 1, clause 2, article 171, clause 1, article 172 , clause 2 of article 169 of the Tax Code of the Russian Federation).

The organization has the right to deduct VAT presented by the contractor for work performed on the basis of an invoice issued in compliance with the requirements of the law, and provided that the installed equipment is intended for carrying out operations subject to VAT.

The deduction is made after the work performed is accepted for accounting and in the presence of the corresponding primary documents (clause 6 of Article 171, clause 5, clause 1 of Article 172, clause 2 of Article 169 of the Tax Code of the Russian Federation).

Accounting entries for fixed assets in budgetary organizations

Fixed assets are recorded in accounting registers at their original cost. It includes the costs of purchasing and constructing facilities, consulting services, delivery and other costs required to bring the facility into a state of readiness for operation, taking into account the VAT charged. Accounting in budget accounting accounts is carried out in rubles and kopecks.

Budgetary organizations are institutions financed from budgetary funds. Accounting in such organizations is carried out on the basis of a special chart of accounts for budgetary institutions with their own entries, which is approved by Order No. 174n of the Ministry of Finance of the Russian Federation dated December 16, 2021. In all budgetary institutions, fixed assets, according to Instruction No. 25n, are accounted for in account No. 010100000 - Basic facilities.

We recommend reading: If You Didn’t Sell a Credit Car at an Auction and the Bailiffs Refused It

Income tax

In tax accounting, property with an initial cost of more than 100,000 rubles is recognized as a fixed asset. (Clause 1 of Article 257 of the Tax Code of the Russian Federation).

In this case, the initial cost of the video surveillance system is 90,000 rubles. (84,000 rub. - 14,000 rub. 24,000 rub. - 4,000 rub.).

Therefore, property worth up to 100,000 rubles. inclusive from the point of view of tax accounting is not a fixed asset.

Thus, for tax accounting purposes, property worth 100,000 rubles. and less is not a fixed asset and is not depreciated. This conclusion follows from paragraph 1 of Art. 256, paragraph 1, art. 257 Tax Code of the Russian Federation.

In this regard, property worth up to 100,000 rubles. inclusive, can be taken into account as part of material costs.

At the same time, there are two options for writing off such an asset (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation):

- the property is written off as expenses in full at the time of commissioning;

- property is written off as expenses over several reporting periods, taking into account the period of its use.

The organization decides which of these options to choose independently.

The selected option must be reflected in the accounting policy (Letter of the Ministry of Finance of Russia dated 03/06/2019 N 03-03-07/14527).

Recording video surveillance in a government institution

If the video surveillance system, by all criteria, is a particularly valuable property and you purchase it according to KFO 5. then the installation had to be paid for according to the same KFO and KOSGU. You simply now change the KOSGU at the bank by submitting to the Federal Treasury a notice of clarification of the budget classification code of the Russian Federation on cash payments made.

If the contract

and other documents, the cost of equipment is separately described and the cost of services for installing the system is indicated separately, payment should be made for services for installing the system under subarticle 226 of KOSGU, and for equipment provided by the contractor under subarticle 310 of KOSGU. At the same time, the entire amount of payment under the contract (for both KOSGU) forms the initial cost of the video surveillance system as a single object of fixed assets.

We recommend reading: What Documents Are Needed to Apply for Child Benefit From 15 Years to 3 Years for Payments of 10 Thousand 2021-2021

Replacement of CCTV cameras

We draw the attention of readers that, according to paragraphs. 3 p. 3 art. 3 of the Law of the Russian Federation No. 2487-1 [4] the protection of objects and (or) property on them with the implementation of work on the design, installation and operational maintenance of technical security equipment [5] is carried out by organizations that have a license for security activities. This, in particular, is stated in the Letter of the Ministry of Economic Development of the Russian Federation dated April 26, 2021 No. D05-1223.

We recommend reading: How to receive compensation for a participant in the liquidation of the Chernobyl accident in Russia

A video surveillance system is a software and hardware complex (video cameras, lenses, monitors, recorders and other equipment) designed for organizing video monitoring, both at local and geographically distributed facilities.

DVR: OKOF code required to register the device

It has already been mentioned that video monitoring systems do not have a separate group according to OKOF, but can be classified in the fourth group. Therefore, the useful life of the equipment must be determined independently, based on the recommendations of the manufacturer and the technical features of the device. The service life must be determined taking into account the following points:

- For municipal, autonomous and budgetary organizations - 0 101 34 000 (equipment related to not particularly valuable property of the organization);

- For budgetary institutions with a subsidy - 0 101 24 000 (devices that are particularly valuable property of the institution).