What goods are subject to excise duty?

An excise tax is an indirect federal tax that must be paid on certain goods and services. Their list is given in Art. 181 Tax Code of the Russian Federation:

- ethyl alcohol from food and non-food raw materials, including denatured, raw alcohol, distillates;

- alcohol with an ethyl alcohol content of more than 0.5%, beer, wine materials;

- cigarettes, cigars, hookah tobacco and other tobacco products;

- diesel fuel, motor oils for diesel and injection engines;

- straight-run gasoline;

- grape;

- vapes and liquids for them;

- cars and motorcycles;

- and other types of goods.

If you import goods from the list given in Art. 181 of the Tax Code of the Russian Federation, to Russia, they must pay excise taxes. Exporters (those who export excisable products from the Russian Federation) are not required to pay excise tax.

Some excisable goods are exempt from excise taxes upon import. Aviation kerosene, benzene, paraxylene, orthoxylene and petroleum raw materials fall into this category (Article 183 of the Tax Code of the Russian Federation, letters from the Ministry of Finance).

Further sales of imported excisable goods will not be subject to excise taxes.

In what tax period is excise duty paid?

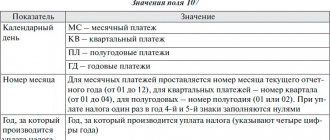

The period in which excise duty must be paid to the budget depends on the type of excisable goods and the transaction performed. Consolidated information on the deadlines for paying excise duty in certain cases is presented below in the form of a table.

| Operation | Payment deadline | Example |

| General procedure | Until the 25th of the next tax period | Beer sold 17,320 bottles of beer in September 2016. Sokol will pay the tax on 10/08/16 (until 10/25/16). |

| Processing of straight-run gasoline, denatured alcohol, middle distillates | Until the 25th day of the 3rd month of the next tax period | Nefteprom JSC is engaged in the processing of straight-run gasoline. 07/27/16 Nefteprom accepted 12,410 tons of gasoline for processing. Nefteprom paid the excise tax for July on 10/04/16 (until 10/25/16). |

| Sales of middle distillates in favor of foreign companies in the Russian Federation | Until the 25th day of the 6th month of the next tax period | JSC Glavmash, a supplier of bunker fuel, sold Czech goods in September 2016 (in the Russian Federation). Glavmash transferred the excise tax for this supply on 03/12/17 (until 03/31/17). |

| Sales of middle distillates in favor of foreign companies outside the Russian Federation | Until the 25th day of the 6th month of the next tax period | JSC Nedra has a license to use the subsoil of the continental shelf of the Russian Federation. In April 2016, Nedra sold excisable goods to a Finnish company, the goods were placed under the customs export procedure. Excise tax on goods was transferred to the budget on 10/17/17 (until 10/25/17). |

Payment of excise tax is accompanied by filing reports with the tax authority. The deadline for submitting an excise tax declaration depends on the type of excisable goods and the transaction performed and is similar to the deadline for paying tax to the budget. In this regard, we consider it advisable to first submit reports to the tax office, and then transfer the specified amount of tax to the budget.

Advances on excise taxes: calculation, payment, terms

For a number of excise transactions, a procedure has been established according to which the company is obliged to make prepayments for excise tax. You are required to pay excise tax in advance if:

- Your company operates in the production of alcoholic and/or alcohol-containing products;

- the company purchases raw materials - ethyl alcohol, raw alcohol, which is subsequently used for the production of excisable goods.

Also, excise tax will have to be paid in advance by those companies that transfer alcohol-containing raw materials for processing to other divisions (branches, departments, representative offices) within the organization.

To calculate the advance amount, use the following indicators:

- the volume of alcohol purchased (transferred within the organization) within the tax period (month);

- tax rate.

The advance amount is determined as a derivative of the above values.

The advance payment for excise duty on the next month's purchases must be made before the 15th of the current tax period. The question arises: how to calculate the advance amount if the purchase of alcohol is only planned, but has not yet been carried out. In this case, you can take as a basis not the actual, but the planned indicator. For example, if the supply of alcohol has not been carried out, but its volume is specified in the contract, you can calculate the advance amount based on the indicator specified in the agreement.

Example No. 1.

On 11/10/16, a contract for the supply of alcohol (share 6.5%) - 118 liters was concluded between JSC Spirprom and JSC Solnechnaya Dolina. The delivery of alcohol to the Solnechnaya Dolina warehouse is planned on December 28, 2016.

In order to pay the excise tax advance on time (by November 15, 2016), the Solnechnaya Dolina accountant made the following calculation:

118 l * 400 rub. (established rate) = 47,200 rub.

The amount was transferred to the budget on 11/12/16. The Sun Valley accounting records reflect the following:

| date | Debit | Credit | Operation description | Sum | A document base |

| 12.11.16 | 19 Excise taxes | 68 Excise taxes | The accrual of the amount of advance excise tax for the upcoming supply of alcohol from JSC "Spirtprom" is reflected | 47,200 rub. | Accounting certificate-calculation |

| 12.11.16 | 68 Excise taxes | 51 | The amount of the excise tax advance was transferred to the budget | 47,200 rub. | Payment order |

The accountant of Solnechnaya Dolina confirmed the transferred advance amount by providing the following to the tax office:

- a copy of the payment order;

- a copy of the bank statement;

- notice of advance payment (4 copies, including 1 in electronic form).

All of the above documents were provided by Solnechnaya Dolina within the established deadline – November 13, 2016 (before the 18th of the current tax period).

Who pays excise taxes

When importing goods into the Russian Federation, the declarant or another responsible person (customs broker) must pay excise duty.

The payment procedure depends on the customs procedure under which the goods are placed. This is discussed in more detail in Art. 185 Tax Code of the Russian Federation:

- excise taxes are paid in full if customs procedures for release and processing for domestic consumption or a free customs zone regime are introduced;

- do not pay excise tax if customs procedures of transit, free warehouse, destruction, duty-free trade, etc. are introduced;

- are fully or partially exempt from excise duty if the goods are imported temporarily.

Procedure and deadlines for paying excise taxes

Excise tax is paid on time and in accordance with the scheme specified in Art. 204–205.1 Tax Code of the Russian Federation. At the same time, the features of this procedure are considered separately in the Tax Code of the Russian Federation:

- for operations with PT;

- situations of import of PT into Russia and territories under its jurisdiction;

- operations with natural gas.

Payment of excise taxes when carrying out transactions with PT

In general, excise tax is paid (unless otherwise provided in Article 204 of the Tax Code of the Russian Federation):

- no later than the 25th day of the month following the expired tax period when transferring or selling PT by their manufacturers;

- based on data on actual sales volumes of PT.

There are also other deadlines for paying excise taxes:

- Not later than the 25th day of the 3rd month following the expired tax period, taxpayers are required to pay excise tax (clause 3.1 of Article 204 of the Tax Code of the Russian Federation):

- carrying out operations with aviation kerosene, if they are: included in the REGA of the Russian Federation (Register of Civil Aviation Operators);

- have an air operator certificate;

- with straight-run gasoline;

- No later than the 25th day of the 6th month following the tax period (in which the relevant transactions were carried out), payment of excise tax is made by taxpayers carrying out transactions recognized as an object of taxation in accordance with subparagraph. 30, 31 clause 1 art. 182 of the Tax Code of the Russian Federation (clause 3.2 of Article 204 of the Tax Code of the Russian Federation).

In some cases listed in Art. 204 of the Tax Code of the Russian Federation, excise tax payers transfer an “excise” advance payment, which they notify tax authorities about in a special manner.

Payment of excise taxes when importing excisable goods into the Russian Federation and other territories under its jurisdiction

Art. 205 of the Tax Code of the Russian Federation determines that the payment of excise taxes in such a situation is carried out taking into account:

- provisions of the law of the Eurasian Economic Union;

- legislation of the Russian Federation on customs affairs (TC CU - Customs Code of the Customs Union, law dated November 27, 2010 No. 311-FZ on customs regulation in the Russian Federation, etc.).

Does the amount of excise tax affect the amount of VAT calculated when importing goods into the Russian Federation, see the material “Inclusion of transport costs in the customs value”.

When importing PT, different customs procedures have their own deadlines for paying excise taxes:

- when releasing PT for domestic consumption, excise duty is paid after registration of the customs declaration, but before the release of the goods (clause 3 of Article 211 of the Customs Code of the Customs Union);

- when processing PT for domestic consumption, the excise tax is paid before the release of PT (Clause 4, Article 274 of the Labor Code of the Customs Union);

- when processing food products in the customs territory - the obligation to pay excise tax arises from the moment of registration of the customs declaration (within the time limits specified in paragraph 3 of Article 250 of the Customs Code of the Customs Union, depending on the situation: on the day of transfer of goods, on the day of loss of goods, or on the day of expiration of the processing period for goods ).

Specific deadlines for paying excise taxes:

- no later than the 20th day of the next month after the receipt of imported goods - when importing goods from the EAEU states;

- within 5 days from the moment of receipt of marked goods - for imported marked goods (clause 4 of article 186.1 of the Tax Code of the Russian Federation);

- other terms for types of PT and operations with them in accordance with the Labor Code of the Customs Union and the Tax Code of the Russian Federation.

Payment of excise tax on natural gas

The procedure for paying excise tax on natural gas is established in clause 7 of Art. 205.1 Tax Code of the Russian Federation. Excise duty on this type of product is paid upon its sale or transfer within the period specified in clause 3 of Art. 204 of the Tax Code of the Russian Federation - no later than the 25th day of the month following the expired tax period.

How to calculate excise duty payable

Excise tax rates are established in Art. 193 Tax Code of the Russian Federation. There are three types of bets:

1. Solid - set in rubles per unit of measurement of the product. For example, the excise tax rate on wine materials is 32 rubles / 1 liter.

The excise tax amount is calculated using the formula:

Excise duty = Tax base × Excise rate

The tax base is the volume or quantity of goods imported from abroad in physical terms.

2. Combined - part is set in rubles per unit, and part as a percentage of the estimated cost. For example, the excise tax rate on cigarettes is 2,359 rubles per 1,000 pieces + 16% of the estimated cost.

In this case, the excise tax is calculated more complicated:

- Stage 1. Amount of excise tax in rubles for 1,000 pieces + Amount of excise tax as a percentage of the estimated value in maximum retail prices (registered in the Notice of maximum and minimum retail prices submitted during customs clearance).

- Stage 2. Excise tax is calculated at the minimum specific rate.

- Stage 3. Compare the amounts from stages 1 and 2. Pay into the budget the one that is larger.

From September 1 to December 31, when importing cigarettes, cigarettes, cigarillos, bidis or kreteks into Russia, the increasing coefficient TV must be applied (clause 10 of Article 194 of the Tax Code of the Russian Federation).

3. Calculated - calculated using a special formula taking into account coefficients. For example, the excise tax rate on straight-run gasoline is determined in rubles per 1 ton using the formula: Apb = 13,100+ 4,865 × K corr.

Where and when to pay customs excise taxes

The place and time of payment of excise taxes depend not only on the customs procedure, but also on the country from which the goods are imported. Different rules apply for imports from the EAEU countries and other countries.

According to standard rules, import excise duty is paid to the customs authority that releases the goods. Importers pay it to the tax office at their place of registration only when they import goods from the EAEU that are not subject to labeling.

Excise duty must be paid along with other customs payments before submitting a customs declaration.

How to determine the place of payment of excise tax

For excisable goods (PT), excise duty is paid at the following place:

- capitalization of purchased PT - if transactions were completed in accordance with subparagraph. 20 clause 1 art. 182 Tax Code of the Russian Federation;

- location of the taxpayer - if the transactions provided for in subparagraph 21, 23–29 paragraph 1 art. 182 Tax Code of the Russian Federation;

- location of the taxpayer and/or its separate divisions - if they carry out operations in accordance with subparagraph. 30, 31 clause 1 art. 182 Tax Code of the Russian Federation;

- PT production - in other cases.

When importing imported PT, as a general rule, excise duty is paid at customs (Article 205 of the Tax Code of the Russian Federation, Article 84 of the Labor Code of the Customs Union). An exception is the import of PT that is not subject to mandatory labeling into the territory of the EAEU. In this case, the payment of excise tax is controlled by tax authorities (clause 13 of Appendix No. 18 to the Treaty on the EAEU). Excise duty on goods subject to labeling is paid at customs (Clause 1, Article 186 of the Tax Code of the Russian Federation).

Excise tax on natural gas is paid at the place where the taxpayer is registered with the tax authority, unless otherwise established by international treaties of the Russian Federation (clause 7 of Article 205.1 of the Tax Code of the Russian Federation).

Find out how to determine the place of payment of taxes in the Russian Federation from the materials posted on our portal:

- “Where to pay VAT and how and where to find the correct details for payment?”;

- “General procedure and terms for payment of personal income tax”;

- “Advance payments under the simplified tax system: calculation, payment terms, BCC”.

Import from the EAEU

According to the agreement on the EAEU, excise taxes are paid in Russia. Where and how to pay it depends on whether the imported product is subject to labeling.

If labeling is not required , pay excise tax to the Federal Tax Service at your place of registration. The payment deadline is no later than the 20th day of the month following the month the goods were accepted for accounting. The excise tax rate is fixed, given in Art. 193 Tax Code of the Russian Federation. The tax base is determined on the date of registration of goods.

Additionally, no later than the 20th day of the month following the month of acceptance of goods for registration, submit to the Federal Tax Service a declaration on indirect taxes and documents: application for import, bank statement for payment of excise duty, transport or shipping documents, agreement, invoices, etc.

If labeling is required , pay excise tax at the issuing customs office within five days after receipt of imported goods. The tax base is determined on the date of receipt of goods. The excise tax rate will be given in Art. 193 Tax Code of the Russian Federation.

To declare the import of marked goods, submit a customs declaration and documents: application for payment of excise duty, shipping (transport) documents, certificates, invoices, contracts, etc.

Object of excise taxation

Briefly, according to Art. 182 of the Tax Code of the Russian Federation, the object of excise taxation is a list of operations specified in it, carried out with excisable goods (PT). Basically, most transactions that are subject to excise taxation are carried out in the Russian Federation. These include, in particular:

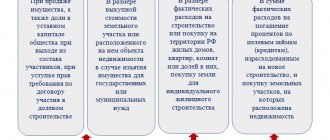

- implementation:

- excisable goods by their manufacturers on the territory of the Russian Federation (taking into account the PT acting as collateral, the subject of a novation or compensation agreement);

- Russian suppliers (as well as agents and commission agents) of bunker fuel exported on water vessels outside the Russian Federation as supplies under the law of the EAEU, as well as exported PT aimed at geological exploration of the continental shelf of the Russian Federation;

- confiscated or ownerless PT according to court decisions, as well as PT that was abandoned in favor of the state, subject to conversion into municipal or state property;

- PT transmission:

- produced from customer-supplied raw materials - to their owner or other persons, including in payment for production services, as well as for processing;

- within the company - manufactured for further production of excise-free goods (except for produced denatured ethyl alcohol, straight-run gasoline);

- between structural divisions of one company that are not independent taxpayers - transfer of produced ethyl alcohol for the production of excisable products;

- by producers of PT - for their own needs, into the authorized capital, mutual funds, as a contribution under a simple partnership agreement when carrying out joint activities;

- to a company participant (his successor) upon his withdrawal from the company and the allocation of a share of the property due;

- receipt (receipt) of PT by companies that have a certificate for their production and processing, as well as for the production of non-excise products; the moment of acceptance of it for accounting is considered to be the moment of its acceptance for accounting;

- import of PT into the Russian Federation and territories under its control. For goods imported into the customs territory of the Russian Federation, the object of excise taxation is their full customs value, which takes into account the amounts of customs duties and fees.

When a company operating excisable goods is reorganized, all rights and obligations to pay excise taxes are transferred to its successors.

A complete list of transactions subject to excise taxes is given in Article 182 of the Tax Code of the Russian Federation.

Tax and accounting of excise duties

Excise taxes are included in the price of goods. There is one exception: if an organization wants to use imported excisable goods to produce other excisable products. In this case, the excise tax can be deducted - the amount of excise tax accrued for the reporting period can be reduced by the amount of excise tax presented by the seller.

In accounting, the amount of excise tax is reflected in account 19 “VAT”; for this purpose, a subaccount “Excise taxes” is opened for it. The wiring is as follows:

- Dt 19 “Excise taxes” Kt 68 “Calculations for excise taxes” - we charge excise duty on imports;

- Dt 68 “Calculations for excise taxes” Kt 51 - we pay excise tax;

- Dt 10 Kt 19 “Excise taxes” - we take into account the excise tax in the costs of purchasing goods;

- Dt 68 “Calculations for excise taxes” Kt 19 “Excise taxes” - we accept the paid amount of excise tax as a deduction.

Keep records of excisable goods, organize imports, submit declarations and calculate excise taxes in the Kontur.Accounting web service. The service also allows you to make payments to employees, submit reports via the Internet, and much more. Try all the features for free - we give you a 14-day test drive.