Veterans, citizens with children, disabled people: how much are they entitled to standard deductions for personal income tax?

The state provides certain categories of citizens with the opportunity to pay a smaller amount of personal income tax by reducing the income they receive by standard deductions.

Standard deductions are fixed amounts, the amount of which is established in Art. 218 Tax Code of the Russian Federation. Their peculiarity is the regularity of provision. Most can be received monthly throughout the year. Only “children’s” standard deductions have a number of additional restrictions and preferences: the size of the deduction depends on the number of children, their age, parents’ income calculated on an accrual basis from the beginning of the year, and other nuances.

The amounts of standard deductions and the categories of citizens to whom they can be provided are shown in the figure:

If the taxpayer is simultaneously entitled to standard deductions in the amount of RUB 3,000. and 500 rubles, he will be given the maximum deduction. The possibility of receiving “children’s” deductions remains regardless of the availability of the right to other standard deductions (clause 2 of Article 218 of the Tax Code of the Russian Federation).

Reporting on accrued personal income tax for individual entrepreneurs

The tax period for personal income tax is calculated by individual entrepreneurs on a general basis as a calendar year. They need to report on their income by April 30, by submitting a 3-NDFL declaration.

About it, see the selection of materials in the “Declaration (NDFL)” section.

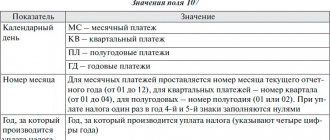

Payment of income tax (clause 9 of Article 227 of the Tax Code of the Russian Federation) is carried out in several stages:

- 50% advance tax for January-June until July 15;

- 25% advance tax for July-September until October 15;

- 25% advance tax for October-November until January 15.

As for the 4-NDFL declaration, it is submitted by newly registered entrepreneurs within 5 days following the month of the first income received in order to calculate possible advance payments. Another reason for filing 4-NDFL is a change in the amount of estimated income of at least 50% in relation to the previous period (letter of the Ministry of Finance of the Russian Federation dated 01.04.2008 No. 03-04-07-01/47 “On the procedure for calculating advance payments for personal income tax persons"). Advance payments are subject to recalculation (clause 10 of article 227 of the Tax Code of the Russian Federation).

See the material “How to submit a declaration in form 4-NDFL in 2019?”

The fine for late submission of the 3-NDFL declaration is at least 1,000 rubles (Article 119 of the Tax Code of the Russian Federation). In case of missed deadlines for filing 4-NDFL reports, tax authorities can take measures in accordance with Art. 126 of the Tax Code of the Russian Federation.

A mechanism for saving on personal income tax using standard deductions

Let's look at an example of how standard deductions help you save money.

Plumber Igor Petrovich Tarasov has the right to a monthly standard deduction of 500 rubles. according to sub. 2 p. 1 art. 218 Tax Code of the Russian Federation. He is caring for two children aged four and eleven years old. The amount of “children’s” deductions for him is 2,800 rubles. (RUB 1,400 × 2). In January 2022, Tarasov I.P. received a salary of 28,731 rubles. How will the standard deduction help him save money?

Let's calculate the tax taking into account standard deductions (NDFL1) and excluding them (NDFL2):

Personal income tax1 = 13% × (28,731 - 500 - 2 × 1,400) = 3,306 rubles.

Personal income tax2 = 13% × 28,731 = 3,735 rubles.

Thanks to the use of standard deductions, Tarasov I.P. will save 429 rubles. (3,735 - 3,306) in January 2022. In subsequent months (until the end of the year), you can still save using a deduction of 500 rubles. The opportunity to save on “children’s deductions” will continue until Tarasov I.P.’s income, calculated cumulatively from the beginning of the year, does not exceed 350,000 rubles. (Subclause 4, Clause 1, Article 218 of the Tax Code of the Russian Federation).

IMPORTANT! If the employee’s income exceeds 5 million rubles. per year, exceeding the amount from 2022 is taxed at a rate of 15%.

For an example of a calculation, see a typical situation from ConsultantPlus. If you do not have access to the K+ system, sign up for a trial demo access for free.

Reporting on accrued personal income tax by other persons

Other individuals who received income determined by clause 1 of Art. 228 of the Tax Code of the Russian Federation are required to report after the end of the personal income tax tax period, which is considered to be the previous calendar year. They also provide the 3-NDFL declaration until April 30. Tax obligations must be paid no later than July 15.

For the tax period for income tax for foreign citizens carrying out activities listed in paragraph 1 of Art. 227.1 of the Tax Code of the Russian Federation, the calendar year is accepted. These groups of persons do not submit declarations at the end of the reporting period, except for the cases listed in paragraph 8 of Art. 227.1 Tax Code of the Russian Federation.

Find materials that can help you prepare your declaration here.

How to save on personal income tax when buying or building housing and when property deduction is not possible

A property deduction is a benefit provided by the state that makes it possible, after purchasing or selling property, to return part of the previously paid personal income tax or reduce its current deductions.

The Tax Code of the Russian Federation provides for four types of property deductions. The size of each of them is limited by the maximum amount:

Find out how the amount of property deduction depends on the type of property being sold and other important nuances of this type of deduction.

A property deduction is not provided if funds from employers or other persons, as well as maternity capital, were used in the purchase or construction of residential real estate (or the acquisition of land for individual housing construction).

You should not count on a deduction even if the purchase and sale transaction of residential real estate was concluded between interdependent persons.

When citizens are recognized as interdependent persons, we tell in this material.

Property deduction is not provided for the sale of securities and certain types of property (for example, real estate used in commercial activities).

Property deduction

In the commented Review, the Supreme Court of the Russian Federation also considered several situations related to the use of property deductions.

Situation 1. In the middle of the year, an employee received a notification from the tax office about the provision of a deduction and applied to the employer for the deduction by submitting a corresponding application. The employer returned to him the amount of personal income tax withheld from the beginning of the year in which the application was submitted. However, the tax authorities decided that only tax amounts that were erroneously withheld after receiving the notification were subject to refund. The court indicated that the employer was right (paragraph 15 of the Review).

Situation 2. A citizen sold a room that he once received following a court decision to collect wage arrears from a joint stock company. When calculating personal income tax for this transaction, he applied a property deduction. The inspectors decided that the deduction could not be used in such a situation - no expenses were incurred and there were no payment documents. But the court ruled that “clause 1 of Article 220 of the Tax Code of the Russian Federation provides the taxpayer with the right to deduct expenses incurred for the acquisition of real estate, regardless of the form of such expenses” (paragraph 16 of the Review).

Situation 3. A citizen bought a residential building and applied a property deduction to this transaction. The amount of the deduction received was less than the maximum possible. The next year, he completed the house and again applied for a deduction - this time in relation to the costs of completion. The inspectorate refused the deduction, recognizing it as repeated. The court stated that “it is not a repeated deduction claimed in respect of one piece of real estate, but in respect of various expenses included in the actual expenses of its acquisition.”

Professional press for accountants

For those who cannot deny themselves the pleasure of leafing through the latest magazine and reading well-written articles verified by experts. Select a magazine >>

Types of social deductions

A social deduction is a legally established opportunity for an individual who has spent funds on education, treatment and some other social purposes to return part of previously paid personal income tax or reduce current tax obligations.

Types of social deductions are presented in the figure:

IMPORTANT! From 2022, you can apply for a new social deduction to pay for fitness services. We talked about the nuances in this publication.

Read more about each type of social deductions in the material.

Who is eligible for the professional deduction?

A professional deduction is an opportunity for individual entrepreneurs, private practitioners, executors of GPC agreements or persons receiving royalties when calculating personal income tax to reduce income received by the amount of documented expenses.

Find out what nuances to consider for each category of professional deduction recipients.

Ordinary citizens who are not registered as individual entrepreneurs, are not engaged in private practice, do not perform work under civil contract agreements and do not receive royalties cannot take advantage of the professional deduction.

Tax period for an entrepreneur

The rules for the tax period for individual entrepreneurs are similar to the rules established for organizations. With one caveat - they do not apply when determining the tax period under the PSN (Clause 4, Article 55 of the Tax Code of the Russian Federation).

Entrepreneur registration

1. Tax period – quarter.

If an entrepreneur is registered in this capacity at least 10 days before the end of the quarter, the first tax period for him is the period from the date of registration as an entrepreneur until the end of this quarter. Otherwise, the first tax period is considered to be the period from the date of registration of the entrepreneur until the end of the quarter following the quarter of registration (clause 3.1 of Article 55 of the Tax Code of the Russian Federation).

2. Tax period – month.

The first tax period for an entrepreneur will be the period from the date of his registration as an entrepreneur until the end of the calendar month of registration (clause 3.3 of Article 55 of the Tax Code of the Russian Federation).

3. Tax period – year.

If an entrepreneur is registered from January 1 to November 30, then the first tax period for him is the period from the date of registration to December 31 of this calendar year.

If an entrepreneur is registered in the period from December 1 to December 31, then the first tax period for him will be the period from the date of registration as an entrepreneur to December 31 of the calendar year following the year of registration (Clause 2 of Article 55 of the Tax Code of the Russian Federation).

Specific transactions for investment deduction

Investment deduction is discussed in Art. 219.1 of the Tax Code of the Russian Federation, introduced by the Law “On Amendments...” dated December 28, 2013 No. 420-FZ.

An individual has the right to this deduction if he:

- received income from transactions with securities traded on the organized securities market;

- deposited personal savings into your IIS (individual investment account);

- received income from transactions placed on the IIS.

Find out how to get an investment deduction for personal income tax in ConsultantPlus. Learn the material by getting trial demo access to the system. It's free.

We talk about the nuances of how organizations use the investment deduction in the article “Investment tax deduction for income tax.”

Chapter 23. Personal income tax

GL 23 Tax Code of the Russian Federation.

Comments to Chapter 23 of the Tax Code of the Russian Federation

- Article 207 of the Tax Code of the Russian Federation. Taxpayers

- Article 208 of the Tax Code of the Russian Federation. Income from sources in the Russian Federation and income from sources outside the Russian Federation

- Article 209 of the Tax Code of the Russian Federation. Object of taxation

- Article 210 of the Tax Code of the Russian Federation. The tax base

- Article 211 of the Tax Code of the Russian Federation. Features of determining the tax base when receiving income in kind

- Article 212 of the Tax Code of the Russian Federation. Features of determining the tax base when receiving income in the form of material benefits

- Article 213 of the Tax Code of the Russian Federation. Features of determining the tax base for insurance contracts

- Article 213.1 of the Tax Code of the Russian Federation. Features of determining the tax base for non-state pension agreements and compulsory pension insurance agreements concluded with non-state pension funds

- Article 214 of the Tax Code of the Russian Federation. Peculiarities of paying personal income tax in relation to income from equity participation in an organization

- Article 214.1 of the Tax Code of the Russian Federation. Features of determining the tax base, calculation and payment of income tax on transactions with securities and on transactions with derivative financial instruments

- Article 214.10. Features of determining the tax base, calculation and payment of tax on income received from the sale of real estate, as well as on income in the form of real estate received as a gift

- Article 214.2 of the Tax Code of the Russian Federation. Features of determining the tax base when receiving income in the form of interest received on deposits (account balances) of individuals in banks located on the territory of the Russian Federation, as well as in the form of interest (coupon), payments

- Article 214.2.1 of the Tax Code of the Russian Federation with Commentary

- Article 214.3. Features of determining the tax base for repo transactions, the object of which are securities

- Article 214.4. Features of determining the tax base for securities lending transactions

- Article 214.5. Features of determining the tax base for income received by participants of an investment partnership

- Article 214.6. Peculiarities of calculation and payment of tax in relation to income on government securities, municipal securities, as well as on issue-grade securities issued by Russian organizations, paid to foreign organizations,

- Article 214.7. Features of determining the tax base, calculation and payment of tax on income in the form of winnings received from participation in gambling and lotteries

- Article 214.8. Request for documents related to the calculation and payment of tax when paying income on government securities, municipal securities, as well as equity securities issued by Russian organizations, paid

- Article 214.9. Features of determining the tax base, accounting for losses, calculating and paying taxes on transactions accounted for on an individual investment account

- Article 215 of the Tax Code of the Russian Federation. Features of determining the income of certain categories of foreign citizens

- Article 216 of the Tax Code of the Russian Federation. Taxable period

- Article 217 of the Tax Code of the Russian Federation. Income not subject to taxation (exempt from taxation)

- Article 217.1. Features of tax exemption for income from the sale of real estate

- Article 218 of the Tax Code of the Russian Federation. Standard tax deductions

- Article 219 of the Tax Code of the Russian Federation. Social tax deductions

- Article 219.1. Investment tax deductions

- Article 220 of the Tax Code of the Russian Federation. Property tax deductions

- Article 220.1. Tax deductions for carrying forward losses from transactions with securities and transactions with derivative financial instruments

- Article 220.2. Tax deductions when carrying forward losses from participation in an investment partnership

- Article 221 of the Tax Code of the Russian Federation. Professional tax deductions

- Article 222 of the Tax Code of the Russian Federation. Powers of legislative (representative) bodies of the constituent entities of the Russian Federation to establish social and property deductions

- Article 223 of the Tax Code of the Russian Federation. Date of actual receipt of income

- Article 224 of the Tax Code of the Russian Federation. Tax rates

- Article 225 of the Tax Code of the Russian Federation. Tax calculation procedure

- Article 226 of the Tax Code of the Russian Federation. Features of tax calculation by tax agents. Procedure and deadlines for tax payment by tax agents

- Article 226.1. Peculiarities of calculation and payment of tax by tax agents when carrying out transactions with securities, transactions with derivative financial instruments, as well as when making payments on securities of Russian issuers

- Article 227 of the Tax Code of the Russian Federation. Peculiarities of calculating tax amounts for certain categories of individuals. The procedure and terms for payment of tax, the procedure and terms for payment of advance payments by specified persons

- Article 227.1. Peculiarities of calculating the amount of tax and filing a tax return by certain categories of foreign citizens engaged in paid labor activities in the Russian Federation. Tax payment procedure

- Article 227.2. Peculiarities of calculating tax amounts on fixed profits of controlled foreign companies

- Article 228 of the Tax Code of the Russian Federation. Peculiarities of tax calculation in relation to certain types of income. Tax payment procedure

- Article 229 of the Tax Code of the Russian Federation. Tax return

- Article 230 of the Tax Code of the Russian Federation. Enforcement of this chapter

- Article 231 of the Tax Code of the Russian Federation. Procedure for collection and refund of tax

- Article 231.1. Features of the refund of tax withheld by the tax agent from certain types of income

- Article 232 of the Tax Code of the Russian Federation. Elimination of double taxation

- Article 233 of the Tax Code of the Russian Federation. Lost power. Final provisions

‹Article 206.1. Peculiarities of calculation and payment of excise tax by persons whose information is included in the unified state register of legal entitiesUp Article 207 of the Tax Code of the Russian Federation. Taxpayers ›

Results

Standard, social and property tax deductions are the most commonly used types of personal income tax deductions.

They are available to individuals receiving income subject to personal income tax at a rate of 13%, subject to certain conditions being met (having children, disabled or veteran status, purchase and sale of property, etc.). Professional and investment deductions are less common and are available to a limited number of people. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.