You can recall an employee from paid leave if he agrees to take a break from a series of days off. The question is raised by the compensation amount paid three days before the vacation: will the vacation pay be recalculated upon recall from vacation, and is it necessary to return the advance payment? If calculations need to be done, then what to do with the withholding of personal income tax - personal income tax, what is the procedure for returning funds received.

Recall of an employee of an organization from vacation and labor legislation

A company employee has the right to annual basic paid leave of 28 calendar days (paragraph 6, part 1, article 21, paragraph 6, article 107, paragraph 1, article 115, part 1, article 120 of the Labor Code of the Russian Federation).

By agreement between an employee of an enterprise and his employer, annual paid leave can be divided into parts, provided that at least one of these parts is at least 14 calendar days (Part 1 of Article 125 of the Labor Code of the Russian Federation).

Thus, it is possible to recall an employee from vacation, unless this leads to the fact that each part of the actually used vacation will be less than 14 calendar days.

During the vacation, the employee retains his place of work (position) and average earnings (Article 114 of the Labor Code of the Russian Federation).

The procedure for calculating the average earnings retained by an employee during vacation is established by Art. 139 of the Labor Code of the Russian Federation and the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922.

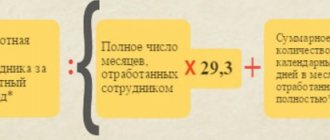

In accordance with paragraph. 4 clause 9 of the Regulations, the amount of average earnings (vacation pay) is determined by multiplying the average daily earnings by the number of calendar days of the main vacation.

Payment for vacation is made no later than three days before its start (Part 9 of Article 136 of the Labor Code of the Russian Federation).

The company's management can call an employee back from vacation if necessary, with the consent of the employee himself (in accordance with Part 2 of Article 125 of the Labor Code of the Russian Federation).

Only workers under 18 years of age, pregnant women and those employed at work with harmful and dangerous conditions cannot be called back from vacation (Part 3 of Article 125 of the Labor Code of the Russian Federation).

That is, recalling an employee from vacation is allowed only with his consent.

The unused part of the vacation must be provided at the employee’s choice at a time convenient for him during the current working year or added to the vacation for the next working year (Part 2 of Article 125 of the Labor Code of the Russian Federation).

It is necessary to take into account that the procedure for settlements between the employer and the employee regarding the amounts of vacation pay in the event of the employee being recalled from vacation is not defined by the norms of the Labor Code of the Russian Federation, and the collection of any amounts from the employee in connection with his recall from vacation or the deduction of these amounts from his salary is not provided for by the norms of the Labor Code of the Russian Federation.

In practice, the following options are used for settlements between the employer and the employee for vacation pay in the event that an employee of the organization is recalled from vacation:

- crediting the amount of vacation pay for unused vacation days against the wages of an enterprise employee;

- return by an employee of the organization to the cash desk of the enterprise of overpaid vacation pay.

At the same time, settlements between the employer and the employee regarding the amounts of vacation pay in the event that an employee of the organization is recalled from vacation must be made on the basis of the employee’s consent expressed in writing.

What to do with paid vacation pay if an employee is called back from vacation?

In accordance with Art. 136 of the Labor Code (LC) of the Russian Federation, payment of money to finance rest days is carried out before its start. When an employee agrees with the employer’s proposal to interrupt his weekend and begin his duties, a situation arises of imposing payment for work on the advance payment already received for the upcoming vacation. In other words, there is an overpayment.

To answer the question whether vacation money is returned when recalled from vacation, you need to refer to the recommendations of the supervisory authority and the requirements of the law:

- letter No. BS-4-11/190790 dated October 24, 2013 from the Federal Tax Service - Federal Tax Service. The document explains that the overpayment that arose during the withdrawal and the personal income tax calculated from it are reversed. Transferred to the category of working days, days off are paid in the usual manner with tax withheld from accrued wages;

- Article 137 of the Labor Code of the Russian Federation. There is no indication in it of a reduction in earnings by the amount of overpaid vacation pay; there is also no requirement to withdraw the advance payment, or to reduce its amount without fail by the amount of the salary. That is, without the employee’s consent, it will not be possible to return vacation money to the company’s cash desk.

It follows from the above provisions that calling an employee back from vacation does not automatically deprive him of part of the vacation pay paid in advance - this would be a violation of labor legislation. The conclusion does not contradict the explanations of the Federal Tax Service, since personal income tax will not have to be reversed either.

Documentation of an employee's recall from vacation

If an employee leaves vacation early, this fact must be documented.

Let's break down the review process into separate steps.

Stage 1. Receipt by the head of the enterprise of an official (report) note , which states the need to recall a specific employee from vacation with an explanation of the reasons.

Stage 2. Contacting the employee . The employee can be informed of the need to take early leave either orally or in writing by sending an official letter.

In any case, for the employee to make a decision, it is necessary to provide him with complete information about what happened and indicate the importance of his participation.

Stage 3. Obtaining the employee’s consent. The employee's consent to the recall is a prerequisite.

To prevent the emergence of controversial issues, such consent must be obtained in writing.

In the consent, the employee must indicate: his data, his position, the consent itself and the date from which the employee leaves the vacation early, the desired date for the provision of the unused part of the vacation.

Stage 4. Issuing an order to recall the employee from vacation. After obtaining the employee’s consent, an order must be issued to recall him from leave.

There is no unified form for such an order, so it can be drawn up in any form with the obligatory indication of: employee data, date of recall, dates of vacation (from which it is recalled), the number of days of vacation that remain unused, dates to which, at the request of the employee, the unused part of the vacation, indicating the need to recalculate vacation pay.

Such an order/instruction must be issued by the time the employee returns to work.

In the order, the employee puts a mark indicating his agreement with its contents.

Please note that in case of refusal, the employee is not obliged to justify or explain the reason and circumstances of his decision. An employee’s refusal to go to work when called back early from vacation is not a violation of labor discipline and cannot lead to disciplinary action or penalties.

Thus, if an employee of an enterprise does not want or cannot interrupt his vacation, then the organization does not have the right to punish him.

How to protect your company and employees

Recalculation of vacation pay: is it necessary?

Even if the employee and management have excellent relations, we should not forget that this does not exclude the possibility of labor disputes, which often end up in court.

It is in the interests of both the employee and the company that every action is documented.

Even in order to call an employee to the workplace, lawyers recommend writing a memo. This is a document drawn up in any form. It is desirable that it indicates the reason for the revocation and contains references to legislative acts.

The note should indicate the date from which the employee must begin performing his duties.

The document must contain assurances that the vacation can be completed at a convenient time and indications of what will be done with the vacation pay.

An employee who agrees to go to work must write at the bottom of the document that he agrees. He can also express his wishes regarding the return of vacation days and the amount received.

You should know that the day of recall must be considered a working day and paid as a working day.

In no case should vacation pay be counted toward future vacation days that the employee will take.

The employee will be able to take the remaining days according to the order. As established by law, he will be paid according to the new working period.

Recalculation of vacation pay is the correct legal path that most enterprises choose.

Top

Write your question in the form below

Review from vacation in personnel documents

Based on the order to recall an employee from leave due to production needs, changes are made to the vacation schedule, time sheet and personal card.

Based on the text of the order to recall an employee from leave due to production needs, the HR employee or accountant must make changes to the vacation schedule.

It can be done like this. In the line where the employee’s interruptible vacation is indicated:

- in column 10 “Note”, note that a certain number of vacation days are transferred to another period;

- in column 8 “Bases (document)” indicate the order for recall from vacation, its number and date;

- in column 9 “Date of intended vacation” reflect the dates to which the unused part of the vacation is transferred.

In the time sheet, the days when the employee was on vacation are marked with the letter code “OT” or the digital code “09”. And the days when the employee was already working (after recall) - with the letter code “I” or the digital code “01”.

The fact of recall from vacation must also be reflected in the employee’s personal card - form No. T-2 (approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1).

In column 4 of Section VIII of the card, you must indicate the number of days that the employee actually took off on vacation.

In this case, column 7 “Grounds” must indicate the details of orders for the employee’s leave and recall from leave.

Recalculation of previously paid vacation pay

As soon as the employee returns to work, from the 1st day of early leave, his salary is calculated.

In this case, the accounting department needs to recalculate the previously paid amount of vacation pay.

Vacation amounts are recalculated as follows:

The average daily earnings must be multiplied not by 28 calendar days, but by the number of days that the employee who returned from vacation actually took time off.

The resulting difference between the “old” amount of vacation pay (vacation pay that was paid to an employee of the organization when he went on vacation) and the “new” amount of vacation pay (vacation pay calculated in the above order in connection with the recall of an employee of the organization from vacation for the actual days of his use of vacation) It may be (by agreement with an employee of the enterprise):

- credited to wages; or

- returned by the employee to the company's cash desk.

The employee will have to “return” the unused portion of the vacation.

The employee can dispose of it at his own discretion:

- take a walk at any convenient time during the current working year;

- add to vacation for the next working year.

In order to avoid additional approvals and red tape, it is advisable, when hiring an employee of an organization and concluding an employment contract, to stipulate in advance and stipulate in it the possibility of recalling a company employee from vacation, taking into account the norms of current labor legislation.

Is the employee's consent required for a recount?

In Art. 137 of the Code says nothing about reducing wages due to overpaid vacation pay. There is also no established requirement for the withdrawal of vacation pay or a forced reduction of wages by their amount. This means that without the employee’s consent to return these funds to the company’s cash desk, it will not be possible to deduct them from his earnings.

The fact of recall from vacation without recalculation of vacation pay must be reflected in the appropriate order. It is not possible to count unretained excess vacation pay toward payment for rest that will be provided in exchange for days off work in connection with a recall. This is explained by the fact that before going on vacation, when using non-vacation days, vacation pay will be paid, the calculation of which will be based on average earnings, the amount of which will change in the new billing period.

Thus, in the absence of the employee’s consent to the voluntary return of overpaid vacation pay, it will be legal not to recalculate so as not to violate labor legislation. In addition, the employer will not allow violations of tax laws, since it will not reverse the income tax withheld when paying vacation pay.

In this case, a situation arises when the employee’s income is doubled, that is, the amount of earnings accrued to him for the actual days of work after early departure from vacation is added to the previously paid vacation pay. In order to resolve this difficult situation once and for all, the employer must establish the procedure for the return of overpaid vacation pay in the relevant local regulation, for example, in the regulations on wages, which the employee must be familiar with upon hiring.

At the same time, there is no point in appealing in court against an employee’s refusal to return overpaid vacation pay on a voluntary basis or to provide consent to offset it against the next advance payment of wages to the employer. An analysis of judicial practice allows us to conclude that the courts most often take the side of the employee (for example, the ruling of the Moscow City Court dated February 16, 2015 No. 33-4915/15), based on the fact that in this case there is no dishonesty on the part of the employee or a counting error (p. 3 Part 1 Article 1109 of the Civil Code of the Russian Federation).

Accrual and payment of vacation pay

The organization's obligations in connection with the emergence of employees' right to paid vacations (including the amount of insurance contributions) are estimated liabilities (clause “a”, clause 2, clause 5 of the Accounting Regulations “Estimated liabilities, contingent liabilities and contingent assets” (PBU 8/2010), approved by Order of the Ministry of Finance of Russia dated December 13, 2010 N 167n).

Thus, earlier, as the organization’s employees received the right to annual paid leave, the organization formed a corresponding estimated liability, the amount of which was attributed to expenses for ordinary activities (clause 8 of PBU 8/2010, clause 5, paragraph 3, 4 clause 8, clause 18 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated 05/06/1999 N 33n).

In accounting, the estimated liability is reflected depending on what type of personnel (production, managerial, etc.) the employee of the organization belongs to in the debit of accounts 20 “Main production” (26 “General expenses” or 44 “Sales expenses”) and credit account 96 “Reserves for future expenses” (Instructions for the application of the Chart of Accounts for accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

The amount of an employee’s wages for working days falling on unused calendar days of vacation, as well as the amount of corresponding insurance premiums depending on the functions performed, relate to production, administrative or commercial expenses of the organization and qualify as expenses for ordinary activities (clause 5, paragraph 3 clause 7, paragraph 3, 4 clause 8 PBU 10/99).

These expenses are taken into account on the dates of calculation of wages and insurance contributions, respectively (clauses 16, 18 of PBU 10/99).

When an employee is granted leave, the accrued amounts of vacation pay and the corresponding amounts of insurance premiums are attributed to the previously formed estimated liability by entries in the debit of account 96 and the credit of accounts 70 “Settlements with personnel for wages” (in terms of the amount of vacation pay) and 69 “Settlements for social insurance and provision" (in terms of insurance premiums) (paragraph 1, 2, paragraph 21 of PBU 8/2010).

The procedure for recalculating vacation pay

The recalculation procedure is as follows. From the total amount of vacation pay, you need to subtract vacation pay that falls on days that the employee did not have time to take “time off.” For those days that the employee worked instead of vacation, accrue his salary in the general manner.

Later, when the employee decides to use the remaining vacation days, recalculate the average earnings to pay for them (Article 139 of the Labor Code of the Russian Federation, clause 1 of the Regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

Reverse excessively accrued vacation pay in accounting. Make corrections in the month in which the employee was recalled from vacation (clause 18 of PBU 10/99, clause 2 of the Instructions to the Unified Chart of Accounts No. 157n).

An example of vacation pay recalculation. An employee is recalled from vacation in the month it began

Chief accountant of the organization A.S. Glebova was granted basic paid leave of 14 calendar days, from August 10 to August 23, 2015. Glebova’s salary is 25,000 rubles. Glebova’s average daily earnings (for calculating vacation pay) is 850 rubles.

Glebova was accrued vacation pay in the amount of 850 rubles/day. × 14 days = 11,900 rub.

The employee does not have rights to deductions for personal income tax.

Personal income tax calculated from vacation pay was: 11,900 rubles. × 13% = 1547 rub.

Five days before the start of the vacation (July 6), the employee was paid vacation pay in the amount of 11,900 rubles. – 1547 rub. = 10,353 rub.

On the same day, personal income tax from vacation pay was transferred to the budget.

Due to operational needs (conducting an on-site tax audit in the organization), on August 17, the employee was recalled from vacation. She agreed to go to work.

In connection with the recall from vacation, the accountant recalculated vacation pay, based on the fact that Glebova was actually on vacation for 7 days (from August 10 to 16): 850 rubles/day. × 7 days = 5950 rub.

Personal income tax on vacation pay amounted to: 5950 rubles. × 13% = 774 rub.

The employee was overpaid vacation pay in the amount of RUB 10,353. – (5950 rub. – 774 rub.) = 5177 rub.

The overpayment for personal income tax amounted to: 1,547 rubles. – 774 rub. = 773 rub.

In total, for August, Glebova was accrued vacation pay in the amount of 5,950 rubles. and salary for days worked from August 1 to August 9 and from August 17 to August 31, 2015 (16 working days). In August 2015 – 21 working days. The employee's salary is: 25,000 rubles. : 21 days × 16 days = 19,047.62 rub.

For August 2015, Glebova was accrued: RUB 19,047.62. + 5950 rub. = 24,997.62 rub.

Previously, she had already been paid vacation pay in the amount of 10,353 rubles. (including overcharged ones). Thus, the amount due for payment for August is equal to: RUB 24,997.62. – (RUB 24,997.62 × 13%) – RUB 10,353. = 11,394.62 rub.

Personal income tax calculated based on the results of the month amounted to: 24,997.62 rubles. × 13% = 3250 rub.

Personal income tax in the amount of 1547 rubles. has already been transferred to the budget on the day of payment of vacation pay. By this amount, the accountant reduced the personal income tax subject to withholding based on the results of August 2015. At the end of August, personal income tax was transferred to the budget in the amount of 3,250 rubles. – 1547 rub. = 1703 rub.

Crediting vacation pay against wages or returning vacation pay to the company's cash desk

If the payment of vacation pay and the employee’s recall from vacation fall within two reporting periods, then an adjustment must be made in the month the employee is recalled from vacation.

The adjustment of accounting records proposed below, related to the offset of part of vacation pay against wages or the return of part of vacation pay to the enterprise’s cash desk, is not for accounting purposes a correction of an error, since such a correction is carried out as a result of receiving new information (about the employee’s recall from vacation), which was not available to the organization at the time of accrual and payment of vacation pay.

The norms of the Accounting Regulations “Correcting Errors in Accounting and Reporting” (PBU 22/2010), approved by Order of the Ministry of Finance of Russia dated June 28, 2010 N 63n (paragraph 8 of clause 2 of PBU 22/2010), are not applied to such an adjustment.

As part of the actual adjustment in the month the employee is recalled from vacation, the following reversal entries can be made simultaneously:

- on the debit of account 96 and the credit of account 70 - for the amount of vacation pay for unused calendar days of vacation;

- on the debit of account 96 and the credit of account 69 - for the amount of insurance premiums from vacation pay for unused calendar days of vacation;

- on the debit of account 70 and the credit of account 68 “Calculations for taxes and fees” - for the amount of personal income tax withheld from vacation pay for unused calendar days of vacation.

Personal income tax

An employee’s salary and vacation pay are his income subject to personal income tax (clause 1 of article 210 of the Tax Code of the Russian Federation).

The employing organization, performing the duties of a tax agent, is obliged to calculate and withhold the calculated amounts of personal income tax from the employee’s specified income upon their actual payment (clauses 1, 2, 4 of Article 226 of the Tax Code of the Russian Federation).

When receiving income in the form of wages, the date of actual receipt by the employee of such income is recognized as the last day of the month for which he was accrued income for work duties performed in accordance with the employment agreement (contract) (clause 2 of Article 223 of the Tax Code of the Russian Federation).

The date of actual receipt of income in the form of vacation pay is defined as the day of payment of vacation pay, including their transfer to the employee’s bank account (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

When paying income to a taxpayer in the form of vacation pay, tax agents are required to transfer the amounts of calculated and withheld tax no later than the last day of the month in which such payments were made (clause 6 of Article 226 of the Tax Code of the Russian Federation).

The tax rate for each of the specified types of income of an employee who is a tax resident of the Russian Federation is set at 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation).

The Tax Code of the Russian Federation does not define any special procedure for calculating personal income tax in the event of an employee’s early recall from vacation.

However, if the payment of vacation pay and the employee’s recall from vacation fall within two reporting periods, then there are official explanations according to which in such a situation the tax agent organization recalculates the amount of vacation pay and, accordingly, the previously withheld amount of personal income tax (Letters of the Federal Tax Service of Russia dated October 24, 2013 N BS-4-11/190790, dated 04/09/2012 N ED-4-3/ [email protected] ).

Thus, according to tax authorities, when an employee is recalled from vacation, the organization (tax agent) recalculates the amount of vacation pay and, accordingly, the previously withheld amount of personal income tax.

Previously accrued vacation pay amounts and the corresponding tax amounts are reversed, and wages are calculated for the days actually worked and the tax is calculated.

How to process a refund and recalculation of vacation pay

In any situation related to the early termination of vacations, there is necessarily a need to recalculate previously accrued and issued vacation pay. What ways does the law provide for resolving this issue?

Let's start with the fact that the law clearly states that vacation pay must be paid in full to the employee three days before the start of the vacation.

It is clear that from the moment the employee is recalled, he begins work, for which wages are already paid. There are several ways to bring the financial component of this part back to normal:

Attention! If an employee completes his vacation in the same calendar month in which he was recalled, then part of the vacation pay may not be returned. This is the most convenient and optimal way out of the situation, both for the accounting staff and for himself.

By the way! When recalling an employee from vacation, you will have to recalculate not only vacation pay, but also personal income tax (NDFL).

Insurance premiums

Vacation pay and wages are accrued to the employee as part of the employment relationship.

Therefore, the amounts of wages and vacation pay paid to an employee under an employment contract are recognized as subject to insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, as well as compulsory social insurance from accidents at work and occupational diseases (clause 1, clause 1, article 420 of the Tax Code of the Russian Federation, clause 1, article 20.1 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against accidents at work and occupational diseases "(hereinafter referred to as Law No. 125-FZ)).

The organization calculates and pays insurance premiums based on the results of the calendar month based on the base for their calculation from the beginning of the billing period (calendar year) to the end of the corresponding calendar month and the rates of insurance premiums minus the amounts of insurance premiums calculated from the beginning of the billing period to the previous calendar month inclusive.

This follows from paragraph 1 of Art. 421, paragraph 1, art. 423, paragraph 1, art. 431 Tax Code of the Russian Federation, paragraph 2 of Art. 20.1, paragraph 1, 9 art. 22.1 of Law No. 125-FZ.

Income tax: accrual and payment of vacation pay

The amount of wages accrued for working days falling on unused vacation days is included in labor costs on the basis of clause 1 of Art. 255 of the Tax Code of the Russian Federation and is recognized as an expense in the month of accrual of this amount (clause 4 of Article 272 of the Tax Code of the Russian Federation).

The corresponding insurance premiums are other expenses associated with production and sales, the date of which is the date of accrual of insurance premiums (clauses 1, 45, clause 1, article 264, subclause 1, clause 7, article 272 of the Tax Code of the Russian Federation).

The amount of vacation pay due to an employee is, for tax purposes, a labor expense (Clause 7, Article 255 of the Tax Code of the Russian Federation).

Such expenses are recognized as expenses on a monthly basis based on accrued amounts (clause 4 of Article 272 of the Tax Code of the Russian Federation).

The corresponding insurance premiums relate to other expenses associated with production and sales (clauses 1, 45, clause 1, article 264 of the Tax Code of the Russian Federation).

The date of expenses in the form of insurance premiums is the date of their accrual (clause 1, clause 7, article 272 of the Tax Code of the Russian Federation).

The moment of recognition in tax accounting of any expenses, except non-operating ones, depends on whether they relate to direct or indirect expenses (clause 1 of Article 318 of the Tax Code of the Russian Federation).

The organization determines the list of direct expenses independently, and all other amounts of expenses, with the exception of non-operating expenses, relate to indirect expenses (paragraph 9, 10, paragraph 1, article 318 of the Tax Code of the Russian Federation).

At the same time, from the wording of the Tax Code of the Russian Federation it follows that direct costs are expenses directly related to the production process (paragraph 10, paragraph 1, Article 318 of the Tax Code of the Russian Federation) (see Letter of the Federal Tax Service of Russia dated February 24, 2011 N KE-4-3/ [email protected] “On the procedure for distributing, for profit tax purposes, costs of production and sales into direct and indirect ones”).

Thus, if the employee is not associated with the production process, then for tax purposes the amount of the employee’s vacation pay and the amount of the corresponding insurance contributions can be qualified as indirect expenses and taken into account in full during the period of their accrual (clause 2 of article 318, paragraph 3 of article 314 Tax Code of the Russian Federation).

If the employee is associated with the production process, then for tax purposes the amount of the employee’s vacation pay and the amount of the corresponding insurance premiums are qualified as direct costs directly related to the production of goods (performance of work, provision of services) and are taken into account as follows:

- Direct costs are distributed among work in progress and products manufactured in the current month (work performed, services rendered)

- Direct expenses refer to the costs of the current reporting (tax) period as products (works, services) are sold, in the cost of which they are taken into account in accordance with Article 319 of the Code.

- If an organization has direct expenses related to work in progress, balances of finished products and goods shipped but not sold, then until the sale of products and these goods occurs, these amounts of direct expenses are not taken into account in the income tax base.

Crediting vacation pay against wages or returning vacation pay to the company's cash desk

As a result of recalling an employee from vacation, when the payment of vacation pay and the recall of the employee from vacation fall within two reporting periods, the question arises about the legality of recognizing expenses in the form of vacation pay in the part attributable to unused calendar days of vacation, and about the need for appropriate adjustments to tax accounting data.

On the one hand, it follows from the existing official explanation that such an adjustment is necessary and should be carried out in relation to the primary tax accounting data in the month of accrual of expenses.

Thus, the tax authorities believe that if the vacation period falls on two reporting periods, then when determining the tax base for income tax, the amount of accrued vacation pay for annual paid leave is included in expenses in proportion to the days of vacation falling on each reporting period (Letter of the Federal Tax Service of Russia for Moscow dated August 25, 2008 N 20-12/079463).

On the other hand, there is judicial practice according to which in cases where the recalculation of vacation pay and the withholding of excessively accrued amounts are not carried out, since neither Art. 125, nor Art. 137 of the Labor Code of the Russian Federation do not provide for a mechanism for recalculation and grounds for deduction; the amount of vacation pay for the days when the employee started work is not excluded from expenses (Resolutions of the Federal Antimonopoly Service of the North Caucasus District dated November 10, 2011 in case No. A32-30018/2010, Federal Antimonopoly Service of the Far Eastern District dated 05/30/2007, 05/23/2007 N F03-A24/07-2/1446).

Thus, in the case of an employee being recalled from vacation, when the payment of vacation pay and the employee’s recall from vacation fall within two reporting periods, the organization must determine the procedure for recognizing expenses in the form of vacation pay in the part attributable to unused calendar days of vacation and consolidate its choice in the Accounting Policy .

Reflection of the recalculation of vacation pay in 6-NDFL due to a calculation error

Adjustments in the calculation of average monthly earnings can lead to both underestimation and overestimation of vacation pay paid and the tax withheld from them.

The annual calculation of 6-NDFL for 2022 should be submitted on the form as amended by the order of the Federal Tax Service of Russia dated September 28, 2021 No. ED-7-11 / [email protected] Read more about this in our article.

Adjustment of 6-NDFL from 2022

If, as a result of the recalculation, vacation pay was subject to additional payment, in the reporting period when this additional payment was made, reflect in section 2 the total amounts, taking into account the additional payment. This follows, for example, from the letter of the Federal Tax Service dated May 24, 2016 No. BS-4-11/9248. It is not necessary to submit a detailed calculation for the period of vacation pay.

If the result of the recalculation is a decrease, the return of excessively withheld personal income tax must be reflected in 6-NDFL:

- in lines 030-032 of section 1 of the form for the reporting period in the last three months of which the tax refund date falls;

- in line 190 of section 2 for the reporting period in which the personal income tax was returned.

If there has not yet been a refund and vacation pay was transferred in the same tax period in which they were recalculated, you must fill out line 180 of section 2.

Important! Explanations from ConsultantPlus We believe that a different approach is possible: the amount of personal income tax paid by a tax agent on the amount of overpayment of vacation pay is not a tax withheld from the taxpayer’s income. It is the amount overpaid by the tax agent. Accordingly, if vacation pay is reduced as a result of recalculation, there is no need to fill out... For more details, see K+. Trial access is available for free.

For the period in which there was an overpayment for vacation pay, submit an update, indicating in section 2 the final indicators, taking into account the reduced amount of vacation pay.

Adjustment of 6-NDFL until 2022

If, as a result of the recalculation, the amount of payments decreased, then, taking into account the requirements of the Procedure for filling out and submitting the 6-NDFL calculation, approved by Order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11 / [email protected] , the tax agent will be required to do the following:

- Provide an update to 6-NDFL for the quarter in which the error was made, changing the indicators of accrued and received income, as well as calculated tax (lines 020, 040 and 130).

- In Form 6-NDFL for the quarter in which the tax was recalculated, it is necessary to reflect changes only in lines 070 and 140.

- If it is not possible to offset the overly withheld tax against upcoming payments, then the amount of tax returned to the individual in the recalculation quarter must be reflected in line 090.

- Neither the correction period nor the recalculation period changes the indicators on lines 100, 110 and 120.

IMPORTANT! For deductions from wages for reasons not listed in Art. 137 of the Labor Code of the Russian Federation, the written consent of the employee will be required.

Now consider the case of adjusting earnings for previous periods, which increased the amount of vacation pay. In this case, additional accruals of income and personal income tax are reflected in the recalculation period on lines 020, 040, 070, 130 and 140, and the additional payment of vacation pay will be income for the period in which it was made (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation ).

Application of PBU 18/02: accrual and payment of vacation pay

If an organization does not create reserves for vacations in tax accounting, then in this case it is necessary to apply the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n (hereinafter referred to as PBU 18/ 02).

In accounting, expenses associated with vacation amounts and related insurance premiums were recognized earlier when the provision was created.

But such expenses were not previously recognized in tax accounting.

As a result, a deductible temporary difference (DTD) and a corresponding deferred tax asset (DTA) previously arose in the organization’s accounting (clauses 11, 14 of PBU 18/02).

Further, when vacation pay and insurance premiums accrued on them are included in tax accounting, the VVR and ONA that arose earlier are reduced (clause 17 of PBU 18/02).

Crediting vacation pay against wages or returning vacation pay to the company's cash desk

If the payment of vacation pay and the employee’s recall from vacation fall within two reporting periods, then in the month the employee is recalled from vacation, as a result of a decrease in expenses recognized in tax accounting by the amount of vacation pay for unused vacation days by the employee and by the amount of the corresponding insurance contributions, it becomes necessary to adjust the values of VVR and SHE is increasing.

Such an adjustment is not a correction of an error for accounting purposes, and the norms of PBU 22/2010 (paragraph 8, clause 2 of PBU 22/2010) do not apply to it.

An increase in the amount of OTA can be reflected by a reversal entry in the debit of account 68 and the credit of account 09 “Deferred tax assets”.

Example

The employee has a five-day, 40-hour work week with two days off on Saturday and Sunday, based on a daily work duration of 8 hours.

His official salary is 30,000 rubles.

Based on the employee’s application, he was granted another paid leave for 14 calendar days (from February 3 to February 16, 2019).

The average daily earnings of an employee, calculated for the purpose of paying him vacation pay, is 1,200 rubles.

Vacation pay is accrued and paid in January.

As a result of recall from vacation, the actual last day of vacation is February 11; the employee began work on February 12.

The organization has the employee’s written consent to offset part of the vacation pay against his salary for February.

The total amount of payments and other remuneration in favor of the employee on an accrual basis since the beginning of the year in February does not exceed the maximum value of the base for calculating insurance premiums.

Any payments to employees are made in non-cash form by transferring funds to their personal card accounts.

In accounting, the amount of accrued vacation pay does not exceed the recognized estimated liability.

Insurance premiums for vacation pay and wages are calculated at the following generally established rates:

- in the Pension Fund of Russia - 22%;

- in the Federal Social Insurance Fund of the Russian Federation (for compulsory social insurance in case of temporary disability and in connection with maternity) - 2.9%;

- to the Federal Compulsory Medical Insurance Fund - 5.1%.

The rate of insurance contributions for compulsory social insurance against accidents at work and occupational diseases is 0.4%.

In tax accounting, a reserve for future expenses for vacations is not created.

Income and expenses are determined using the accrual method,

The reporting periods for income tax are the first quarter, half a year and nine months of the calendar year.

Grounds for revocation

The employer can recall an employee from vacation (Part 2 of Article 125 of the Labor Code of the Russian Federation). For example, such a need may arise if:

- the organization carries out an inventory and the presence of a materially responsible person is mandatory;

- the organization is conducting an on-site tax audit, during which the chief accountant will have to be at the workplace;

- the system administrator is called back from vacation due to problems with computer networks, etc.

A prerequisite for issuing a recall from vacation is the employee’s consent to return to work. If the employee does not agree to the recall, it is prohibited to interrupt the vacation. This follows from Part 2 of Article 125 of the Labor Code of the Russian Federation. An employee’s refusal to go to work is not a violation of labor discipline (clause 37 of the resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2).

Situation: how to formalize an employee’s consent to recall from vacation?

Labor legislation does not say how to formalize an employee’s consent to recall from vacation. To avoid possible claims from inspectors, formalize the employee’s consent to begin work in writing in one of the following ways:

– in the form of an employee application in any form;

– in the form of an employee’s mark on the order for recall from vacation: “I agree to recall from vacation.”

Calculation

Let's carry out the necessary calculations:

Calculation of wages and vacation pay

In this case, vacation pay is due to the employee in the total amount of 16,800 rubles. (1200 RUR x 14 days).

Of this, the amount of vacation pay for unused vacation days is 6,000 rubles. (1200 RUR x 5 days).

Since in February 2022, which includes 20 working days, the employee actually worked three working days instead of vacation (from February 12 to 14), his salary for this period is 4,500 rubles. (RUB 30,000 / 20 days x 3 days).

Personal income tax (NDFL)

Considering that the employee was recalled from vacation in February, and the income he received in January in the form of vacation pay for unused calendar days of vacation is counted against the salary paid to him for February, the organization needs to adjust the tax base for personal income tax for February, reducing it by the amount of vacation pay for unused vacation days in the amount of 6,000 rubles. and increasing by the amount of wages due on these days in the amount of 4,500 rubles.

What to do with the remaining unused vacation days

When an employee is recalled early from vacation, the question inevitably arises: what to do with the remaining days? It's simple: they need to be compensated.

Moreover, the right to choose the method of compensation is assigned to the employee.

He has the opportunity to choose the following options:

- Add that part of the vacation that remains unused to the vacation of the next year. In this case, he will have to rely on the enterprise’s pre-drawn vacation schedule;

- Use up unused vacation days this year. An undeniable advantage here is that the employee can decide on the time and date of vacation at his own discretion. In most cases, this is exactly what employees who are recalled from vacation early prefer to do.

Recalculation of the base for calculating insurance premiums

Insurance contributions to extra-budgetary funds are calculated based on the results of each month.

In the situation under consideration, the amounts of vacation pay were included in the base for calculating insurance premiums in January.

Considering that the employee was recalled from vacation in February, and the income he received in January in the form of vacation pay for unused calendar days of vacation is counted against the wages paid to him for February, the organization needs to adjust the base for calculating insurance premiums for February, reducing it by the amount vacation pay for unused vacation days in the amount of 6,000 rubles. and increasing by the amount of wages due on these days in the amount of 4,500 rubles.

In accounting in January you need to make the following entry:

- on the debit of account 68 “Calculations for taxes and fees” and the credit of account 09 - 4,381.44 rubles. — STI was reduced by the amount of vacation and insurance contributions ((16,800,5107.20) x 20%).

In February, upon recall of the employee from vacation, the following reversal entries must be made at the same time:

- on the debit of account 96 and the credit of account 70 - 6,000 rubles. - the amount of vacation pay for unused calendar days of vacation;

- on the debit of account 96 and the credit of account 69 - 1,824 rubles. - the amount of insurance premiums from vacation pay for unused calendar days of vacation ((6,000 rubles x (22% 2.9% 5.1% 0.4%));

- on the debit of account 70 and the credit of account 68 “Calculations for taxes and fees” - 780 rubles - for the amount of personal income tax withheld from vacation pay for unused calendar days of vacation (6,000 rubles x 13%);

- on the debit of account 09 and the credit of account 68 “Calculations for taxes and fees” - 1,564.8 rubles - for the amount of IT related to vacation and insurance contributions for unused vacation days ((6000 1824) x 20%).

Example 1. Registration of a recall from vacation using a special extension mechanism

Employee Zakharkin S.P. 14 days of vacation were provided from November 22 to December 5. The amount of vacation pay is 19,112.66 rubles, personal income tax is 2,485 rubles.

The employee is recalled from vacation for 2 days: from November 25 to 26. Unused vacation days Zakharkin S.P. will take extra leave immediately after the end of the original vacation: December 6 and 7.

Actual vacation periods of Zakharkina S.P. taking into account the recall and transfer of 2 days:

- from 11/22/2021 to 11/24/2021

- from 27.11.2021 to 07.12.2021

We will register the recall and transfer of unused vacation days using a special vacation extension mechanism.

Let's create a correction document Vacation using the Correct Vacation document . On the Main vacation , we will indicate the vacation period taking into account the new end date (12/07/2021)

On the Extensions, transfers, reviews tab, we will add the period for which Zakharkina S.P. recalled from vacation (November 25-26).

As a result, vacation pay was accrued for 14 days (= 3 + 4 + 7).

The amount of vacation pay also remained the same - 19,112.66 rubles, personal income tax did not change - 2,485 rubles.

When posting a document in the personal income tax registers, movements were generated, but the total amount of lines for each register is zero, and the date of receipt of income and the basis document did not change:

- accumulation register Income accounting for personal income tax calculation

- accumulation register Calculations of taxpayers with the budget for personal income tax

Correction document The vacation had no impact on personal income tax accounting. This is confirmed by the reports Detailed analysis of personal income tax by employee and Analysis of personal income tax by date of receipt of income (Taxes and contributions - Reports on taxes and contributions). Vacation pay and tax on it are taken into account in relation to the source document (Vacation No. 6 dated November 17, 2021) and the date of receipt of income (November 18, 2021).

Lines with empty amounts in reports appeared due to movements generated by the Vacation . They will not affect personal income tax accounting.

If the second part of the vacation after the recall would begin in December and the average in December is significantly higher, it is safer to increase the amount of vacation pay for the second part of the vacation manually in the Vacation .