What is a payment order

A payment order is an order drawn up in a document of a certain form from the account owner to the bank servicing this account to write off a specific amount of money to the recipient’s account opened with the same bank or other financial institution.

From September 10, 2021, the payment order form was approved by Bank of Russia Regulation No. 762-P dated June 29, 2021; it has not changed compared to what was previously in force. It is used to transfer funds:

- for delivered (performed, rendered) goods (work, services);

- to budgets of all levels, as well as the social insurance fund;

- for the purpose of returning/placing credits (loans), deposits and paying interest on them;

- for other purposes provided for by law or agreement.

The payment order form and a sample of how to fill it out can be found here.

Procedure for filling out a payment order

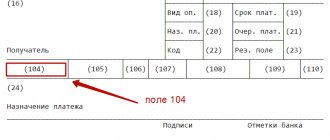

The content of the payment order and its form must comply with the requirements prescribed by law. The document regulating the procedure for filling out the fields of payment orders is Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n, which describes in detail the algorithm for filling out each field.

You can find samples of filling out payment forms for different types of taxes in the Ready-made solution from ConsultantPlus. Try K+ for free and get samples from the experts.

For information about which details are basic for a payment order, read the article “Basic details of a payment order”. And how the list of details to fill out depends on who the transferred funds are intended for, read here.

If you still have questions about filling out payment forms, ask them on our forum. For example, you can find out how to fill out a payment order for a fine on the thread.

How to fill out field 107 when paying personal income tax: recommendation from the Ministry of Finance

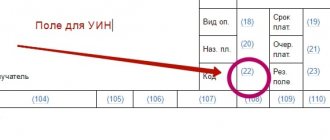

Field 107 of the payment order is the tax period.

This indicator is used to indicate the frequency or specific date of tax payment established by law. Find out what values field 107 can take here.

As the Ministry of Finance explains, for personal income tax, in this field you need to indicate the month for which it is paid (see letter dated June 11, 2019 No. 21-08-11/42596). The Federal Tax Service previously provided similar explanations.

Example

When paying personal income tax on employees’ salaries for July 2022, in detail 107 you must indicate “MS.07.2021”.

Field 107 “Tax period” in the payment order for 2021–2022

Let us consider in detail the rules for filling out the tax period in the payment order (field 107 “Tax period”) in 2021–2022.

Check whether you have correctly determined the tax period for your case, with the help of explanations from ConsultantPlus experts. Get trial access to K+ for free.

This field is filled in when generating payment orders for the payment of taxes and contributions:

- To indicate the period for which the tax (contribution) is paid.

- To indicate a specific payment date - in exceptional cases established by law.

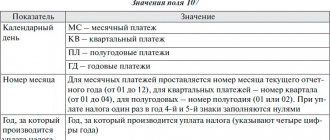

Field 107 has 10 characters, 8 of them are indicated in a specific order, and the remaining 2 are used for separation and are filled with periods. Signs 1 and 2 indicate the frequency of tax (contribution) payment, which can take the following values:

- menstruation (MS);

- quarterly (QW);

- semi-annual (PL);

- annual (AH).

The 4th and 5th digits of the indicator correspond to the number of the selected period:

- for monthly payments, the number of the month of the reporting period is indicated - such a number can take a value from 01 to 12 according to the number of months in the year;

- for quarterly payments, the quarter number is given - the number takes a value from 01 to 04 according to the number of quarters;

- for a half-year, the half-year number is indicated, it has 2 values: 01 and 02;

- for payments made once a year, zeros are entered.

The 3rd and 6th characters correspond to the “dot” symbol and are separating characters.

Characters 7 to 10 are reserved for indicating the reporting year. If the law specifies the exact date for tax payment, then this date is indicated in the “Tax period” field of the payment order.

The “Tax period” field can be filled in for payments not only of the current year, but also of past periods, if the taxpayer himself has discovered errors in the reports already submitted and independently pays additional tax (contribution). In this case, field 107 should reflect the tax period in which the changes were made.

There are a number of situations in which a specific date is indicated in the “Tax period” field . This occurs when the associated Payment Basis field 106 has a specific encoding. A specific date in such situations means for the basis of payment:

- TP - payment deadline established by the tax authority;

- RS - date of payment of part of the installment tax amount, based on the existing installment schedule;

- FROM - the date when the deferred payment ends;

- RT - date of payment of part of the restructured debt based on the existing restructuring schedule;

- PB - the end date of the procedure that is applied in a bankruptcy case;

- PR—end date of suspension of collection;

- IN - date of payment of part of the investment tax credit.

In the event that payment is made for a debt identified during a tax audit or according to a writ of execution, a zero value is indicated in the “Tax period” field.

In case of advance payment of tax, field 107 indicates the tax period for which payment is made.

Please note that when making payments to customs, field 107 is filled in completely differently.

ConsultantPlus experts provided detailed comments on filling out all fields of the payment order for the payment of taxes. If you don't have access to K+, get it for free and follow the directions.

When the exact date is indicated in field 107

In certain cases, in the “Tax period” field (107) you should indicate not the payment period (quarter, month, etc.), but a specific date. When any of the following values are entered in the “Base of payment” field (106), the date is indicated in accordance with the relevant document:

- TR – the period established in the requirement of the Federal Tax Service,

- RS – tax payment date in accordance with the installment schedule,

- FROM – date of completion of the deferred payment,

- RT – payment date according to the debt restructuring schedule,

- PB – date of completion of the bankruptcy procedure,

- PR – last day of suspension of collection,

- IN – date of payment of part of the investment tax credit.

For example, the requirement of the Federal Tax Service (TR) sets the deadline for repayment of tax debt - 07/25/2017, which means that in field 107 of the payment slip you need to indicate: “07/25/2017”.

How to indicate the tax period in a payment order if the debt is repaid on the basis of a tax audit report or a writ of execution? In this case, field 107 must be filled with a zero value: “0”.

Examples of filling out field 107

Let us look at the rules for filling out the “Tax period” field in the 2022 payment order using examples.

Example 1

The organization transfers an advance payment for property tax for the 3rd quarter of 2022, therefore, in field 107 it will be indicated: KV.03.2021.

ATTENTION! When paying advances under the simplified tax system or income tax for 9 months of 2022, in field 107 you should also indicate: KV.03.2021.

Example 2

An individual entrepreneur pays tax in connection with the application of the simplified tax system for 2022, in accordance with the declaration submitted to the tax authority; field value 107 - GD.00.2021.

Example 3

The organization pays the monthly personal income tax payment for September 2021; field value 107 - MS.09.2021.

Example 4

The organization pays tax at the request of the tax authority, which contains a specific deadline for payment - 09/26/2021; field value 107 - 09/26/2021.

In 2022, changes were made to the details of the payment order for the payment of taxes. From 05/01/2021, be sure to fill out field 15: the number of the bank account that is part of the ESC. In addition, the Treasury account and the name of the bank have changed. We have provided the details here.

What to indicate

All types of fiscal obligations have individual settlement frequency. For example, we are required to transfer insurance premiums and personal income tax to the Federal Tax Service on a monthly basis. VAT - once a quarter, Unified Agricultural Tax - once every six months, and payment of transport or property tax - once a year (if regional authorities have not approved reporting periods).

So, for each type of periodicity there is a separate year. Let's determine how to indicate the tax period (year, quarter, half-year and month) in the payment slip:

- Monthly tax calculations, for example, personal income tax, income tax, insurance premiums (compulsory medical insurance, compulsory medical insurance, VNIM) and others. In this case, in field 107, indicate: “MS.XX.YYYY”, where “MS” is a constant value, “XX” is the digital designation of the calendar month (from 01 to 12), “YYYY” is the tax period in the payment slip - year. Let’s say that in order for a budgetary institution to pay contributions to compulsory pension provision for September, indicate in the field: “MS.09.2019”.

- Quarterly payment. In this case, the code takes the value “KV.XX.YYYY”, where “KV” is a constant, “XX” is the quarters in order from 01 to 04. For example, to pay VAT for the 3rd quarter of 2022, indicate “KV” in the payment slip .03.2019.”

- Semi-annual payment. With this option for calculations with the budget, the code “PL.XX.YYYY” is indicated in field 107. The decoding is similar: “PL” is a constant value, “XX” determines the half-year - for the first - 01, for the second - 02. For example, state employees on the Unified Agricultural Tax pay tax for the first half of the year, in the payment order we indicate: “PL.01.2019”.

- How to indicate an annual payment on a payment slip? For annual transfers, the values have the following format: “GD.00.YYYY”, where “GD” is a constant designation. For example, an institution pays transport tax once a year, for 2022 the details are “GD.00.2019”.

Consequences of incorrectly filling out field 107

Filling out field 107 “Tax period” incorrectly does not result in the payment to the budget being recognized as not transferred. Consequently, the payer can clarify the payment provided that he independently discovers the error (clause 7 of Article 45 of the Tax Code of the Russian Federation).

To clarify the payment, you must submit to the Federal Tax Service a statement of the error, drawn up in any form, and attach a copy of the payment order to it. If necessary, a joint reconciliation of paid taxes is carried out, based on the results of which a report is drawn up. Based on this act and a written statement about the error, the tax authority makes a decision to clarify the payment.

Results

A payment order is a document used to transfer funds to the recipient. Field 107 “Tax period” is filled in when paying taxes or contributions and contains key information about the period for which the payment is made. The accuracy of identification of the payment by the regulatory authority and, as a consequence, the unambiguity of its assignment to the corresponding tax period depends on the correctness of filling out this field.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Incorrect tax period indication

Even if the period in field 107 of the payment order is indicated incorrectly, the tax must still go to the budget, since this is not the reason for failure to fulfill the obligation to pay tax.

When an error is discovered by the taxpayer himself, it is better to clarify the tax period by sending an application to the Federal Tax Service with a copy of the payment slip (clause 4, clause 4, clause 7 of Article 45 of the Tax Code of the Russian Federation). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.