“107” is one of the fields of the payment order, which indicates the tax period when transferring taxes, insurance contributions and advance tax payments. Payments for the transfer of funds to the budget are filled out in compliance with the Rules approved by Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n. The tax period in the payment order is indicated when transferring current taxes and insurance premiums. It is also necessary to fill in detail 107 when the taxpayer or tax agent voluntarily repays the arrears. We will tell you how to fill out this field correctly in our article.

What it is

A payment order is considered a special type of administrative documentation, based on which a Savings Bank or other credit institution transfers funds from the client’s current account using the specified details. The reporting papers are filled out by the company's accountant or an employee of the Security Service of the Russian Federation.

The financial institution accepts orders of two types:

- Paper. The document is created in Word format, then printed on an A4 sheet;

- Electronic. A similar copy of the administrative paper is created on remote Internet resources, for example, in Sberbank Business Online.

Orders can be one-time or regular. In the first option, the payment card is considered invalid after the transaction. In the second, a constant transfer of funds from the client’s deposit is carried out after a certain time period.

In the payment order, field 107 is required to be filled in. It is also necessary to indicate the billing period for which insurance premiums are being transferred or the debt to the Federal Tax Service is being repaid.

How is the tax period determined?

We have compiled data on the duration of periods for all taxes, as well as insurance premiums and trading fees, into a table.

| Length of period | Tax name | Article of the Tax Code of the Russian Federation |

| Month | Excise taxes | 192 |

| MET | 341 | |

| Gambling tax | 368 | |

| Quarter | VAT | 163 |

| Water tax | 333.11 | |

| UTII | 346.30 | |

| Trade fee | 414 | |

| Year | Personal income tax | 216 |

| Income tax | 285 | |

| Tax on additional income from hydrocarbon production | 333.53 | |

| Unified agricultural tax | 346.7 | |

| simplified tax system | 346.19 | |

| PSN (if the patent is issued for a shorter period, the tax period is the period for which the patent was issued) | 346.49 | |

| Transport tax | 360 | |

| Organizational property tax | 379 | |

| Land tax | 393 | |

| Property tax for individuals | 405 | |

| Insurance premiums | 423 |

Submit all tax returns online for free

Functions of the “tax period” field and payment order

Payments are required for the following transactions:

- Transfer of funds to counterparties as payment for goods or services;

- Transfer to state and non-state funds (for example, tax police);

- Settlements with credit institutions or replenishing deposits from an existing personal account;

- Financial transactions within the framework of signed agreements and concluded agreements;

- Mandatory regular payments: payment of utilities, telephone, Internet, payment of state duty, etc.

Column 107 is required to be filled out, since it indicates the billing period. It is displayed in the form of ten characters, the first eight digits are the period for which the fee is paid, the remaining two characters are the points delimiting the encoding points.

Example

The first two digits indicate the frequency of payment:

- MS – every month;

- KV – transfer is carried out once a quarter;

- PL – the transaction is carried out once every six months;

- GD - annual payments.

The next two digits specify the billing period. If the payment is made monthly, you must enter a number from 01 to 12, this indicates in which month you want to transfer the money. For quarterly cancellation, an indicator from 01 to 04 (quarter number) is indicated. For semi-annual transactions, encryption 01 or 02 is used, indicating in which half of the year the payment will take place. An operation carried out once a year does not require additional coding and is indicated as 00.

The remaining numbers are the year. For example, if you are transferring a payment to the Federal Tax Service for March of the current year, then the customs authority code in field 107 will look like this: MS.03.2018.

Tax period codes for VAT

The following codes are used in the VAT declaration (Appendix No. 3 to the Procedure for filling out the declaration, approved by Order of the Federal Tax Service dated October 29, 2014 No. ММВ-7-3/ [email protected] ):

| 21 | I quarter |

| 22 | II quarter |

| 23 | III quarter |

| 24 | IV quarter |

| 51 | I quarter during reorganization (liquidation) of the organization |

| 54 | II quarter during reorganization (liquidation) of the organization |

| 55 | III quarter during reorganization (liquidation) of the organization |

| 56 | IV quarter during reorganization (liquidation) of the organization |

Also see “New VAT return form: how to submit reports for the first quarter quickly and without errors.”

Fill out, check and submit a new VAT return through Kontur.Extern Submit for free

Field 106, when to fill it out

This column is intended to indicate the basis for the transfer. Is it possible to leave it blank? No! In line 106 you must write one of the following values:

- TR – requirement for payment from the tax police;

- RS – installment repayment;

- FROM – date when the deferred transfer ends;

- RT – calculations according to the debt restructuring schedule;

- IN – repayment of investment loan;

- PR – covering a debt suspended for collection.

In column 107 indicate the period indicated in line 106. If the basis is an audit report from the tax inspectorate, then zeros are entered in field 107.

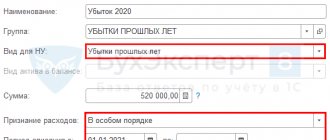

Codes of tax periods according to the simplified tax system

The declaration under the simplified tax system uses the following codes (Appendix No. 1 to the Procedure for filling out the declaration, approved by order of the Federal Tax Service dated December 25, 2020 No. ED-7-3 / [email protected] :

| 34 | Calendar year |

| 50 | Last tax period for reorganization (liquidation) of an organization |

| 95 | Last tax period when switching to a different taxation regime |

| 96 | Last tax period upon termination of business activity |

Submit a free notification of the transition to the simplified tax system and submit a declaration under the simplified tax system via the Internet

Incorrect completion of line 107

Be that as it may, the payment order is filled out by a person, so it is impossible to completely eliminate the risk of error. If the column is filled in incorrectly, this is not a reason to refuse payment.

If an error is detected, the payer can contact the nearest tax police department with a statement about the error. You must have a duplicate of the payment with you. The application is written in free form. Based on the results of the appeal, Federal Tax Service employees draw up a report and correct the translation.

Sample payment order for state fees to the arbitration court in 2021-2022

Let's look at the procedure for filling out a state duty payment using a conditional example.

Let’s say LLC “ICS” filed an application with the Federal Tax Service for the return of an overpayment of property tax in the amount of 90,000 rubles.

“Sample application for refund of overpaid tax” will help you fill out such an application .

However, the inspection did not return the money within the prescribed period, and the company decided to appeal to the Moscow Arbitration Court with a statement declaring the inaction of the tax authorities illegal, as well as with a demand for the return of the overpayment in the specified amount and payment of interest in the amount of 990 rubles.

To learn how such interest is calculated, read the article “How to calculate interest for late tax refunds .

Since in this case the appeal combines requirements of a property and non-property nature, IKS LLC will pay two state fees (subclause 1, clause 1, article 333.22 of the Tax Code of the Russian Federation):

- 3,000 rub. — for recognizing inaction as illegal (subclause 3, clause 1, article 333.21 of the Tax Code of the Russian Federation);

- RUB 3,640 (4% of 90,990 rubles) - on a property claim for the return of overpayments and interest (subclause 1, clause 1, article 333.21 of the Tax Code of the Russian Federation).

That is, the total amount payable will be 6,640 rubles.

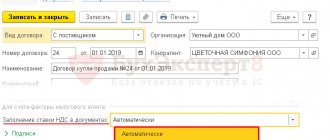

When drawing up a payment order, ICS LLC:

- will indicate the payer status - 01;

- recipient - the Federal Tax Service for the city of Moscow, indicating the Federal Tax Service Inspectorate at the location of the court (in this case, Federal Tax Service Inspectorate No. 26);

NOTE! From 05/01/2021, be sure to fill out field 15 when the state duty is administered by the tax authorities. In payments for the transfer of tax payments, this field must indicate the bank account number of the recipient of the funds (the number of the bank account included in the single treasury account (STA)). This follows from the letter of the Federal Tax Service of Russia dated October 8, 2020 No. KCh-4-8/16504. See here for details.

- KBK - 182 1 0800 110;

- OKTMO - at the location of the court;

- basis of payment (field 106) - TP;

- in fields 107 “Tax period”, 108 “Document number” and 109 “Document date” will enter 0;

What has changed since October 1, 2021 in the order of filling out fields 101, 106, 108 and 109, see here. Read more about payment fields in this article.

- in the purpose of payment it will explain what the claim is, to whom it is being brought and what its price is.

IMPORTANT! Indicate the type of payment in the payment order in field 5. The procedure for filling it out is determined by the bank. If the bank has not installed it, leave the field blank (Appendix 1 to the Regulations of the Bank of Russia dated June 29, 2021 No. 762-P).

As a rule, you can find all the details for paying the state duty on the website of the court to which you want to apply. There you can also calculate the amount of state duty.

You can find out all the details on filling out the payment form for paying the state duty in the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

A completed sample payment order for payment of state duty for 2021 - 2022 can be viewed and downloaded on our website:

Find out how to pay the state duty through a representative in cash here .

Which UIN to indicate in the payment order for payment of state duty, see “ConsultantPlus”. If you do not have access to the K+ system, get a trial online access for free.

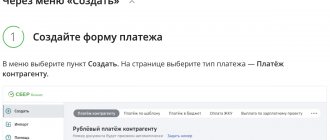

How to fill out a payment order in Sberbank Business Online

To start working with Internet banking, follow the link https://sbi.sberbank.ru. Carry out the authorization procedure. On the main page in your Personal Account, select the “Ruble Transactions” category. It is located in the quick access menu, which is on the left side.

In the “Payment orders” section, a window with filters will open, where you can find completed payments and select the appropriate option. This will eliminate the need to re-enter details and save time.

If such a payment has not been made before, click on the “Create a new document” link. Here you will have to fill in all the fields (billing period, amount to be written off, etc.). Before creating a payment order, check that the information entered is correct. Make sure that tax period 107 in Sberbank Online is filled out correctly.

The completion of the payment order formation will be the choice of execution order. This is convenient if you create several documents at the same time. The fact of write-off is confirmed via SMS or electronic signature of the manager (chief accountant).

Types of tax periods

According to paragraph 1 of Article of the Tax Code of the Russian Federation, the tax period is a period of time at the end of which the final tax base is determined and the final amount of tax is calculated, which must be transferred to the budget.

The specific tax period for each tax is established in Part 2 of the Tax Code (in the chapter devoted to the relevant tax). This period varies from a month to a year. The period of time at the end of which you need to calculate the total amount of the trading fee is called the taxation period, and the insurance premiums are called the settlement period.

Fill out, check and submit a new insurance premium calculation online for free

Codes of tax periods for income tax

The following codes are used in the income tax return (Appendix No. 1 to the Procedure for filling out the declaration, approved by Order of the Federal Tax Service dated September 23, 2019 No. ММВ-7-3/ [email protected] ):

| 21 | first quarter |

| 31 | half year |

| 33 | nine month |

| 34 | year |

| 35 | one month |

| 36 | two month |

| 37 | three months |

| 38 | four months |

| 39 | five months |

| 40 | six months |

| 41 | seven months |

| 42 | eight months |

| 43 | nine month |

| 44 | ten months |

| 45 | eleven months |

| 46 | year |

| 50 | last tax period during reorganization (liquidation) of the organization |

Fill out and submit a new income tax return online Submit for free