How does the country from which imports come affect the calculation?

The procedure for calculating VAT is determined by two groups of rules:

- related to countries participating in the Eurasian Economic Union (EAEU);

- intended for countries outside this union.

In addition to Russia, the EAEU includes 4 more countries: Armenia, Belarus, Kazakhstan and Kyrgyzstan. There is no customs between them, and interaction regarding the import of goods (including on issues of VAT taxation) is regulated by the Treaty on the EAEU, signed on May 29, 2014 in Astana.

Imports into Russia from all other countries occur through customs and are subject to the procedure established by customs legislation, which is based on the EAEU Customs Code and documents published by the Federal Customs Service of Russia. With regard to the calculation of VAT, the main document here is the order of the State Customs Committee of the Russian Federation dated 02/07/2001 No. 131.

The existence of different rules predetermines not only differences in the procedure for determining the tax base, but also differences in other aspects of working with import VAT. At the same time, there are principles common to them. Among them:

- mandatory taxation of imported goods if they are not exempt (clause 1, article 71 of the Treaty on the EAEU, clause 1 of the appendix to the order of the State Customs Code of the Russian Federation No. 131);

- a single basic list of grounds for tax exemption, referring to Art. 150 of the Tax Code of the Russian Federation (subclause 1, clause 6, article 72 of the Treaty on the EAEU, clause 13 of the appendix to the order of the State Customs Committee of the Russian Federation No. 131);

- the same values used for calculating tax rates (clause 15 of section III of Appendix No. 18 to the Treaty on the EAEU, section 3 of the Appendix to Order of the State Customs Committee of the Russian Federation No. 131).

What unites the two groups of rules is the fact that their application is not prevented by the application by the importer of a special regime or exemption provided for in Art. 145 of the Tax Code of the Russian Federation. That is, persons recognized as VAT non-payers for tax purposes in Russia are required to pay the tax accrued when goods are imported into the country.

Tax rates and the possibility of exemption from its payment

VAT charged when importing goods into Russia is calculated at the rates generally established for its territory, i.e. 20% or 10% (clause 5 of Article 164 of the Tax Code of the Russian Federation). The choice of a specific rate depends on the type of imported goods (clauses 2, 3, Article 164 of the Tax Code of the Russian Federation).

Exempt from taxation (Article 150 of the Tax Code of the Russian Federation):

- goods imported as gratuitous aid to Russia;

- medical, prosthetic and orthopedic products, technical means intended for the rehabilitation of disabled people, corrective lenses, glasses and frames for such glasses, raw materials and components for the manufacture of such goods (if their analogues are not produced in Russia);

- materials for the preparation of immunobiological drugs;

- cultural property purchased by Russian government agencies or received as a gift;

- books, other printed publications, film products imported through non-commercial exchange;

- products manufactured on the territory of a foreign state that Russia uses under the terms of an international treaty;

- technological equipment, analogues of which are not produced in Russia;

- natural diamonds that have not been processed;

- goods intended for use in foreign and diplomatic missions;

- currency (both of Russia and foreign countries), which is a valid means of payment, securities;

- marine products extracted and processed (if required by technology) by a Russian organization;

- ships registered in the Russian International Register of Ships;

- goods (except excise goods) involved in international cooperation in the field of space;

- medicines not registered in Russia intended for specific patients;

- materials that have no analogues produced in Russia, which will be used in research and scientific and technical developments;

- breeding stock (also its sperm and embryos) and poultry (and its eggs).

When imported from an EAEU member country, the tax will also not be imposed on customer-supplied raw materials (clause 14 of Section III of Appendix No. 18 to the EAEU Treaty) and goods purchased from a Russian seller, but delivered to the buyer within the territory of the EAEU country (letter from the Ministry of Finance of Russia dated February 26 .2016 No. 03-07-13/1/10895).

Period of application of the deduction

Situation: at what point does the right to deduct VAT paid at customs upon import arise?

The right to deduct VAT paid at customs arises in the quarter when the imported goods were accepted for registration and is retained by the importer for three years from that moment. For example, if goods were accepted for accounting on June 30, 2015, then the right to deduct VAT paid at customs when importing these goods is retained by the buyer until June 30, 2022 (Clause 3, Article 6.1 of the Tax Code of the Russian Federation).

VAT paid at customs can be deducted if the following conditions are met:

- the goods were purchased for transactions subject to VAT or for resale;

- the goods are credited to the organization’s balance sheet;

- the fact of VAT payment has been confirmed.

VAT is deductible if the imported goods were placed under one of four customs procedures:

- release for domestic consumption;

- processing for domestic consumption;

- temporary importation;

- processing outside the customs territory.

This procedure for applying the deduction follows from the provisions of paragraphs 1, 2 of Article 171 and paragraphs 1, 1.1 of Article 172 of the Tax Code of the Russian Federation.

The organization's own property and all business transactions carried out by it are reflected in the relevant accounting accounts (Article 5, paragraph 3 of Article 10 of the Law of December 6, 2011 No. 402-FZ). Thus, acceptance for accounting is a reflection of the value of property in the accounting accounts that are intended for this purpose.

If we are talking about inventory items, registration is the moment when their value is reflected in account 10 “Materials” or account 41 “Goods” with the execution of the corresponding primary documents (for example, a receipt order in form No. M-4, commodity invoice according to form No. TORG-12). This conclusion is confirmed by the Russian Ministry of Finance in letter dated July 30, 2009 No. 03-07-11/188.

Deduction of VAT amounts paid on the import of fixed assets, equipment for installation and (or) intangible assets is made in full after they are registered (clause 1 of Article 172 of the Tax Code of the Russian Federation).

When registering imported goods, it is necessary to take into account the features associated with determining the moment of transfer of ownership of goods from the seller to the buyer. This moment (for example, shipment of goods to the carrier, payment for goods by the buyer, crossing of the Russian border by goods, etc.) must be recorded in the foreign trade contract. If there is no such clause, the date of transfer of ownership should be considered the moment the seller fulfills his obligation to supply the goods. Usually this point is associated with the transfer of risks from the seller to the buyer, which in turn is determined according to the provisions of the International Rules for the Interpretation of Trade Terms "INCOTERMS 2010".

If imported goods have been cleared through customs, but ownership of them has not yet transferred to the buyer, they can be taken into account off the balance sheet. For example, on account 002 “Inventory assets accepted for safekeeping.” In this case, the buyer also has the right to deduct VAT paid at customs. This conclusion can be drawn from the letter of the Federal Tax Service of Russia dated January 26, 2015 No. GD-4-3/911.

For more information on the procedure for submitting VAT for deduction depending on their registration, see:

- for equipment requiring installation - How to record the receipt of fixed assets requiring installation;

- for objects recorded on account 08 - Under what conditions can input VAT be deducted?

The procedure applied in terms of VAT to goods imported from the EAEU

The import procedure from a member country of the EAEU in relation to VAT is characterized by the following:

- The need to pay tax by the importer appears after the goods are accepted for registration or after the date of the next payment established by the leasing agreement (if the transaction is carried out under it) occurs (clause 19 of Section III of Appendix No. 18 to the Treaty on the EAEU).

- The tax base will be determined, respectively, either on the date the goods are registered or on the payment date reflected in the leasing agreement.

- The accrued tax should be transferred to the tax authority and a report dedicated to it should be submitted there, including two additional reports (an application for import and a declaration drawn up in a special form).

- The tax must be calculated and reported on a monthly basis, doing this for the months in which the import took place.

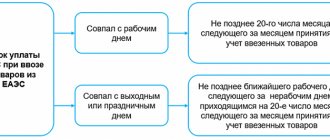

- There is a special deadline for filing reports and tax payments, which falls on the 20th day of the month following the month of import (clauses 19, 20 of Section III of Appendix No. 18 to the Treaty on the EAEU).

The basis of the tax base will be the value of the goods reflected in the documents accompanying them (clause 14 of section III of Appendix No. 18 to the Treaty on the EAEU). An excise tax will be added to it if the goods are excisable.

ATTENTION! In general, the costs of delivering goods do not increase the VAT tax base. The exception is cases when such expenses are included in the cost of imported goods (paragraph 2, clause 14 of Appendix 18 to the Treaty on the EAEU, letter of the Ministry of Finance dated October 7, 2010 No. 03-07-08/281). Despite the fact that the letter from the Ministry of Finance draws conclusions based on the protocol in force before the entry into force of the Treaty on the EAEU, these clarifications can be applied at the present time.

For a leasing agreement, the base will arise in the amount of each next payment (clause 15 of Section III of Appendix No. 18 to the Treaty on the EAEU).

Amounts expressed in foreign currency will have to be converted into Russian rubles, doing this at the exchange rate as of the date (clauses 14, 15 of Section III of Appendix No. 18 to the Treaty on the EAEU):

- registration of goods;

- payment reflected in the leasing agreement, regardless of when and in what amount the payment was actually made.

The entire settlement process for each specific delivery under a specific contract will be reflected in the application for the import of goods.

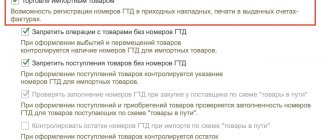

Customs declaration for import into 1C 8.3 Accounting

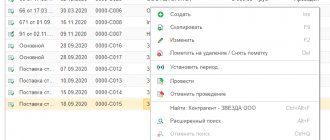

The customs declaration of goods in 1C 8.3 is reflected in the import customs declaration document in the section Purchases - Purchases - import customs declaration. Create it based on the document Receipt (act, invoice) by clicking the Create based on .

GTD in 1C Accounting 8.3

Main tab :

- The customs declaration number is the number from column A of the customs declaration (CD);

- The deposit is the basis for settlements. Type of agreement - Other ;

- Customs duty - the amount of the fee, column 47 “Calculation of payments” by type of payment 1010;

- Link Currency - rub. Settlements with customs are carried out in rubles, so select rubles. After this, the data on the Sections tab of the customs declaration in 1C will be filled in rubles;

- Calculations - the data on the link should be filled out if you need to offset the advance customs payment for specific payment orders. In our example, we do not select payments, since the payment was made according to two payment orders, and it is against them that the advance is credited automatically.

Mutual settlements with customs are carried out on account 76.09, therefore the Account for accounting of settlements with the counterparty is indicated exactly as such. The advance on it is counted in the same way as on accounts 60.02 or 62.02.

View Settlements with customs

- Reflect VAT deduction in the purchase book checkbox . If it is installed, then all payment documents against which the advance was offset will be reflected in the purchase book: payment orders for the payment of duties, fees, VAT. And it should only include the payment order that paid VAT.

BukhExpert8 recommends not checking this box, but registering a VAT deduction using the document Formation of purchase ledger entries, in which you can manually adjust the payment order data.

tab of the customs declaration in 1C based on the document Receipt (act, invoice) .

Please indicate at the top:

- Customs value : from column 12 “Total customs value” - if you fill out the entire declaration for goods;

- from column 45 “Customs value” - if you fill in according to the data in one of the sections of the declaration for goods.

In 1C, customs value is not stored or calculated.

- % duty - rate or fixed amount of duty on all goods (column 47 “Calculation of payments” of the declaration for goods, type of payment 2010). If the duty rate is not the same for goods, then the column is not filled in, and the total amount of duty is manually set in the Duty .

- % VAT - VAT rate for all goods (column 47 “Calculation of payments”, payment type 5010).

If, as a result of auto-filling the customs declaration document for imports , there are discrepancies in the amounts of duty and VAT, for example, due to rounding in 1C, then these amounts must be adjusted manually.

See also How the amount of VAT is calculated at customs when importing goods from non-CIS countries

Products by section:

- if there are several goods, then distribute the amounts of duty and VAT between the goods using the Distribute ;

- if duty is levied only on specific items, in the Duty , manually enter the amount of duty applicable to specific goods;

- Amount - the cost of goods from the document Receipt (act, invoice) , since it is this amount, together with the amounts of duty and fee, that is used to fill out column 15 of the purchase book (clause 6 of the Rules for maintaining the purchase book, approved by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137).

- Accounting account, Accounting account (NU) - an accounting account in the debit of which duties and fees are reflected in the accounting system and NU;

- VAT account - account 19.05;

- Comment - BukhExpert8 advises filling out information about the payment slip for the payment of VAT offset against the customs declaration (column 47 “Calculation of payments”, type of payment 5010). This data will be needed when deducting VAT.

Postings

Examples of calculating the tax base for imports from the EAEU

Example 1

Mir LLC imported 20 office tables to Russia from the Republic of Belarus in August. The price of each of them is 3,000 Russian rubles. Accordingly, the total cost of delivery is 60,000 Russian rubles. The product is not excisable, i.e. the excise tax will not participate in the calculation of the tax base.

Thus, the tax base for this supply will be equal to 60,000 rubles. The applicable tax rate is 20%. At the end of August, Mir LLC will have to pay 60,000 × 20% = 12,000 rubles to the budget.

Example 2

Under a leasing agreement, Quartz LLC received technological line equipment worth 12,000,000 Russian rubles from the Republic of Belarus in June. According to the terms of the agreement, payments are calculated for 12 months and are paid in equal installments. That is, in August, Quartz LLC will have to pay the Belarusian supplier 1,000,000 rubles.

It is this amount that will become the tax base for calculating import VAT for August. The tax from it will be: 1,000,000 × 20% = 200,000 rubles.

Import into 1C 8.3 Accounting step by step

The organization entered into a contract with the supplier Galaxy LLC for the supply of goods from Germany in the amount of 20,000 EUR.

On March 11, an advance payment in the amount of 10,000 EUR was made.

On March 19, the supplier Galaxy LLC shipped the goods Lathe IM-1 (1 pc.) worth 20,000 EUR. The transfer of ownership of the goods occurs at the moment the goods are transferred by the carrier to the buyer’s warehouse. Delivery basis - DAP Moscow.

On March 27, advance customs payments were made (VAT - 315,000 rubles, duty - 75,000 rubles, fee - 750 rubles).

On March 29, customs declaration of goods was carried out. The machine was delivered to the warehouse and accepted for accounting.

Conditional courses for example design:

- March 11 — the rate of the Central Bank of the Russian Federation is 73.00 rubles/EUR;

- March 29 — the rate of the Central Bank of the Russian Federation is 75.00 rubles/EUR.

Rules for applying VAT when importing from a country that is not a member of the EAEU

When importing from a country that is not part of the EAEU, the following principles are significant for VAT:

- Without paying the tax, the goods subject to taxation will not be released from customs (clause 1 of the appendix to the order of the State Customs Code of the Russian Federation No. 131).

- The calculation of its amount occurs simultaneously with the registration of a cargo customs declaration (CCD), and it is in this document that its value should be sought (clause 12 of the appendix to the order of the State Customs Committee of the Russian Federation No. 131).

- The tax should be paid to the customs authority, and this may not be done by the importer himself (clause 2 of the appendix to the order of the State Customs Committee of the Russian Federation No. 131).

- No additional reporting is required.

The tax base will be (clause 5 of the appendix to the order of the State Customs Committee of the Russian Federation No. 131):

- customs value of the goods;

- customs duties (if applicable);

- excise tax (if the product is subject to it).

It must be calculated with a preliminary breakdown of goods into groups by name and distinguishing among them those subject to and not subject to excise taxes, as well as those that are products of processing of materials sent for this purpose from Russia (clause 7 of the appendix to the order of the State Customs Code of the Russian Federation No. 131).

In what cases is it possible to be exempt from VAT when importing goods from countries outside the EAEU? For the answer to this question, see the Ready-made solution from ConsultantPlus. And if you do not have access to the legal reference system, sign up for temporary demo access. It's free.

Deduction when customs value changes

Situation: how to reflect in tax reporting VAT that was overpaid at customs and accepted for deduction? The overpayment was caused by an incorrect determination of the customs value of goods by customs. By court decision, the overpayment was returned to the organization.

The amount of VAT that customs returns to the organization based on a court decision must be reflected in the tax return for the period in which the court decision came into force.

The right to deduct VAT paid at customs when importing goods arises for an organization if the conditions provided for in paragraph 2 of Article 171 and paragraph 1 of Article 172 of the Tax Code of the Russian Federation are simultaneously met.

Information about VAT paid at customs is indicated in the purchase book. In column 3 of the purchase book, the number of the customs declaration is reflected (subparagraph “e”, paragraph 6 of section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). And in column 7 of the purchase book - the date and number of the payment order confirming the payment of VAT at customs (subparagraph “k”, paragraph 6 of section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). The purchase ledger indicators serve as the initial data for filling out the relevant sections of the VAT return (clause 4 of the Procedure approved by Order of the Ministry of Finance of Russia dated October 29, 2014 No. ММВ-7-3/558).

Adjustment of the customs value of goods and the corresponding amount of tax by court decision is the basis for clarifying previously declared deductions. Since the deduction was overestimated due to an incorrect determination of the customs value, the excess VAT amount refunded must be restored. This should be done in the quarter in which the court decision came into force. There is no need to submit an updated declaration for the period in which the inflated deduction amount was reflected. Such clarifications are contained in the letter of the Ministry of Finance of Russia dated April 8, 2014 No. 03-07-15/15870 (brought to the attention of the tax inspectorates by letter of the Federal Tax Service of Russia dated April 21, 2014 No. GD-4-3/7606).

Controlling agencies believe that a reduction in the customs value of imported goods with a refund of overpaid VAT is not a basis for clarifying tax obligations of previous periods. The fact is that previously submitted tax reporting needs to be clarified only in cases where errors made by the payer were found in it (clause 1 of Article 54, clause 1 of Article 81 of the Tax Code of the Russian Federation). However, both the adjustment of the customs value when importing goods and the cancellation of this adjustment by court decision cannot be considered as a mistake by the importing organization. After all, until the court made such a decision, the payment of an inflated amount of VAT at the request of customs and the reflection of this amount in the tax return were completely justified. The legality of this approach is confirmed by arbitration practice (see, for example, Resolution of the FAS Moscow District dated October 21, 2011 No. A40-151153/10-140-889).

Examples of calculating the tax base for imports from a country outside the EAEU

Example 1

Signal LLC imports chilled fish from Vietnam, which is not classified as a delicacy. The customs value of the consignment is 300,000 Russian rubles. The goods are subject to customs duties. Its value is 60,000 rubles. The goods are not excisable.

The tax base will be determined as the sum of customs value and customs duty, i.e. it will be equal to 300,000 + 60,000 = 360,000 rubles.

The tax rate applicable to a commodity such as fish is 10%. Accordingly, the tax due will be 360,000 × 10% = 36,000 rubles.

Example 2

Comfort LLC declares the arrival of knitwear from China. Among them are intended:

- for adults - their customs value is 400,000 Russian rubles, the customs duty on them is 80,000 rubles;

- for children - their customs value is 200,000 Russian rubles, customs duty - 40,000 rubles.

When calculating VAT, goods for adults will be subject to a 20% rate, and knitwear intended for children will be taxed at a rate of 10%. Accordingly, the bases need to be calculated separately. The final tax amount will be obtained by summing its two values, calculated from two different bases: (400,000 + 80,000) × 20% + (200,000 + 40,000) × 10% = 120,000 rubles.

Rules for accepting import VAT as deductions

To include import-related VAT in deductions, regardless of which country the import was made from, the following conditions must be met (clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation):

- the goods are accepted for accounting (and this may also be off-balance sheet accounting);

- the goods are intended for operations subject to VAT;

- tax has been paid.

For imports from a country that is not a member of the EAEU, these conditions are met at the time of import. Since no additional actions are required from the taxpayer, such tax is deducted during the period of importation. The document that serves as an invoice for him when entering data into the purchase book is a cargo customs declaration (CCD).

When importing from a member country of the EAEU, the tax is paid in the month following the month of import, which at the border of tax periods will lead to a transfer of the deduction to a later one. In addition, the possibility of its application here poses additional requirements related to the presence of special mandatory reporting submitted to the Federal Tax Service (import application and declaration). Until it is accepted by the tax authority, the deduction is not considered possible (letter of the Ministry of Finance of Russia dated July 2, 2015 No. 03-07-13/1/38180). A deduction for imports from a member country of the EAEU will be included in the purchase book with reference to the details of the import application.

Conditions for applying the deduction

VAT paid at customs on imported goods can be deducted (clauses 1, 2 of Article 171 of the Tax Code of the Russian Federation) subject to the following conditions:

- the goods were purchased for transactions subject to VAT;

- the goods are accepted for accounting (recorded to the organization’s balance sheet);

- the fact of VAT payment is confirmed by primary documents.

When importing goods from countries participating in the Customs Union, VAT is paid not at customs, but through the tax office (Article 4, 72 of the Treaty on the Eurasian Economic Union, clause 13 of Appendix 18 to the Treaty on the Eurasian Economic Union). For more information on how to obtain a tax deduction in such a situation, see How to deduct VAT paid when importing from the Customs Union.

VAT is deductible if the imported goods were placed under one of four customs procedures:

- release for domestic consumption;

- processing for domestic consumption;

- temporary importation;

- processing outside the customs territory.

Such deduction conditions are established by paragraph 2 of Article 171 and paragraph 1 of Article 172 of the Tax Code of the Russian Federation.

When importing goods into Russia, VAT may be paid through an intermediary acting on behalf and at the expense of the importer. In this case, the importer has grounds to deduct the amount of tax paid by the intermediary. If VAT on the import of goods was paid by a foreign organization (supplier) or an intermediary (agent, commission agent) acting on its behalf, the importer has no right to take advantage of the tax deduction. This was stated in the letter of the Ministry of Finance of Russia dated June 14, 2011 No. 03-07-08/188.

In some cases, VAT paid at customs is not deductible, but is included in the cost of purchased goods. This must be done if the imported goods:

- used in transactions not subject to VAT (exempt from taxation);

- used for the production and sale of products, the place of sale of which is not recognized as the territory of Russia;

- imported by an organization exempt from fulfilling taxpayer obligations under Article 145 of the Tax Code of the Russian Federation, or an organization that is not a VAT payer (for example, applying a special tax regime);

- it is intended to be used in operations that are not recognized as sales according to paragraph 2 of Article 146 of the Tax Code of the Russian Federation.

Such rules are established by paragraph 2 of Article 170 of the Tax Code of the Russian Federation.

Situation: is it possible to deduct VAT paid at customs upon import if only part of the contract amount is transferred to the foreign seller? Imported goods are registered and intended for resale.

Answer: yes, you can.

In this situation, the organization has fulfilled all the conditions for deduction:

- VAT is transferred to the budget;

- goods are accepted for accounting;

- the goods will be used for resale.

As for the debt not repaid to the foreign seller, this is not an obstacle to deduction (clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation).

This approach is confirmed by the explanations of the tax service (see, for example, letter of the Department of Tax Administration of Russia for Moscow dated April 18, 2003 No. 24-11/21291).

Situation: is it possible to deduct VAT when importing equipment contributed to the authorized capital of an organization by a foreign founder?

Answer: yes, it is possible, but only if such equipment is not included in the list approved by Decree of the Government of the Russian Federation of April 30, 2009 No. 372.

If the equipment is not included in this list, then when importing it at customs, the organization will pay VAT, regardless of the reasons why the equipment is imported into Russia. As a general rule, the transfer of property to the authorized capital is not subject to VAT (subclause 1, clause 2, article 146 of the Tax Code of the Russian Federation). However, the decision to transfer property to the authorized capital is made by a foreign founder at the moment when the property is located outside of Russia. This means that the operation of transferring the contribution to the authorized capital also takes place abroad. Under such circumstances, the organization imports into Russia not property intended for contribution to the authorized capital, but its own property. Therefore, if the imported equipment is intended for use in transactions subject to VAT, there are no restrictions on the tax deduction of VAT paid at customs. A similar point of view is reflected in the letter of the Federal Tax Service of Russia dated January 25, 2006 No. MM-6-03/62. Arbitration courts adhere to the same position (see, for example, decisions of the Federal Antimonopoly Service of the Moscow District dated February 14, 2007 No. KA-A40/13730-06, dated December 6, 2006 No. KA-A41/11591-06).

If the equipment is included in this list, then its import into the customs territory of Russia is not subject to VAT. In this case, the basis on which the equipment is imported into Russia (purchase, contribution to the authorized capital) does not matter. This follows from the provisions of paragraph 7 of Article 150 of the Tax Code of the Russian Federation. Since the organization will not pay VAT at customs when importing equipment, it will have no basis for claiming the tax amount for deduction.

Situation: is it possible to deduct VAT paid at customs upon import if the organization paid the tax amount using borrowed funds?

Answer: yes, you can.

The Tax Code of the Russian Federation states that VAT paid at customs can be deducted. There are no restrictions on the source of tax payment in the legislation (clause 2 of Article 171 of the Tax Code of the Russian Federation). Therefore, the mere fact of paying import VAT using borrowed funds does not deprive the payer of the right to deduction.

This point of view is shared by the Russian Ministry of Finance in letter dated August 24, 2005 No. 03-04-08/226.

Arbitration courts share this position (see, for example, rulings of the Supreme Arbitration Court of the Russian Federation dated December 14, 2007 No. 16379/07, dated February 7, 2007 No. 859/07, resolutions of the FAS East Siberian District dated August 15, 2007 No. A33 -27276/05-F02-5437/07, Northwestern District dated October 1, 2007 No. A56-207/2007, dated September 17, 2007 No. A56-31300/2006, dated February 28, 2007 No. A56- 11254/2006, dated February 12, 2007 No. A56-17166/2006, dated November 27, 2006 No. A56-32438/2005, Volga-Vyatka District dated July 2, 2009 No. A11-9386/2008-K2-18 /461, Moscow District dated November 14, 2007 No. KA-A40/11812-07).

Situation: is it possible to deduct VAT paid at customs upon import, taking into account the additional amount accrued based on the adjustment of the customs value to the cargo customs declaration?

Answer: yes, you can.

The form for adjusting the declaration for goods is an integral part of the customs declaration (paragraph 3, paragraph 2 of the Procedure approved by the Decision of the Board of the Eurasian Economic Commission of December 10, 2013 No. 289). Therefore, if other conditions for VAT deduction are met, the organization has the right to take into account the adjustment of the customs value and accept for deduction the amount of tax actually paid (see, for example, letter of the Department of Tax Administration of Russia for Moscow dated July 7, 2003 No. 24-11/36764).

Postings arising when accounting for VAT on imports

For VAT on imports, the entries made in accounting will not differ:

- the accrual of tax payable will be displayed as Dt 19 Kt 68;

- payment for it - Dt 68 Kt 51 (for payments to customs, posting Dt 68 Kt 76 is possible here, if VAT is transferred to the customs authority in advance);

- acceptance for deductions - Dt 68 Kt 19.

However, in terms of dates, differences in transactions related to countries outside the EAEU and countries participating in this union will be significant. In the first case, they are carried out on the date of release of the goods into the territory of Russia, and in the second - in the month following the month of import, subject to the acceptance by the tax authority of reporting related to imports from the EAEU.

During the period when all the necessary conditions associated with the use of deductions are met, they will be reflected in the regular quarterly VAT return, but different lines of section 3 will be used in it: 150 - for the tax paid at customs, 160 - for the tax paid to the tax office. organ.

Capitalization of imported goods in 1C 8.3

Receive goods from third countries in 1C using the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases – Purchases – Receipt (acts, invoices).

Please indicate:

- Invoice No. from - data of the primary document, for example, invoice No. and date;

- from - date of transfer of ownership.

Fill out the table with the purchased goods.

- % VAT - Without VAT ;

See also How to correctly indicate the customs declaration and the country of origin of goods when importing

Postings

See also New “import” documents in the Federation Council (from the recording of the broadcast on December 21, 2022)

Results

The rules for calculating and paying VAT related to imports depend on the country from which the import is made: whether it is a member of the EAEU or not.

Imports from a country within the EAEU are simplified with regard to the import procedure itself (there is no customs), but are accompanied by additional reporting to tax authorities and later fulfillment of the conditions for including import tax as deductions. Imports from a country that is not a member of the EAEU occur through customs and require payment of a tax to release the goods into Russia. The tax bases for countries that are members of the EAEU and those that are not members of the EAEU are determined differently. In the first case, it is the value reflected in the shipping documents (plus excise tax, if any), and in the second case, it is the customs value, increased by customs duty and excise tax (if duty and excise tax must be paid). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Organization of accounting of import transactions

According to clause 5 of PBU 5/01 and clause 15 of the Methodological Instructions, regulated by Order of the Ministry of Finance dated December 28, 2001 No. 119n, products are registered at actual cost. It consists of the following components:

- contract price;

- additional costs of the importer not included in the transaction price, in particular, delivery costs, etc.;

- customs duties and fees;

- excise taxes (for excisable products).

This point is based on clause 6 of PBU 5/01 and clause 16 of the Guidelines.

The expenses related to the actual cost (clause 6 of PBU 5/01) include only customs duties, and there are no customs duties. But since their payment when importing products is an indispensable condition, these costs also need to be taken into account as directly related to the purchase of products and included in its cost.

Correspondence in accounting by cost:

Dt 41 Kt 60 - cost of products at the time of transfer of ownership;

Dt 44 Kt 60 - transportation costs;

Dt 44 Kt 60 - intermediary services for the purchase of products (registration through an intermediary company);

Dt 44 Kt 76/Settlements with customs - customs duty (collection);

Dt 41 Kt 44 - cost of products taking into account purchase costs;

Dt 41 Kt 19/Excise taxes - inclusion of excise tax in the cost of imported products.

Valuation of products and costs paid in foreign currency

If the cost of purchased products is determined in foreign currency, then its valuation is carried out in rubles at the exchange rate of the Central Bank of the Russian Federation, which is established on the date of its reflection in accounting. This is indicated in paragraph 19 of the Methodological Instructions (Order of the Ministry of Finance No. 119n).

When paying in advance for imported products, its value under an agreement or contract in rubles must be calculated at the rate of the Central Bank of the Russian Federation on the date of payment upon the fact (paragraph 2, paragraph 9, paragraph 10 of PBU 3/2006). In this case, the unpaid part of the cost of the purchased product is determined at the exchange rate on the date of transfer of ownership of it (clause 5, paragraph 1, clause 9 of PBU 3/2006).

That part of the debt that was paid in advance does not require revaluation. The other part of the debt that has not been paid for products accepted for accounting must be revalued as of the end of each month and (or) on the date of repayment of the debt (clause 7 of PBU 3/2006). In this case, exchange rate differences appear - they must be reflected in accounting as part of other income and expenses (clause 13 of PBU 3/2006).

Customs payments

To calculate customs duties, it is necessary to determine the customs value of the product. It is established by the declarant or the customs authority (clause 3 of article 23 of the Law of August 3, 2018 No. 289-FZ, clause 14 of article 38 of the EAEU Labor Code).

Customs payments are not only duties and fees, but also excise taxes (for excisable products), as well as VAT for imported products (clause 1, article 46 of the EAEU Labor Code, subclause 13, clause 1, article 182, subclause 4, clause 1 Article 146 of the Tax Code of the Russian Federation).

Excise tax is a non-refundable tax; accordingly, its amount is included in the cost of products (clause 6 of PBU 5/01, clause 2 of Article 199 of the Tax Code of the Russian Federation).

The tax base for VAT when importing products into the Russian Federation is calculated as the sum of customs value, customs duties and excise taxes. This point is defined in paragraph 1 of Art. 160 Tax Code of the Russian Federation.

Typically, import VAT is paid to the customs account as an advance payment, and after that, if the company becomes obligated to pay VAT, the customs office writes off the required amount (Article 57 of the EAEU Labor Code).

The correspondence is as follows:

Dt 76/Settlements with customs for VAT Kt 51 - advance payment for VAT at customs;

Dt 19 Kt 68/VAT calculations - VAT payable at customs;

Dt 68/Calculations for VAT Kt 76/Settlements with customs for VAT - write-off of VAT on imported products by customs.

In a situation where the importer uses OSNO and is not exempt from VAT, the amount of tax upon import is accepted for deduction. Of course, this is provided that the imported products will be used in operations subject to VAT (clause 2 of Article 171 of the Tax Code of the Russian Federation).

Importers using special tax regimes are also required to pay VAT to the budget. In this case, the amount of VAT is not deducted, but is taken into account as expenses.

If VAT deduction is applied, you need to generate correspondence:

Dt 68/VAT calculations Kt 19 - VAT deduction paid at customs.

Posting of imported products

In accounting, imported products must be reflected at the actual cost on the account. 41 (clause 5 of PBU 5/01). The costs of its acquisition, if they are not included in the customs value, can be taken into account by a trade organization in the cost of production or as part of sales costs (clause 13 of PBU 5/01).

If a shortage (damage) of imported products is detected, the commission draws up an act, for example, in form No. TORG-3.

You can purchase services that help you work as an accountant here.

Do you want to install, configure, modify or update 1C? Leave a request!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter