When getting a job, a person carries with him not only a store of knowledge, skills and hopes, but also certain documentary evidence of his personality, competence and law-abidingness. When going through the official employment procedure, you need to pay attention to the documentary side of the process. The law provides for a certain list of documents that must be in the hands of each applicant when establishing an employment relationship. In practice, this list is usually further expanded due to the requirements of the employer.

Question: What educational documents can be required when hiring a medical worker to conduct pre-trip and post-trip medical examinations of drivers? View answer

Let's consider which papers are required when concluding an employment contract, and which requirements can be argued about, and whether it is worth doing.

What documents should an employer request when hiring a citizen of Kyrgyzstan ?

Stage one - job application

So, after a successful interview, it was decided to hire the person. The first thing a future employee must do is write an application. It is submitted to the head of the organization. The document is written in free form by hand. For convenience, you can print ready-made forms. The text should be something like this:

“To the General Director of LLC Ivanov and Partners, Ivanov Ivan Ivanovich, from Petrov Petrovich.

Statement

Please hire me for the position of sales manager.”

Date, signature.

The employment application is signed by the manager or his deputies authorized to hire employees . In addition to the visa, the director must indicate his consent - write “I don’t object”, “I agree” or something similar.

Conduct occupational safety training

Briefing is carried out to explain to the employee how to behave in the workplace. There are introductory, primary, unscheduled and targeted briefings.

Conduct induction training for each new employee. The rest - depending on his position or as needed.

Employees whose duties are not related to the use of equipment, tools, storage and use of raw materials and materials can be exempted from initial and repeated training. The list of positions that do not undergo these instructions, you state. For example, you can release employees who work only with office equipment - a computer, printer, telephone.

Sample order for approval of positions exempt from initial training

Unscheduled and targeted briefings are carried out if something happens. For example, labor protection legislation has changed, workers have violated safety regulations, or government agencies have issued an order to conduct training. Such instructions are less common, so we will not talk about them in detail.

Before instructing employees, undergo occupational safety training yourself. Conducting briefings without training is the same as not conducting them at all. Tuition is paid - approximately 2,500-4,000 rubles.

To conduct an introductory briefing:

- Develop and approve a training program. Here is an approximate list of questions for her and a sample approval order.

- Appoint yourself as responsible for labor safety - this requires another order.

- Conduct induction training on the employee's first day of work.

- Make a note in the journal about the briefing, with yours and the employee’s signatures.

Article: organization of labor protection in a small enterprise

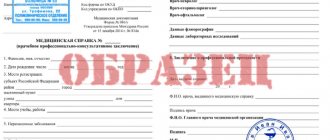

Stage two - medical examination

It's not for everyone. The Government of the Russian Federation has developed a list of professions for which medical examinations are mandatory . These are workers engaged in hazardous working conditions, doctors, rotation workers. In relation to an online store, a medical examination must be carried out by office employees who work with a computer more than 50% of the time and sales workers - for example, sellers of goods delivery points, as well as couriers.

If you have an online food store or delivery of fast food - sushi, rolls and hamburgers, then employees who are involved in working with food also need a medical book . And minors undergo medical examinations, regardless of their profession - everything.

To undergo a medical examination, you must give the future employee a referral. There is no approved form for it, but there is a list of requirements for this document. According to the order of the Ministry of Social Development No. 302n, the following must be indicated in the direction:

- name of the organization indicating the form of ownership (IE or LLC);

- activity codes according to OKVED;

- name of the medical institution to which the employee is sent;

- Full name of the employee and job title;

- indication of the department (sales department, accounting department, etc.);

- list of harmful factors.

Based on the information specified in the referral for examination, doctors will decide which specialists the applicant should undergo and which tests to take. After successfully passing the examination, the employee is given a certificate with a conclusion about suitability for work.

Note. Russian legislation has the concept of “Special assessment of working conditions” . Any entrepreneur is obliged to invite a specialized organization to examine all workplaces and give an opinion on the state of workplaces and the specifics of activity. It is on the basis of this conclusion that it is decided whether employees need medical examinations or not.

Send the employee for a medical examination, if necessary.

Some employees are required to undergo a medical examination before starting work. These include:

- Workers in the food industry, catering and trade, water supply facilities, medical organizations and child care institutions. For example, sellers, cooks, waiters, teachers.

- Workers with harmful and dangerous working conditions and those whose duties are related to traffic. Check the lists to see if your employee falls into this category.

- Employees under 18 years of age.

- Employees from other cities who work in the Far North and equivalent areas.

A medical examination is carried out before an employment contract is signed. If the candidate refuses, don't hire him.

The employee undergoes a medical examination at your expense. To do this, you enter into an agreement with the hospital and send an employee there. Based on the results of the medical examination, he will be given a certificate or an entry will be made in the medical book.

Article: who and when should undergo a medical examination

Stage three - employment order

The employee returned to you with a medical certificate confirming his suitability for work. Now it's up to you. The first thing you must do as an employer is issue a hiring order. This is the main document for employment. On its basis, an employment contract is concluded, which we will talk about in due course.

The order indicates the name of the organization, full name of the head, and the serial number of the document. The text is as follows:

“Recruit Ivan Ivanovich Ivanov for the position of sales manager from such and such a date”

Date, signature.

The employee is introduced to the employment order under his personal signature. The order is recorded in the order log. A medical examination certificate and a job application are attached to it - this will be the employee’s personal file.

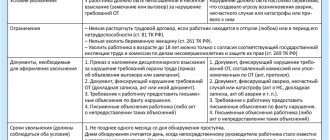

Additional documents due to the specifics of the work

Some specialties and positions associated with certain legal requirements require documentary evidence of the applicant's personality characteristics. The Labor Code of the Russian Federation and certain regulations provide for such professions some additional documentation, which the employer has the right to request during employment:

- a driver's license of the appropriate category (if the employee is applying for a position that involves driving a certain type of transport);

- medical record (required when holding a position in the teaching, medical, trade fields, as well as for catering workers);

- work permit issued by the Federal Migration Service - for citizens of other states who are getting a job in Russia;

- a recent certificate of medical examination (form 086-U) confirming the absence of contraindications for the specified professional activity - for types of work associated with health hazards or in unfavorable conditions, as well as for all minor applicants;

- a certificate of no criminal record and/or criminal prosecution (possibly about rehabilitation after such) is needed for some positions that provide restrictions on this basis, for example, for work in the judicial system.

Stage five - making an entry in the work book

If the employee already has a completed work report, you just need to make a new entry there. This is done by the HR inspector or an authorized person. This could be the individual entrepreneur himself. The entry is extremely simple:

“Hired at XXX LLC for the position of sales manager in the sales department from such and such a day of such and such a month on the basis of order No. 1.”

Date, signature of the inspector or official, seal of the organization. Or HR department, if you have one.

This is if labor exists. If an employee gets a job for the first time and does not have a work book, one must be created. Labor papers are sold in any bookstore or office supply store. The employee must purchase it and bring it to you. And you, in turn, fill out the title page. There is a minimum of data - the employee’s full name, his education and profession, date of birth, date of filling out the book and signature of the person in charge. This is usually a human resources inspector or an authorized employee. In the case of an individual entrepreneur - the individual entrepreneur himself.

The first page must be filled out in legible handwriting, without blots or corrections. This document will remain with the employee for life and will be needed when applying for a pension. The organization's seal is also placed on the title page.

Sign an employment contract

An employment contract is the basis of the relationship with an employee. In it you indicate his position, responsibilities, work schedule, salary and financial responsibility. All conditions are listed in Article 57 of the Labor Code.

Sign the employment contract within three days from the date of actual start of work. If you refuse local acts, use the standard form of agreement that the government has developed. Just fill in the blanks.

If some clauses do not apply to your situation, remove them from the contract. For example, about the special nature of the work, if this is an ordinary office employee, or about compensation for the use of personal belongings, if he works on your equipment.

Print out the agreement in two copies. Give one to the employee, and ask them to write on yours “I received a copy of the employment contract” with a date and signature.

We notify the state about the status of the employer and begin paying contributions

First, let's digress a little and think about the global. Our country has pensions, health insurance and other benefits from the state. There are special funds for this . It is from there that the state takes funds for old-age pensions, treatment and rehabilitation of occupational diseases and other needs.

When you become an employer, you are required to contribute money to all these funds . This is the basis of the social well-being of the population. Let's briefly explain how it works:

- Tax Inspectorate. Collects taxes - both yours and your workers'. You pay tax on profits, employees - personal income tax - personal income tax. The money goes to maintaining the state apparatus, paying doctors, teachers, police, and so on.

- Pension Fund of Russia - PFR. Accumulates money to pay old-age pensions.

- Social Insurance Fund - FSS. The fund pays for the treatment of injuries after industrial accidents, occupational diseases, and sanatorium-resort treatment.

In 2022, you only need to file one notification—to Social Security. There is no need to report anything to the pension and tax authorities: they will find out everything themselves from the first quarterly reports.

Once notices are submitted, you begin paying fees. Taxes and pension contributions are paid to the Federal Tax Service, insurance contributions to the social insurance fund. Since pension contributions are controlled by the tax office and not by the pension fund, contributions must be reported to the latter. And monthly. If you have paid your insurance premiums to the tax office, you submit a notification of payment to the Pension Fund. And so - every month.

Let's summarize. In order to avoid problems with government agencies, you must pay insurance, pension contributions and taxes for each employee . To do this, you need to submit a notification to the social insurance fund. This is given 30 days after the employee is hired. After this, make transfers to the tax and Social Insurance Fund, and send monthly reports on payment of contributions to the pension fund.

Civil contract

It happens that you need to hire employees for one-time work. For example, your office needs some cosmetic renovation. It is necessary to re-stick the wallpaper, paint the walls, replace the plumbing and tiles in the restroom. Don’t hire plumbers, plasterers and painters for this! This is where a civil contract comes to the rescue. Such an agreement is drawn up for one-time work. A classic example of a civil law contract is a work contract. You act as a customer, and the performer acts as a contractor. The document specifies the type and volume of work, the timing of its completion and payment terms. After completing the order, the parties sign the acceptance certificate for the work performed and financial documents, after which they part with the world.

What to do if workers are needed from time to time?

Let's imagine the situation. You have a small online store and use a single tax on imputed income - UTII. The tax return in this mode is submitted once a quarter. But you don’t want to fill it out yourself and don’t know how – it’s better to hire a qualified accountant for these purposes.

As in the case of office renovation, it is not profitable to hire a specialist to fill out one single piece of paper every 3 months and take it to the tax office. Therefore, the best option in this situation is an outsourcing or agency labor agreement . It looks like this. A certain organization employs a full-time accountant. You agree with its manager that once a quarter he provides you with an accountant to prepare and submit reports. And you enter into an appropriate agreement. This will be the outsourcing agreement.

What else?

We have listed what you need to do when hiring an employee. In addition, you have other responsibilities. Here are the main ones:

- Conduct a special assessment of workplaces. Read more about this in the article Special assessment of working conditions.

- Maintain a vacation schedule. Read more about it in the article How to send an employee on vacation.

- Maintain a time sheet.

- And also: pay salaries on time, pay vacations and sick leave, and submit a bunch of reports. Read our help articles in the “Working with Employees” section - we talk about this in detail there.

The bitter truth of life instead of a conclusion

Now let's count. Do you know what fine an individual entrepreneur faces if he does not register his employees as required? From 5 thousand rubles. Without going into mathematics, approximately the same amount of contributions to the funds must be paid for each employee every month. And this is at the minimum wage.

It would seem that it is easier for entrepreneurs to pay fines than to register their employees legally. But this is all due to ignorance of the laws. Upon closer examination, it turns out that by paying all the required fees, you only save . For example, sick leave can be paid not from your own pocket, but from the social insurance fund. And for insurance deductions it is quite possible to save on taxes. We will definitely teach you this in future articles. In the meantime, register your employees as expected and sleep well !

Develop local acts, if you want

Local acts are separate documents that regulate some issue in the organization: internal labor regulations, storage and use of personal data, regulations on remuneration, instructions on labor protection.

Previously, local acts were mandatory, but from 2022 micro-enterprises were allowed to abandon them. And everything that they regulate should be included in the employment contract according to the standard form. We will talk about it in detail in the next section.

How do you know if you are a micro-enterprise? If your annual income does not exceed 120 million rubles and there are fewer than 15 employees, you fall into this category.

If you want, you can write everything down in separate documents and show each of them to the employee. And he will sign that he read it all.