Transportation and procurement costs (TPC) are associated with the procurement and delivery of material assets: raw materials, goods, raw materials, materials, tools. In this article we will look at the features of accounting for material and equipment in the cost of materials.

You will learn:

- what document in 1C reflects TZR when purchasing materials;

- how to deduct VAT on additional expenses so that it is reflected in the VAT return;

- how to reflect the payment of the cost of materials and delivery to the supplier with one payment document on different accounts.

Step-by-step instruction

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

On January 29, the Organization purchased stationery from Karandash LLC. Materials worth RUB 9,322. (including VAT 18%) are accepted for accounting.

Delivery of materials was carried out by the supplier for an additional fee. The cost of services was 1,416 rubles. (including VAT 18%). The Organization's accounting policy provides that equipment and materials are distributed among purchased materials in proportion to the cost of their acquisition.

On January 29, the Organization paid the cost of materials and their delivery.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Purchasing materials | |||||||

| January 29 | 10.01 | 60.01 | 7 900 | 7 900 | 7 900 | Acceptance of materials for accounting | Receipt (act, invoice) - Goods (invoice) |

| 19.03 | 60.02 | 1 422 | 1 422 | Acceptance for VAT accounting | |||

| Registration of SF supplier | |||||||

| January 29 | — | — | 9 322 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.03 | 1 422 | Acceptance of VAT for deduction | ||||

| — | — | 1 422 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| Reflection in accounting of materials delivery services | |||||||

| January 29 | 10.01 | 60.01 | 1 200 | 1 200 | 1 200 | Accounting for delivery service costs | Receipt of additional expenses |

| 19.03 | 60.01 | 216 | 216 | Acceptance for VAT accounting | |||

| Registration of SF supplier | |||||||

| January 29 | — | — | 1 416 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.03 | 216 | Acceptance of VAT for deduction | ||||

| — | — | 216 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| Transfer of payment to the supplier | |||||||

| January 29 | 60.01 | 51 | 10 738 | 10 738 | Transfer of payment to the supplier | Debiting from the current account - Payment to the supplier | |

Purchasing materials

Regulatory regulation

Materials for production purposes are accounted for in account 10.01 “Raw materials and supplies” at actual cost or accounting prices (clause 5 of PBU 5/01, chart of accounts 1C).

Actual cost is the actual costs directly related to the acquisition of inventories, including the costs of procurement and delivery to the place of use of inventories, including insurance costs. VAT is not included in the cost of inventories (clause 6 of PBU 5/01).

In tax accounting (TA), the actual cost of inventories is determined in the same way based on their acquisition prices and other acquisition costs, excluding input VAT and excise taxes (clause 2 of Article 254 of the Tax Code of the Russian Federation).

If inventories are used for activities not subject to VAT, then incoming VAT is included in the actual cost (clause 1, clause 2, article 170 of the Tax Code of the Russian Federation).

Accounting in 1C

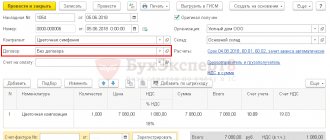

The purchase of materials is reflected in the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases – Purchases – Receipt (acts, invoice) – button Receipt – Goods (invoice).

This document can not only be entered manually using the supplier’s paper invoice, but also downloaded from the invoice in Excel format.

More details Downloading nomenclature and prices from TORG-12

And if an organization and its supplier have an EDI connected, then they can exchange electronic documents.

The tabular section indicates the purchased production materials.

Postings according to the document

The document generates transactions:

- Dt 10.01 Kt 60.01 - materials accepted for accounting;

- Dt 19.03 Kt 60.01 - VAT accepted for accounting.

Documenting

The organization must approve the forms of primary documents, including the document on the receipt of materials. In 1C, a Receipt Order in form M-4 is used.

The form can be printed by clicking the Print button - Receipt order (M-4) of the document Receipt (act, invoice) . PDF

Posting materials in 1C

Receipt of materials in 1C 8.3 is reflected in the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases - Purchases - Receipts (acts, invoices).

In the tabular section, indicate the name of the goods received by the organization, their quantity and cost.

Familiarize yourself with the nuances of filling out each field and column in the guidebook

Postings upon receipt of inventories in 1C

Postings are generated:

- Dt 60.01 Kt 60.02 - offset of advance payment;

- Dt 10.01 Kt 60.01 - materials accepted for accounting;

- Dt 19.03 Kt 60.01 - VAT accepted for accounting.

Registration of SF supplier

VAT is accepted for deduction if the conditions are met (clause 2 of Article 171 of the Tax Code of the Russian Federation):

- materials purchased for activities subject to VAT;

- a correctly executed SF (UPD) is available;

- materials were accepted for accounting (clause 1 of article 172 of the Tax Code of the Russian Federation).

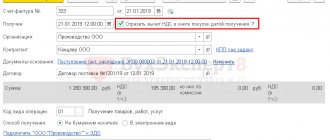

To register an incoming invoice, you must indicate its number and date at the bottom of the Receipt document form (act, invoice) and click the Register . PDF

The Invoice document received is automatically filled in with the data from the Receipt document (act, invoice) .

Operation type code : “Receipt of goods, works, services.”

If the document has the Reflect VAT deduction in the purchase book by date of receipt checkbox , then when it is posted, entries will be made to accept VAT for deduction.

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt 19.03 - VAT accepted for deduction.

Purchase Book report can be generated from the Reports - VAT - Purchase Book section. PDF

Reporting

The VAT return reflects the amount of VAT deducted:

In Section 3 page 120 “Amount of VAT to be deducted”: PDF

- the amount of VAT accepted for deduction.

In Section 8 “Information from the purchase book”:

- invoice received, transaction type code "".

Reflection in accounting of materials delivery services

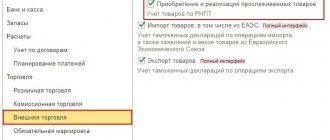

The method of reflecting additional expenses in accounting is established by the organization independently in its accounting policies.

Accounting options may be as follows:

- are included in the cost of inventories by allocating costs for each unit of materials;

- are taken into account in a separate expense account (clause 83 of Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n). This option cannot be applied in 1C without additional modifications to the program.

In NU, additional costs when purchasing materials are included in the cost of materials and equipment (clause 2 of article 254 of the Tax Code of the Russian Federation).

Find out more about the procedure for accounting for costs for the delivery of materials in the articles Accounting for additional costs when purchasing assets and Options for accounting for additional costs when purchasing inventory items

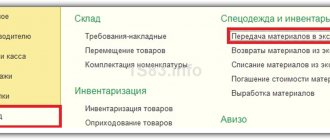

Additional expenses, which are included in the actual cost of materials, are documented in the document Additional Receipt. expenses in the section Purchases – Purchases – Additional receipts. expenses or from the document Receipt (act, invoice) Create based on button .

On the Main it is indicated:

- Content - the name of the service, in our example - Transport services .

- Amount - the amount of delivery costs - 1,200 rubles.

- Distribution method - the method of distributing additional costs between individual purchased materials. Can take on the following values: By amount – i.e. proportional to the cost of inventory items. (in our example);

- By quantity - i.e. proportional to the quantity of goods and materials.

On the Products , the materials for which you want to distribute the amount of additional costs according to the selected method are indicated. This tab can be filled out for several documents Receipt (act, invoice) .

You should install:

- Accounting account (BU) - 10.01, additional accounting account. expenses in accounting.

- Accounting account (NU) - 10.01, additional accounting account. expenses at NU.

- VAT account - 19.03 “VAT on purchased inventories”: in our opinion, it is more correct to indicate the account for input VAT relating to an asset to the cost of which additional expenses are added.

Postings according to the document

The document generates transactions:

- Dt 10.01 Kt 60.01 - additional cost. expenses are included in the cost of inventories;

- Dt 19.03 Kt 60.01 — VAT on additional charges. expenses are taken into account.

Transfer of materials to production in 1C 8.3

We will produce something from previously received materials. To do this, the program needs to reflect the transfer of materials to production and write them off as costs. The “Request-invoice” document performs these actions. You can find it in the “Production” or “Warehouse” menu.

In the header of the document we will indicate our organization and warehouse. In the tabular part on the “Materials” tab we list three items: boards, varnish and nails. If you want cost accounts to be different for items, check the “Cost account on the “Materials” tab” flag. In this case, the “Cost Account” tab in the document will disappear and this tab will display columns in which you indicate this data, but for each specific item separately. In this example, all materials will have a single account.

Let's move on to the next tab, on which we will indicate a single account for all transferred item items: 20.01. We will also indicate here that the costs will be attributed to the production department and indicate the cost item.

In this example, we will not fill out the last tab – “Customer Materials”. Let's assume that we produce only from our own materials without involving third parties.

After posting the document, we can open its postings and verify that they are formed correctly.

Also watch a video on writing off materials from account 10 in 1C using stationery as an example:

Registration of SF supplier

To register an incoming invoice, you must indicate its number and date at the bottom of the Receipt of additional expenses and click the Register . PDF

The Invoice document received is automatically filled in with the data from the Additional Receipt document. expenses .

Operation type code : “Receipt of goods, works, services.”

If the document has the Reflect VAT deduction in the purchase book by date of receipt checkbox , then when it is posted, entries will be made to accept VAT for deduction.

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt 19.03 - VAT accepted for deduction.

Purchase Book report can be generated from the Reports - VAT - Purchase Book section. PDF

Reporting

The VAT return reflects the amount of VAT deducted:

In Section 3 page 120 “Amount of VAT to be deducted”: PDF

- the amount of VAT accepted for deduction.

In Section 8 “Information from the purchase book”:

- invoice received, transaction type code "".

Transfer of payment to the supplier

The transfer of payment to the supplier is formalized by the document Write-off from the current account, transaction type Payment to the supplier in the Bank and cash desk section – Bank – Bank statements – Write-off button.

To pay under several settlement documents or under several contracts, it is necessary to split the payment.

Postings according to the document

The document generates the posting:

- Dt 60.01 Kt - the debt to the supplier has been repaid.

Test yourself! Take a test on this topic using the link >>

See also:

- Document Receipt additional. expenses

- Purchase of materials with additional delivery costs,

- Purchase of a fixed asset with additional delivery costs

- Additional costs when purchasing goods under the simplified tax system

- Document Receipt additional. expenses

- Purchasing goods from a separate division with delivery costs included in their price

- Transport costs when purchasing goods are taken into account separately

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Test No. 55. Purchasing materials with additional delivery costs...

- Acquisition of a fixed asset with additional delivery costs Let's consider the features of reflecting in 1C the acquisition of a fixed asset with additional...

- Test No. 50. Purchasing a fixed asset with additional delivery costs...

- Test No. 54. Purchasing goods from a separate division with delivery costs included in their cost...

Transfer of advance payment to the supplier for materials

The transfer of an advance to a supplier from a current account in 1C is reflected in the document Write-off from a current account, transaction type Payment to supplier in the Bank and cash desk section - Bank - Bank statements - Write-off.

Postings

Wiring is generated:

- Dt 60.02 Kt - advance payment transferred to the supplier.

If the supplier has issued an advance invoice for prepayment, then you can use the right to deduct VAT.

Read more about registering an advance invoice from a supplier and accepting VAT for deduction