The filling out procedure is prescribed in the Order of the Federal Tax Service of the Russian Federation dated October 15, 2020 No. ED-7-11/753 (as amended on September 28, 2021). For the first time, the 6-NDFL calculation for 2021 will include the 2-NDFL certificate as an appendix; it will no longer be required to be submitted separately. A certificate of income and tax amounts at the end of the year is filled out separately for each individual to whom the income was paid, and 6-NDFL is submitted quarterly for the entire organization.

Quarterly reporting reflects the total income paid to all individuals. The data in section 1 of form 6-NDFL is shown for the last three months of the reporting period, in section 2 - on a cumulative basis from the beginning of the year. Certificates of income and tax amounts are filled out once a year; they do not need to be submitted with quarterly reports.

Reporting must be submitted at the place of registration of the organization or individual entrepreneur. For each separate division, a separate 6-NDFL calculation is submitted at the place of its registration (letter of the Ministry of Finance of the Russian Federation dated November 19, 2015 No. 03-04-06/66970, letter of the Federal Tax Service of the Russian Federation dated December 28, 2015 No. BS-4-11 / [email protected] ) .

Wow! –50% on Kontur.Extern

Hurry up to connect before March 15th.

Report back with new certificates. To learn more

Small firms with up to 10 employees are allowed to submit 6-NDFL reports on paper.

If the number exceeds 10 people, you will have to report electronically. This norm applies from 01/01/2020 in accordance with the amendments made to the Tax Code by Federal Law dated 09/29/2019 No. 325-FZ.

If during the reporting period the organization did not pay income to employees, there is no need to submit a zero calculation of 6-NDFL. But there are times when it is better to play it safe and submit the form. Read more in the article.

The Extern system will help you easily and quickly send reports via telecommunication channels.

Submit electronic reports via the Internet. Extern gives you 14 days for free!

Try for free

Deadlines for submitting 6-NDFL

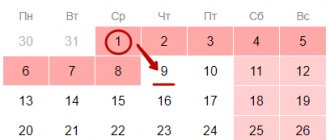

Form 6-NDFL must be submitted no later than the last day of the month following the reporting quarter. And the annual calculation is no later than March 1 of the year following the expired tax period (taking into account clause 2 of Article 230 of the Tax Code as amended by Federal Law No. 325-FZ of September 29, 2019).

Taking into account weekends and holidays in 2022, the following reporting deadlines are provided:

- for 2022 - no later than 03/01/2022;

- for the 1st quarter of 2022 - until 05/04/2022;

- for half a year - until 08/01/2022;

- nine months - until 10/31/2022.

The accountant's calendar will help you submit Form 6-NDFL on time.

Features of filling out Section 1 and Section 2

Sections 1 and 2 are completed for each tax rate applied in the tax period.

They fill in the fields “Budget classification code” (in section 1, field 010 and in section 2, field 105) of the BCC, corresponding to the tax rate. Thus, for personal income tax at a rate of 15%, relating to income over 5 million rubles, you need to indicate KBK - 182 1 0100 110 (Order of the Ministry of Finance dated October 12, 2020 No. 236n).

Example . The only employee in 2022 is paid a monthly salary of 700,000 rubles (deductions are not provided). During the tax period, the amount of income will be 8.4 million rubles. This is more than 5 million rubles, which means personal income tax will be calculated at a progressive rate. From the moment when the income exceeded 5 million rubles, Sections 1 and 2 in the calculation of 6-NDFL for 2022 must be filled out in two copies: one for the rate of 13%, the second for the rate of 15%.

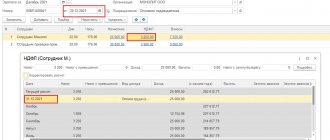

An example of filling out section 2 for the reporting period - 2022:

1. Income not exceeding 5 million rubles and personal income tax at a rate of 13%.

2. Income exceeding 5 million rubles and personal income tax at a rate of 15%

Procedure for filling out 6-NDFL

Below you will find brief instructions for filling out 6-NDFL.

Form 6-NDFL contains a title page, two sections and an appendix.

If an organization submits 6-NDFL for separate divisions, the checkpoint and OKTMO of such divisions must be indicated on the title page. In any case, the TIN is assigned to the parent organization.

From 2022, when deregistering an individual entrepreneur or head of a peasant farm, you must indicate one of the following reporting period codes:

- 83 - for the first quarter;

- 84 - for half a year;

- 85 - in 9 months;

- 86 - per year.

Displaying line 080 in form 2.6 personal income tax

As is known, the duties of a tax agent include a number of actions, including the timely calculation and withholding of personal income tax from income paid to individuals, as well as the transfer of the received tax to the budget. Failure of the tax agent to fulfill its obligations usually entails liability in the amount of twenty percent of the amount of tax not withheld or remitted.

Failure to fulfill obligations carries penalties

The presence of line 080 in Form 6 Personal Income Tax is due to the need to display the fact of tax non-withholding in the presence of income paid to individuals and to record the amount of non-withholding tax.

Data for filling out the specified line

Thus, the line we are considering is filled in in a special situation in which the tax agent, for a number of reasons, cannot withhold personal income tax until the end of the current reporting period (usually December 31).

Usually data is filled out before December 31st

The reasons why the specified personal income tax was not withheld may be:

- The presence of a gift that was given to a person who is not registered as an employee in the company and does not receive payments from the company; Personal income tax may be impossible to withhold from a gift

- Tax on material benefits, in a situation where a person was not paid cash income.

When calculating data on line 080, please note that this line is NOT intended to display the amount of tax that is transferred from one quarter to another.

Let's look at the features of data calculation for line 080

This may be useful: TIFF 300 DPI converter online for tax purposes.

How to fill out Section 1 “Data on tax agent obligations”

In this section, you need to group income for the last three months by date of receipt. For each group, you need to note the dates of tax withholding and transfer to the budget.

Thus, line 020 indicates the generalized amount of withheld tax for all employees for the last three months, line 021 indicates the date no later than which the tax must be transferred to the budget, and line 022 indicates the generalized amount of withheld tax payable. Lines 030-032 are provided for personal income tax amounts that were returned to employees.

The sum in field 020 must be equal to the sum of fields 022, of which there must be the same number as fields 021. Similar rules are provided for lines 030-032.

Starting from 2022, the date of receipt of income by an individual, the date of tax withholding and the amount of income actually received do not need to be indicated.

Income certificate 2-NDFL

The tax office also provides information on the income of individuals 2-NDFL. In this certificate, in the “Characteristic” field, you will need to indicate two or four, and in the fifth section, fill in the corresponding line reflecting the amount of unwithheld tax.

Also note that this certificate, which includes sign “1”, must be filled out and sent to the tax office. After all, if the tax agent reported the impossibility of withholding tax, this does not negate his important obligation to provide the tax certificate with the certificate we are considering.

Sample of the form in question

How to fill out Section 2 “Calculation of calculated, withheld and transferred personal income tax amounts”

In the second section, you should show the amount of accrued income, calculated and withheld by personal income tax, generalized for all individuals from the beginning of the tax period. The amounts of accrued dividends, income under labor and civil contracts for the performance of work (rendering services) are recorded in separate lines.

Section No. 2 of the 6-NDFL calculation can be placed on several pages if the organization uses different personal income tax rates.

Since 2022, new fields have appeared in which information about highly qualified specialists is indicated:

- field 115 - from the amounts of income under labor and civil contracts (lines 112 and 113), the amount of income of highly qualified specialists is allocated;

- field 121 - highly qualified specialists are selected from the total number of income recipients;

- field 142 - allocate the amount of personal income tax calculated from the income of highly qualified specialists.

Also added to the calculation is field 155, which reflects the amount of income tax to be offset.

Calculation of 6-NDFL for 2022. Features of filling out

Reporting time has arrived. Next in line is the reporting of the tax agent for personal income tax. For the reporting season, the Federal Tax Service updated the form for calculating the amounts of personal income tax calculated and withheld by the tax agent (form 6-NDFL, hereinafter also referred to as Calculation), approving the changes by its Order dated September 28, 2021 No. ED-7-11 / [ email protected] , which apply starting with the submission of the 6-NDFL calculation for 2021.

Now is the time to pay attention to the key points in filling out and checking the Calculation for 2022.

Section 1 “Data on tax agent obligations”

The lines of this section have not been changed, but it is important to note that field 020 indicates the amount of tax, generalized for all individuals, actually withheld for the last three months of the reporting period. Thus, in the annual Calculation, you should indicate only the amount that was withheld from taxpayers when paying them income, and not simply calculated by the tax agent, and such withholding occurred in the time interval from 10/01/2021 to 12/31/2021.

Field 021 indicates the date no later than which the withheld tax amount must be transferred. In this case, it does not matter what period the tax is due to be transferred to the budget; the date may well refer to the next quarter (year).

Field 022 indicates the generalized amount of withheld tax to be transferred on the date specified in field 021.

The amount of tax withheld for the last three months of the reporting period, indicated in field 020, must correspond to the sum of the values of all filled in fields 022.

Section 2 “Calculation of calculated, withheld and transferred personal income taxes”

As is now stated in clause 4.1 of the Procedure for filling out and submitting calculations according to Form 6-NFDL, approved. Appendix No. 2 to the order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11 / [email protected] , Section 2 indicates the amounts of accrued and actually received income, calculated and withheld tax, generalized for all individuals, on an accrual basis from the beginning of the tax period to the corresponding tax rate. The key change is the indication that only the income actually received by taxpayers from a given tax agent should be included in the section. Yes, yes, not those that are accrued and not those for which the “date of actual receipt of income” has just arrived according to Art. 223 of the Tax Code of the Russian Federation, but only those paid to the taxpayer. It must be said that the terminology of the Tax Code of the Russian Federation and the terminology of the Order in this part are not very harmonious with each other. Without additional explanations, it is difficult to correctly recognize what is meant by “actually received income.”

Let us turn to the Letter of the Federal Tax Service of Russia dated November 25, 2021 No. BS-4-11/ [email protected] , which explains the procedure for reflecting income in the form of wages in Section 2: “the amounts of income in the form of wages that are accrued and actually paid to individuals are indicated to persons (received by individuals) on the date of submission of the calculation in Form 6-NDFL. Amounts of wages not actually paid to the organization’s employees (amount of wage arrears) as of the date of submission of the calculation in Form 6-NDFL are not indicated by the tax agent in the calculation in Form 6-NDFL.” It turns out that even if at the end of the reporting (tax) period the payment was not made, but was made by the time the Calculation is submitted to the tax authority, it will be included in the indicators of lines 110 - 115. If at the time of filing the reporting there is a debt to pay income of any type to the taxpayer, include These amounts should not be included in section 2. But that is not all! After the actual payment of income, you need to submit an updated calculation so that everything falls into place (and the above-mentioned Letter from the Federal Tax Service warns us about this). Until clarifications are made, the Calculation data will not correspond to at least one of the control ratios:

Line 112 + line 113 in 6-NDFL ≥ line 050 of Appendix 1 to section 1 of the RSV, i.e.

the amount of income paid under employment contracts and GPA, the subject of which is the performance of work (provision of services), according to Form 6-NDFL cannot be less than the base for calculating insurance premiums for compulsory health insurance according to the Calculation of Insurance Contributions.

Income is included in the base for insurance premiums regardless of their actual payment, while 6-NFDL reflects only the amounts paid, and there will be no peace until the employees (performers) are paid off.

For example, the bonus for December 2022 was paid on 02/28/2022. The accountant submitted the 6-NDFL calculation for 2022 to the tax authority on 02/15/2022. The amount of this premium is included in the base for calculating VOPS for 2021 and is reflected in the DAM for 2022, but in Form 6-NFDL for 2022 it is not initially reflected, since the premium has not yet been paid at the time of reporting. In the primary version, 6-NDFL on line 140 of section 2 and the amount of tax accrued on the premium are not shown. Only no earlier than 02/28/2022 should an updated calculation of 6-personal income tax for 2022 be submitted, including this payment in lines 110 and 112 of section 2, and the personal income tax accrued from it in line 140 of section 2. But, since the actual deduction of personal income tax from the bonus payment fell in February 2022, then the tax amount will be included in lines 020, 022 and 160 in the calculation for 1 sq. 2022, not 2022

One cannot ignore another important change - but already in the form itself - in section 2. Line 155 “Amount of corporate income tax subject to offset” has been added to the form. It was sorely lacking in the original version of Form 6-NDFL, since it was impossible to reflect the “discount” that taxpayers receive when withholding personal income tax on dividends according to the rules of clause 3.1 of Art. 214 of the Tax Code of the Russian Federation and the data in the reporting falsely indicated incomplete withholding of tax by the tax agent. This line reflects the amount of corporate income tax calculated and withheld in relation to dividends received by a Russian organization, subject to offset when determining the amount of tax payable in relation to the income of a taxpayer recognized as a tax resident of the Russian Federation from equity participation in this Russian organization, in proportion share of such participation.

When filling out form 6-NDFL, clarifications from the Federal Tax Service of Russia regarding the reflection of income may also be useful:

- to which a progressive personal income tax scale is applied (Letters of the Federal Tax Service dated December 1, 2020 No. BS-4-11 / [email protected] , dated September 14, 2021 No. BS-4-11 / [email protected] ), including the income of internal part-time workers ( Letter of the Federal Tax Service dated June 11, 2021 No. BS-4-11/ [email protected] );

- completely not subject to taxation (Letter of the Federal Tax Service of Russia dated September 17, 2021 No. BS-4-11/ [email protected] );

- persons who have lost their tax resident status (Letter of the Federal Tax Service of Russia dated April 30, 2021 No. BS-4-11/ [email protected] );

- persons engaged in remote work and living abroad (Letter of the Federal Tax Service of Russia dated July 15, 2021 No. BS-4-11 / [email protected] ).

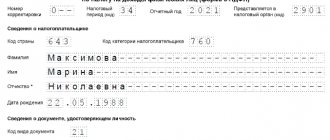

Appendix No. 1 to the Calculation “Certificate of income and tax amounts of an individual”

For the tax period 2022 and subsequent years, tax agents do not generate separate certificates of income and tax amounts of an individual in Form 2-NDFL, but include them as an integral part in Calculation 6-NDFL (Appendix No. 1, hereinafter referred to as the Certificate). The information presented in this application is similar to the structure of the canceled Form 2-NFDL.

When filling out the Certificate, you must keep in mind the expansion by Order of the Federal Tax Service of Russia dated September 28, 2021 No. ED-7-11/ [email protected] of the list of codes for types of income and deductions. The additions are quite extensive, for example, now data on income from renting out property by an individual to a tax agent should be detailed:

| Revenue code | Was | It became |

| 1400 | Income received from the rental or other use of property (except for similar income from the rental of any vehicles and communications equipment, computer networks) | Income received from the rental or other use of property (except for similar income from the rental of residential and non-residential real estate, any vehicles and communications, computer networks) |

| 1401 | X | Income received from rental or other use of residential real estate |

| 1402 | X | Income received from leasing or other use of real estate, with the exception of income received from leasing or other use of residential real estate |

A separate code 2015 is defined for daily allowances exceeding 700 rubles. for each day of being on a business trip on the territory of the Russian Federation and no more than 2,500 rubles. for each day of being on a business trip outside the territory of the Russian Federation.

If the application of new codes is ignored, the tax agent faces a fine of 500 rubles: this is provided for in clause 1 of Art. 126.1 of the Tax Code of the Russian Federation for the submission by a tax agent to the tax authority of documents containing false information (Letters of the Federal Tax Service of Russia dated 08/09/2016 No. GD-4-11/14515, dated 12/09/2016 No. SA-4-9 / [email protected] ). It is interesting that a fine is imposed for each distorted document, but previously there were many of them - a 2-NDFL certificate for each taxpayer, and now there is only one - the 6-NDFL form itself, where the Certificates are only attachments, but not an independent document.

The new structure of form 6-NDFL has set new control ratios (approved by Letter of the Federal Tax Service of Russia dated March 23, 2021 No. BS-4-11 / [email protected] ), which are applied for the first time to the data of the Certificate during desk control for 2022, and determine the permissible error in calculating income and tax for each taxpayer:

The sum of all lines “Amount of income” of the Appendix “Information on income and corresponding deductions by month of the tax period - the sum of all lines “Amount of deduction” of the Appendix “Information on income and corresponding deductions by month of the tax period” * rate / 100) minus “Amount of tax calculated » Section 2 of Appendix No. 1 to 6-NDFL) = no more than 1 rub.

Line “Amount of unwithheld tax” of Section 4 of Appendix No. 1 to 6-NDFL = absolute value (“Amount of income from which tax is not withheld by the tax agent” of Section 4 of Appendix No. 1 to 6-NDFL * rate / 100 - “Amount of unwithheld tax” Section 4 of Appendix No. 1 to 6NDFL) = no more than 1 rub.

Line “Calculated tax amount” of Section 2 of Appendix No. 1 to 6-NDFL - “Tax base” * “Tax rate” / 100 = no more than 1 rub.

The above letter also provides other interesting control relationships.

The most insidious “control points”

Line 110 “Amount of income accrued to individuals” – line 140 “Amount of tax calculated” ≥ the amount of payments made to individuals on taxpayer accounts relating to the corresponding period

This benchmark ratio assumes that all payments from the tax agent's bank accounts to individuals for the relevant period do not exceed the "net" amount of income due to taxpayers. If the ratio is not met, suspicions arise of incomplete withholding of tax or payment of income that is not reflected in 6-NDFL. However, there is nothing a priori criminal in this. Income could be completely non-taxable and therefore not reflected in the Calculation; payments could be made to individual entrepreneurs or self-employed people, etc. However, the tax authority will send a request to the tax agent to provide clarifications or make appropriate corrections within five working days. If, after reviewing the provided explanations and documents, or in the absence of explanations from the tax agent, a violation of the legislation on taxes and fees is established, additional tax control measures may be carried out in order to identify a possible understatement of the tax base.

Average salary ≥ minimum wage

The average salary is determined for each employee based on the data in the Appendix “Information on income and relevant deductions by month of the tax period” of the Certificate relating to wages.

If this indicator is lower than the minimum wage, then work begins to identify potential tax schemes related to “gray” salaries, fictitious transfer of workers to part-time work, part-time pay, etc.

We expect the same effect if another control ratio is not met:

Average salary ≥ average salary in a constituent entity of the Russian Federation for the relevant sector of the economy

For him, the average salary is determined differently: in general for the tax agent on the basis of the data in the Appendices “Information on income and corresponding deductions by month of the tax period” Certificates related to wages submitted by the tax agent according to the relevant INN, OKTMO, KPP for the same period.

Data on the average salary in a constituent entity of the Russian Federation for a particular type of activity can be found on the Transparent Business portal in the Tax Calculator section.

reporting 6-NDFL

Send

Stammer

Tweet

Share

Share

Responsibility

The following types of penalties are provided for tax agents:

- Late submission of personal income tax reports threatens the taxpayer with a fine of 1,000 rubles. A fine is assessed for each full or partial month of delay in the report (clause 1.2 of Article 126 of the Tax Code of the Russian Federation);

- when submitting a personal income tax report 10 days after the deadline, the Federal Tax Service may block the bank account of an organization or individual entrepreneur (clause 3 of article 76 of the Tax Code of the Russian Federation);

- for false information in form 6-NDFL, the company will pay 500 rubles (Article 126.1 of the Tax Code of the Russian Federation);

- If the company violates the procedure for submitting a report in electronic form, it will be fined. The fine will be 200 rubles.

How to reflect vacation pay in 6-NDFL

Submit electronic reports via the Internet. Extern gives you 14 days for free!

Try for free

Question answer

The amount of accrued income generalized for all individuals from the beginning of the tax period is shown in the second section of the form in line 110. In line 113, the amount of income under civil contracts for the performance of work or provision of Section 1 of form 6-NDFL is indicated, among other things, the day no later than of which the tax on the income paid under the GPC agreement must be transferred - the next day after the date of transfer to the bank account or issuance from the cash desk (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Line 022 reflects the amount of tax. Withheld taxes on income under a contract are reflected in 6-NDFL separately for each payment date, including all advance payments.

The correctness of filling out 6-NDFL is checked according to the control ratios established by Letter of the Federal Tax Service dated March 23, 2021 No. BS-4-11/3759. The values of a certain line must correspond to another line, the sum of the lines, and be greater or less than the established indicators. Checking 6-NDFL using control ratios helps eliminate questions from the Federal Tax Service.

6-NDFL for separate structures is submitted in separate settlements at the place of registration of each division of the company. If the location of the parent organization and its separate divisions is the territory of one municipal entity, or if the separate divisions are located on the territory of one municipal entity, then 6-NDFL is submitted to the tax authority at the place of registration of one of these separate divisions, chosen by the company independently, or at the location parent organization. The choice of a tax authority must be declared before the start of the tax period using a special form (paragraph 7, clause 2, article 230 of the Tax Code of the Russian Federation).

Dividends are also reflected in 6-NDFL. The amounts of accrued dividends and calculated personal income tax are highlighted in separate lines in the second section of the form. In line 111 - the amount of income accrued in the form of dividends, in line 141 - the amount of tax calculated on income in the form of dividends.

Income in kind is considered received on the day of its actual transfer. This is the date the gift is presented or the amount transferred to pay for the employee’s education is debited from the account. It is impossible to withhold personal income tax on income in kind when it is received, so the tax agent must withhold tax from any other cash income. In such a situation, line 021 “Tax transfer deadline” of section 1 of form 6-NDFL reflects the date of transfer of the tax withheld from “non-monetary” income, and line 022 will also contain the amount of tax on in-kind income. The amount of income is reflected in line 110 of section 2.

Which income should be reflected in 6-NDFL and which not?

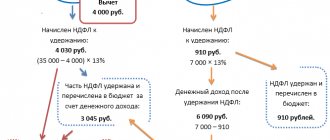

In 6-NDFL, you need to show all income from which personal income tax is subject to withholding as tax agents. Income that is only partially taxed must also be included in the calculation. For example, this could be income in the form of material assistance or the value of gifts, for which there is a limit of 4,000.00 rubles per year, because the total value of such income may exceed the non-taxable minimum during the year. The following income does not need to be included in the calculation of 6-NDFL:

1. Income that is completely exempt from personal income tax.

2. Income of individual entrepreneurs, notaries, lawyers, and other persons engaged in private practice.

3. Income listed in paragraph 1 of Art. 228 Tax Code of the Russian Federation. For example, this could be income from the sale of property owned by an individual.

4. Income of residents of other countries that are not taxed in the Russian Federation by virtue of international treaties.