When is an updated declaration needed?

Sometimes it happens that after submitting a tax return, an accountant finds an error in the calculations and thus it turns out that the tax was calculated incorrectly.

What to do in this situation? The answer is obvious: it is necessary to correct the accounts and recalculate the tax. If the tax amount turns out to be underestimated, the accountant is obliged to submit an updated declaration (paragraph 1, clause 1, article 81 of the Tax Code of the Russian Federation). If the error did not lead to a tax reduction, then you can do without clarification. Here, the right to choose remains with the organization (paragraph 2, paragraph 1, article 81 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated September 27, 2017 No. 03-02-07/1/62596). The adjusted declaration reflects the amount of tax calculated taking into account changes that have occurred or an error discovered. The results of tax audits carried out during the period of submission of the clarification should not affect the calculation of the tax base and the tax amount itself (subclause 2, clause 3.2 of the procedure for filling out an income tax return, approved by order of the Federal Tax Service dated September 23, 2019 No. ММВ-7-3/ [email protected] , below is the order).

Important! The income tax return for 2022 is submitted using a new form. Comments and a sample from ConsultantPlus will help you fill it out. Trial access to the system can be obtained for free.

If you haven't paid your tax before submitting an updated return, get ready for a fine

A clarification with an increased tax amount means that obligations to the budget have not been fully fulfilled. If the tax has not been paid before submitting the updated declaration, a fine of 20% of the amount of the underpayment is possible. You can be fined if you have not paid tax and penalties before submitting an updated declaration. If they are paid, there will be no fine.

Of course, they are fined not for filing an amendment with an increased tax, but if there really was an error in the first declaration. The tax authorities must identify it.

If there is an overpayment of taxes in the budget, you will not have to contribute anything additional. There will be no fine in this case.

You will not have to pay if the amendment is submitted for a period that was checked on-site and no tax errors were found.

Details about when you need to file an amended declaration, what consequences are possible, as well as other nuances can be found in the article “ Updated declaration: what does an accountant need to know? "

What are the consequences of submitting an updated declaration?

You should always remember that following the submission of an updated declaration with a reduced tax amount, tax authorities can conduct an on-site tax audit for the updated tax period, and they can do this even if this period has already been audited (paragraph 6, paragraph 10, article 89 of the Tax Code RF).

Before submitting an updated declaration (if the accountant initially underestimated the tax amount), the company will need to pay additional tax to the budget and, in addition, pay penalties. An organization can avoid a fine if:

- Will have time to submit an updated declaration before the deadline for filing the primary one (clause 2 of Article 81 of the Tax Code of the Russian Federation).

- The deadline for paying the tax has not expired and the organization submitted an update before it learned about the discovery of errors by the tax authorities or the appointment of an on-site tax audit (clause 3 of Article 81 of the Tax Code of the Russian Federation).

- The updated declaration was submitted after the tax payment deadline had expired, but before the company learned that the tax authority had discovered errors or scheduled an on-site tax audit. In this case, you need to pay the arrears and penalties before submitting the updated declaration (subclause 1, clause 4, article 81 of the Tax Code of the Russian Federation).

Penalty Calculator will help you calculate penalties .

- The deadline for paying the tax has expired, and the updated declaration was submitted after an on-site inspection, the results of which did not reveal any errors or distortions of information (subclause 2, clause 4, article 81 of the Tax Code of the Russian Federation).

The tax agent can also avoid liability under Art. 123 of the Tax Code of the Russian Federation, subject to compliance with the above conditions (paragraph 3, clause 6, article 81 of the Tax Code of the Russian Federation).

The updated declaration is submitted in the form that was in force in the adjusted tax period (clause 5 of Article 81 of the Tax Code of the Russian Federation).

The current income tax return form, as well as the form for submitting an update for previous periods, can be found here.

Article 81 of the Tax Code of the Russian Federation. Making changes to the tax return, calculations (current version)

Thus, taking into account the position of the Plenum of the Supreme Arbitration Court of the Russian Federation, if, after three years after the end of the corresponding tax period, an organization submits an updated tax return, which reflects tax deductions not previously declared in the primary tax return submitted within a three-year period, the deadline for reporting VAT amounts to the refund is not considered to have been complied with, since the rule regarding the maximum three-year period for filing a tax return is not observed.

To apply the provisions of paragraph 4 of Article 81 of the Tax Code of the Russian Federation and to exercise the right to offset, the overpayment of tax as of the date of submission of the updated tax return must be confirmed.

It follows from the foregoing that when establishing the validity of bringing a taxpayer to tax liability on the basis of an updated tax return, it is necessary to check the actual occurrence of debt to the budget for the tax payment deadline established by law for the tax period under review, as well as on the date of submission of the updated return for the purpose of possible offset of the additionally calculated amount tax and corresponding penalties. If there is an overpayment on the date of submission of the updated tax return, it should be sufficient to fully repay the amount of tax additionally calculated by the taxpayer for payment, as well as penalties. Under such circumstances, the conditions for exemption from tax liability for payment of the missing amount of tax and penalties provided for in paragraph 4 of Article 81 of the Tax Code of the Russian Federation may be considered met.

This conclusion is confirmed by judicial practice (see Resolutions of the FAS Moscow District dated 07/09/2012 N A40-26154/10-140-200, FAS West Siberian District dated 05/15/2012 N A27-9884/2011).

In the Resolution of the Federal Antimonopoly Service of the West Siberian District dated July 25, 2012 N A46-17303/2011, the court explained that in order to be exempt from tax liability under paragraph 1 of Article 122 of the Tax Code of the Russian Federation, when submitting an updated tax return, the taxpayer must have an overpayment for this tax on the day of its submission, which covers the amount of tax payable under the amended declaration, and if there is arrears on the day of filing the amended declaration, the taxpayer must pay the tax and penalties for late payment of the tax before filing it.

In Resolution dated September 11, 2012 N A12-23054/2011, the FAS Volga District indicated that tax legislation provides for the possibility of releasing a taxpayer from liability for non-payment or incomplete payment of tax if the taxpayer independently identifies a violation and makes a calculation (recalculation) of the amount due for payment. specific tax period of the tax amount, calculate penalties for late payment of the additional tax amount assessed as a result of the identified error, pay the additional accrued tax amounts and penalties to the budget, make corrections to the previously submitted declaration by submitting an additional (updated) declaration.

Only if all of the above conditions are met in the aggregate, can a taxpayer be released from liability for non-payment or incomplete payment of tax for the corresponding tax period.

It should be taken into account that the taxpayer is released from liability if, before the start of an on-site tax audit for the relevant year, he has submitted an updated tax return and he voluntarily fulfills the corresponding obligation to pay taxes, including penalties.

In the Determination of the Supreme Arbitration Court of the Russian Federation dated October 19, 2012 N VAS-10379/12, it is explained that the grounds for releasing a taxpayer from tax liability when checking changes made by him to a tax return are established by Article 81 of the Tax Code of the Russian Federation.

The rules of this article do not provide for the possibility of exemption from the application of tax liability measures in the event of submitting an updated tax return after the inspection has identified a tax offense.

It is necessary to take into account the position set forth in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated October 11, 2011 N 2119/11, according to which challenging the grounds for calculating tax without filing an updated tax return by submitting directly to the court a demand for invalidation of non-normative acts of the inspectorate adopted within the framework of the indisputable collection procedure the amount of tax declared by the enterprise in the declaration initially submitted by it would mean a violation of the requirements of Article 81 of the Tax Code of the Russian Federation and an unreasonable shift to the court of the tax authority’s responsibility to verify the legality of reducing the amount of tax previously calculated by the taxpayer (see also Resolution of the Federal Antimonopoly Service of the East Siberian District dated 09.11.2012 N A33-8611/2011).

Paragraph 2 of paragraph 1 of Article 81 of the Tax Code of the Russian Federation does not provide the taxpayer with the right to receive a tax refund in the event of filing updated tax returns three years after the end of the relevant tax period, both by virtue of paragraph 2 of Article 173 of the Tax Code of the Russian Federation, and due to the fact that the opposite was evidenced would eliminate any deadlines for submitting tax returns by taxpayers to the tax authorities at the place of registration, which is unacceptable, if only because the tax authorities must be able to verify the accuracy of the declared amounts.

The above is confirmed by the position of the Federal Antimonopoly Service of the Ural District in Resolution dated October 3, 2012 N F09-8851/12.

The Tax Code of the Russian Federation does not provide tax authorities with the right to refuse a taxpayer to accept an updated tax return or to ignore its contents. If the updated tax return was submitted to the appropriate tax authority at the place of registration of the organization, but before the tax authority made a decision on a desk audit of the initial return, then the initial return loses legal force.

Consequently, if before the end of the desk audit the taxpayer submitted an updated tax return, then the decision made on the initial return is illegal.

The FAS North Caucasus District in Resolution dated December 8, 2010 N A53-3/2010 and the FAS Moscow District in Resolution dated March 23, 2010 N KA-A40/2152-10 came to similar conclusions.

Particular attention should be paid to the interpretation given in the Resolution of the Federal Antimonopoly Service of the Moscow District dated September 24, 2012 N A40-6180/12-99-34: the court found that the updated declaration (adjustment) by the organization was filed after the inspection report was drawn up, but before the disputed decisions were made .

Taking into account the provisions of Article 81 and Part 2 of Article 88 of the Tax Code of the Russian Federation, the court indicated that for the purposes of applying paragraph 9.1 of Article 88 of the Tax Code of the Russian Federation, the legislator gives a different meaning to the concept of “end of inspection”. In this case, the end of the audit does not mean the literal end of those actions that the tax authority performs before drawing up the audit report, but the complete completion of all audit actions ending with the adoption of a decision, since it does not make sense to continue all actions in relation to the tax return that was clarified by the taxpayer.

Thus, at the time of submission of the updated declaration (adjustment), the desk verification of the declaration was not completed.

Consequently, the tax authority, by virtue of clause 9.1 of Article 88 of the Tax Code of the Russian Federation, was obliged to stop the desk audit of the value added tax declaration and order a new audit based on the updated declaration (adjustment).

Since the contested decisions of the tax authority were made without taking into account the information that the organization had before they were made in connection with the filing of its declaration, they violate the rights and legitimate interests of the taxpayer, and therefore were declared invalid by the court.

Interconnected with the application of the provisions of Article 81 of the Tax Code of the Russian Federation on the updated tax return is the issue of the taxpayer’s exercise of the right to a tax deduction for VAT in a later tax period.

As established by the Federal Antimonopoly Service of the Moscow District in Resolution No. A40-49984/12-91-279 dated January 29, 2013, the taxpayer is not deprived of the right to deduction in a later tax period, since he has complied with the specified three-year period.

In addition, tax legislation does not contain restrictions on the use of tax deductions at a later period than the period of receipt of the goods and receipt of the invoice.

The tax authority's arguments regarding the taxpayer's right to submit an updated tax return for the period in which business transactions were carried out and invoices were issued were rejected by the courts based on the provisions of Article 81 of the Tax Code of the Russian Federation, since filing an updated tax return is a right, not an obligation, of the company.

The court stated that failure to submit an updated tax return cannot serve as a basis for depriving a taxpayer of the right to a tax deduction, provided that he complies with the conditions provided for in Articles 171, 172 and 169 of the Tax Code of the Russian Federation.

The Resolution of the Eleventh Arbitration Court of Appeal dated November 2, 2012 N A55-11459/2012 noted that tax legislation does not give tax authorities the right to refuse a taxpayer to accept an updated tax return or to ignore its contents. If the updated tax return was submitted to the appropriate tax authority at the place of registration, but before the tax authority made a decision on a desk audit of the initial return, then the initial return loses legal force.

From the moment the tax return is submitted to the tax authority, the taxpayer’s personal card reflects the information declared by the taxpayer, which is considered reliable until a tax audit establishes otherwise.

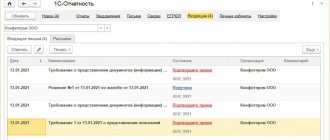

Information about the tax liability specified in the company’s updated tax return is reflected by the tax authority on its front card.

When comparing the information contained in the initial tax return with the information in the updated tax return, the appellate court found that the updated tax return contained information about the size of the tax base, the amount of tax deductions and the amount of tax liability that differed from similar information on the original return.

The appellate court believes that the tax inspectorate should have carried out a desk audit of the updated tax return, information from which is reflected in the company’s front card, and made a decision based on the results of the audit of the updated return. Since the contested decision was made taking into account the comparison of information obtained during the audit with information canceled by the company, the conclusions contained therein based on the results of such a comparison do not meet the criteria of reliability, therefore, such a decision of the tax authority is invalid.

In Resolution dated January 25, 2013 N A40-53027/12-99-297, the Federal Antimonopoly Service of the Moscow District concluded that the non-application of tax deductions does not lead to an underestimation of the amount of tax payable, therefore the submission of an updated tax return for the purpose of applying tax deductions is a right, not an obligation taxpayer.

According to the legal position of the Presidium of the Supreme Arbitration Court of the Russian Federation, set out in Resolution No. 2217/10 of June 15, 2010, a taxpayer’s declaration of a deduction for value added tax, the right to which arose in one period, in a tax return for a later period cannot in itself serve as a basis to deprive him of the right to apply a tax deduction, if such an application took place within a three-year period from the moment the right to deduct arose.

Submission by the taxpayer to the tax authority of all properly executed documents provided for by the legislation on taxes and fees in order to obtain a tax benefit is the basis for receiving it, unless the tax authority proves that the information contained in these documents is incomplete, unreliable and (or) contradictory.

After the clarification was submitted, the organization ceased to exist

After the reorganization of the enterprise, the updated declaration is submitted by its legal successor at the place of its registration or at the place of registration as the largest taxpayer (clause 2.6 of the procedure).

In this case, on the title page of the updated declaration submitted by the successor, the TIN and KPP of the successor organization and its name must be indicated, and the TIN and KPP of the reorganized organization (its separate division) must be indicated on separate lines.

In section 1 of the updated declaration submitted by the successor for the reorganized organization (its separate division), OKTMO is indicated at the location of the latter (clause 4.5 of the procedure).

If a company moves and changes its address, then the clarification will need to be submitted to the tax authority with which it will be registered, but the OKTMO code is indicated the same as in the initial declaration (letter of the Federal Tax Service of Russia for Moscow dated October 30, 2008 No. 20-12/101962).

It is necessary to note that all explanations from officials were given at the time when the OKATO code was applied. In connection with the replacement of the OKATO code with the OKTMO code, it must be assumed that all the above conclusions have not lost their relevance at the present time.

You also need to keep in mind that if an organization or its OP changes its location and pays taxes or advances during the year to the budgets of different constituent entities of the Russian Federation, the corresponding number of pages of subsections 1.1 and 1.2 of Section 1 can be presented as part of the clarification.

For example, if the address is changed on August 1, in the updated declaration for the half-year, the amount of additional payment (reduction) of the advance for the half-year and the monthly advance payment due “no later than July 28” are indicated in subsections 1.1 and 1.2 of Section 1 with the OKTMO code at the old location. On a separate page of subsection 1.2 of Section 1 with the new OKTMO code, the amounts of advances with payment deadlines “no later than August 28” and “no later than September 28” are given.

This is stated in paragraph 4.6 of the order.

When moving a unit, in the clarification, fill in the details “TIN/KPP of the (closed) separate subdivision that has changed the powers”, indicating here the old checkpoint of the separate unit (clause 2.8 of the procedure).

If you have access to ConsultantPlus, check whether you need to submit an update. If you don't have access, get a free trial of online legal access.

The procedure for calculating penalties

As follows from paragraph 3 of Art.

75 of the Tax Code of the Russian Federation, penalties are accrued for each calendar day of delay in fulfilling the obligation to pay income tax, starting from the day following the tax payment established by law (unless otherwise provided for in Chapter 25 of the Tax Code of the Russian Federation). According to paragraph 4 of Art. 75 of the Tax Code of the Russian Federation, penalties for each day of delay are determined as a percentage of the unpaid tax amount. The interest rate of penalties is assumed to be equal to 1/300 of the refinancing rate of the Central Bank of the Russian Federation in force at that time.

Please note: from January 1, 2016, instead of the refinancing rate, the key rate of the Bank of Russia is applied (Resolution of the Government of the Russian Federation dated December 8, 2015 No. 1340).

The Bank of Russia has set the following key rates:

– from May 2, 2022 – 9.25% (Information dated April 28, 2017); – from March 27, 2022 – 9.75% (Information dated March 24, 2017); – from September 19, 2016 – 10.0% (Information dated September 16, 2016); – from June 14, 2016 – 10.5% (Information dated June 10, 2016); – from January 1, 2016 – 11% (Information from 12/11/2015 and from 07/31/2015).

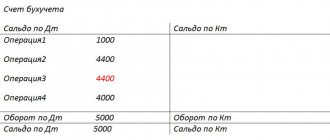

P = ZN x KS / 300 x D, where:

P – amount of penalties; ZN – tax debt; KS – key rate of the Central Bank of the Russian Federation; D – the number of calendar days in the period when the key rate and the amount of debt did not change.

Penalties are accrued starting from the day following the tax payment established by law (clause 3 of Article 75 of the Tax Code of the Russian Federation).

As for the last day for calculating penalties, today there are two opinions on this matter. First, penalties are accrued on the day preceding the day of their payment (clause 2 of section VII of the appendix to the Order of the Federal Tax Service of Russia dated January 18, 2012 No. YAK-7-1 / [email protected] , Letter of the Ministry of Finance of Russia dated July 5, 2016 No. 03-02 -07/2/39318). The second - on the day of actual repayment of the arrears (clause 57 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57).

The author adheres to the second opinion, and in practical examples, the calculation of penalties will be carried out taking into account the day of repayment of the arrears.

Please note: from October 1, 2022, clause 4 of Art. 75 of the Tax Code of the Russian Federation will be presented in a new edition (amended by Federal Law No. 401-FZ of November 30, 2016).

The interest rate of penalties for organizations is assumed to be equal to:

- for delay in fulfilling the obligation to pay tax for a period of up to 30 calendar days (inclusive) - 1/300 of the refinancing rate of the Central Bank of the Russian Federation in force at that time;

- for delay in fulfilling the obligation to pay tax for a period of more than 30 calendar days - 1/300 of the refinancing rate in force for the period up to 30 calendar days (inclusive) of such delay, and 1/150 of the refinancing rate in force for the period starting from the 31st calendar day of such delay delays.

Calculate the amount of penalties using our Penalty Calculator. He will calculate not only penalties for taxes, contributions and fees, but also for unpaid wages on time and penalties for late payment of utilities. There is an opinion that when calculating tax penalties, the day of payment of the overdue payment is not included (letter of the Ministry of Finance dated 07/05/2016 N 03-02-07/2/39318), however, the Federal Tax Service has always thought differently, so our calculator takes into account the point of view of the tax authorities services.

The organization has/had separate divisions

If the OP continues to work, the update is submitted to the same place where the initial declaration was submitted.

If a division is closed, updated declarations for it, as well as declarations for subsequent (after closure) reporting periods and the current tax period, are submitted to the Federal Tax Service at the location of the organization or at the place of its registration as the largest taxpayer (clause 2.6 of the procedure).

In this case, the title page indicates code 223 and the checkpoint at the location of the organization (the largest taxpayer), and in the details “TIN/KPP of the (closed) separate unit that changed the powers” - the checkpoint of the closed separate unit (clause 2.7 of the procedure).

If separate divisions of an organization switch to paying tax through a responsible division (parent organization), then an updated declaration must be submitted at the place of registration of the latter (letter of the Federal Tax Service of Russia dated June 30, 2006 No. GV-6-02/664).

If the OP was responsible, and then ceased to be so, according to the details “TIN/KPP of the (closed) separate unit that changed the powers”, you need to indicate the checkpoint at the location of the former responsible separate unit (clause 2.8 of the procedure).

Clarification of the income tax return: document form

Special forms for updated reports have not been developed; they are submitted on a regular approved declaration form and to the same inspectorate where the company is registered. But it should be remembered that an updated income tax return for previous tax periods is submitted on the forms that were in force precisely in those periods for which the erroneous return was filed (clause 5 of Article 81 of the Tax Code of the Russian Federation). That is, if in 2022 an inaccuracy is discovered in the declaration for 2014, then clarifications must be submitted in the form relevant in 2014.

For your information! When submitting clarifications based on data established for periods before 01/01/2014, when OKATO codes were in effect (replaced today by OKTMO codes), they are indicated (letter of the Federal Tax Service dated 02/25/2014 No. BS-4-11/3254). But when paying arrears for periods before 01/01/2014 according to the adjusted declaration, the OKTMO code is reflected in the payment order.

The peculiarity of the preparation of the updated declaration is that it does not reflect the difference between erroneous and correct indicators, but records reliable recalculated values.

All sections, sheets and annexes that were drawn up in the initial version of the declaration are filled out in the clarification, while the corrected indicators are entered instead of erroneous ones, and the remaining data from the primary report, being initially reliable, is duplicated.

The title page will also be different, since it must indicate the correction number. Let us remind you that in the primary document, in the field with the adjustment number, the attribute “0” is indicated, and in the updated declaration, if it is the first in a row, “1”. When submitting another clarifying form for the same period, the value “2” is indicated in this cell, etc. The number of clarifications is not limited by law.

Tax legislation does not require documentary explanations to be attached to the adjustments made, however, there is a high probability that the Federal Tax Service will request them, so it is better to immediately attach an explanatory note to the clarification, indicating in it:

- period for submitting erroneous information;

- inaccuracies in the primary declaration;

- fields that have been adjusted;

- calculation of the base and newly calculated tax when these values change;

- copies of documents confirming payment of arrears and penalties (if they were paid before the clarifications were submitted).

Results

The obligation to submit an updated declaration arises only if the taxpayer independently discovers non-payment of tax. In the case of separate divisions, when changing the address or reorganization, there are specifics associated with the procedure for reflecting OKTMO, KPP in the updated declarations, as well as the place of their submission. By following certain rules, when submitting an amendment with an increase in the amount of tax, you can avoid liability under Art. 120, 122 Tax Code of the Russian Federation. However, it must be taken into account that its submission may entail an on-site tax audit.

Read about the specifics of generating updated declarations for other taxes in the following articles:

- “How to make an updated VAT return in 2021”;

- “Features of the updated tax return 3-NDFL”;

- “How to submit an updated tax return under the simplified tax system?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.