What is the difference between a payment request and an instruction request?

Some employees of enterprises and organizations confuse these two documents. They are indeed similar to some extent, but there are also differences between them, both in form and functionality.

If we talk about form , then

- payment orders issued to pay for products must include the date of receipt of inventory items,

- and payment requests, among other things, contain a link to the agreement or other document in execution of which the payment is made, a list of attached papers and the date of sending the necessary documents to the counterparty.

As for the functional part , then

- in case of a payment request, the one who pays the funds and the one who receives them are closely related to each other (the supplier directly demands payment from the consumer for the goods or services received),

- and with a payment request-order, a credit organization also fits into their duet, which is fully involved in the process of transferring funds (i.e., it itself counts, transfers, controls and is responsible for all operations in case of failures).

Payment request form

Let us recall that a payment request form is a document that serves as the basis for settlements when a creditor, supplier or other recipient of funds demands repayment of a debt by transferring the appropriate amount to his bank account. For more information about this, see “Payment request-order is”.

In Russia, payment requirements are applied on the basis of the Regulations on the Rules for the Transfer of Funds, which was approved by the Central Bank of Russia on June 19, 2012 No. 383-P.

Typically, a payment request form is convenient when calculating work performed, services provided, goods supplied, and in other cases that are specified in the agreement (contract). According to their status, these payment transactions are banking transactions for collection.

Many people do not fully understand the difference between a payment request and a collection order. The common feature of collection payments is that no one asks the will of the account owner to conduct banking transactions. However, collection orders differ from other payment documents in that money is forcibly withdrawn from the owner’s account, without notifying him. Usually bailiffs do this, always attaching writs of execution, court orders, etc. And a payment request can also be applied in contractual relations. Then:

- this form of payment must be specified in the contract;

- An addendum is drawn up to the bank account agreement indicating the counterparty who can issue payment requests.

Also see "".

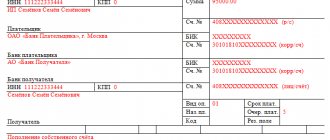

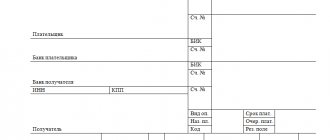

The sample payment request established by law is given in Appendix 6 to the specified Regulation of the Central Bank of the Russian Federation No. 383-P. According to OK 011-93, this is form 0401061:

From our website for free and via a direct link to the payment request here.

With or without acceptance

Money transfers involving a payment request can be made with or without the payer’s acceptance.

Acceptance is the agreement of a company with debts to pay them in full within a certain period of time.

If the payer is ready to pay for the transaction using acceptance, in the “Term of payment” request field, the recipient of the amount must indicate “With acceptance”, and in the line “Term for acceptance” put the number of days (working days) during which the payer undertakes to transfer the required amount.

Typically, the payer’s response is given five days (working days) or the period is specified in the agreement between the parties.

It should be noted that financial transactions using acceptance must be accompanied by statements from both parties.

It happens that a party to a contract, which must pay its monetary obligations using acceptance, refuses to do so - in this situation, it must give the credit institution a written explanation of its position.

There are often situations when organizations collect debts through a bank without acceptance. Most often this happens in court, due to compliance with the law, or when it is specified in the agreement between the parties. In the latter case, the payer is obliged to enter in advance a section on direct debiting of money into the agreement with the credit institution or make additional arrangements with the bank. agreement to the contract.

Also, bank specialists need to provide information about organizations that can issue payments for direct debiting of finances, information about services and products that can be paid for under such conditions, and links to specific contracts indicating their exact sections and clauses.

Opened form:

A payment request is a settlement document that contains a request from the collector of funds (creditor, supplier, recipient) to the debtor (payer) to transfer a certain amount to his bank account in payment of the debt.

These relations are regulated by the Regulations on non-cash payments in the Russian Federation of the Central Bank of the Russian Federation dated October 3, 2002 N 2-P, which, in particular, states: “Payment requirements are applied in settlements for goods supplied, work performed, services rendered, as well as other cases provided for by the main agreement.” Settlements with payment requests are banking operations for collection.

The payment request form is drawn up according to form 0401061 (Appendix 9 to the Regulations), included in the All-Russian Classifier of Management Documentation OK 011-93 (class “Unified Banking Documentation”).

Settlements with payment requests can be carried out with the prior acceptance of the payer or in an unaccepted (indisputable) manner. Acceptance is, in this case, the debtor’s consent to satisfy the payment request, that is, to transfer the amount stipulated by the contract to the product supplier. When making payments with payment requests with the payer’s acceptance, in the “Terms of payment” field, the recipient of the funds must put the mark “with acceptance”, and in the “Term for acceptance” field indicate the number of working days (usually, according to the agreement or at least 5 working days), within which the payer's response must follow. Acceptance of a payment request or refusal of it (full or partial) is formalized by appropriate statements.

It is possible to collect a debt through a bank without acceptance in cases provided for in the main agreement, by a court decision, or on the grounds approved by law. In the first case, the payer must include in advance in the agreement with the bank a condition on direct debiting of funds or enter into an additional agreement on this. In addition, the bank must be provided with information about suppliers who have the right to submit payment requests for direct debit of funds; information about goods and services that must be paid for; as well as dates and numbers of contracts and the corresponding clauses therein.

When making payments using payment claims without acceptance, in the “Terms of payment” field, the creditor marks “without acceptance”, and if collection is carried out on the grounds provided for by law, he also indicates the name of the law, its number, date of adoption and the corresponding article. In the “Purpose of payment” field, the collector, in cases of demanding payment for electricity and heat energy, water supply, postal, telegraph, telephone and other services, indicates the readings of measuring instruments and the current tariffs or calculations for them. The legislation also establishes the right to the direct write-off of fines and excess amounts received under supply contracts, freight charges and fines in transport obligations, and the amounts of claims recognized by the debtor.

A detailed description of the fields of the payment request form is in Appendix 12 to the Regulation of the Bank of Russia “On non-cash payments in the Russian Federation” dated October 3, 2002 No. 2-P. Please note that fields without details do not need to be filled in. Corrections, including the use of correction fluid, blots, and erasures in payment requests are not allowed. Payment documents are valid for presentation to the servicing bank for ten calendar days, not counting the day of their issue.

See also:

Submit a payment request Sample payment request - pdf Sample payment request - gif

Questions and answers on the form

What to look for in a payment request

The payment request form has a strictly defined unified form, which is mandatory for use. Usually you need to make 2 copies . One of them, after registration and approval, is transferred to the bank, the second, after completion, is returned to the account owner.

Both copies must be signed by the director and chief accountant of the enterprise (but if the director performs the function of the chief accountant in the company, then one autograph is sufficient).

Today, there is no strict need to certify forms using a seal, since since 2016 legal entities have been exempted from the obligation to use stamp products in their work (except in cases where this norm is specified in the company’s internal regulatory documents).

What is this in simple words?

The payment request form has the form 0401061 of a paper or electronic document, which is intended for processing settlements with other entities.

The document form is strictly unified and must be used. Usually 2 copies are drawn up: one is transferred to the bank, the other to the account holder.

The essence of the form is an offer to transfer funds to pay off obligations. This is one of the functions of bank cash management services.

Payment requirements vary depending on the characteristics and features:

- with acceptance, if consent is expected from the debtor to pay the debt, the document is marked “with acceptance”;

- without acceptance, the operation is carried out automatically without informing the account owner.

To fulfill the requirement without acceptance, it is necessary to have appropriate conditions in the signed agreement between the credit institution and the client.

After complying with all formalities, suppliers of goods have the right to put an inscription without acceptance, the funds will be automatically debited.

Filling out a payment request without acceptance in practice requires a lot of time and is extremely rare.

Automatic transfer of funds is possible in the following cases:

- compliance with the norms of a special legislative act (there is a special field for details);

- carrying out utility payments (electricity, gas, water supply), registering meter readings and current tariffs;

- claims against the account holder;

- penalties under signed contracts (supply agreement).

Often the requirement is used as an enforcement mechanism of the court.

This type of document is used by bailiffs, the winning party in a lawsuit.

Once you receive a court decision, you can fill out a payment request immediately at the bank.

How is it different from an assignment - similarities and differences

Accounting professionals sometimes confuse these two concepts, but they differ in both form and function.

Unlike an order, funds under a payment request (without acceptance) are debited from the debtor’s account without his consent; the owner is only notified of the transaction.

Based on the payment order, the business entity independently manages cash flows by sending the appropriate instructions to the credit institution.

If the need for consent from the debtor is indicated, the request indicates the deadline for its receipt. If consent is not received on time, the document is returned without execution.

Example of filling in for acceptance debit

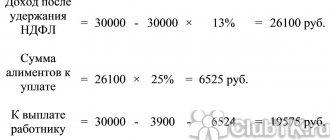

Let’s assume that Furniture Guru LLC, under the supply contract No. 7-M/18 dated 02/05/2018 and the invoice dated 02/21/2018, loaded office furniture in the amount of 225,000 rubles to Vympel LLC. 00 kop. But payment under the contract was never received.

This is what a sample payment request for this situation looks like.

Thus, when making payments using payment requests with the payer’s acceptance, the recipient of the money must indicate:

- payment condition – number “2” (i.e. you need to receive the debtor’s acceptance);

- acceptance period – the number of working days for the debtor to respond (as a general rule, this is 5 working days, unless a shorter period is specified in the agreement between the debtor’s bank and the debtor).

Do not fill out fields without details. Blots, corrections with a proofreader, or erasures are unacceptable.

Remember that the refusal of a payment request (full/partial) or its acceptance is confirmed by statements of appropriate content.

We prepare a payment request according to established standards

Payment documents submitted to the bank must be drawn up on an up-to-date form and taking into account all the requirements for their details. Let's consider the procedure for filling out payment requests in the form established by the settlement standard SPR 2.03-2-2020 from October 1, 2022 <*>.

The payment instruction in the form of a payment request contains the request of the beneficiary (collector) to the payer to pay a certain amount of money through the bank <*>.

Beneficiaries (collectors) can form and submit payment requests to the servicing bank <*>:

- on paper;

— in the form of electronic documents;

- in the form of electronic messages.

Note: On paper, a payment request is drawn up in the form of an external presentation of an electronic payment request (EPT), provided for by the settlement standards (hereinafter referred to as the SPR) <*>.

Payment documents in the form of payment requests are drawn up <*>:

- when making payments with the payer’s acceptance - a payment request with the payer’s acceptance;

- collection of funds in an indisputable manner from the accounts of payers - payment request without the payer’s acceptance;

- settlements by direct debit of the account - payment request for direct debit of the account.

Note! In the presented samples of filling out a payment request in the external presentation form of the EPT, bold font is used for clarity.

An approximate example of filling out a payment request with the payer’s acceptance

| PAYMENT REQUEST N: 1 | Date of: 201105 | Payment form: with acceptance | ||||||

| Amount and currency: Eleven thousand Belarusian rubles 00 kopecks | ||||||||

| Currency code: | 933 | Amount in numbers: | 11000,00 | |||||

| Payer: Enterprise LLC | ||||||||

| Account N: | BY10BLBB30120111110000022222 | |||||||

| Sending bank: OJSC “BANK 1”, Minsk | ||||||||

| Bank code: | AKBBBY2X | |||||||

| Correspondent of the receiving bank: | ||||||||

| Bank code: | Account N: | |||||||

| Recipient bank: OJSC “BANK 2”, Minsk | ||||||||

| Bank code: | BPSBBY2X | |||||||

| Bank of the collector: | ||||||||

| Bank code: | ||||||||

| Claimant: | ||||||||

| Beneficiary: Firm LLC | ||||||||

| Account N: | BY10BPSB30120222220000011111 | |||||||

| Purpose of payment: For metal products under contract No. 115 dated 09.10.2020, TN N 00123 dated 09.17.2020. Including VAT 1833.33 | ||||||||

| Document N: 115 | Document date: 200910 | Unique acceptance number: | Review code: | |||||

| Legislative act number: | Legislative date: | |||||||

| Payer's UNP: | UNP of the beneficiary: | UNP of a third party: | Payment code: | Queue: | ||||

| 600222333 | 600111222 | 22 | ||||||

| Signatures of the beneficiary (claimant): | To be filled in by the receiving bank (collector's bank) | |||||||

| Receipt date: Bank stamp: | ||||||||

| To be completed by the sending bank | ||||||||

| Receipt date: Signature of the responsible executive of the sending bank: Bank stamp: | ||||||||

Additional information on filling out a payment request with the payer’s acceptance

A payment request with the payer's acceptance (hereinafter referred to as a payment request with acceptance) is used when making internal bank transfers in payment for goods shipped, work performed, services rendered and in other cases provided for by the agreement concluded between the beneficiary and the payer <*>.

In accordance with the agreement concluded between the payer and the beneficiary, a payment request with acceptance can be presented to the payer's foreign currency account and executed with sale <*>.

A payment request with acceptance is executed only on the basis of an application for acceptance received by the bank from the paying client <*>.

The execution of a payment request with acceptance in a certain form is carried out taking into account the established requirements. The description and procedure for filling out the required details in each of the fields of the payment request with acceptance is determined by Appendix 2 to Instruction No. 66 <*>.

Read this material in ilex >>* *follow the link you will be taken to the paid content of the ilex service

Features of the document

Despite the similarity of the two payment documents - instructions and requirements, there are functional differences between them. By drawing up a payment order, the buyer gives the bank an order to pay the supplier a certain amount, in accordance with the contractual obligations between them. A demand means that the supplier (collector) requires the buyer (debtor) to make payment for the goods/services provided under the terms of the contract. Thus, the requirement is always issued by the supplier or seller. A common example of this document is the presentation of bills for housing and communal services, which literally mean the following: the service is provided under an agreement, the amount of debt has been generated and presented to the buyer.

The required information when filling out the request is:

- date or period of receipt of goods and materials or services by the buyer,

- reference to the agreement in fulfillment of the terms of which the payment is made,

- a list of documents accompanying the transaction and the date they were sent to the counterparty.

The transfer of funds upon payment request can be carried out with or without the payer’s acceptance (i.e., his consent to payment). As a rule, this condition is specified in the contract or agreement. In the document field “Term of payment”, the supplier indicates “1” if acceptance has already been received in advance. Code “2” is entered if acceptance is required - in this case, in the “Term for acceptance” line, enter the number of working days during which the required amount must be transferred. When the deadline for acceptance is not specified, 5 days are allotted for it, but provided that the payer’s agreement with the bank does not provide for a shorter period.

There are often situations when debt collection is carried out through a bank without acceptance, i.e. without the debtor's consent. For example, when a demand is made by a court decision, in the implementation of legislative norms or in accordance with the terms of a concluded agreement. In the latter case, the payer must reflect this fact in advance in the banking service agreement (or supplement the agreement with the credit institution by drawing up an appropriate agreement to it).

To submit a payment request, use the unified form 0401061 according to OKUD. It is given in Appendix No. 6 to the Regulation of the Central Bank No. 383-P dated June 19, 2012, and Appendix No. 1 to the Regulation specifies the rules for filling it out. The claimant has the right to submit the formed demand to the servicing bank within 10 calendar days, not taking into account the day of statement.