The patent tax system is the only special regime available only to individual entrepreneurs. Often, buying a patent turns out to be more profitable than paying taxes under other regimes.

Read more: Patent for individual entrepreneurs for 2022: types of activities

However, now the constituent entities of the Russian Federation have the right to establish the potential annual income for PSN without restrictions. This has caused patent prices to rise significantly in some regions.

But there is also a positive aspect - now an individual entrepreneur can reduce the cost of a patent for insurance premiums transferred for himself and his employees. Therefore, we recommend first using a patent calculator to compare the tax on PSN with the tax burden on other taxation systems. If necessary, you can contact us for a free consultation.

If you are convinced that PSN is the best option for you, then you need to submit an application for a patent to the inspectorate, its other name is form 26.5-1.

Please note: in 2022, to obtain a patent, an application form approved by order of the Federal Tax Service dated December 9, 2020 No. KCh-7-3 / [email protected] . All previous forms have lost their validity.

Free tax consultation

Form 26.5-1

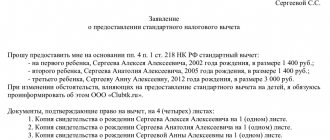

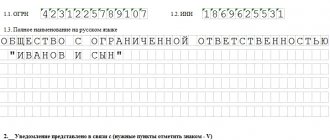

The patent application consists of five pages:

- title, for reporting identification information about an individual and the validity period;

- name of the type of activity;

- information about the place of business;

- information about vehicles (when choosing to transport goods and passengers);

- information about objects used in business (for leasing premises; retail trade; provision of catering services).

The first two pages are filled out by all applicants, and the pages containing information about transport or about trade and catering facilities are completed only when choosing the appropriate line of business.

The form is in editable PDF format. To fill it out correctly, it is recommended to use Acrobat Reader.

How to fill out an application using Elba if you have already registered an individual entrepreneur

To do this, go to the “Details” section → “For reporting” → “Submit a patent application” or click on the “Create a patent application” link in the “Current tasks” section.

A step-by-step task will open. Fill out the form, Elba will take the rest of the data from the details.

Step 1. Fill in the details

The patent can begin on any date, but we recommend specifying the first of the month. Many tax authorities do not accept applications with a different date.

The tax rate is almost always 6%. This does not mean that you will pay 6% on proceeds. For each type of activity on a patent, the regions determine the amount of expected income. It is from this fixed amount that you will pay the rate.

If you fall under a tax holiday, choose a 0% rate. Indicate the clause and article of the regional law that introduced holidays for your business. A 0% rate means that you do not need to pay for a patent.

In Crimea and Sevastopol the rate is 4%. Elba will substitute it automatically when you select a region.

Step 2: Specify objects

What this step will be depends on your type of activity.

If your business is retail or public catering , select an object, fill in its address, indicate the object's characteristics and area.

It is sometimes difficult for retailers to determine the difference between a store and a pavilion. Clause 3 of Article 346.43 of the Tax Code of the Russian Federation provides the following definitions:

- Store - a specially equipped building (part of it) intended for the sale of goods and provision of services to customers and provided with retail, utility, administrative and amenity premises, as well as premises for receiving, storing goods and preparing them for sale;

- Pavilion is a building that has a sales area and is designed for one or more workplaces.

To fill in the sign and area, the regional patent law will be useful. In some regions, the cost of a patent depends only on the area of the sales floor or service area, and in others - on the total area of the store or cafe.

There are eight attributes of an object, but retail and catering need to choose one of three. The first sign is intended for rental, 2-4 - for retail, 5-7 - for catering, and the last one - for parking lots.

| Code | Sign | When to indicate |

| 1 | The area of the rental property. | You rent out residential or non-residential premises, a garden house or a plot of land. |

| 2 | The area of a stationary retail chain facility with a sales floor. | There is a trading floor. In your region, potential income depends on the total area of the store or pavilion. |

| 3 | The area of the trading floor for the object of trade organization. | There is a trading floor. In your region, potential income depends on the size of the sales floor. |

| 4 | The area of a retail space in a stationary retail chain facility that does not have a sales floor. | There is no trading floor. Trade at a retail market, fair or kiosk. |

| 5 | The area of a catering facility that has a customer service hall. | There is a service hall. In your area, the potential income depends on the total square footage of the restaurant, bar, cafe or eatery. |

| 6 | The area of the customer service hall at the catering facility. | There is a service hall. In your region, potential income depends on the size of the service area. |

| 7 | Area of a catering facility that does not have a customer service hall | There is no service hall. You sell through a kiosk, tent or culinary department at a restaurant, bar, cafe or other catering outlets. |

| 8 | Vehicle parking area | Activities of parking lots for vehicles |

If you are renting out real estate , click on the “Add property” button and select what you are renting out: land, residential or non-residential premises. Fill in the address and select the attribute “1 - area of the property being rented out.”

If you transport cargo or passengers , you will see the “Add vehicle” button. Select the type of vehicle and indicate the characteristics from the documents for it.

For other types of activities, simply indicate the address where you plan to work. If there is no specific address, do not fill in anything, but proceed directly to the next step to submit the application.

Step 3. Submit the application to the tax office

Sign and submit the application. If you do not have an electronic signature, print it out and submit it on paper. In 2022, the tax office accepts applications until December 16.

Once submitted, you will receive an acceptance receipt or rejection notice. The inspection does not send the patent electronically, so after 5 days it is better to pick it up on paper - the cost and payment details will be indicated there. In addition, the counterparty may ask for a scan of the patent to make sure that you are working in a special mode without VAT.

In fact, it is not necessary to go to the tax office. You can calculate the cost of a patent using a calculator, and create a payment using the tax service. If you are worried that you might make a mistake with the payment, pick up the patent on paper.

Information about the patent will appear in the taxpayer’s personal account: number, validity period and payment calendar.

As of 2022, patent laws have changed. On Elba's blog we talked about the changes and answered frequently asked questions.