Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

Organizations need to pay income tax on new BCCs. The Ministry of Finance has updated the budget classification codes dated 06/08/2020 No. 99n.

KBK - classification codes that organizations write in payment documents for the purpose of transferring funds to the budget. Payments first go to the treasury, and only then all funds are divided between the federal, regional and local budgets. In this article we will look at the differences between the new budget classification codes for income tax and the old ones and tell you how to use them.

KBK on income tax for legal entities in 2022 and 2022

In 2022, nothing has changed in the rules for paying income tax - the same distribution and rates:

- to the regional budget - 17% of the tax base;

- to the federal budget - 3% of the tax base.

For legal entities, changes in budget classification codes were minor, but they must be taken into account when filling out payrolls. They relate to the amount of taxes that are calculated on profits on marketable bonds and mortgage-backed bonds.

KBC for 2022

| Budget | Tax | Fines | Penalty |

| Federal | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Regional | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

KBC for 2022

| Budget | Tax | Fines | Penalty |

| Federal | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Regional | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

Where is the KBK indicated in 2021?

The budget classification code must be indicated in payment orders when transferring taxes, fees, penalties, fines and other obligatory payments to the budget. In the current form of payment, given in Appendix 3 to the Bank of Russia Regulation No. 383-P dated June 19, 2012, field 104 is intended for KBK.

In addition, the BCC should be indicated in some tax returns: for income tax, for VAT, for transport tax (cancelled from 2022), as well as in the calculation of insurance premiums (DAM). This allows tax authorities to post payments according to ownership.

From January 1, 2022, indicate in your payment slips some new BCCs for taxes, fees and insurance fees, which were approved by orders of the Ministry of Finance of Russia dated 06/08/2020 No. 99n and dated 11/29/2019 No. 207n.

Features of tax calculation and payment

The company received income. Subtracting expenses from it, we get profit, which is taxed. This tax will be called direct. All legal entities located in Russia - domestic and foreign - are required to pay it. Entrepreneurs working for OSNO must pay income tax.

Income tax does not apply to:

- entrepreneurs who are on the simplified tax system, UTII, patent and unified agricultural tax;

- persons who own a gambling business;

- participants of the Skolkovo center;

- organizers of the 2022 FIFA World Cup.

What is the tax in 2022 KBK 18210102010011000110

The specified BCC is established for one of the most common taxes - personal income tax, which is calculated from the salaries of employees in amounts not exceeding 5 million rubles. It is worth noting that this BCC is not used in legal relations regulated by the provisions of Art. 227, 227.1, as well as 228 of the Tax Code of the Russian Federation, despite the fact that they also require the payment of personal income tax.

So, in accordance with the provisions of Art. 227 this tax is paid by individual entrepreneurs working under the general taxation system. Art. 227.1 of the Tax Code of the Russian Federation regulates the payment of personal income tax by certain categories of foreign citizens. Art. 228 of the Labor Code of the Russian Federation regulates the calculation and payment of personal income tax by individuals on income not related to work. For each type of specified legal relationship, a separate BCC has been established.

Penalties for late payment of personal income tax in 2022 must be transferred to the taxpayer using KBK 18210102010012100110, fines - using code 18210102010013000110.

Payment of income tax in 2022 KBK

Payment is transferred within 28 days of the month following the reporting period. Advance payments must be made quarterly (for certain categories of Article 286 of the Tax Code of the Russian Federation) or monthly, despite the fact that the tax period is a year.

| Tax | Penalty | Fine |

| New KBK income tax (tax on interest on bonds) | ||

| 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax, provided that production sharing agreements that were concluded before the adoption of Federal Law No. 225 are implemented | ||

| 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax levied on the profits of foreign companies whose activities are not related to activities in Russia, with the exception of income in the form of dividends | ||

| 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on profits of controlled foreign companies | ||

| 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on profits received by Russian organizations in the form of dividends from Russian companies | ||

| 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on profits received by a foreign organization as dividends from a Russian company | ||

| 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on profits received by Russian organizations in the form of dividends from foreign companies | ||

| 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on income received from state and municipal securities in the form of interest | ||

| 182 1 01 01070 1000 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on profits of controlled foreign companies | ||

| 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

KBK for payment of the minimum tax under the simplified tax system (until 01/01/2016)

| NAME | PAYMENT TYPE | KBK |

| Minimum tax under simplification for tax periods expired before 01/01/2016. | tax | 182 1 05 01050 01 1000 110 |

| penalties | 182 1 05 01050 01 2100 110 | |

| interest | 182 1 05 01050 01 2200 110 | |

| fines | 182 1 05 01050 01 3000 110 |

FILES

KBK interest on income tax

If you need to pay a tax penalty, you must use your code, which is written in payment orders. To find out which profit tax penalty code to write in column 104 of the payroll, you need to replace provisions 14-17 in the code for the main payment.

For penalties, instead of 1000, the value 2100 is used. Codes for penalties are located depending on where they are transferred (budget level).

- federal budget - 182 1 0100 110;

- regional budget - 182 1 0100 110.

The penalty code for taxes to the federal budget in provisions 11-12 has the value 11, and to the regional budget this value is 12. If a shortage is detected in the treasury of the constituent entities of the Russian Federation, then the penalties are transferred using the BCC to the regional budget.

The most needed KBK for 2022: table

Below are tables with the BCC for 2022 for basic taxes and insurance premiums.

KBK for paying taxes for organizations and individual entrepreneurs on OSN in 2021

| NAME OF TAX, FEE, PAYMENT | KBK 2021 |

| Corporate income tax (except for corporate tax), including: | |

| 182 1 0100 110 |

| 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Property tax: | |

| 182 1 0600 110 |

| 182 1 0600 110 |

| Personal income tax (individual entrepreneur “for yourself”) | 182 1 0100 110 |

KBK tax payment for organizations and individual entrepreneurs under special regimes in 2021

| NAME OF TAX, FEE, PAYMENT | KBK 2021 |

| Tax under the simplified tax system, when the object of taxation is applied: | |

| 182 1 0500 110 |

| 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

KBC on insurance premiums in 2022

| TYPE OF INSURANCE PREMIUM | KBK 2021 |

| Insurance premiums for OPS | 182 1 0210 160 |

| Insurance premiums for VNiM | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0213 160 |

| Insurance premiums for compulsory health insurance in a fixed amount (including 1% contributions) | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance in a fixed amount | 182 1 0213 160 |

| Additional insurance contributions to compulsory pension insurance for employees who work in conditions that give the right to early retirement, including: | |

| – for those employed in work with hazardous working conditions depend on the results | 182 1 0210 160 |

| – for those employed in work with hazardous working conditions depends on the results | 182 1 0220 160 |

| – for those employed in jobs with difficult working conditions depend on the results | 182 1 0210 160 |

| – for those employed in jobs with difficult working conditions depends on the results | 182 1 0220 160 |

| Insurance contributions to the Social Insurance Fund for injuries | 393 1 0200 160 |

Errors in the KBK of income tax

When filling out field 104 of the payroll, organizations often confuse the codes. Due to errors in payments, money is sent to unknown payments. The inaccuracy can be corrected. To do this, you need to write an application to the tax office to clarify the payment.

The application can be submitted in free form. The most important thing is to remember to write the wrong payment details and provide the correct information.

Author of the article: Alexandra Averyanova

Pay income tax and other taxes in the cloud service for small businesses Kontur.Accounting. The service will prepare payment slips and remind you about payment deadlines, generate reports, and help you easily calculate salaries and other payments. Get to know all the features of Kontur.Accounting for free for 14 days.

In which legal acts are the BCC approved?

KBK is a code for the budget classification of income or expenses of the budget of the Russian Federation.

In practice, business owners use only the “income version” of the KBK in their legal relations - indicating them in payment orders and thus identifying the payment that is transferred to the budget. This could be a tax, fee, contribution, duty, penalty or fine. Budget classification codes are approved in the regulations of the main federal department that is responsible for taxes and fees - the Ministry of Finance of the Russian Federation. For 2022, the procedure for the formation and application of BCCs, their structure and principles of appointment were approved by order of the Ministry of Finance of the Russian Federation dated 06.06.2019 No. 85n. And the lists of codes related to the federal budget and extra-budgetary funds are by order of the Ministry of Finance dated November 29, 2019 No. 207n. For 2022 - by order No. 99n dated 06/08/2020, for 2022 - by order No. 75n dated 06/08/2021. That is, if you need to find out which tax KBK 18210301000012100110 (or any other) corresponds to in 2022, then order No. 75n dated 06/08/2021 will be the primary source.

Let's consider the main BCCs used by businessmen in 2022.

Main BCCs for taxes and contributions in 2019: list, explanation

The most used in 2022 are KBK, necessary for modern Russian individual entrepreneurs and business entities dealing with payment:

- Personal income tax for hired employees (KBK 18210102010011000110);

- income tax (regional KBK - 18210101012021000110, federal - 18210101011011000110);

For details, see the material “KBK when paying income tax in 2018-2019.”

See also “KBK for insurance premiums for 2018-2019 - table”.

KBK-insurance premiums (old periods)

| Type of insurance premium | KBK (for contribution) | KBK (for penalties) | KBK (for a fine |

| Insurance premiums for OPS | 182 1 0200 160 | 182 1 0200 160 | 182 1 0200 160 |

| Insurance premiums for VNiM | 182 1 0200 160 | 182 1 0200 160 | 182 1 0200 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0211 160 | 182 1 0211 160 | 182 1 0211 160 |

| Insurance premiums for compulsory health insurance in a fixed amount | 182 1 0200 160 | 182 1 0200 160 | 182 1 0200 160 |

| Insurance premiums for compulsory health insurance in a fixed amount (1% contributions) | 182 1 0200 160 | 182 1 0200 160 | 182 1 0200 160 |

| Insurance premiums for compulsory medical insurance in a fixed amount | 182 1 0211 160 | 182 1 0211 160 | 182 1 0211 160 |

True, the BCC for additional contributions to compulsory pension insurance for periods expired before 01/01/2017 is the same as for periods starting from 01/01/2017.

All existing organizations and individual entrepreneurs pay taxes to the Federal Tax Service. The tax office uses budget classification codes to determine the type of income of a company from which the amount was transferred to the state budget.

If the overlay is not quickly eliminated, the organization or individual entrepreneur may receive penalties and interest due to failure to comply with the tax deadlines established by law.

Income tax in 2022 (decoding KBK 18210101012021000110, 18210101011011000110)

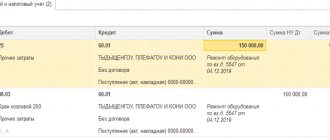

Corporate income tax is paid to two budgets - federal and regional. In the first case, the payment orders indicate KBK 18210101011011000110, in the second - 18210101012021000110. The same KBK are used when transferring arrears to the budget and making recalculations for the tax in question.

Penalties for income tax to the federal budget in 2022 must be transferred using BCC 18210101011012100110, fines - using code 18210101011013000110. When transferring fines and penalties for tax to the regional budget, it is necessary to indicate in the payment document, respectively, BCC 1821010101202300011 0 and 18210101012022100110.

KBK 18210501011011000110: what is the name of payment when paying tax in 2022

Important: Check your payment codes with the correct KBK insurance premiums and enter the correct payer status.

If you indicate an incorrect BCC, then the Tax Code of the Russian Federation does not prohibit clarification of the erroneous BCC. However, it can be clarified within the limits of one tax, for example, if instead of a new code the company has installed an old one. But this will have to be proven in court (resolution of the Federal Antimonopoly Service of the Central District dated January 31, 2013 No. A64-5684/2012).

In order not to argue with the inspectorate, it is easier to pay the tax again to the correct BCC. And ask for an erroneous payment to be offset against future payments.

| Name of tax, fee, payment | KBK |

| Corporate income tax (except for corporate tax), including: | |

| — to the federal budget (rate — 3%) | 182 1 0100 110 |

| — to the regional budget (rate from 12.5% to 17%) | 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Property tax: | |

| - for any property, with the exception of those included in the Unified Gas Supply System (USGS) | 182 1 0600 110 |

| - for property included in the Unified State Social System | 182 1 0600 110 |

| Personal income tax (individual entrepreneur “for yourself”) | 182 1 0100 110 |

KBK taxes: for paying taxes for organizations and individual entrepreneurs in special modes

| Name of tax, fee, payment | KBK |

| Tax under the simplified tax system, when the object of taxation is applied: | |

| - “income” | 182 1 0500 110 |

| — “income minus expenses” (tax paid in the general order, as well as the minimum tax) | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |