History of origin and methodology of application of reversals

Reversal is an option for adjusting all required data in accounting. The word stornare itself is of Italian origin and means “turn back”, “retract”. The concepts of “reverse” and “minus” are identical.

Documents that can be submitted:

- extra;

- with erroneous correspondence;

- which indicate an inflated amount.

Such documentation is subject to cancellation. Postings of this kind are reflected in accounting documents with a negative sign.

The term “reverse” is not always applicable in case of errors. Sometimes, when during a specified period accounting is carried out at planned prices, after which adjustments are made to actual indicators, these amounts have to be reduced. Let's use the term “reverse” as an option.

Previously, during manual calculations, detected errors were recorded in the following way: incorrect amounts were not crossed out, but additionally entered in red ink. But not everyone had red ink. I had to enter such amounts and immediately circle them with rectangular frames. When calculating the final amounts, the red numbers were subtracted and reversed.

Example. Account turnover: the correct amount is 1000, but instead of the amount 4000, 4400 was indicated (operation in Fig. 2).

The feasibility of introducing color storno was described by A. A. Beretti back in 1889. In Russian accounting, the phrase “red reversal” has become more acceptable.

Of course, it would be possible (theoretically) to swap the debit and credit positions and thereby reset the erroneous entry. This is how a reverse reversal is obtained with the formation of the correct final balance. However, in this case, the amount of turnover on the accounts turns out to be overestimated. It is noted that the accounting information is not completely reliable.

The technique of correcting errors by reverse debugging has an unofficial name - “black reversal”. And here, too, different methods of calculation are provided. You can make a calculation similar to the last option (Fig. 3), if the correspondence of the accounts is correct. It is enough to indicate only the delta between the correct and deposited amounts. Then you will not need to additionally create the correct wiring.

The reverse reversal technique is more applicable in Western accounting systems and credit institutions. Russian accounting understands reversal as “red reversal” by default.

The term “reversal” cannot be found in accounting legislation. If you turn to the source PBU 22/2010, which describes the procedure for correcting errors, you will not find the term reversal there either. But the legislative acts regulating the accounting activities of autonomous and budgetary organizations directly state that errors should be corrected using the red reversal method. The country has developed a practice of reversing erroneous documents, so the term “reversal” in the future must be taken into account specifically “red reversal”.

Reversal when introducing automated processes

When accounting was transferred to the area of automated processes (on a PC), transactions began to be generated with a minus sign - without changing the correspondence of accounts. In the reverses, in order to improve visualization, the color red was left for negative values. There are reporting forms that provide the following instructions: Negative numbers should be shown in parentheses. When calculating the results, it will be clear that they need to be subtracted.

Here's another option. As a result of an error, an underestimated amount could be indicated, despite the fact that the invoice correspondence is correct. Then you can use the option of not using the reversal method. You will simply have to create an additional entry for the difference in the amount.

It is worth paying attention to the following nuance, due to the specifics of automated accounting in 1C. When posting a document, postings are generated in the program taking into account the chart of accounts. They are called accounting entries; as a result, the amounts of assets and liabilities of the balance sheet will be presented. However, the financial service also needs to fill out reports to funds, tax returns, and other registers. These indicators cannot be methodologically linked to the chart of accounts. They are formed taking into account other principles.

The term “tax accounting” arose, and it turned out to be quite stable. Data for it must be generated taking into account the requirements of the Tax Code (the main standard for the formation of accounting remains a document such as PBU - the Regulations on Accounting).

In the settings, in 1C postings, the abbreviation BU is often found, that is, accounting, as well as NU, which means tax accounting. Auxiliary intermediate registers have also been introduced. For example, in such registers data for the purchase and sales ledger is generated. So the reversal of documentation covers both those transactions related to accounting and tax calculations. Moreover, the registers should be filled out correctly.

Accounting adjustments

Changes that reduce the cost of shipped goods/services must be documented: an additional agreement must be drawn up to the previously concluded agreement, which will record all aspects of the new agreements.

A decrease in the cost of delivery is reflected in the seller’s accounting by reversal entries:

| Content | D/t | K/t |

| REVERSE the amount of goods/services to be returned | 41 | 62 |

| REVERSAL of VAT on returned goods and materials | 19 | 62 |

| REVERSE of VAT accepted for deduction on return | 68 | 19 |

Example

On January 12, 2022, under the agreement, Afina LLC shipped 150 sets of metal products to Hephaestus LLC in the amount of 324,000 rubles. (including VAT 20% - 54,000 rubles). The price of one set without VAT is 1800 rubles, its cost is 1000 rubles. The buyer paid for the goods in full, but upon receipt at the warehouse, he discovered 10 sets that did not meet the requirements of his production, in the amount of 21,600 rubles. in view of VAT.

LLC "Gefest" notified the seller about sending a claim and an additional agreement to the contract to reduce the cost of the goods, return them and transfer funds for them. Afina LLC agreed with the demands put forward, signing the document and returning 21,600 rubles to the buyer’s account.

Postings for adjusting sales downward from the seller

Postings in supplier accounting (Athena LLC):

Content D/t K/t Sum Sales revenue 62 90/1 324000 VAT charged 90/3 68 54000 Payment received from Gefest LLC 51 62 324000 The cost of 150 sets was written off 90/2 43 150000 Implementation adjustments: Reflected decrease in STORNO sales 43 62 21600 VAT on the cost of returned goods STORNO 19 62 3600 VAT previously accepted for deduction has been reversed 68 19 3600 Refund to buyer 62 51 21600 Adjustment of sales downward: postings to the buyer

Postings to Hephaestus LLC will be as follows:

Content D/t K/t Sum Posting of goods 41 60 270000 VAT on purchased goods and materials 19 60 54000 Payment for delivery 60 51 324000 VAT is accepted for deduction 68 19 54000 Adjustment according to additional agreement: Other income accrued 76 91/1 18000 VAT on returned goods has been restored 76 68 3600 A refund 51 76 21600

How to create reversal documents in 1C 8.3

As an example, you can take the reversal of documents in 1C when accruing vacation.

Example. In November 2022, the employee was accrued vacation pay. The amount is 30 thousand rubles, whereas the amount should have been 25 thousand rubles. This means that the reversal operation in 1C 8.3 is carried out in December 2017.

Here is the path through the menu: Operations => Operations that were entered manually.

By clicking the “Create” button, the user receives a list of acceptable actions. You need to select “Document reversal”.

The documentation to be reversed is now indicated.

First, the document type is selected, and then the document itself is selected.

Reversal postings are automatically generated.

Not only accounting and tax accounting data are filled in, but also other accounting registers.

A certain accounting register might not automatically be included in the reversal document. Then it is added manually. You need to use the “More” button menu and click “Select registers”. A list appears from which the appropriate register is selected.

The printed format of the Storno document is an accounting statement.

Here is the technical side of vacation reversal in 1C. In practice, it often turns out that simply reducing the accrued amount, that is, recovering previously paid money from the employee, will not work. Here you cannot violate the provisions of the Labor Code (Article 137 of the Labor Code of the Russian Federation).

How to make adjustments to a document in 1C KA 2?

List of documents for which the option should work:

- Receipt of goods to the warehouse;

- Movement of goods;

- Domestic consumption of goods (Write off as expenses);

- Other posting of goods;

- Write-off of shortages of goods;

- Capitalization of surplus goods;

- Damage to goods;

- Re-grading of goods;

- Assembly of goods;

- Movement of products and materials.

To make the adjustment available, go to the menu “Master data and administration - Financial result and controlling - Financial result”.

There we set the flag “Use correction documents”.

1C Integrated Automation 2: use correction documents

You can now create patches. Let's look at the example of the document “Write-off as expenses”.

We go to the desired document and click on the “Enter based on” button to open the “Correction” or “Reversal” menu.

1C Integrated Automation 2: entering document corrections Write-off as expenses

When correcting, the program simply copies the document data, while maintaining a link to the original document. Our task is to enter the data “correctly”. For example, change the quantity and nomenclature to the correct option.

1C Integrated Automation 2: tabular part of document correction Write-off as expenses

The program itself reverses the records of the old document and formalizes the movement in the current period with new data.

Let's see what happens in the regulated accounting transactions:

1C Integrated Automation 2: document correction postings Write-off as expenses

As you can see, the document reverses the posting of the document being corrected and regenerates the posting based on the new data in the current period.

Please note that if written off as an expense, the adjustment will affect the expense account for the current period. In our example, expenses on account 20 are reduced. If the expense account does not have sufficient turnover according to document analytics, then such adjustments can lead to negative balances.

Now let's look at what's in the registers:

1C Integrated automation 2: movements in document correction registers Write-off as expenses

Since we write off goods as expenses, before calculating the cost, the program generates movements only in the goods accounting registers. The principle is the same: complete reversal and new movement in the current period.

After the month is closed, movements in the “Other expenses” register appear in the document:

1C Integrated Automation 2: Other expenses when correcting a document Write-off as expenses

And they fall into the “Income and Expenses” report in the current period:

1C Integrated Automation 2: document corrections Write-off as expenses in the Income and Expenses report

If the adjustment is downward, then the amount of expenses on the document will be reflected in the report with a plus, and not with a minus.

I made an example in a period in which there are no other movements, so that it is clearly visible how the program takes into account the correction. If you have expenses for this item in this period, they will be reduced by the amount of the correction.

Well, one last thing. In the balance sheet for the expense account, all movements on the document are visible. In the absence of other movements in the expense item, the program can distribute the negative balance to account 90.

1C Integrated automation 2: balance sheet for account 20

We have discussed with you how to correct warehouse accounting documents for a closed period in 1C Integrated Automation, starting with version 2.5.6.

If you need to understand production and cost accounting in 1C KA 2, then come to the course:

Accounting for reversal of implementation in 1C

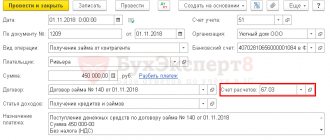

In the “Implementation” section for documents, reversal in 1C is performed according to the same algorithm as already indicated above. Reversal of sales from the previous accounting posting period will be generated automatically. The correct indicators will be indicated. But reversing VAT in tax accounting requires performing auxiliary settings.

Example. In September 2022, the act and invoice were issued. The amount of the service provided was 11,800 rubles, which also included VAT - 1,800 rubles. The documents were processed through the accounting department. However, in September the contract of completion of work was not signed by the counterparty; he agreed to sign only in November 2017. This means that the September document should be reversed.

In order to correctly account for VAT, you will need to, together with reversing the document in accounting, fill out an additional sheet to the sales book for the third quarter of 2017. This add. the sheet will no longer represent the erroneous invoice, it will be cancelled. The document itself adjusting VAT will be generated in November 2022. At the same time, it will designate the 3rd quarter of 2022 as the adjustment period.

The data will be adjusted. Taking into account the adjustment, an updated VAT return is filled out. Section 9 will need to be invoked.

In the Sales Reversal document, you will need to go to the “VAT Sales” tab.

The columns that are related to additional information are filled in. sales book sheet. You will need to use the “Adjusted period” column, where you put the date from the 3rd quarter.

The “Sales Book” report is used. You need to set the settings.

The sales book has opened new sections - sheets with additional content.

The invoice is reversed.

You need to fill out a VAT return after clarification. The correction number must be indicated.

After filling out the declaration, the data will be presented in section 9.

Reversal of the document “Transfer into operation”

To reverse an incorrectly entered document “ Domestic consumption”

"with the type of operation "

Transfer into operation

", we recommend using the document "

Other receipt of goods

" with the type of operation "

Transfer into operation

".

To reverse a primary document you need:

1. Enter based on the document “ Domestic consumption”

" with the type of operation "

Transfer into operation

" document "

Other receipt of goods

"

2. Document “ Other posting of goods”

» is automatically created from the household.

operation “ Return from service

” and is filled in with the data of the document - the basis

In the new document, the user is required to independently indicate the price of the returned goods and materials ))) and the expense item

This approach is primarily due to the fact that the user himself must determine the book value of inventory items returned from service. The system suggests reflecting the cost of returning inventory items on an income item (in our example, “Other income”)

3. Conduct the completed document and complete the Month Closing Procedure

.

Postings for the return of inventory items from operation are generated directly in the document “ Repayment of the cost of inventory items in operation

”

3.1 Data for posting to an off-balance sheet account (MC) is generated automatically by the system

3.2 Data for posting to restore the value of inventory items on the balance sheet - performed according to the data specified in the document “ Other posting of goods”

» with the type of operation «

Return from service

»

How to submit Reversal of receipts in 1C

Example. The supplier's invoice was posted twice - erroneously. It was recorded in advance accounting (once) and in the documentation of goods receipt (second time). This means that one of the designated receipts needs to be deleted. The amounts should be reversed exactly according to the second of the specified documents.

The reversal of receipts in 1C 8.3 will be generated according to the previously discussed algorithm. The amounts were reversed without difficulties only in accounting, but in tax accounting it will be more difficult to reverse. There is no “VAT Purchases” register.

We are considering an invoice document (primary, not reversal). It contains data on which additional information is generated. shopping book sheets.

Various methods have been developed for filling out the “VAT Purchases” register. It is proposed to use the “More” button, then you can add this register to the document. This is a reverse Receipt. Filled in manually.

Also, the designated register can be filled in automatically when an invoice is reversed.

If the VAT register is filled out correctly, when the purchase book is created, you should expect additional information to appear. leaf.

In section 8, data will appear when the declaration is filled out.

Add. The purchase ledger sheets may end up being completed in other ways.

Method 1

Promotion through the menu: Operations => Reflection of VAT for deduction.

The settings of this document should indicate that additional sheets, purchase book entries.

Use the “Items and Fill” tab with the “Fill according to settlement document” option.

When filling out this section, positive account numbers are entered by default. You will need to cancel the invoice. The “Amount” value must be replaced manually with a negative one, and the columns “VAT” and “Total” will be listed automatically.

You can now start reforming the report on the purchase book and declaration. It was indicated above how to do this.

Method 2

Promotion through the menu: Operations => Regular VAT operations.

Now Create => VAT Restoration.

It is necessary to indicate that it was necessary to reflect the restoration in the purchase book. A warning will appear. You should click “Yes”.

It is possible to fill in the data manually using the “Add” button. By using the “Fill” button, select the “Fill in amounts to be restored” option. There is no need to change the sign of the sum to negative.

In the future, the formation of a purchase book with additional sheets and an updated declaration is carried out as standard.

You can purchase services that help you work as an accountant here.

Do you want to install, configure, modify or update 1C? Leave a request!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

How to reverse a document in 1C

Published 02.10.2014 18:15 Author: Administrator Every accountant faces the need to reverse documents. This may be the correction of an error from the previous reporting period or other circumstances; the main thing is to correctly reflect such an operation in the program so that there are no problems in further work. Let's look at how to do this in the programs 1C: Enterprise Accounting 8 and 1C: Integrated Automation 8.

In 1C: Enterprise Accounting 8 edition 3.0, you need to go to the “Operations” tab and select “Operations entered manually”.

Click the “Create” -> “Document Reversal” button.

We select the organization, the type of document to be reversed, and the document itself.

Postings are filled in automatically. If necessary, you can make changes manually, but in this case you need to remember that you will have to change not only the accounting data, but also the data of the accumulation registers, if there are also movements on them. Otherwise, errors may occur when generating reports.

In the 1C program: Comprehensive automation of 8 reversal document movements is done a little differently. You need to switch the interface to “Full” and go to the Operations -> Documents menu, then select the “Adjusting register entries” document.

Create a new document, check the “Use filling in movements” checkbox, add a row to the table and in the “Action” column select “Reverse document movements”. Then in the next field, select the type and the document to be reversed, click the “Fill in movements” button.

Postings appear on the “Accounting registers” and “Accumulation registers” tabs. If necessary, you can correct them manually, but remember that changes must be made to all registers!

If you still have questions about reversal, you can ask them in the comments to the article, and I will definitely answer you.

And if you need more information about working in 1C: Enterprise Accounting 8, then you can get our book for free using the link.

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

+1 #44 Olga 12/22/2020 09:47 In 2022 paid for fuel and lubricants. Before concluding an agreement with a supplier in cash (advance report) and after concluding an agreement through a cash account (including VAT). Payments were automatically posted to one seller twice. I wrote off fuel and lubricants according to the norm. Due to inexperience, I did not reconcile the debt balances. As a result, it is necessary to remove the double payment from the supplier at the expense of net profit. Tell me what to do now in 2022.

Quote

0 #43 Olga 02/01/2019 16:08 Good afternoon! The subconto for the movement of the accumulation register was entered incorrectly in the document (manual adjustment of document movements). The period is closed. Do I need to make corrections to this register in the current period through a reversal operation or make a correction to an entry in an arbitrary register? Thank you.

Quote

0 #42 Alexey 08/13/2018 19:34 Good afternoon. When selling in USD for export, the currency rate was indicated incorrectly in the “Prices and Currency” menu (operation 2Q2018). On August 13, 2018, I’m trying to edit the document “Sales of goods” with the document “Adjustment of sales”, but the program does not allow me to change the course on the “Advanced” tab - what to do (1C ed/conf 1.1.105.2) in order to correctly generate additional lists of the sales book (course should be more than in the document “Sales of goods”)?

Quote

0 #41 Ukhova Natalya 05/11/2018 10:40 I quote Damir:

Good afternoon How to reverse the “Debt Settlement” document in the Integrated Automation program 2.2.2.219

Good afternoon

Try the document “Operation (regulated accounting)”, in the main tab, select the related document, then “Fill out the reversal”. Quote 0 #40 Damir 05/08/2018 15:01 Good afternoon! How to reverse the “Debt Settlement” document in the Integrated Automation program 2.2.2.219

Quote

0 #39 Anastasia358 08/25/2017 09:59 Good afternoon! 1s8.3. Last year we carried out an account with VAT, but when the program crashed, the VAT amount in the account disappeared, and an account was recorded without VAT, also with the wrong amount. This year, the document with the entry of the additional sheet was completely reversed. However, the program does not allow you to enter this invoice again in the current period, citing the fact that the document was entered in the previous period, which is closed. Tell me what to do?

Quote

0 #38 Ukhova Natalya 03/03/2017 16:19 I quote Ekaterina0208:

I quote Olga Shulova: I quote Marina: Hello Olga! There is no way to reverse the receipts in the previous period. It turns out that the invoice was mistakenly accepted for accounting on August 28. It turned out that this was on October 30. What documents should I use to reflect this in 1C: accounting of the enterprise? I made Operations vv. manually - reverse the document - selected the receipt document. What next? How can I make sure that it is reflected in the additional list of the book of purchases? and on what date should I perform the operation. manually?

Hello!

You also need to make a VAT restoration, indicate that the restoration should be reflected in the purchase book and add an additional flag in the table. leaf. The reversal is that you did the right thing. We set the date for the current period. Good afternoon, Olga! Help me to understand. in 4Q16 the goods were returned from the buyer. Now we have found out that the buyer did not carry out a return, but a sale. I made a reversal for the return, the amounts were all correct in the movement of the document. Now we need to restore VAT, did I understand correctly? how to do it? Good afternoon When the “Return from the buyer” was done, VAT was included in the purchase book, right? After reversing the postings, we recommend making a “VAT Restoration” document; after posting it, the VAT amounts will be included in the sales book for the current period. Next, enter “Receipt of goods and services” and the invoice received based on the sale from the buyer. Quote +1 #37 Ukhova Natalya 03/03/2017 16:05 Quote Elena!:

Hello! in 1C 8.3 I reversed the receipt and reflected VAT for deduction, this operation was included in the additional sheet of the purchase book, the receipt itself in the purchase book is not in the adjustment report. the amount of tax subject to deduction is reduced by double the reversal amount and, accordingly, the amount of tax payable increases by double the reversal amount. I just can’t understand why, please help!

Good afternoon

Try removing the document “Reflection of VAT for deduction”. Quote 0 #36 Ekaterina0208 03/02/2017 15:12 Quote Olga Shulova:

I quote Marina: Hello Olga! It’s impossible to reverse the receipts in the previous period. It turns out that the invoice was mistakenly accepted for accounting on August 28. It turned out that it was October 30. What documents should I use to reflect this in 1C: accounting of the enterprise? I made Operations vv. manually - reverse the document - selected the receipt document. What next? How can I make sure that it is reflected in the additional list of the book of purchases? and on what date should I perform the operation. manually?

Hello!

You also need to make a VAT restoration, indicate that the restoration should be reflected in the purchase book and add an additional flag in the table. leaf. The reversal is that you did the right thing. We set the date for the current period. Good afternoon, Olga! Help me to understand. in 4Q16 the goods were returned from the buyer. Now we have found out that the buyer did not carry out a return, but a sale. I made a reversal for the return, the amounts were all correct in the movement of the document. Now we need to restore VAT, did I understand correctly? how to do it? Quote 0 #35 Elena! 02/03/2017 14:54 Hello! in 1C 8.3 I reversed the receipt and reflected VAT for deduction, this operation was included in the additional sheet of the purchase book, the receipt itself in the purchase book is not in the adjustment report. the amount of tax subject to deduction is reduced by double the reversal amount and, accordingly, the amount of tax payable increases by double the reversal amount. I just can’t understand why, please help!

Quote

+1 #34 Natalya Latysheva 04/28/2016 13:11 Hello! After carrying out reversing transactions in 1C, you need to submit a corrective return for the 1st quarter of 2016 to the tax authority. If this is the only correction, then the tax return will be reduced.

Quote

0 #33 Pavel1212 04/28/2016 12:09 I understood how to do it in 1C, but now I need to submit documents to the tax office. Sales of goods and services were reversed for the first quarter of 2016; in the second quarter, VAT was already paid. What are the actions after merging in 1c?

Quote

0 #32 Elenka 02/17/2016 12:46 Hello! Please tell me how to do it in 1s 8.2. The deduction for the invoice for the 2nd quarter was transferred to the 3rd quarter, and now to the 1st quarter. 16, it is necessary to return the deduction for the account from 3Q to 2Q... and the deduction from 4Q to 3Q (there was also a transfer of the deduction to 4Q)

Quote

0 #31 Elena11 12/28/2015 11:28 Hello! Tell me how to do it correctly, in the last period I entered the same invoice for receipt twice, how can I balance it now?

Quote

+1 #30 Olga Shulova 11/17/2015 1:24 pm I quote Marina:

Hello Olga! It’s impossible to reverse the receipts in the previous period. It turns out that the invoice was mistakenly accepted for accounting on August 28. It turned out that it was October 30. What documents should be used to reflect this in the 1C: accounting of the enterprise? I made Operations centuries. manually - reverse the document - selected the receipt document. What next? How can I make sure that it is reflected in the additional list of the book of purchases? and on what date should I perform the operation. manually?

Hello!

You also need to make a VAT restoration, indicate that the restoration should be reflected in the purchase book and add an additional flag in the table. leaf. The reversal is that you did the right thing. We set the date of the current period Quote 0 #29 Marina 11/12/2015 10:49 pm Hello Olga! There’s no way to reverse the receipt in the previous period. It turns out that the invoice was incorrectly accepted for accounting on 08/28. It turned out to be October 30. What documents should I use to show this in 1C: accounting of the enterprise? I made Operations centuries. manually - reversing the document - selecting the document receipt. What next? How can I make sure that it is reflected in the additional list of the book of purchases? and on what date should I perform the operation. manually?

Quote

0 #28 Olga Shulova 11/10/2015 21:10 I quote karma:

complex 8.2, OSN, sale with VAT

The situation here is not entirely typical, because...

it's about implementation. In fact, you need to cancel this document, reflecting it with minuses in the addendum. sales book sheet. An important question: did the buyer not present this document for deduction? In general, it is worth using the document “Reflection of VAT accrual”, checking in it the necessary checkboxes about additional information. sheet Quote 0 #27 karma 11/06/2015 10:59 complex 8.2, OSN, sale with VAT

Quote

0 #26 Olga Shulova 11/06/2015 08:05 I quote karma:

Good afternoon It is necessary to reverse the sale of the 2nd quarter, I have corrected the registers, but what document should I use next? Help please.

Good afternoon

What program are you working in? On the general taxation system? Was the sale inclusive of VAT? Quote 0 #25 karma 11/05/2015 17:50 Good afternoon! It is necessary to reverse the sale of the 2nd quarter, I have corrected the registers, but what document should I use next? Help please.

Quote

0 #24 karma 05.11.2015 17:32 How to reverse the sale of 2 sq. I made a crust. And then what document?

Quote

0 #23 Olga Shulova 11/04/2015 21:12 I quote Anna:

Hello Olga! Please write an algorithm for making changes in past periods, I am a novice accountant, and the specifics of my organization are such that changes are constantly being made and, as a result, constant clarifications are made. Let's say, as described above, I have a receipt reflected twice in the 2nd quarter, I discovered an error in the 3rd quarter and am reversing the current period? and then I make an update for the 2nd quarter? Before that, I re-create the purchase book entry? And which tabs in this document do I refill? Thanks in advance. I'm trying to understand these moments.

Hello Anna!

Write what program you are working in, this greatly affects the algorithm. In the previous question, if you are talking about it, we were talking about the 1C: Integrated Automation 8 program, accounting there is organized somewhat differently than, for example, in 1C: Enterprise Accounting 8. Quote 0 #22 Anna 11/04/2015 18:09 Hello, Olga ! Please write an algorithm for making changes in past periods, I am a novice accountant, and the specifics of my organization are such that changes are constantly being made and, as a result, constant clarifications are made. Let's say, as described above, I have a receipt reflected twice in the 2nd quarter, I discovered an error in the 3rd quarter and am reversing the current period? and then I make an update for the 2nd quarter? Before that, I re-create the purchase book entry? And which tabs in this document do I refill? Thanks in advance. I'm trying to understand these moments.

Quote

+1 #21 Larisa23 10.30.2015 21:04 Thank you, everything seems to have worked out. I thought that the document must first be included in the formation of records; without this, it will not end up in the sales book. It seems like this happened before, I haven’t worked in 1C for a long time, there was a long break. In VAT Recovery, I manually changed the loan account. But it seems to me that wiring D90.03K68.02 is more suitable. March 19 does not appear anywhere in these operations. But in any case, it goes into the additional sheets in the sales book and is uploaded to the declaration, and this is the main thing for now.

Quote

0 #20 Olga Shulova 10.29.2015 21:26 I quote Larisa23:

Yes, posting in VAT Recovery is meaningless. But only after this document has been processed, the Return automatically goes into the Formation of the Purchase Ledger, but just like a regular return and does not reverse anything there. But it doesn’t get into the sales book, and when installed, reflect the restoration in the sales book.

Now I tried to reproduce the situation at my base.

June 2015 - a return from the buyer with a return invoice was introduced, VAT was accepted for deduction. In September 2015, the return was reversed using the document Adjustment of register entries. Then the document “VAT Restoration”. Reflect the VAT recovery in the sales ledger. The invoice must be the invoice for the reversed return. Check the box that the entry is additional. sheet and indicate the period. The document generates transactions Dt 19.03 Kt 68.02. It goes into the sales book. Not in the document “Creating sales book entries”, but directly in the report and declaration, bypassing this document. What are you doing wrong as described? Quote 0 #19 Larisa23 10.27.2015 16:10 We will provide clarification. And how can I upload all this to additional sheets now?

Quote

0 #18 Larisa23 10.27.2015 16:00 Yes, posting in VAT Recovery is meaningless. But only after this document has been processed, the Return automatically goes into the Formation of the Purchase Ledger, but just like a regular return and does not reverse anything there. But it doesn’t get into the sales book, and when installed, reflect the restoration in the sales book.

Quote

0 #17 Olga Shulova 10.26.2015 21:02 I quote Larisa23:

In the return, in the VAT tab, the return goes into the purchase book. He passed in the 2nd quarter. Then it turned out that it shouldn’t exist. In the return, reversing entries with negative amounts. In Adjusting register entries, the same transactions with positive amounts are made. The refund turns out to be reversed in the program and this can be seen from the invoice analysis. Now how should these corrections get into the purchase book for additional items? I don’t understand the sheets. After performing the VAT Restoration operation, the Formation of purchase ledger entries (additional sheets) enters as a regular return, but in theory it should have negative values. Maybe you don’t need to do Restoration, but enter everything manually in the Formation of records (for additional sheets)?

I believe that this amount should generally be a plus in the sales book.

The tax office is not particularly happy with cons in purchase books these days. And just VAT Restoration should be suitable, but I still can’t understand why you have generated postings D68.02 K68.02., which are completely meaningless. Are you submitting a clarification? Quote 0 #16 Larisa23 10/22/2015 5:04 pm In the return, in the VAT tab, the return goes into the purchase book. He passed in the 2nd quarter. Then it turned out that it shouldn’t exist. In the return, reversing entries with negative amounts. In Adjusting register entries, the same transactions with positive amounts are made. The refund turns out to be reversed in the program and this can be seen from the invoice analysis. Now how should these corrections get into the purchase book for additional items? I don’t understand the sheets. After performing the VAT Restoration operation, the Formation of purchase ledger entries (additional sheets) enters as a regular return, but in theory it should have negative values. Maybe you don’t need to do Restoration, but enter everything manually in the Formation of records (for additional sheets)?

Quote

0 #15 Olga Shulova 10.21.2015 22:27 I quote Larisa23:

Reversal postings D90.02.1K43, D62.01K90.01.1, D90.03K68.02. Restoration of VAT D68.02K68.02.

I don't like these wiring.

Let's sort it out in order. In the return itself, how is the VAT tab filled out? Was it in the purchase book? Look here: the implementation makes postings in plus, then the return reverses these postings. What you wrote is precisely a reversal of the sales transactions. But the reversal of the return should return them to positive territory again. Quote 0 #14 Larisa23 10.21.2015 13:00 Quote Author:

I quote Larisa23: Hello! In the program 1C Enterprise 8.3, Integrated Automation ed. 1.1 reversed in the 3rd quarter Return of goods from the buyer of the 2nd quarter using Adjustment of register entries. Next I did the VAT Restoration. Now this return ends up in the Q3 purchase book as a regular return from a buyer, and even with code 16. What did I do wrong?

Hello!

Has the VAT Restoration document been filled in automatically? Can you write the entries that are formed by both documents (reversal and restoration)? Yes, the VAT Restoration was filled out automatically, but the counterparty and s/f agreement was entered manually. Reversal postings D90.02.1K43, D62.01K90.01.1, D90.03K68.02. Restoration of VAT D68.02K68.02. Quote +1 #13 Olga Shulova 10/21/2015 11:21 I quote Larisa23:

Hello! In the program 1C Enterprise 8.3, Integrated Automation ed. 1.1 reversed in the 3rd quarter Return of goods from the buyer of the 2nd quarter using Adjustment of register entries. Next I did the VAT Restoration. Now this return ends up in the Q3 purchase book as a regular return from a buyer, and even with code 16. What did I do wrong?

Hello!

Has the VAT Restoration document been filled in automatically? Can you write the entries that are generated by both documents (reversal and restoration)? Quote 0 #12 Larisa23 10.20.2015 21:05 Hello! In the program 1C Enterprise 8.3, Integrated Automation ed. 1.1 reversed in the 3rd quarter Return of goods from the buyer of the 2nd quarter using Adjustment of register entries. Next I did the VAT Restoration. Now this return ends up in the Q3 purchase book as a regular return from a buyer, and even with code 16. What did I do wrong?

Quote

0 #11 Olga Shulova 07/21/2015 21:58 Quoting Maria13:

Good afternoon) in the turnover according to 10.1 it shows 1 ruble in red. When writing off materials, the amount was written off correctly, but the amount was written off 1 ruble more... what is the correct manual entry to correct this 1 ruble? Thank you

Hello!

Please specify which 1C program you are using? The name is displayed upon startup or can be viewed in the help (for example, Enterprise Accounting, Complex Automation, etc.). And one more thing: have you already closed this month? Quote -1 #10 Maria13 07/21/2015 11:27 Good afternoon) in the turnover for 10.1, 1 ruble is shown in red. When writing off materials, the amount was written off correctly, but the amount was written off 1 ruble more... what is the correct manual entry to correct this 1 ruble? Thank you

Quote

0 Tatyana Aleksandrovna 07/10/2015 12:20 Thank you very much! Everything worked out!

Quote

0 Olga Shulova 07/10/2015 11:30 I quote Tatyana Aleksandrovna:

Good afternoon There is no “Adjustment of register entries” in the program! There is an “Adjustment of receipts”, but I carried out the reversal through “Operations entered manually.” Did I do it right? But in the “Purchase Book” this receipt appears in red and does not form an additional one. sheet!

The first part of the article describes the document “Operations entered manually”.

Correcting register entries is already for the Integrated Automation program. So everything is correct. Has the “VAT Restoration” document been completed? Quote +1 Tatyana Aleksandrovna 07/10/2015 10:24 Good afternoon! There is no “Adjustment of register entries” in the program! There is an “Adjustment of receipts”, but I carried out the reversal through “Operations entered manually.” Did I do it right? But in the “Purchase Book” this receipt appears in red and does not form an additional one. sheet!

Quote

0 Olga Shulova 07/09/2015 22:34 I quote Tatyana Aleksandrovna:

Good afternoon In the 1st quarter of 2015, services were received twice by mistake, please tell me how to correctly make a reversal in 1C 8.2? It turns out in 2Q. Do you need to submit a VAT update in 2015?

Hello!

You need to follow the method described in the article. And also make a document “VAT Restoration”, it should be filled out automatically. If we are guided by the legislation, then yes, clarification. Quote 0 Tatyana Aleksandrovna 07/09/2015 10:28 Good afternoon! In the 1st quarter of 2015, services were received twice by mistake, please tell me how to correctly make a reversal in 1C 8.2? It turns out in 2Q. Do you need to submit a VAT update in 2015?

Quote

-1 Olga Shulova 06/17/2015 10:58 I quote Elena Nikolaevna:

Hello! Please tell me, from January 2015 there are new rules for submitting VAT, will this somehow affect if documents are removed or everything is in the usual order? Thank you!

Hello!

The article provides a very general algorithm, but with VAT we now have many nuances. Can you give a specific example of what needs to be reversed with transaction dates? Quote 0 Elena Nikolaevna 06/16/2015 17:06 Hello! Please tell me, from January 2015 there are new rules for submitting VAT, will this somehow affect if documents are removed or everything is in the usual order? Thank you!

Quote

0 Olga Shulova 04/28/2015 14:04 I quote Nadya:

Good afternoon. Please tell me what kind of transactions to reflect the reversal in the closed period of foreign exchange receipts (advance payment), so that the turnover on the account. 52 came with a bank statement. A larger amount was posted in the receipt than in the bank statement. We work in 1s 8.3

Hello!

What about the method described in the article? Didn't fit for some reason? The postings should be the same as in the document itself, but with minuses. The operation is automatically filled in according to the document data. Will only account 52 be affected there? 51 no? You just need to think about what to do with exchange rate differences if the currency was sold/has fallen. Quote -1 Nadya 04/24/2015 21:32 Good afternoon. Please tell me what kind of transactions to reflect the reversal in the closed period of foreign exchange receipts (advance payment), so that the turnover on the account. 52 came with a bank statement. A larger amount was posted in the receipt than in the bank statement. We work in 1s 8.3

Quote

Update list of comments

JComments