About legal entities

Who has the right to a property deduction A Russian citizen who pays

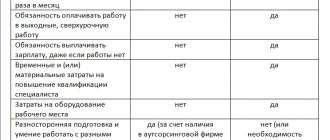

What is outsourcing? Outsourcing appeared several years ago and is now gaining more and more

Report form 6-NDFL By Order of the Federal Tax Service of Russia dated September 28, 2021 No. ED-7-11/ [email protected] changes were made to the existing

Where to find revenue on the balance sheet When a company has been operating for a year, everyone is interested in knowing what its revenue is

In accordance with Part 3 of Art. 72.2 of the Labor Code of the Russian Federation, downtime means a temporary suspension

Article 286 of the Tax Code of the Russian Federation. Procedure for calculating tax and advance payments (current version) 1. Tax

Objects of taxation on the simplified tax system and tax rates According to Art. 346.14 Tax Code of the Russian Federation, entrepreneurs and

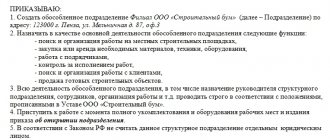

What is a separate division? Separate divisions include any departments of the company, including

When an entrepreneur registers as an individual entrepreneur, he has a month to choose a tax regime. Otherwise

Understanding the Form, Who Files Form 12-F is a document that every organization must file.