Objects of taxation on the simplified tax system and tax rates

According to Art. 346.14 of the Tax Code of the Russian Federation, entrepreneurs and organizations using the simplified tax system can choose the object of taxation: income or income reduced by the amount of expenses. The object of taxation can then be changed, but this cannot be done in the middle of the year. If a simplifier plans to change the object of taxation from “income” to “income minus expenses” or vice versa, he will only be able to do this starting next year. In addition, he must notify the Federal Tax Service about this in writing before December 31 of the current year.

Not all income is taken into account on the simplified tax system. For example, receiving a loan or income from a business on another tax system does not need to be taken into account when calculating the simplified tax system.

The rules for calculating the amount of tax are established in Art. 346.21 Tax Code of the Russian Federation. The tax is calculated using the formula

Where:

NB

- the tax base;

StN

— tax rate.

The size of the tax rate depends primarily on what object of taxation has been chosen. For the simplified tax system “income” the rate is 6%, and for the simplified tax system “income minus expenses” - 15%. In this case, the rate can be reduced by regional legislation to 1% (for the simplified tax system “income”) and 5% (for the simplified tax system “income minus expenses”). A reduced rate can be established both for all taxpayers and for their specific categories.

If an entrepreneur has chosen a simplified tax system of 15%, the minimum tax rule will apply to him: if at the end of the year the amount of calculated tax is less than 1% of the income received for the year, a minimum tax of 1% of the income received is paid.

Special cases

If a loss is received

When filling out a declaration under the simplified tax system with the taxable object “income minus expenses” with losses, there are some peculiarities.

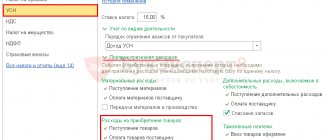

To reflect the loss, section 2.2 of the declaration provides a block of lines 250-253 . Here you need to indicate the negative difference between income and expenses for a certain period - quarter, half year, 9 months and year. The following image shows an example of reflecting a loss in section 2.2:

Section 2.2 (Loss)

Please note that even despite receiving a loss at the end of the year, the minimum tax must be paid .

If advance payments paid within the year exceeded the amount of the minimum tax, then this difference should be reflected in section 1.2 on line 110 . This will mean that at the end of the year the tax amount will be reduced.

If there is no activity

Lack of activity does not relieve an organization or individual entrepreneur of the obligation to file a declaration. It is submitted according to the general rules with only one difference - dashes .

Conditions for applying the simplified tax system

Simplified language is used by organizations and individual entrepreneurs, subject to two limits:

- annual income does not exceed 150 million rubles;

- the average number of employees per year is less than 100 people.

Previously, if the limits were exceeded, an entrepreneur or organization using a simplified system was automatically transferred to OSNO. From January 1, 2022, other rules came into force. The limits were increased to 200 million rubles and 130 people on staff, however, with an annual income of 150 to 200 million rubles or a staff of 101 to 130 people, the rate for the simplified tax system “income” is increased to 8%, and for the simplified tax system “income minus expenses” - up to 20%.

Accounting simplified tax system reporting

The obligation of simplifiers to submit financial statements to the Federal Tax Service was introduced on January 1, 2013, although previously this did not apply to them.

The requirement to submit accounting reports was introduced in Part 1 of Art. 6, part 2 art. 13 of the Law on Accounting dated December 6, 2011 No. 402-FZ. The law identifies economic entities to which this obligation does not apply, but there are no simplified organizations among them. Firms using the simplified tax system, as a rule, belong to small businesses, whose representatives can submit a “stripped-down” set of reports: only a balance sheet and a report on financial results, the forms of which are approved by Appendix No. 5 to Order No. 66n of the Ministry of Finance of the Russian Federation dated July 2, 2010. Read more about simplified accounting and reporting in the following materials:

- “Simplified reporting for small businesses”;

- “How to fill out a balance sheet using the simplified tax system?”;

- “Accounting for an LLC using the simplified tax system: submitting reports”;

Who will be able to apply the simplified tax regime from 2022

In 2022, the simplified system will become available to a larger number of organizations and individual entrepreneurs, since a deflator coefficient will be applied to the income limit. The value of the deflator coefficient for the simplified tax system for 2022 is 1.096 (Order of the Ministry of Economic Development of Russia dated October 28, 2022 No. 654).

Thus, taking into account the deflator coefficient, the income limit will be:

- 164.4 million rubles (regular limit);

- 219.2 million rubles (increased limit).

To switch to a simplified system from 2022, it is necessary that the organization’s income for 9 months does not exceed the limit established in paragraph 2 of Art. 346.12 Tax Code of the Russian Federation. Taking into account the deflator coefficient, the size of this limit is 123.3 million rubles.

Deadlines for filing a declaration and paying tax according to the simplified tax system for 2021

Based on the above rules, the specific deadlines for submitting the report and paying the simplified tax system in 2022 are determined as follows.

For advance payments that do not depend on who pays them, the deadlines for paying the simplified tax system 2022 will be the same for legal entities and individual entrepreneurs:

- 04/25/2022 - due date for payment of the simplified tax system for the 1st quarter of 2022;

- 07/25/2022 - due date for payment of the simplified tax system for the first half of 2022;

- 10/25/2022 is the deadline for paying the simplified tax system for 9 months of 2022.

But the deadlines for paying the final simplified tax system for 2022, tied to the deadline for filing the declaration, will be different for legal entities and individual entrepreneurs:

- 03/31/2022 is the deadline for submitting the declaration and paying the simplified tax for 2022 for legal entities;

- 05/04/2022 is the last day of the deadline for submitting the report and paying the simplified tax system 2022 for individual entrepreneurs (taking into account the postponement of the deadline from Saturday 04/30/2022).

Thus, you will need to submit reports and pay taxes on time.

For information on how to fill out a declaration under the simplified tax system for 2022 and where, read the articles:

- “Declaration form for the simplified tax system for 2022 - 2022”;

- “How to fill out a declaration using the simplified tax system.”

Who does not have the right to use simplification

In addition to limits on annual income and the average number of employees in the state, the legislation provides for restrictions on the application of the simplified tax system by the scope of the enterprise’s activities. Organizations that are not entitled to apply the simplified tax regime include:

- enterprises that have branches or representative offices (with the exception of companies with separate divisions that are not registered in the constituent documents as branches or representative offices);

- non-state pension funds;

- investment funds;

- professional participants in the securities market;

- banks;

- insurers, etc.

A complete list of persons who cannot apply the simplified tax system is given in paragraph 3 of Art. 346.12 Tax Code of the Russian Federation.

What basic reporting do organizations submit to the simplified tax system?

Tax reporting under a simplified taxation system is the most important. The tax under the simplified tax system replaces three taxes at once: VAT, income tax, and property tax on objects without cadastral value. Therefore, tax reporting on the simplified tax system includes only one tax return, which the taxpayer submits once a year.

If an organization has suspended its activities and does not receive any income, a zero return is submitted to the tax office.

According to paragraph 1 of Art. 346.23 of the Tax Code, a tax report according to the simplified tax system must be submitted no later than March 31 of the year following the reporting year. If that day falls on a weekend or non-working day, the deadline is moved to the next working day. This is stated in paragraph 7 of Art. 6.1 NK.

In addition to tax reporting, the organization must submit other reporting documents to the simplified tax system:

- Financial statements

- Personal income tax report

Maintaining accounting records is the responsibility of any organization. The law also obliges companies to submit accounting reports, regardless of the chosen taxation system. Organizations using the simplified tax system must submit to the State Information Resource of Accounting Reports (GIRBO) a balance sheet, a report on financial results, as well as attachments to these documents. Deadline: no later than three months after the end of the reporting year.

Any organization with employees, regardless of the special regime, plays the role of a tax agent, therefore it is required to report quarterly to the tax office in Form 6-NDFL. Dates:

- reporting for the first quarter, half a year and nine months must be submitted no later than the last day of the month following the reporting quarter;

- The annual report must be submitted no later than March 1 of the year following the reporting year.

- Reporting on insurance premiums

Since the payment of insurance contributions from payments to employees is the responsibility of employers, organizations must submit quarterly calculations of contributions to the tax office and a report in Form 4-FSS to the Social Insurance Fund. Payments must be submitted by the 30th day of the month following the reporting period.

The deadlines for submitting 4-FSS reports differ depending on the format in which the report is submitted. If the form is submitted in paper form, the deadline is the 20th day of the month following the reporting period. If the report is submitted electronically, it must be submitted no later than the 25th.

When to submit a tax return under the simplified tax system “Income minus expenses”

The deadline for submitting the declaration for the past year for organizations is March 31, for individual entrepreneurs - April 30.

Always submit your declaration. Even if no activity was carried out, send a zero report. You also need to report when you spent money but didn’t earn anything.

Sometimes you have to submit updated declarations for previous periods. For example, an entrepreneur discovered an error that led to an understatement of tax - and is afraid to hide it from the tax office. Then he can send a declaration with the correct data himself and avoid fines.

The opposite situation looks suspicious for the tax authorities. If an entrepreneur submits an amended return, according to which the amount of expenses will be greater and the tax will be less, the tax office will suspect that the expenses are not real. Such an updated declaration may lead to an audit.

Basic reporting of individual entrepreneurs on the simplified tax system

A simplified individual entrepreneur submits tax reporting once at the end of the year. On the simplified tax system, the deadlines for submitting reports on the main tax for individual entrepreneurs are later than for organizations. Individual entrepreneurs are required to submit a tax return under the simplified tax system by April 30 of the year following the reporting year.

Individual entrepreneurs with hired employees submit the following documents to the tax authority:

The report in form 6-NDFL is submitted quarterly - no later than the end of the next month for the reporting quarter, and for 2022 you must report no later than March 1, 2022.

The 2-NDFL certificate is submitted annually as part of the 6-NDFL report no later than March 1 of the year following the reporting year.

In addition to reporting to the Federal Tax Service, individual entrepreneurs using the simplified tax system and their employees submit reporting documents to the Pension Fund and the Social Insurance Fund:

- report on form 4-FSS - quarterly to the FSS, the deadlines are the same as for organizations;

- report in form SZV-M - monthly to the Pension Fund of Russia, no later than the 15th day of the month following the reporting month;

- personalized accounting information - annually to the Pension Fund of Russia, no later than March 1 of the year following the reporting year.

- a report in the SZV-TD form - to the Pension Fund of the Russian Federation, each time after hiring, transfer or dismissal, or no later than the 15th day of the month following the reporting month, if other personnel events took place.

Individual entrepreneurs using the simplified tax system without employees submit only a tax return. Since they do not have staff, they are exempt from submitting 2-NDFL and 6-NDFL reports, as well as from submitting RSV, SZV-M and 4-FSS reports.

Advance payments and totals

We must remember the discrepancy that arises between the preparation of the declaration at the end of the year and the actual transfer of tax amounts. The reporting periods for the simplified tax system are the first quarter, six months and 9 months, therefore the calculation and payment of the simplified tax are made based on the results of each quarter. According to Art. 346.21 of the Tax Code of the Russian Federation, tax payments must be made no later than the 25th day of the month following the reporting period.

In 2022, the deadlines for tax payment will be:

- for the first quarter - April 27;

- for the half year - July 27;

- for 9 months - October 26.

Quarterly tax payments are essentially advance payments, the amount of which the business determines based on its own calculations. The Federal Tax Service considers such payments to be overpayments of tax. The businessman and the tax office check whether they were correct based on the annual return. We remind you that the amount for the year must be transferred no later than the reporting deadline.

Taking into account weekends and holidays in 2022, payments must go through:

| Organizations | IP | |

| For 2022 | Until March 31, 2022 | Until April 30, 2022 |

Changes in the reporting form of the simplified tax system

Due to the fact that since 2022, the procedure for applying the simplified tax system has undergone changes and increased rates have appeared, the tax return form for the simplified tax system has been updated. The new form was approved by order of the Federal Tax Service dated December 25, 2022 No. ED-7-3 / [email protected] The updated form is used from March 20, 2022. From 2022, tax reporting under the simplified tax system will be accepted only using the new form.

In order not to violate the order of filling out the reporting document and submit the reports on time, connect Astral Report 5.0. The service allows you to manage several companies at once, and the update system allows you to gain timely access to current reporting forms.