Report form 6-NDFL

Order of the Federal Tax Service of Russia dated September 28, 2021 No. ED-7-11/ [email protected] amended the previously existing form and procedure for filling out 6-NDFL in 2022 for tax agents, approved by Order of the Federal Tax Service No. ED-7-11/ [email protected] ] dated 10/15/2020.

IMPORTANT!

Starting from 2022, the calculation includes a certificate of income and calculation of the amounts of personal income tax calculated and withheld by the tax agent for form 6-NDFL (former form 2-NDFL), but this section should be submitted only at the end of the year.

The report, which shows the calculation of personal income tax amounts, is submitted quarterly. In what format and how to fill out the new form 6-NDFL in 2022 depends on the number of employees:

- in electronic format, if during the reporting quarter the organization made payments in favor of 10 people or more;

- if the organization reports for less than 10 people, then the form will be allowed to be submitted on paper.

The tax amount is indicated in rubles, and the income amount is indicated in rubles and kopecks.

IMPORTANT!

The 6-NDFL calculation has been updated once again. This is necessary in connection with amendments made to the Tax Code of the Russian Federation. Changed:

- reporting period codes;

- section 2;

- certificate of income and tax amounts of an individual (reporting form).

Read more: the 6-NDFL calculation form will be changed again

Calculation form 6-NDFL

For 2022 you need to report on the same form. It was approved by Order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected]

6-NDFL consists of the following sections:

- Title page.

Includes basic information about the employer, the period for which the calculation is submitted and the Federal Tax Service to which it is sent.

- Section 1.

Filled out with a cumulative total from the beginning of the year, includes information about all employee income for the reporting (tax) period.

- Section 2.

Includes information on payments for the last 3 months of the reporting period.

Form 6-NDFL for 2022

Report submission deadlines

Form 6-NDFL is sent to the tax office no later than the last day of the month following the reporting quarter. For annual calculations, an extended period applies - no later than March 1 of the following year.

IMPORTANT!

For the 3rd quarter of 2022, report no later than 11/01/2021, since 10/31 is Sunday.

We have collected relevant information in the table of deadlines for submitting 6-NDFL in 2022:

| Billing period | Deadline for submission |

| For the 1st quarter of 2022 | Until April 30 |

| For the 2nd quarter of 2022 (calculation on an accrual basis for six months in section 1) | Until August 2 (31.07 - Saturday) |

| For the 3rd quarter of 2022 (calculation on an accrual basis for 9 months in section 1) | Until November 1 (31.10 - Sunday) |

| For 2022 (calculation on an accrual basis for the year in section 1) | Until 03/01/2022 |

Who should take it?

Individual entrepreneurs and organizations that are tax agents, that is, those who pay income to employees and other individuals. To put it simply, form 6-NDFL is submitted by those who also fill out and submit 2-NDFL.

The difference between these two forms is that 2-NDFL is drawn up for each employee, and 6-NDFL is drawn up for all employees once a quarter.

How to reflect in 6-NDFL (click on the links) :

- 3rd quarter, vacation pay, sick leave, civil contract, dismissal;

- Rent, financial assistance, zero reporting, dividends, other nuances.

Fines for reporting

There is a fine for failure to comply with the deadlines for submitting the report. Each month of delay will cost 1000 rubles according to the norms of clause 1.2 of Article 126 of the Tax Code of the Russian Federation. The official responsible for failure to submit personal income tax reports on time will be fined in the amount of 300 to 500 rubles (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

According to Article 76 of the Tax Code of the Russian Federation, the tax service has the right to block the bank accounts of a tax agent who has not submitted a report.

IMPORTANT!

As of July 1, 2021, the blocking rules have changed. Now the Federal Tax Service must notify about this measure 14 days in advance, and an account can be blocked if the report is not submitted 20 working days after the deadline, and not after 10, as was the case until now.

If the information in the calculation is found to be unreliable, the organization will be fined 500 rubles (Clause 1 of Article 126.1 of the Tax Code of the Russian Federation). Therefore, the chief accountant of each organization needs to take care not only of how to fill out 6-NDFL without errors, but also how to submit the report without missing deadlines.

Unlawful submission of the 6-NDFL report on paper carries a fine of 200 rubles (Article 119.1 of the Tax Code of the Russian Federation).

In ConsultantPlus you will find not only the procedure for filling out 6-NDFL with a form and samples, but also a video seminar that will answer any questions. Get free access using the link below.

Fines for 6-NDFL

For violations committed during the registration and submission of 6-NDFL, fines may follow:

- For late submission of the calculation.

The fine will be 1,000 rubles. for each full or partial month from the day established for the submission of the calculation to the day on which it was submitted (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). The employee responsible for submitting 6-NDFL may be fined from 300 to 500 rubles. (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

For late reporting, tax authorities have the right to block the company’s accounts if the payment is not received by the inspectorate within 10 working days after the end of the legally established deadline for submission (clause 6 of article 6.1, clause 3.2 of article 76 of the Tax Code of the Russian Federation).

- For inaccurate information and mistakes made.

The fine for such a violation is 500 rubles. (clause 1 of article 126.1 of the Tax Code of the Russian Federation). You can be fined for errors in the taxpayer’s personal data or total indicators (clause 3 of the Federal Tax Service Letter No. GD-4-11/14515 dated 08/09/2016).

If errors or inaccuracies do not lead to a reduction in personal income tax subject to transfer to the budget, or a violation of the rights of citizens, tax authorities can reduce the amount of the fine (clause 1, clause 1, clause 4, article 112 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated 08/09/2016 No. GD -4-11/14515).

- For submitting a paper 6-NDFL instead of an electronic one.

If your company is required to submit a calculation in electronic form, but you submitted it to the tax office on paper, the fine will be 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation).

Useful information from ConsultantPlus

See a ready-made solution on how to fill out form 6-NDFL (it's free).

Changes in 6-NDFL that must be taken into account in 2022

For legal successors of reorganized companies, there is an obligation to submit Form 6-NDFL, if the company itself has not done so before the end of the reorganization. This procedure for filling out 6-NDFL should be followed by the successor organization:

- indicate the INN and KPP of the tax agent at the top of the title page;

- use code 215 in the details “At location (accounting) (code)”;

- in the “Tax Agent” detail, indicate the name of the reorganized entity or its separate division;

- in the new detail “Form of reorganization (liquidation) (code)” indicate one of the values: 1 - transformation, 2 - merger, 3 - division, 5 - accession, 6 - division with simultaneous accession, 0 - liquidation;

- indicate “TIN/KPP of the reorganized company.”

In addition, there have been other changes in the filling out rules, depending on who submits the 6-NDFL:

- the largest taxpayers provide the checkpoint according to the certificate of registration with the tax office at the location of the legal entity, and not at the place of registration as the largest taxpayer;

- tax agent organizations that are not major taxpayers must indicate the value 214 in the attribute “At location (accounting) (code)”.

On the title page of form 6-NDFL the full details of the document confirming the authority of the representative are indicated. Form 6-NDFL, combined with certificate 2-NDFL, is valid from the 1st quarter of 2021.

IMPORTANT!

In 2022, companies with separate divisions have the right to choose a tax office to submit reports if the parent organization and separate divisions are located in different municipalities. They need to notify all the Federal Tax Service with which they are registered about their choice by sending a notification no later than the 1st day of the tax period in the form approved by Federal Tax Service Order No. ММВ-7-11/ [ email protected] dated 12/06/2019.

Is it necessary to provide a zero calculation?

No, don't. This basis is provided by Letter of the Federal Tax Service of the Russian Federation dated March 23, 2016 N BS-4-11/4958. Individual entrepreneurs and organizations are required to submit 6-NDFL only if they are recognized as tax agents. And they are recognized as such if they paid income to employees (in accordance with Article 226 of the Tax Code of the Russian Federation). That is, there may be 3 situations when the zero calculation does not need to be submitted:

1) There are no workers on staff at all;

2) The employees are on the payroll, but no payments were made to them during the reporting period.

3) No activity.

This position is confirmed by the words of a tax official who was asked a similar question on the forum (click to enlarge the picture):

Is it necessary to submit an explanatory note to the Federal Tax Service () - why is 6-NDFL not submitted? NO, not necessary. But to be on the safe side, no one forbids you to do this (in any form), for example like this:

Step-by-step instructions on how to correctly fill out 6-NDFL for the 4th quarter of 2022

Although the report has been in effect for several years, the preparation of 6-NDFL still raises questions among employers and accountants. In addition, a number of changes have been made to it that must be taken into account when filling out. Young accountants are entering the profession and need clarification. Especially for them, we will analyze the actions step by step.

The document consists of the following sections:

- Title page.

- Section 1 (information is reflected only for the specified quarter, without taking into account previous periods).

- Section 2 (information is formed on an accrual basis).

- Appendix 1 (to be completed only in the report for the 4th quarter and contains information about the income of each employee, similar to what was previously reflected in the 2-NDFL certificates)

Let's look at the instructions for filling out 6-NDFL in 2022 with examples.

Title page

We write the full name of the tax agent. The TIN and KPP of the organization submitting the report are indicated in the appropriate fields. If the report is submitted by a branch, then the branch checkpoint is indicated. Indicate the correction number. If form 6-NDFL is submitted for the first time during the reporting period, then zeros are reflected in the “Adjustment number” field.

An adjustment implies a change in the information submitted to the Federal Tax Service. Clarification of the calculation for the corresponding reporting period is indicated by the adjustment number: -1, -2. -3 and so on.

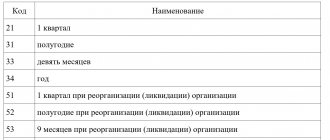

The period for providing 6-NDFL is the quarter for which the employer reports:

- 1st quarter - code 21;

- half-year - code 31;

- 9 months - code 33;

- year - code 34.

Codes for organizations transferring information at the stage of reorganization (liquidation) are indicated in Appendix 1 of the order.

The tax period is the calendar year for which the information is provided. The corresponding 4 digits are entered in the field. Then the line indicates the code of the tax office to which the reports are submitted. This is a four-digit code in which:

- the first two digits are the region number;

- the second two digits are the inspection code.

IMPORTANT!

Reporting is sent to the inspectorate at the location of the organization or its separate division. Individual entrepreneurs submit the 6-NDFL report to the tax office at the place of residence or activity.

The code “By location (accounting)” helps determine which organization submits reports. The full list of codes is contained in Appendix 2 to the order.

The most common for organizations:

- by place of registration - 214;

- at the place of registration of a separate division - 220.

Individual entrepreneurs also indicate special codes:

- at place of residence - 120;

- by place of activity - 320.

We indicate the OKTMO code (municipal entity) and the taxpayer’s telephone number. As required by the order of the Federal Tax Service for filling out the 6-NDFL report, indicate the code of the municipality in whose territory the organization or branch is located and registered. Sometimes citizens are paid money (salaries and bonuses) by both the parent organization and its division. In this case, two forms with different OKTMO codes are filled out and submitted at once.

Section 1

The current procedure for filling out 6-NDFL for the 4th quarter requires that in section 1 the amounts of tax withheld or returned to employees in the 4th quarter of 2022 be indicated. Previously, such information was not reflected in the forms. The rules for filling out the report explain what amounts need to be reflected in line 030 of section 1 of the 6-NDFL calculation: returned by the tax agent to the taxpayer.

IMPORTANT!

The new form does not require you to indicate the receipt of income and the tax withholding date.

The information is indicated as follows:

- field 021 - deadline for transferring personal income tax under Art. 226 of the Tax Code of the Russian Federation, that is, on the next working day after payment of income, and for vacation pay and sick pay - the last day of the month in which they were paid; the actual date of transfer does not play a role (letter of the Federal Tax Service No. BS-4-11 / [email protected] dated 12/01/2020);

- field 022 - the amount that must be transferred on time, from field 021; all income with the same tax payment deadline is indicated in one amount;

- field 030 - the amount of personal income tax returned to employees in the 4th quarter;

- field 031 — return date, field 032 — returned amount.

If the question arises of how to calculate the amount of tax withheld in 6-NDFL, it is necessary to sum up the tax on all income paid to employees in the reporting period.

Section 2

Tax rates on income of employees under employment contracts and persons performing work (providing services) under civil contracts: 13, 15, 30 and 35%. In 2022, there is an increased rate of 15% for large incomes (over 5 million rubles per year). In the example of how to fill out 6-personal income tax for the 4th quarter of 2022, the standard personal income tax rate is considered - 13%. In the case of tax calculation at different rates, for each rate the data that relates only to the specified personal income tax rate will be generated.

The current rules for filling out 6-NDFL (for dummies) require filling out the section on a cumulative basis from the beginning of the year.

Line 110 indicates the total amount of employee wages for January-December and all vacation pay, sick leave and other income received in 2022, without reduction for taxes and deductions. There is no separate example of filling out vacation pay; they are included in the total amount of employee remuneration. The amount of deductions is indicated in line 130, and the calculated personal income tax is indicated in 140.

Line 160 indicates the amount of tax withheld for 2022. It does not always coincide with the amount of personal income tax in line 140. In field 170, indicate the amount of personal income tax that cannot be withheld until the end of the year. For example, tax on a gift to an individual who does not receive regular cash income from the organization.

IMPORTANT!

Lines 110 and 112 do not indicate the amount of December salary paid in January. The amount and date of payment of personal income tax from it is entered in section 1, and in section 2 - the withheld tax in line 160.

The tax authorities explained the procedure for indicating salaries for past periods paid in the current period in a letter dated September 13, 2021 No. BS-4-11 / [email protected] There are alternative points of view of the Ministry of Finance, but since the Federal Tax Service checks the calculations, it is better to focus on its position in this matter, so as not to give explanations.

Personal income tax on wages is transferred no later than the next day after wages are paid to employees. But the tax on vacation and sick pay is not allowed to be paid immediately. The main thing is to make it before the end of the month in which they were paid to employees (Article 226 of the Tax Code of the Russian Federation).

IMPORTANT!

When preparing the report, keep track of what new fields are included in Section 2 of 6-NDFL and what to indicate in them. Make sure that all the cells in it are filled. Cells without values are marked with dashes.

This rule also applies to the title page. Even in the longest line containing the name of the organization, all remaining spaces are filled with dashes.

Requirements for filling out 6-NDFL for 2020

Requirements for drawing up and filling out the 6-NDFL report are given in Order No. ММВ-7-11/ [email protected] :

- We enter information from left to right, starting from the first familiarity. We put a dash in empty cells.

- We always fill in the details and total indicators, but if there is no value for the total indicators, we put “0”.

- Page numbering is continuous and starts from the title page.

- When filling out the report, you cannot use correction tools.

- Each page must be printed on a separate sheet; duplex printing is not permitted.

- We fasten the sheets so as not to damage the paper, so you cannot use a stapler.

- When filling out the report by hand, we use only black, blue or purple ink.

- When filling out on the computer, set the Courier New font to a height of 16-18 points.

- We fill out the report separately for each OKTMO.

Fill out the title page 6-NDFL

On the title page please include:

- TIN and checkpoint.

We indicate them according to the tax registration certificate. Individual entrepreneurs do not have a checkpoint; they do not indicate it in the report.

- Correction number.

If 6-NDFL is submitted for the first time during the reporting period, the value “000” is indicated, indicating the initial calculation. If a clarification is submitted, indicate its number: 001, 002, etc.

- Presentation period.

For the annual report, enter code 34. If you are submitting the report during liquidation or reorganization, enter the value “90.” Codes for other periods, including during liquidation (reorganization), are given in Appendix No. 1 to the Filling Out Procedure, approved. Order No. ММВ-7-11/ [email protected] .

- Taxable period.

The year during which the report is submitted is entered. When submitting 6-personal income tax for the periods of 2022 (including at the end of the year), we indicate “2020”.

- Submitted to the tax authority.

We put the code of the Federal Tax Service to which the report is submitted.

- At the location of the account.

We take the value for filling this line from Appendix No. 2 to the Procedure. For example, individual entrepreneurs (who do not use PSN or UTII) indicate the code “120”; organizations, if they are not the largest taxpayers, enter code “214”, etc.

- Tax agent.

Organizations indicate here their short name, which is reflected in the charter. If there is no short one, write the full one. Individual tax agents indicate their full names without abbreviations.

- OKTMO code.

Since 6-NDFL is compiled separately for each OKTMO and KPP code, you need to generate the number of calculations that corresponds to the number of your OKTMO/KPP.

- Contact phone number.

Here, please enter a current telephone number so that the inspection inspector, if necessary, can contact you and clarify any questions he may have.

- Reliability and completeness of information...

If the tax agent submits the report personally, enter “1”, if his representative – “2”. The lines below indicate the full name of the representative or the name of the representative organization.

Filling out Section 1

In this section we transfer information about all income, including allowances, bonuses and cumulative payments from the beginning of the year ─ for the period from January to December. It also needs to reflect data on other income paid to “physicists”, for example, dividends. Section 1 is completed separately for each tax rate applied.

- Line 020.

We indicate the total amount of income accrued to employees since the beginning of 2020.

- Line 025.

If dividends were not paid in 2022, enter “0” in the line.

- Line 030.

We indicate the amount of deductions provided to employees that reduce taxable income.

- Line 040.

We display the amount of calculated tax from the beginning of the year, calculated using the formula: (line 020 – line 030) * line 010.

- Line 045.

We fill in if dividends were paid to the employee, personal income tax was accrued on them and subsequently paid to the budget. Otherwise, put “0” in the line.

- Line 050.

We indicate the total amount of fixed advances paid for foreigners working under a patent. If no such payments were made, enter “0”.

- Line 060.

We enter the total number of employees who received taxable income in 2022.

- Line 070.

We indicate the total amount of personal income tax withheld since the beginning of 2022.

- Line 080.

We reflect personal income tax not withheld by the employer.

- Line 090.

We indicate the amount of personal income tax excessively withheld by the employer from the employee’s income (in accordance with Article 231 of the Tax Code of the Russian Federation).

Filling out Section 2

In this section, include payments for the last 3 months of the reporting period ─ in the report for 2022, it is necessary to reflect data for October, November and December.

- Line 100.

We indicate the date of actual receipt of income reflected on page 130. When filling out this line, you must take into account that for some payments the timing of actual receipt of income is different.

The date of receipt of salary and monthly bonus is the last day of the month for which it is assigned, even if it falls on a weekend. When paying bonuses for a year, quarter or for a specific event, the date of receipt of income is considered the day of its payment (Letter of the Ministry of Finance dated October 23, 2017 No. 03-04-06/69115).

The date of receipt of income under a civil contract, sick leave and vacation pay, financial assistance, vacation compensation and dividends is the day the income is paid to the employee.

- Line 110.

- We reflect the date of actual deduction of personal income tax from the income paid. Tax on all types of payments is withheld on the day the income is paid.

- Line 120.

We indicate the deadline for transferring personal income tax to the budget. The deadline for paying personal income tax on wages and other income, with the exception of vacation pay and benefits, is the day following the day the tax was withheld. And for vacation and sick leave - the last day of the month.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

- Line 130.

We enter the total amount of income received (without subtracting personal income tax) as of the date indicated in line 100.

- Line 140.

We indicate the total amount of personal income tax withheld.

Sample 6-NDFL for 2022

Former 2-NDFL certificate included in the calculation

New Appendix No. 1 to the calculation contains a certificate of income of individuals (formerly 2-NDFL). Employers should not fill out certificates for all employees quarterly; they are submitted only at the end of the year. There is no need to submit a blank application quarterly.

Using our example of filling out 6-NDFL with 2-NDFL certificates for the 4th quarter of 2022, we will show how to fill out information for one employee:

Read more: how to fill out an income certificate for issue to an employee

Procedure for providing Calculation 6-NDFL

Form 6-NDFL can be submitted to the tax authority:

• On paper, filled in by hand or using software

• In electronic form using an enhanced qualified electronic signature ATTENTION: if the average number of employees exceeds 25 people, then 6-NDFL, certificate 2-NDFL, notice of the impossibility of withholding personal income tax are submitted ONLY in electronic form.

If an individual entrepreneur combines the simplified tax system and UTII, how to submit 6-NDFL?

• According to the simplified tax system, form 6-NDFL is submitted to the tax office at your place of residence.

• For UTII - at the place of registration as a UTII payer (Letter of the Federal Tax Service dated 01.08.2018 No. BS-4-11/13984).

The date of submission of Calculation 6-NDFL is recognized as:

• Date of its actual submission - when submitted personally or by a representative of a tax agent to the tax authority;

• The date of its sending by mail with a description of the attachment - when sent by mail;

• The date of its dispatch, recorded by the system when submitting the Calculation in electronic form via telecommunication channels of the electronic document management operator.

Zero 6-NDFL

The obligation to submit a calculation in Form 6-NDFL to the tax authority at the place of registration arises if the taxpayer is recognized as a tax agent, that is, makes payments in favor of individuals. If during the reporting period income is not accrued or paid to employees, there is no need to provide a report. The Federal Tax Service informed about this in letter No. BS-4-11/4901 dated March 23, 2016.

If during the calendar year there was at least one payment in favor of an individual in the nature of wages, sick leave, financial assistance, remuneration for services rendered (work performed) as part of the execution of a civil contract, then a report is drawn up. Since the form is filled out on a cumulative basis, in the future, indicators from the first, second and third quarters will be saved in a cumulative manner. In principle, there is no zero 6-personal income tax; the report will still contain information about at least one payment.

If last year the organization was a tax agent, and in the current reporting period for some reason stopped paying income to employees, there is no need to submit a report to the tax authority. Although the company is not obliged to explain to the tax authorities what the loss of tax agent status is associated with, it is recommended to send a letter of non-provision of 6-NDFL, drawn up in any form, to the Federal Tax Service.

Fill out form 6-NDFL online

It is possible to fill out a report online on the websites of accounting software developers - “My Business”, “Contour”, “Sky” and others. Some sites allow you to do this for free, but usually the services require a small fee (up to 1000 rubles).

Methods for submitting 6-NDFL

You can submit a report to the Federal Tax Service:

- On paper.

You can submit it yourself, through a representative, or by sending it by registered mail with a list of attachments.

Be careful: a paper report can be submitted in 2022 only if the number of employees does not exceed 10 people. (Letter of the Federal Tax Service dated November 15, 2019 No. BS-4-11 / [email protected] ).

If there are more employees, you will have to report electronically. You may be fined for submitting a report on paper when you are required to submit it in electronic format.

- In electronic form.

How to prepare a report for the 1st quarter of 2022?

After the 1st quarter, tax agents need to fill out 6-NDFL and submit it before April 30, 2022 inclusive. The calculation provides data for the period from January to March 2022.

You need to fill out:

- title page - general data;

- section 1 - information for the last 3 months (January, February, March 2021);

- section 2 - data for the entire period (January - March 2021).

That is, for the first reporting period, both sections will be filled in based on the results of the first three months. In the future, in section 1 it will be necessary to provide information only for the last three months, in section 2 - for the entire period from the beginning of the year.

Instructions for filling

The table below explains exactly how employers need to fill out Form 6-NDFL, taking into account all the changes. The filling out process for the 1st quarter is different in that the last 3 months coincide with the reporting period, and therefore the registration process is simplified.

| Form field 6-NDFL | Instructions for filling |

| Title page | |

| INN/KPP | Details of the employer's organization. For individual entrepreneurs only TIN. |

| Page no. | 001. |

| Correction No. | 000. If a previously submitted form is changed, then the correction number is in the format 001, 002, etc. |

| Reporting period (code) | 21 – code for the 1st quarter in accordance with Appendix 1 to the Procedure for filling out form 6-NDFL. |

| Calendar year | 2021 is the year to which the reporting period relates. |

| Submitted to the tax authority | Number of the Federal Tax Service branch at the location of the organization or at the place of residence of the individual entrepreneur. |

| By location | Most commonly used codes:

The full list of codes can be found here. |

| Tax agent | Full name of the organization or full name of the entrepreneur, notary, lawyer. |

| Form of reorganization, liquidation/Deprivation of powers of the OP | The corresponding code from Appendix 4 to the Filling Procedure is indicated. If these activities were not carried out, the field is not filled in. |

| TIN/KPP of the reorganized/liquidated organization (OP) | The relevant details are indicated if the specified activities were carried out in relation to the organization or its separate division. |

| OKTMO | Details of the tax agent at the address. |

| Telephone | Current contact telephone number for communication with tax specialists. |

| Number of sheets | For calculation and attached documents. |

| Credibility | Traditionally, information is filled out about who submits Form 6-NDFL - the head of the organization or a representative (the individual entrepreneur himself or a proxy). |

| Section 1 – tax data for the period from January to March 2021 | |

| INN/KPP | Repeat similar details from the title page. |

| Page | 002 |

| 010 | KBK – 18210102010011000110. |

| 020 | The withheld tax is total for all employees whose withholding date fell on the period from January 1 to March 31, 2022. The date of personal income tax withholding for wages is the day of its payment. Important:

Lines 021 and 022 provide explanations of specific amounts transferred to the budget in the last 3 months. |

| 021 | Date no later than which the tax must be transferred - personal income tax is paid on the day of withholding (date of payment of income) or the next day. |

| 022 | The corresponding amount for the tax indicated on line 021 on the left. The amount of income from which this tax is withheld, as well as the date of its recognition, does not need to be reflected in the new form. |

| Reference ratio: | Sum of line indicators 022 = line indicator 020. |

| 030 | If the tax agent has issued a tax refund in the last 3 months, then the total amount returned to employees must be entered in this field. The decryption is given in lines 031 and 032 |

| 031 | Return date. |

| 032 | Appropriate refund amount. |

| Reference ratio: | Sum of line indicators 032 = line indicator 030. |

| Section 2 – data on charges and taxes for the entire reporting period (in this case, the 1st quarter of 2021) | |

| 100 | Tax rate. |

| 105 | KBK. |

| 110 | Income (dividends under labor and civil employment contracts) accrued for the 1st quarter - only those incomes are included whose accrual date fell within the period from January 1 to March 31, 2022. For salaries - this is the last day of the billing month, for bonuses - similarly. Important:

|

| 111 | Data on accrued dividends in the 1st quarter are provided separately. |

| 112 | The amount of accrued income under the employment contract. |

| 113 | Accrued income under civil contracts. |

| Reference ratio: | The sum of the indicators of lines 111, 112, 113 is equal to the indicator of line 110. |

| 120 | The number of employees who received income in the 1st quarter (including all types of accruals). |

| 130 | If the employer applied deductions to employee income to reduce the tax burden, then the total amount of deductions must be shown in this line (standard, professional, investment, property and social according to the tax notice). |

| 140 | Personal income tax calculated at the rate from line 100 from the difference in income and deductions = line 100 * (line 110 - line 130). |

| 141 | Personal income tax calculated from dividends = line 100 * line 111. |

| 150 | The field is filled in if there are foreign workers on patent. |

| 160 | Withheld tax in the 1st quarter of 2022. Important:

|

| 170 | If tax is not withheld from any income, then the total amount not withheld is entered in this field of form 6-NDFL. |

| 180 | Personal income tax, which is withheld in excess of the required amount. |

| 190 | Personal income tax, which was returned in the 1st quarter of 2022. |

Design example

Below is a sample filling for the following source data:

The Alliance LLC organization has 5 employees to whom income was accrued in the 1st quarter of 2021 (tax is withheld on the day the income is paid):

- salary for December 2022 - 300,000 paid on 01/11/21, personal income tax of 39,000 was withheld from it;

- salary for January 2022 - 280,000 issued on 02/09/21, personal income tax of 36,400 was withheld from it;

- salary for February 2022 - 330,000 paid on 03/09/21, personal income tax was withheld from it 42,900;

- salary for March 2022 - 320,000 issued on 04/09/21, personal income tax of 41,600 was withheld from it;

- vacation pay for March 2022 - 30,000 paid on March 20, 2021, personal income tax of 3,900 was withheld from them.

Filling example: