What is outsourcing

Outsourcing appeared several years ago and is now becoming more and more widespread.

Translated from English, the word “outsourcing” means the use of external resources. This term implies the transfer by an organization of certain types or functions of production business activities under a contract to another company.

Outsourcing companies are usually trusted with non-production or one-time, non-recurring types of work. These may include, for example:

- legal services,

- accounting services,

- cleaning service,

- logistics,

- food services, etc.

Who can use outsourcing services? This is primarily beneficial for small and medium-sized businesses, but large businesses can also transfer some of their service functions outside the company.

What is the meaning of outsourcing, why is it gaining popularity? First of all, this is the rational use of one’s own finances, in other words, saving. Not everyone can afford to keep a first-class specialist, be it an IT specialist, an accountant or a lawyer, on a company’s staff on a permanent basis.

Sometimes one-time services of professionals are required, for which it is also irrational to maintain a full staff.

Next, we will consider all the pros and cons of outsourcing using the example of accounting.

All OKVED codes for accounting services

Provision of accounting services and tax accounting in 2022 as a type of activity according to OKVED 2 with decoding and taking into account the changes that entered into force on July 11, 2016, which will allow you to accurately select them.

The type of activity accounting services is not a licensed type of activity.

The right to apply reduced rates of insurance premiums (clause 5, clause 1, Article 427 of the Tax Code of the Russian Federation), contributions for injuries (Article 1 of the Federal Law of December 22, 2005 No. 179-FZ), depends on the data codes used by the LLC or individual entrepreneur. the need to submit certain forms of statistical reporting, etc.

The activities of an accountant are not limited by laws and standards, so we have selected for you everything you need for this type of activity and its scope, taking into account the experience and existing practice of providing accounting services.

Ways to obtain accounting services

An organization cannot operate without an accountant, even using the simplest taxation system, since firms are not exempt from accounting. And it is better for individual entrepreneurs to work together with an accountant, since although they are not required to keep accounting records, maintaining management accounting will be an excellent help in business, and tax legislation in our country is very changeable.

Thus, an accountant is an indispensable friend of business.

How a business can receive accounting services:

- full-time accountant (remote, part-time, full-time),

- freelance accountant,

- outsourcing company.

Let's look at the pros and cons of outsourcing accounting services compared to an in-house accountant. At the same time, a freelance accountant will combine the features of both a full-time accountant and an outsource company.

What to choose is ultimately decided by the business owner. At the same time, he can combine a full-time accountant and an outsourcer. For example, one will deal with the primary work, entering initial data into the program, and the other will prepare reports and work with the tax authorities.

If an entrepreneur has not yet decided on the choice of an accountant and wants to keep records himself, our article “Review of programs and services for online accounting” .

Values

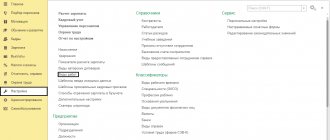

According to the Rosstandart directory, activities in the field of accounting, as well as law, have a general code of “69”. Among other things, it includes the following OKVED accounting services in 2022:

- maintaining accounting records, as well as preparing accounting (financial) statements;

- conducting an audit of the financial condition of the enterprise;

- consulting on tax issues.

The table below shows all OKVED codes for accounting services and related activities.

| Accounting services: OKVED codes | |

| Code | What does it include |

| 69.2 | Providing services in the field of: · accounting; · conducting a financial audit; · consulting on tax issues. |

| 69.20 | Accounting, fin. audit and tax consulting include: · maintaining/restoring accounting, including the preparation of accounting (financial) statements, consulting on accounting issues; · audit of accounting (financial) statements of organizations and provision of audit-related services by audit firms and private auditors; · tax consulting and representation of clients before tax authorities. Also – preparation of tax documentation. This group does NOT include: · processing and generation of summary data (this is code 63.11); · management consulting on accounting systems, budget management procedures (this is code 70.22); · collection of payments on bills (this is code 82.91). |

| 69.20.1 | Conducting a financial audit: · auditing the accounting (financial) statements of companies and providing audit-related services by audit firms and private auditors. |

| 69.20.2 | Services in the field of accounting: · maintenance/restoration of accounting, as well as the formation of accounting (financial) statements, accounting consulting; · acceptance, reduction and consolidation of accounting (financial) statements. |

| 70.22 | Consulting on business and management issues May include advice, recommendations or assistance in the development of procedures and methods: · accounting; · cost accounting programs; · budgeting. Does NOT include: · development of accounting software systems (this is code 62.01); · legal consulting and mediation (this is code 69.10); · accounting and auditing, consulting on tax issues (this is code 69.20). |

The main differences between an outsourcer and a full-time employee

The main difference between a full-time employee and a third-party employee is the type of contract concluded. This is also the main advantage of outsourcing accounting services.

An employment contract is concluded with a full-time employee working on a full-time basis or even remotely. Relations with such an employee are regulated by the Labor Code of the Russian Federation.

A civil contract is concluded with an outsourcer, be it a freelance accountant or a company. And these relations are regulated by the Civil Code of the Russian Federation.

Read about the differences between employment and civil law contracts in our article “Insurance premiums for GPA in 2020 -2021” .

We present a comparative table based on legal norms. It makes clear the advantages of outsourcing accounting services over a full-time accountant:

And this is not a complete list of different parameters. This also includes a simpler procedure for severing civil law relations compared to labor relations, as well as the fact that the responsibility of the performer is more easily spelled out in a civil law contract than in an employment contract.

Well, the main difference is the need to calculate contributions and calculate personal income tax from a staff member’s salary. A freelance accountant, as a rule, is an individual entrepreneur or self-employed, so he calculates all contributions and taxes independently. No additional amounts are also accrued for payments that the company transfers to the outsourcing company.

Let's show with an example:

As you can see, a full-time employee will cost the company about 40% more.

Have you decided to turn to an outsourcer, but don’t know how to arrange their services? Sign up for a free trial access to ConsultantPlus and receive a step-by-step algorithm on how to take into account an agreement with an outsourcer in accounting and when calculating taxes.

Services for accounting and individual transactions

Professional accounting will allow managers to make decisions without the risk of receiving penalties from tax authorities and inspection authorities.

Employees do not need to be reminded about the end of the reporting period and the deadlines for filing returns.

For example, the list of accounting services includes services for accounting of banking and cash transactions, which include:

- opening and closing client accounts;

- preparation of payment orders to the client’s servicing bank;

- registration, printing of payment orders ready for signature in paper form, preliminary preparation of payment orders ready for sending in electronic form in the Bank-Client account management systems;

- accounting services for client's current accounts;

- preparation of cash documents for the bank

- preparation and provision to the client of documents for the bank confirming the calculation and establishment of a cash limit at the enterprise's cash desk, execution and provision to the client of documents for receiving cash from the bank;

- maintaining a cash book;

- registration and accounting of primary documents - cash receipts and expenditures, formation of the enterprise cash book.

As part of the provision of this list of services, as a rule, accounting services are provided to support loan applications, prepare, coordinate and execute a package of documents for obtaining loans from banks and other financial transactions.

The list of accounting services for payroll includes:

- direct calculation of wages to the customer’s employees (including calculation of vacations, temporary disability due to illness, injuries, etc.);

- accounting support of mutual settlements with the customer’s employees;

- calculation of all types of taxes (personal income tax, insurance premiums) for accrual and withholding;

- preparation and execution of documents for settlements with the customer’s employees - pay slips and cash receipts;

- provision of information about income received (according to the personal income tax form-2), certificates of place of work and other information in accordance with the forms approved by the legislation of the Russian Federation;

- preparing a set of documents for the bank in order to transfer employees to the “salary” project.

Disadvantages of outsourcing

Let us summarize again the advantages of outsourcing:

- cheaper than a full-time accountant;

- more flexible contractual terms;

- absence of temporary gaps in work (vacation or sick leave of a staff accountant);

- the ability to quickly respond to changes in business processes due to experience in various fields and the presence of several specialists.

However, there are also problems of accounting outsourcing that cannot be ignored:

- In large outsourcing companies, a specialist will be assigned to your company, but in the event of his dismissal, vacation or illness, your affairs will be managed by another employee who will not immediately understand the intricacies of your business, which may negatively affect your accounting.

- Outsourcers usually work with the primary source provided. It is not their responsibility to call your suppliers to remind them to urgently send documents.

- The outsourcer's services are specified in the contract. For many additional services that a staff member performs according to the job description, the outsourcer will charge a separate fee.

- Many businessmen like to see and directly control the work process, which is problematic in outsourcing conditions.

- A full-time accountant has more leverage (for example, in the form of a bonus), which is a definite plus for a business owner.

- Third parties have access to the enterprise’s trade secrets, and to all accounting imperfections and tax flaws.

- Problems may arise with the transfer of the accounting base upon termination of the contract.

- The management of your company's affairs is transferred from specialist to specialist, so there may not be a permanent contact person, which makes the collaboration process difficult.

Who is responsible for maintaining company records? The answer is in our article .

Freelance accountant

Special mention should be made of freelance accountants, who, as mentioned above, combine the features of a full-time accountant and an outsourcer, that is, their pros and cons.

Freelance accountants work with micro and small businesses. It is difficult to cope with several medium-sized companies alone.

A freelancer has the advantages of outsourcers. There are no additional expenses for it: no contributions, no taxes, no costs for workplace equipment and training.

At the same time, he has the disadvantages of a full-time employee: he may get sick or go on vacation. You won’t have to pay for this, but the accountant may fall out of the work process during this time. However, freelance accountants, having a free schedule, often treat their days off quite flexibly and get in touch even during their vacation.

At the same time, a freelancer also has the advantages of a full-time employee. This is a specific person who does accounting, understands your specifics and will select the optimal accounting and taxation option for you.

As for unprofessionalism and ordinary human dishonesty, it can be found in a full-time employee, in an outsourcing company, and in a freelance accountant.

To protect yourself from troubles as much as possible, you need to correctly draw up a civil contract with the outsourcer. You can download a possible version of an agreement for the provision of accounting services for free by clicking on the image below:

Accounting restoration services

The reasons why it is necessary to restore accounting in a company can be very diverse. What determines the cost of accounting restoration?

There is no single universal method for restoring records, since everything depends on specific circumstances (the presence or absence of primary accounting documents, the state of the electronic database, etc.).

Restoring accounting is always a complex process that can only be handled by a highly qualified accountant with experience and understanding of the specifics of this procedure. Accounting can be restored either by the company itself (if there are competent specialists on staff) or by using the services of specialized companies.

Important! Hiring the services of specialized companies has a number of advantages, since by entrusting the restoration of accounting to a specialized company, the customer will be provided with professional specialists in the field of accounting and tax accounting.

Specialists in the provision of accounting services know about all the nuances of the legislation that was in force in “past” periods (they monitor the constant changes in legislation and the view of certain situations of regulatory authorities).

The cost of accounting restoration services depends on a number of factors:

- the state of accounting at the enterprise and the required amount of work;

- the need to develop templates for enterprise documents;

- time period during which high-quality accounting was not carried out;

- the number of transactions and payments to be processed by accounting recovery specialists;

- the number of reporting forms to work with;

- the number of regulatory authorities to which documents must be submitted after adjustment.

The cost of restoring accounting records is, of course, almost always lower than the costs that enterprises have to bear due to complaints from regulatory authorities. At the same time, the customer’s costs are fully compensated by the quality and completeness of support.

Results

Outsourcing is the transfer of part of the necessary work to third parties.

Outsourcing of legal, accounting, and IT services is becoming widespread. The main advantages of outsourcing are savings and the opportunity to work with highly qualified specialists for whom there is no money on staff. But there are also disadvantages: the impersonality of the work, the risk of disclosure of trade secrets by third parties, the inability to directly control the process. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.