Create a personal account

To create a taxpayer’s personal account, or rather an account, you need to contact any branch of the Federal Tax Service. You should have two documents with you:

- passport;

- TIN.

The inspector will issue a special document stating:

- date of registration;

- inspection unit code;

- personal data of the applying citizen;

- login;

- primary cipher

After receiving the form, the citizen should go to the website and log in to the Personal Account using the login and code from the Federal Tax Service, which are indicated in a special window.

In addition, logging into the Personal Account is possible using an electronic digital signature key or an account on the State Services portal.

Mobile application of the Tax Service of the Russian Federation

A functional Federal Tax Service application has been developed for owners of smartphones and tablets. The program is distributed free of charge; at the moment it is only available for download on Android devices. To log into your profile, again indicate the login and password from your personal account or State Services.

The official program has the following features:

- studying information about contributions;

- request data on payments made;

- studying tax documentation;

- pay taxes online in a couple of clicks, etc.

Changing the access code

After the initial login, you need to change the password in the taxpayer’s personal account. To do this, you should open your physical profile. faces. This is done by clicking on the name of the registered person.

The profile contains the following tabs:

- Contact Information;

- Personal Information;

- history of actions;

- obtain digital signature;

- accounts abroad.

You can change the password in your taxpayer’s personal account in the “contact information” section. To do this, click the “change password” button.

After this, the code requirements appear on the screen:

- at least 7 characters;

- presence of uppercase and lowercase letters;

- the presence of numbers and special characters.

If the new cipher does not meet at least one of the requirements, the system will not accept it.

Important to know: If a citizen does not change the original code within a month, he will have to apply to the Federal Tax Service to receive a registration card again.

In the appropriate windows you need to indicate the old code from the registration card and enter the new code twice. After this, click “save”.

Nuances

The password for the electronic signature certificate protects the signature from fraudsters. Therefore, when entering it, the following must be taken into account:

- a password consisting of 8 or more characters, containing uppercase and lowercase Latin letters, numbers and other characters, is secure;

- the combination must be complex, reliable, but memorable for the user;

- An option to solve the problem is to revoke the current certificate and generate a new one by entering a new password.

Any questions related to the use of your Personal Account and electronic signature will be answered by specialists of the Federal Tax Service contact center by calling 8(800)222-22-22.

FacebookVKontakte

What to do if a person has forgotten the password

If the user has forgotten the code, lost the registration card, or there are suspicions that the authorization data has been stolen, he needs to contact the Federal Tax Service to obtain new authorization parameters in the personal account.

You can also block your account for security reasons. This is done in your profile, in the “contact information” section, by clicking on the “Refuse to use the service” button.

A notification will appear on the page that opens, in which you need to indicate the reason for stopping the use of your personal account. Then click “send application”.

Can third parties obtain the registration card?

A person can contact the inspectorate for primary data to enter his personal account independently or through a representative, using a notarized power of attorney. For minors, parents/legal representatives receive a registration card. To do this they will need to present:

- passport;

- birth/adoption certificate.

Interesting: Using LC is absolutely safe. Taxpayer personal data is protected by the https protocol, providing authentication and secure access.

However, the legislation does not provide for the possibility of obtaining a registration card via the Internet or by mail. When contacting the Federal Tax Service in person, generating an access code will take a few minutes.

How to create your personal taxpayer account?

There is no need to create a personal taxpayer account, and it will not work.

To register in it, you only need to contact any tax authority, regardless of the place of registration, where, after submitting an application, a registration card with a primary password for logging into the system will be issued. When contacting the inspectorate at your place of residence, you must have an identification document (passport) with you.

When applying to other inspections, you must have an identification document (passport) and a certificate of registration of an individual (original or copy). Data in the Service will be displayed not only by the region of registration of the taxpayer, but also by all places of registration of the taxpayer in any tax authority in Russia.

The primary password received upon registration has a limited validity period and therefore must be replaced within a calendar month. Those. it is only needed for the first login to your “Personal Account” in order to change it to your password there.

When recovering your password, I entered the wrong control word three times, have you exhausted the possibility of recovering your password forever?

When entering the details to recover your password, you are given three attempts to enter the details. If the allowed number of attempts is exceeded, the ability to recover the password is blocked for a day. You can recover your password in this way in 24 hours, or you (your legal/authorized representative - using a notarized power of attorney/power of attorney equivalent to a notarized one) can contact any inspection of the Federal Tax Service of Russia (with the exception of specialized inspectorates of the Federal Tax Service of Russia), regardless of place of registration, with an identification document.

There is a registration card, the primary password has not been changed. When you try to log in to your Personal Account, the following message appears: “Incorrect password.”

Check that the password is entered correctly (when working in the Internet Explorer browser, it is possible to visually control the entered password). Please note the password requirements:

- The password is entered only in the ENG (English) layout;

- Mandatory presence of uppercase (AZ) and lowercase (az) letters;

- Mandatory presence of Arabic numerals (0-9);

- The password must contain special characters: (“#,$,^,&,*,_,-,+,%,@”);

- The number of characters in the password must be at least 7;

- Spaces are not allowed.

For legal entities persons

Legal entities can also register in the LC on the website of the tax service. Access to the account is carried out not using a login, but through a qualified electronic signature verification key certificate, which is issued by a certification center.

Legal persons in the personal account on the tax website can perform the following actions:

- find out information about tax debts;

- receive an extract from the Unified State Register of Legal Entities;

- make inquiries;

- receive certificates;

- make changes to information about the organization;

- control the execution of requests.

Users also have access to other actions to control budget payments.

Ways to find out the token PIN code

There are two ways to find out the code from the token:

- Use the factory preset code - it will work if the code was not changed after installation. The factory default EDS password depends on the token brand: “Rutoken”, eSmart, JaCarta and JaCarta LT - 12345678; eToken - 1234567890 or eToken; Jacarta SE - 1111111 for the PKI part and 0987654321 for the GOST part.

- If the factory combination does not match, the code is reset. In this case, all that remains is to pick it up. The number of incorrect attempts is limited to ten, so an endless search of combinations is inappropriate here.

Finding a forgotten code will be easier if you increase the number of attempts to select options using administrator rights. To do this you need:

Step 1. Go to the token control panel. The Control Panel tab is usually located on the Start button.

Step 2. The system will prompt you to enter the user or administrator PIN code. Select the “Administrator” option and enter the code. The default EDS PIN code is available here: for Rutoken - 87654321, for Jacarta SE - 00000000 for the PKI part and 1234567890 for the GOST part. If the factory code does not match, it means that it was reinstalled and you need to remember the new combination, for which you are given ten attempts.

Step 3. In the window that appears at the top, select the “Administration” tab and find the “Unblock” button on the right side of it. After pressing it, the PIN code will be unlocked, and the system will notify you about this with an additional message. After clicking “OK” the user will continue searching through possible codes from the electronic signature.

Unlocking the certificate is also available through CryptoPro CSP, but this will still require confirmation of administrator access:

Step 1. Open the program and find the “Hardware” tab, then click “Configure media types.”

Step 2. Select a token and find the “Information” section in its properties.

Step 3. Click the “Unblock PIN” button.

After unlocking the PIN code, the user will not have access to the certificate, but the number of attempts to find out the forgotten PIN code will increase.

If none of these schemes are feasible, for example because the user does not have an administrator password, the PIN will not be known. In this case, you will have to revoke the existing certificate and order a new electronic signature.

About the author of this article

Polina GoltsovaLawyer My initial specialty was lawyer, legal consultant. For the first two years of practical activity, she worked in the general legal department of the organization, where she provided comprehensive legal support to the employer’s activities.

However, since 2013, government procurement has become the main focus of my practical activity. I worked in the contract services of several large budgetary institutions at the federal and regional levels and a commercial organization whose activities are related to government procurement. She was involved in legal support of government procurement, contractual and claims work, represented the interests of employers in arbitration courts and the Federal Antimonopoly Service.

For the last three years I have been creating legal content, writing popular articles on current issues of law enforcement for several information portals.

Other publications by the author

- 2022.03.04News and changesA bill on measures to support suppliers under sanctions was introduced to the State Duma

- 2022.03.03 State Defense Order The duties of the authorized bank accompanying transactions under the state defense order have changed

- 2022.03.03News and changesA sudden jump in prices will not protect against RNP: opinion of the courts

- 2022.02.28 Procurement control The Treasury explained the features of processing acceptance documents in electronic form

Digital signature key

Citizens can receive an electronic digital signature key and authorize on the portal using it. A digital signature is issued at a Certification Center accredited by the Ministry of Telecom and Mass Communications.

If the digital signature key is lost, the user must contact the Certification Center that issued the electronic signature.

Help: A list of accredited Certification Centers can be found on the website minsvyaz.ru in the “activities” section.

When using an electronic digital signature or the State Services portal for authorization, you do not need to enter a login.

Creating an account on the inspection website allows taxpayers to use tax services without leaving home. To do this, it is enough to visit the tax office once and receive a registration card. After changing the password, the cipher set by the user cannot be changed and is valid indefinitely.

Question answer

CONNECTION METHODS AND GENERAL QUESTIONS

Why do I have to change my password within a month?

Your personal account contains information that constitutes a tax secret in accordance with Article 102 of the Tax Code. Despite the fact that the generated password has a high degree of security, it is recorded on paper, so you must change the password within the prescribed period. There is no need to change your password in the future.

CONNECTION IN INSPECTION

CONNECTING USING YOUR UNIFIED PUBLIC SERVICES PORTAL ACCOUNT

CONNECTION USING AN ELECTRONIC SIGNATURE KEY

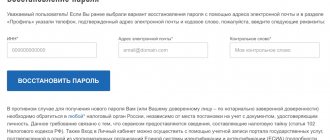

How to recover your personal account password for tax ru?

Anyone can have this problem: they forgot their password. But nothing critical happened. If you lose the password issued by the tax office, it can be restored on the page when logging into your account. To do this, you had to first fill out your profile by entering your email and indicating a secret word.

To restore, we follow a simple procedure:

- Click on the “Forgot your password?” button;

- In the recovery form, enter the TIN, email address and secret word.

Immediately after submitting your application, you will receive an email with a link to change your password. It is important to do everything carefully, since if you enter the data incorrectly, the login to unlock your account will be frozen for 1 day.

If it was not possible to recover the password in this way, then you need to contact the place where it was received: at the tax office or at the EDS service center. But this, as you understand, can take a lot of your time.