No application - no documents

Before we talk about how a copy of the work book is certified, let us remind you that the work book itself is the property of the worker.

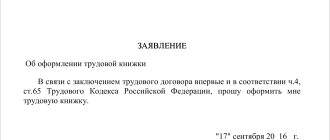

But it is temporarily kept by the employer so that he can enter into the document all the necessary information about the citizen’s professional activities. In order to receive a work book, an extract from it or a copy, according to Article 62 of the Labor Code of the Russian Federation, a person must not only ask a personnel department employee to prepare the document, he must contact his superiors in writing. Below is a sample application for a copy. Its form is not established at the legislative level, so the appeal can be drawn up arbitrarily, but taking into account the requirements for personnel documentation (to whom and from whom it is written, the reason and grounds for the appeal, date and personal signature of the applicant). The application can be drawn up by hand or using a computer, as the sample shows. In the latter case, it is important that the application be signed personally by the applicant.

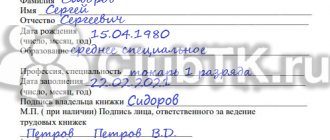

Sample application for issuance of a copy of a work record book

Please note that local regulations of the company may establish another form of applying for labor. In this case, the corresponding form is issued to the employee, who fills it out according to the prescribed rules.

A very important point: the reasons for applying for a copy can be different - to obtain a loan from a bank, obtain a foreign passport, provide data on work experience to the Pension Fund, etc. But in the application, the worker is not required to answer the question why he needed it. This is not provided for by law. Therefore, if in the application forms developed at the enterprise it is required to indicate why it was necessary to certify documents related to the work, GIT inspectors may regard this as a violation of legal norms.

Personnel officers should also remember that it is necessary to consider an employee’s request for a copy of the work book or other documents within three days. And not only to consider, but also to have time to correctly prepare the requested extracts. All of them are provided free of charge. Please note that the employer cannot refuse to provide a copy; this is contrary to the Labor Code of the Russian Federation.

What can a copy be useful for?

A copy of the work permit is periodically required by various organizations, these include:

- Banks;

- Federal Migration Service;

- Embassies;

- Social protection;

- Courts and others.

This document may be required for:

- Obtaining a loan, mortgage, benefits, allowances, subsidies;

- Registration of passport and visa;

- During the trial;

- When adopting children, etc.

Since the work book is the only document recording information about a person’s work activity, this document is required when carrying out certain actions.

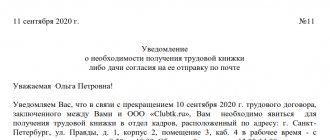

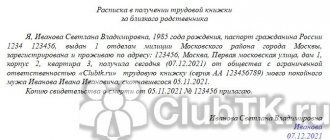

Sample: how to properly certify a copy of a work record book

A copy issued at the request of the employee, in our case, is an official document. Therefore, it must meet certain requirements. Let's look at them in detail to find out how to properly certify a work record book.

- You need to scan (print) all completed sheets, starting with the title page.

- Each sheet must contain printed text on one side only. If the text is printed on both sides of the sheet, it may not be accepted.

- The text after printing should be clear and easy to read.

- The sheets must be numbered and stitched, as is done by notaries. On the back of the last sheet, you need to “seal” the ends of the thread with a paper sticker and write how many sheets have been collected.

- Each page must be certified. This must be done by a person who is granted such a right by a local regulatory act of the organization or a power of attorney. Otherwise, the personnel officer is obliged to certify the papers from the general director.

- According to clause 5.26 of GOST R 7.0.97-2016 “National Standard of the Russian Federation. System of standards on information, librarianship and publishing. Organizational and administrative documentation. Requirements for document preparation”, the person certifying the document writes “Correct”, then indicates his position, signs and deciphers, and puts down the date.

- The certification note must be supplemented with a record of the place where the original is stored. The inscription “The original document is located in (name of organization) in file No. ... for ... year” is necessary so that the recipient of the copy is informed about the place of storage of the original - please note that the sample certification of a copy of the work book shown in the article contains such a line.

- According to GOST, the employer can use a special stamp to mark the certification of a copy of the work book.

- It is believed that the accuracy of the data must also be confirmed by the seal of the employing organization. However, in the Russian Federation, some companies are exempt from the obligation to have round seals, so they physically cannot affix them. But the documents certified by them will have the same force, even if there is no stamp.

- Regarding the location of the “Correct” entry, the signature and date of the person certifying the duplicate, the seal. All this should capture the data being certified, but not cover or overlap it. Otherwise, the recipient will not be able to read the information and the employee will have to return.

- In some cases, the employee may ask to write the phrase “Currently working.” There is no legal prohibition on this, so it is permissible to make an appropriate entry.

Please note that all of the above requirements are described in GOST, which is voluntary. Therefore, banks, Pension Funds and other organizations may have their own requirements for document certification. They should be clarified in advance.

Sample: how to certify a work book according to the current GOST

Copy for the bank

Each financial institution has its own requirements for providing a package of documents for a loan. A copy may be needed in the following cases:

- for mortgage;

- for a large cash loan;

- for a subsidy.

The copy is needed so that the bank can verify that the citizen is employed and is able to repay the loan on time (for which funds are needed). The bank is obliged to warn the future borrower in advance what package of documents needs to be collected and what is the period for each copy, including the financial institution must inform how long a copy of the work book is valid.

In almost all banks, copies are valid for up to 30 days. But depending on certain conditions, the copy can be valid from two weeks to three days. Such requirements apply to large cash loans. And if a citizen provides a copy that has an expired certification, the bank has the right not to accept the entire package of documents.

The main rule when certifying a copy of an employment document for a bank is that at the end of the document there is a note that the person is currently employed in a specific organization.

Today, the most pressing question is how long a copy of a work book is valid for a mortgage. It is valid for a month.

Common mistakes

If the personnel officer incorrectly certifies a copy of the work record book, the employee will bring it back and everything will have to be redone. To prevent this from happening, you can print out and keep on hand a sample copy of the work book certified by the employer.

What mistakes do experts often ignore?

- Due to the seal imprint, part of the text is hidden, which makes it difficult for the recipient of the document to understand the records. Place the seal correctly so that it does not interfere.

- The seal itself is worn out, it is difficult to make out which organization it belongs to.

- There are no signatures, position or other information and the person who certified the copy of the work book. Or this employee is not authorized to perform such actions.

- Errors were made when making entries and corrections were made. Any blots are unacceptable; because of them, the document may be declared invalid and returned to the person. If an error is made during certification, the sheet must be scanned again, printed, and the correct information entered.

- Not all sheets are certified. This is only permissible if all sheets of the copy are stitched, numbered and sealed.

Carefully study the sample on how to certify a copy of a work record book and remember the proposed instructions. It will be needed more than once, since the authenticity of other documents relating to the professional activities of workers is similarly confirmed.

Other structures

To apply for a visa, you also need to provide a copy of your work record. In this case, slightly different rules apply. If all documentation has a deadline of up to three months, then for labor documentation it is again a month. However, some pages need to be translated into a foreign language.

Those who have encountered the registration of social security benefits know that it always involves collecting a huge number of documents and certificates. A work record book is no exception if you need to apply for child benefits or a lump sum payment. The validity period of a copy of a work record for social security is the same as the validity of a copy of a work record for a loan - 30 days. The same deadlines apply to documents collected in court.

Where else can you get a certified copy of a work book?

Until now, we have considered the situation when a person works, and his work book is kept by the employer - in the personnel department or accounting department, if it deals with personnel documentation. But if a citizen is unemployed, he has a work book in his hands, and he needs a certified copy, he must contact a notary. Additionally, you need to take your passport. In a notary office you can certify a copy of a work document for a working person. To do this, he asks the employer for a document against receipt, and then returns it.

The notary copies the necessary pages (usually only completed sheets), stamps them, dates them, and signs them.

But keep in mind that a notary can only make copies of the original work book. If the employee makes copies in advance and brings them, the papers will not be accepted. Because the lawyer checks all the records before copying and only then can certify the work book. By the way, if a notary finds errors or inaccuracies in the records, he will suggest that the person first correct them with the employer, and then make a certified copy.

Notary services are always paid. It is better to check the cost at a specific notary office.

For FMS

You can apply for a foreign passport at the Federal Migration Service. To do this, among other lists of documents, the citizen must provide a copy of the employment document. However, it is provided only to employed persons. If a citizen is unemployed, then he is obliged to show the original form where his last job is recorded.

How long is a copy of a work book valid for a foreign passport? The same as for obtaining a mortgage – a month. But unlike banks, FMS allows you to renew your copy. To do this, you need to contact the employer with an already made copy of the document and re-stamp it.

All information must be easy to read and recognize.

Features of the income certificate according to the bank form

Quite often, the amount of income in the 2-NDFL certificate is not sufficient to purchase a loan or mortgage. The employer can only indicate the official part of the salary; data on part-time work, for example, is not provided there. To solve this problem, banks offer to fill out another certificate - according to a form developed by the lender.

A salary certificate in the form of a bank contains complete and reliable information about a person’s real (including unofficial) income. The employer is not afraid to indicate the real amount of income, because the bank does not have the right to disclose this data, including to the tax office.

Each bank develops its own certificate form, but they all contain similar fields to 2-NDFL, except that the bank is not at all interested in the amount of taxes withheld. Information about the organization, its details and address are also indicated in the same way. About the employee, fill in the fields for full name, position and length of service.

In a special table, the company’s accountant enters the monthly amount of the employee’s salary, exactly the amount that he receives in his hands. These numbers are then summed up and the total for the specified period is displayed. It should be noted that you should not indicate unrealistic amounts, since the bank can check the average salary level for the same position in the entire region.

You can get a certificate form in the bank form directly from the credit institution itself or download it from its official website.

The validity period of the certificate in the bank form is slightly shorter than the validity period of the personal income tax certificate 2 for a mortgage; as a rule, it is only 10-30 days. This is due to the fact that such a document is unofficial. There is a possibility that the employee will take the certificate and quit. Therefore, all lenders are reducing the time it is relevant.

Recommended article: Mortgage for families with a disabled child in Sberbank

Validity period for personal income tax certificate 2 for a mortgage

The form certificate is the main document from the employer about the earnings of the person who decided to take out a mortgage. The organization's accountant indicates in this certificate the accrued income for a certain time period, as well as the amount of taxes withheld. In essence, such a certificate is an indicator of a person’s financial condition and confirms the very fact of official work.

The following information is included in the certificate:

- the beginning and end of the time period;

- information about the employer himself, his address, taxpayer number, telephone number;

- information about the employee, when he was born, where he lives, passport information;

- a table indicating the amount of income and deductions monthly,

- an additional table with all deductions, final figures of earnings and withheld funds.

The accounting department is obliged to issue this document to the employee within three days.

The 2-NDFL certificate, which reflects income for the year, formally does not have an expiration date, however, banks can determine such a period themselves. For example, in Sberbank the validity period of 2 personal income tax for a mortgage is 30 days (), and in VTB it is 45 days. The validity period of the certificate can vary from six months to a year, so it is important to find out all the details from the lender and try to collect documents on time.

If the mortgage certificates have expired

Despite the fact that 2-NDFL certificates and bank forms are valid for quite a long time (from 12 to 45 days), sometimes people who are busy collecting documents and searching for real estate miss these deadlines. Will the bank accept such certificates? Very rarely, creditors make concessions; usually they do not accept an expired certificate; it will simply be invalid. Especially a certificate in the bank form. And the unlucky client will have to go and make a certificate again.

Recommended article: List of mortgage insurance companies accredited by Sberbank

Nowadays, there are almost no people left who have never taken out a bank loan. People apply for mortgages quite often. Previously, banks almost always refused a mortgage loan if a person had an outstanding loan. But healthy competition among banks did its job and mortgage approvals with a suspensive condition appeared.

Finding out the validity period of mortgage certificates from the seller

When preparing a voluminous package of documents for a mortgage, some nuances that seem trivial are often overlooked, for example, various certificates

But in vain! They are of great importance, many of them confirm the purity of the transaction and reduce the risks of challenging it.

We present a short overview of certificates from the seller and other documents, as well as their validity periods.

Certificate of registration (registration) at the address of this apartment

Many people know it as a certificate of family composition, issued by the passport office of the housing and communal services or management company. All residents registered at this address and their family ties to the person who ordered the certificate are indicated. There is also a Form 12 certificate - archival, it indicates everyone who was registered in this apartment for the entire period of its existence. This is very important to eliminate the risk of the transaction being invalidated. This can happen if people who went to prison lived there, and so on.

Recommended article: Binbank and Otkritie will merge - what mortgage borrowers should do

The law does not establish a validity period for such a certificate . But usually it is valid for 30 calendar days, so ordering it in advance is useless.

Certificate of permission from the guardianship and trusteeship authorities for a mortgage

If a minor child is the owner or co-owner of the apartment being sold, the bank will require this certificate. The guardianship authorities review the documents within 2 - 4 weeks, and then issue a guardianship permit for sale. The document is valid for one month and then becomes invalid. Guardianship may be refused if the house is still under construction, or if the conditions of the new housing are in some way worse than those of the existing housing. The decision can be appealed in court.

Certificate of absence of debts on taxes and fees

Issued by the tax office within five working days, since the generation of information involves requests to various authorities.

This validity period is not established by law, and each bank can independently determine the number of days the document is valid. Some banks consider the certificate valid only for 10 days, many specify a period of one month or even three months; this should be clarified with your bank.

Certificate of absence of debt on utility bills

Such a document can be obtained by contacting the HOA accounting department or the cash settlement center (RCC), where it is issued according to the standard EIRC 22 form.

The terms of issue and validity period are not established by law; it is necessary to clarify the requirements of the bank. But usually this certificate is valid for a month, since utility bills are usually paid once a month.

Certificate of absence of encumbrances on real estate

This is an extract from the USRN (Rosreestr database), anyone can request it. All restrictions and encumbrances on real estate for the entire period of its existence are entered into the Rosreestr database. All of them (arrest, pledge, easement, lease and others) will be indicated in the extract, and the risks of challenging the transaction will be minimized.

You can receive the document at Rosreestr itself (3 days), through the MFC (5 days) or online on the Rosreestr website and on the State Services portal. The validity period of such an extract is not specified by law; it is usually valid for 1 month, including for banking institutions.

Certificates from the psychoneurological dispensary PND and narcological dispensary

They are necessary so that the transaction is not invalidated due to a person’s mental disorder or drug addiction. You can receive a certificate at the dispensary on the same day, its validity period depends on the purpose of receipt, for the bank it is valid for 1 year.